When Gartner released its annual “Supply Chain Top 25” report last May, it did more than simply identify global industry leaders and best practices. It also helped shippers understand the ever-changing dynamics of emerging markets.

While the physical movement of massive volumes of goods will remain part of most shipper's manufacturing and distribution plans, the digitization of supply chains in these new regions is changing many of the rules. “There's definitely a dichotomy in the strategy large multinationals take in support of emerging markets,” says Stan Aronow, research vice president at Gartner.

For example, Unilever has a strong supply chain brand, which is reflected by its top-tier opinion poll score. However, the Dutch consumer products leader is making big bets in the digitization of its supply chain in emerging markets. “A key initiative is robotic process automation (RPA) supporting the order-to-cash process run from its regional service control towers,” says Aronow. “Its more than 20 ‘bots' have already automated hundreds of processes, with a roadmap for hundreds more in running operations in emerging markets.

Aronow notes that some other top players like Nestle and Diageo choose to set up local operations, teams and tailored offerings in emerging markets. For example, Diageo has a very innovative “cube manufacturing” concept that it uses to enter African markets in a low cost and portable way. If a particular market doesn't work out as planned, they can pick up their mobile manufacturing units and move them to another promising country.

“Other companies go after emerging markets through partnerships,” says Aronow. “These can be strategic such as Walmart recently buying a stake in Flipkart for the Indian market. Unilever and others have entered into selective e-commerce partnerships, such as Alibaba and JD.com in China to avoid needing to manage all of the last-mile distribution and order to cash processes.”

However, Aronow concedes that the challenges in these markets are persistent. There's less developed last-mile logistics, local tastes that require product customization that drive complexity into the supply chain, and “cash-crunched customers” that often require lower cost offerings and higher stock replenishment rates.

“Now, in 2018, protectionism is spreading in response to announced moves by the U.S. and the U.K., among others,” says Aronow. “This has led many organizations to re-evaluate the location strategy for their supply networks. We also see strong growth constraining available supply in geographies, increasing the cost of logistics and labor. But the most advanced supply chains are proactively managing these risks and continue to post solid performances.”

What now for BRICS?

Up until recently, the trend tracked most closely by global logistics managers has been the rise of developing markets in Brazil, Russia, India, China and South Africa—the so-called “BRICS”—to lead the world to new economic heights.

As a consequence, leading forwarders, third-party logistics providers and freight integrators have been keen on using predictive analytics to forecast demand in those regions and elsewhere in the emerging marketplace.

The Kuehne + Nagel Group, for example, has introduced the “gKNi World Trade Indicator” to measure growth trends in all of the world's hot spots. Powered by LogIndex, the group's data company, the indicator suggests that the two largest economies in the world are experiencing a coinciding development of their trade balances. China is showing a strengthening of the trade balance in May and June. By contrast, the U.S. trade deficit is likely to widen further, after a surprising countertrend in March.

“Cross-border trade seems to be returning to normal year-on-year growth after 12 months of robust growth,” says João Monteiro, managing director of LogIndex and global head of new business at Kuehne + Nagel. “However momentum has been decreasing and the second quarter could be heading towards the negative territory.”

In terms of regional developments, China dominates the view on Emerging Markets with good import and exports, Monteiro adds. “Six economies signal a positive momentum, while eleven countries in the sample are trending downward. China, India, South Korea and Brazil expanded their foreign trade activities by 13.6% to 22.8%.”

The positive development of world trade and its continuation is also clearly shown by the “DHL Global Trade Barometer,” which was introduced last January. According to Tim Scharwath, a member of the management board at DHL Global Forwarding, logistics managers can use the barometer as an index with consolidated data from China, India, Japan, South Korea, Germany, United Kingdom and United States.

“These countries represent a well-balanced mixture of industrial and emerging countries as much as import and export orientation,” says Scharwath. “Together, they display 50% of the global trade volume, and therefore can be used to indicate the development of the global trade.”

Nevertheless, the global index or the specific country results can't allow a derivation for a different particular country or region, such as the BRICS. “In general, the latest update of the Global Trade Barometer stated an overall positive development for the Chinese economy, which is mainly driven by a strong air trade,” says Scharwath. “Furthermore, the results of the indicator don't show China losing share to other Asian nations.”

Promising start

Agility Global Integrated Logistics, based in Kuwait, notes that emerging markets growth prospects appear to be more promising than in recent years as a consequence of the introduction of digitized supply chain management solutions.

The company's annual survey of more than 500 logistics managers indicates that nearly two-thirds agree with the International Monetary Fund's 2018 emerging markets forecast of 4.8% to 4.9% GDP growth. If that comes to fruition it would mark the fastest expansion for emerging markets since 2013 and a second consecutive year of higher growth for developing economies, which have slowed dramatically since a 7.4% GDP gain in 2010.

Essa Al-Saleh, Agility's CEO says it's “refreshing” that the industry sees small and medium-sized businesses (SMEs) as the ones getting the most out of emerging markets growth. This view was echoed by Toby Edwards, CEO of Shipa Freight – the company's subsidiary aimed at helping SMEs increase their participation in international trade.

“The key enabler for this growth is technology,” says Edwards. “Nearly 90 percent of our respondents believe that technology is levelling the playing field for them to operate globally,”

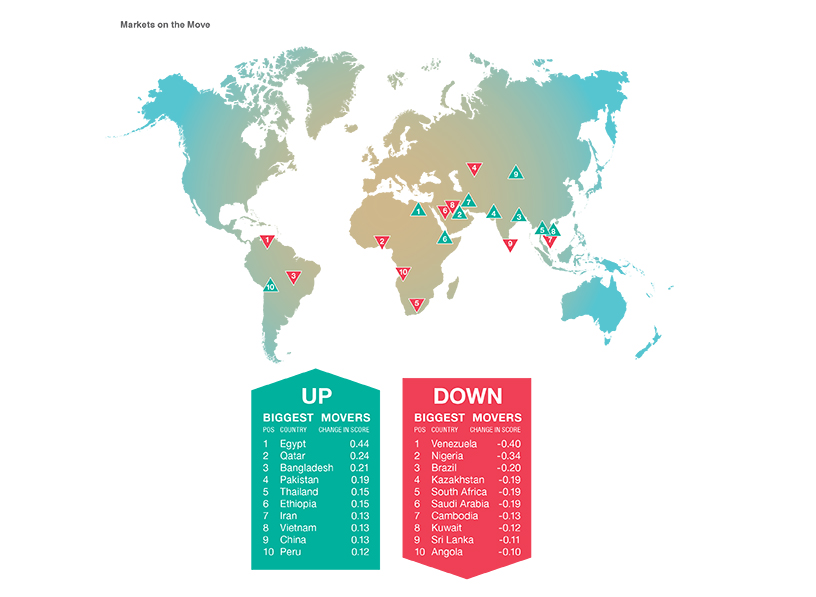

According to Agility, other nations moved up in rankings by improving their infrastructure and transport connections, including India, Indonesia, Turkey, Egypt, Iran, Pakistan, Argentina and Bangladesh. Meanwhile, those who failed to improve in this regard were Kazakhstan, Sri Lanka, Colombia, Brazil, Thailand and Kuwait. Researchers also note that in Sub-Saharan Africa, infrastructure, links between economic centers and poor connectivity are deepening concerns for the logistics industry.

Source: Agility Emerging Markets Logistics Index 2018

Transport Intelligence (Ti), a leading analysis and research firm for the logistics industry, compiled the index data for Agility, which contains a few caveats from John Manners-Bell, Ti's chief executive.

“Undoubtedly the trade war will have an impact on emerging markets,” he says. “Many of the products affected by the new tariffs on electronic and industrial goods are made up of intermediate components sourced right across the Asian region.”

Manners-Bell observes that suppliers in Vietnam, Indonesia, Philippines and Malaysia will feel the impact, as well as companies in China where these components are ultimately assembled before being shipped across the Pacific. “Integrated and complex intra-regional supply chain networks have developed and, in value-adding terms, China may only account for a small proportion of the end product. It should also be noted that many U.S. suppliers feed into these networks and will consequently be affected by the tariffs.”

However, it is unlikely that the tariffs will act as a complete deterrent to importing affected products from China, adds Manners-Bell. “Many of the products which have targeted by the Trump administration are not available from domestic producers. Take lithium batteries for example, a sector in which China is becoming increasingly dominant,” he says.

This would mean that the main victims of the tariffs will be American businesses and consumers who will have no option but to absorb the additional costs. According to Manners-Bell, this will not only have an impact on consumer spend but U.S. businesses will become less competitive globally.

“Some emerging markets may benefit from U.S. businesses sourcing direct,” says Manners-Bell, “but this will only happen if they already manufacturer alternative products to Chinese competitors. As many are more likely to be intermediate suppliers feeding into Chinese high-tech supply chains, this seems to be unlikely.”

SC

MR

Latest Supply Chain News

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- More News

Latest Resources

Explore

Explore

Business Management News

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- Supply chain salaries, job satisfaction on the rise

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks