Have global supply chains adjusted to the new normal? What are the structural impacts to supply chains due to the events of the past three years? Are supply chains better equipped to handle the next large-scale disruption? These are some of the burning questions in the minds of business leaders.

The elevation of supply chain from being a cost center to a source of competitive advantage was a major phenomenon in the last decade with scale, speed, and flexibility being key qualities. The turn of the decade with the onset of pandemic has highlighted supply chains’ role as a key building block of global commerce with reliability and resilience as the key qualities. While organizations are investing heavily to create a robust digital supply chain to support their business, what about the global supply chain?

This article reviews 3 commonly cited indexes, comprehends the factors, interprets the trends, and rounds up with an assessment of the health of the global supply chain.

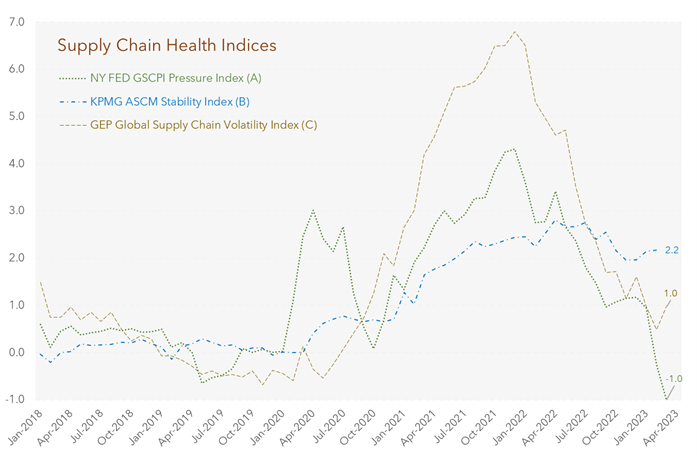

The first index (Index A) is the global supply chain pressure index released by the New York Fed to gauge the importance of supply constraints in economic outcomes. The metric is represented as deviation from zero or average pressure where zero refers to global supply chains operating under typical conditions. The contributing data points for the index are ocean and air freight rates indices and four supply chain components of the Purchasing Managers Index (PMI). A unique aspect of this index is a consideration of both supply and demand aspects of manufacturing with the corresponding cost of long-distance shipping.

The second index (Index B) is the supply chain stability index co-created by KPMG and Association of Supply Chain Management (ASCM) where stability is defined as the ability of the supply chain to achieve key performance targets on a consistent basis. It considers 25-plus metrics across domestic and international logistics, labor market, and orders to quantify the stress in the supply chain while overlaying macroeconomic events. A value of zero on the index indicates a smooth operation of the global supply chain. The supply chain data points included in this index is extensive covering myriad functions and modes of the global supply chain

The third index (Index C) is the global supply chain volatility index released by GEP and S&P Global as a measure of the capacity utilization, product availability, and volatility in the global supply chain. The statistical calculation conducted on PMI data, comments trackers, and commodity price and supply indicators impact on delivery times yields a metric signifying volatility. A value of zero denotes a global supply chain operating at optimal capacity and volatility matching the previous month. The data for this index, PMI, while survey based, is considered an objective measure of economic activity since it is based on a standardized set of questions and calculations.

All the above indices demonstrate similar patterns across three disparate time periods. Until 2020, the indices hovered around the zero or average value except during brief disruptions like the Japanese tsunami and the trade wars signifying an acceptable operating health of the global supply chain. The staggering impact of the pandemic caused a steady ascendancy in the indices peaking around Q4 2021 highlighting unprecedented upheaval and stress. Since Q1 2022, two of the three indices (Index A and C) started abating and are approaching the zero or average value while Index B has stayed close to its peak. What is driving the divergence in the trending since Q1 2022?

The key to this deviation lies in the factors driving these indices. While all three indices incorporate relevant supply chain variables in orders, manufacturing capacity, shipping costs, and inventory levels, the data sources vary. The survey-based PMI propels Index C and parts of Index A. The rest of Index A and the entirety of Index B is derived out of objective metrics from government and independent entities. Also, Index B’s metrics are largely U.S. based while Indexes A and C include data representing major trading partners of the U.S. Notably, the analytical treatment and weights assigned to each variable in the indices could also drive the variation in trends.

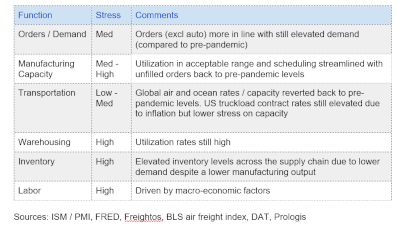

Have global supply chains reverted back to normal (from Indexes A and C), or are they still operating under stress (per Index B)? Based on a review of functional metrics, the authors affirm that certain functions of supply chain are still under pressure while others have reverted back to a “new normal” operating mode.

About the authors:

Ashok Viswanathan is the director of digital supply chain and analytics at Best Buy and an adjunct professor at the Rutgers Business School. Sudesh Kesarkar is a manager of analytics for Best Buy.

SC

MR

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More News

Latest Resources

Explore

Explore

Business Management News

- Technology’s role in mending supply chain fragility after recent disruptions

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks