Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

May-June 2018

Last month, I was in Atlanta at the Modex trade show. In one sense, it is a tribute to the automation technologies managing today’s distribution networks. And, I’m not only talking about automated materials handling systems, but also the software and NextGen technologies such as robotics, wearable technologies, including smart glasses and augmented reality solutions and sensors enabling the Internet of Things. In another sense, all of these solutions are coming together to drive fulfillment. With the increase in e-commerce, getting the right product to the right customer at the right time has never been more important. Browse this issue archive.Need Help? Contact customer service 847-559-7581 More options

It's a law of gravity that what goes up must come down. The corollary for e-commerce is that much of what goes out will come back—think of it as a circular supply chain. Or, as the Wall Street Journal put it last February: “Retailers still celebrating their strongest holiday sales in years now face the less-pleasant task of disposing of billions of dollars in returned merchandise.”

In the same article, Zac Rogers, an operations and supply chain professor at Colorado State University, estimated that post-retail sales, which includes returns and over-stock items, is growing at an estimated 7.5% a year. Meanwhile, Optoro, a third-party logistics provider, estimated that roughly 13%, or $90 billion, of this year's holiday sales, would pass through the reverse supply chain by the end of February.

While that estimate includes all verticals, in some fashion categories, such as shoes, the returns rate is estimated to be as high as 70%. Amy Augustine, the senior manager of reverse logistics for U.S. Cellular, estimates that her organization handled nearly 550,000 returned electronic devices and accessories in 2017. Those devices all had to be shipped, received, inspected and resold or disposed of in a way that delivers value to the organization.

At U.S. Cellular, reverse logistics is a mature operation. Augustine has been in her role for five years, with clear lines of responsibility. Not only does she have a team reporting directly to her, there is a line of command to the C suite. “Our leadership is aware that there is a cost associated with reverse logistics,” says Augustine. “They want to understand the holistic picture from soup to nuts.” Augustine points out that reverse logistics was cash flow positive last year.

But is U.S. Cellular the exception or the rule? Do most organizations have an executive who owns the reverse logistics process? Have most organizations implemented best practices for handling and disposing of returns in a manner that delivers value? Is the executive suite aware of the costs and potential revenue to be gleaned from returns? And, if not, are organizations preparing for the future or just muddling through?

Those are among the questions the Reverse Logistics Association, Supply Chain Management Review and WERC set out to answer in a recent survey of readers and members.

See “About the Research” below for information about the study.

To download the full Research Report click here.

Our bottom line: Organizations like U.S. Cellular that are paying attention to returns are realizing a benefit that either adds to or minimizes the hit to their bottom line. At the same time, the U.S. Cellulars of the world are the exceptions and not the rule as too few organizations are devoting sufficient resources to their reverse logistics processes.

About our research

This research was conducted in January 2018 by Peerless Research Group on behalf of the Reverse Logistics Association, Supply Chain Management Review and the Warehousing Education and Research Council. The study was conducted to better understand how organizations are handling their reverse logistics operations. The results are based on 272 qualified respondents and has a margin of error of +/- 6.1%.

This research was conducted in January 2018 by Peerless Research Group on behalf of the Reverse Logistics Association, Supply Chain Management Review and the Warehousing Education and Research Council. The study was conducted to better understand how organizations are handling their reverse logistics operations. The results are based on 272 qualified respondents and has a margin of error of +/- 6.1%.

Respondents represented a broad range of titles, including corporate/divisional director (11%), VP/general manager (14%), logistics/distribution director/manager (19%), warehouse/DC director/manager (8%), supply chain director/manager (7%), operations director/manager (7%), reverse logistics/returns director/manager (9%) and purchasing director/manager (2%). An additional 23% of respondents listed their title as engineer, inventory control manager, logistics supervisor, owner, product engineer, purchasing and logistics manager, sales or shipping supervisor.

More than one-third of respondents were manufacturers (34%), followed by 3PLs and transportation/warehousing service providers (33%), wholesale distributors (12%), retailers (7%), e-tailers (6%) and consultants (6%). More than one-third (34%) listed their primary business as business-to-business while 11% noted that they primarily sold directly to consumers; the remaining 55% sold into both channels. The average revenue of respondents was $862.7 million, with 27% indicating revenues of more than $1 billion; at the other end of the scale, 37% indicated revenues of less than $50,000.

The who's who of reverse logistics

One of the truisms of business, attributed to management guru Peter Drucker, is that what gets measured gets managed. Now, truth be told, Drucker went on to add that the practice is true “even when it's pointless to measure and manage it …” We would argue that when it comes to the sheer volume of returns coupled with the growth of e-commerce, failing to measure the logistics, labor and revenue associated with reverse logistics is far from pointless—it's no longer an option.

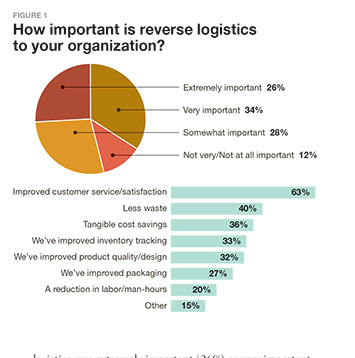

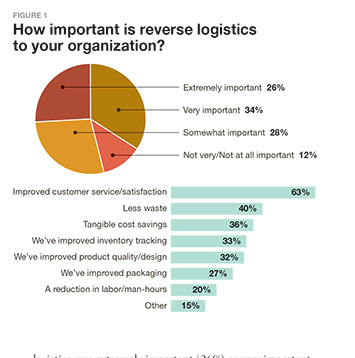

Survey respondents do recognize that when done right, reverse logistics delivers value to the organization. Nearly two-thirds, for instance, cited improved customer service and satisfaction as a benefit of their reverse logistics processes, followed by less waste (40%) and tangible cost savings (36%) At the same time, just 60% said that reverse logistics was extremely important (26%) or very important (34%) to their company. You have to wonder why.

Survey respondents do recognize that when done right, reverse logistics delivers value to the organization. Nearly two-thirds, for instance, cited improved customer service and satisfaction as a benefit of their reverse logistics processes, followed by less waste (40%) and tangible cost savings (36%) At the same time, just 60% said that reverse logistics was extremely important (26%) or very important (34%) to their company. You have to wonder why.

The first step in raising the visibility of returns is having someone responsible for the process. Yet, based on survey responses, in many respects returns and reverse logistics is an orphaned function, with no one clearly claiming parental responsibility. Only 17% reported that they had a department dedicated to reverse logistics and another 16% responded that reverse logistics was organized under a single group or department—which might have other priorities. The latter ranged from logistics (31%) to distribution (16%) to supply chain (14%) to sales (7%). Nearly 60% responded that reverse logistics is handled across more than one department, ranging from logistics (55%) to sales (30%) to finance (14%) to product marketing (7%).

The titles of respondents, which ranged from corporate directors to operations managers to purchasing managers, reflects that diversity. Indeed, only 9% of respondents were managers or directors of reverse logistics. You can read more about the breakdown of respondents in the “About our research” sidebar.

Perhaps the most telling response was that more than two-thirds of respondents (68%) said that no one at the corporate level in their company was responsible for reverse logistics. Nor are senior leaders overseeing the process as a rule: Only 15% of the reverse logistics managers reported to a vice president of operations while only 13% each reported to the CEO or president and only 9% reported to a vice president of supply chain.

Rather, the responsibility for reverse logistics was largely doled out to department managers (44%) or supervisors (13%) in logistics, warehousing, inventory management and other departments associated with traditional supply chain management functions. Senior leaders at the president/CEO (16%) or vice president (18%) level accounted for just over one-third of respondents. The list of titles to whom the individual in charge of reverse logistics reported was equally diverse, with some 26 titles; the question of who else was involved in reverse logistics operations produced a list of 50 other titles.

Rather, the responsibility for reverse logistics was largely doled out to department managers (44%) or supervisors (13%) in logistics, warehousing, inventory management and other departments associated with traditional supply chain management functions. Senior leaders at the president/CEO (16%) or vice president (18%) level accounted for just over one-third of respondents. The list of titles to whom the individual in charge of reverse logistics reported was equally diverse, with some 26 titles; the question of who else was involved in reverse logistics operations produced a list of 50 other titles.

The impression is that while the number of returns continues to grow, reverse logistics is largely in the hands of mid-level managers, with responsibility spread across a multitude of departments and with little oversight at the senior level.

Returns basics

The “make or buy” decision could be one of the most important decisions related to any logistics or distribution function. In the case of reverse logistics, more than two-thirds of respondents (68%) are handling their returns operations in-house and another 2% indicated that they outsource now but plan to pull those tasks back under their control. Meanwhile, 13% responded that they outsource all of their reverse logistics operations and an equal percentage outsource some tasks but keep others in-house. Only 4% of those who currently do it in-house plan to outsource to a 3PL in the future.

Why do it yourself? More than half (54%) said it allows them to keep better control, while 51% said they can be more responsive to customers, 47% have the resources to handle in-house and 45% believe they can do it for less expense.

Of those currently outsourcing, 60% said it is not their core competency and an equal percentage believe it's more cost-effective to outsource. Interestingly, 38% believe that a 3PL can be more responsive to customers, 33% said they just don't have the resources or labor to do it in house, and 25% are limited by space in their facilities.

Regardless of who handles returns, a surprising 39% of respondents said they have no visibility into returns—they just show up. A similar number (38%) receive scheduled reports and 32% track point of sale information at their returns center.

More surprising, 40% of respondents couldn't determine how much reverse logistics is saving their company and another 36% aren't sure. Only 24% said they were able to determine how much their reverse logistics operation is saving their company, with an estimated average annual revenue savings of 16.5%.

Some 44% of respondents accept returned items at a fulfillment or returns center, and another 15% of respondents said they were 3PLs who handle reverse logistics tasks for their customers, presumably at the 3PLs distribution center. Three-fourths of respondents don't expect that to change in the next two years.

Some 44% of respondents accept returned items at a fulfillment or returns center, and another 15% of respondents said they were 3PLs who handle reverse logistics tasks for their customers, presumably at the 3PLs distribution center. Three-fourths of respondents don't expect that to change in the next two years.

More than 70% of respondents are collecting information regarding returned items, and another 15% say they sometimes collect information. In fact, only 11% said that they never collect information about returned items. The most common collected data among retailers (R) and manufacturers (M) included who is returning the item (81% - R, 92% - M), the model number (79% - R, 81% - M) and the date sold (60% - R, 64% - M). Retailers were also collecting if the customer is a repeat returner (60%), where the item was purchased (44%) and how the item was purchased (35%), while 57% of manufacturers were also collecting the serial number.

The number one reason for returns, noted by 59% of respondents, was defective merchandise, estimated to account for 16.3% of returns. Forty-two percent of respondents identified buyer's remorse as a reason for returns while 29% noted that the product wasn't what the customers was expecting or that the product had been misrepresented as a reason for returns.

The most common challenges associated with processing returns: Damaged goods (52%), no reason given for a return (40%), missing parts (38%), incorrect or inaccurate manifests (36%), and a reverse logistics process that needs improvement (33%).

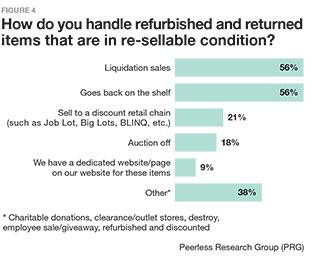

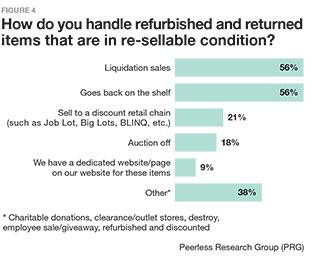

Last, respondents are utilizing a multitude of channels for the disposition of returned items that are in re-sellable condition, ranging from putting the item back on the shelf or a liquidation sale (both at 56%), selling to a discount retail chain such as Big Lots (21%), auctioning off inventory (18%) and utilizing a dedicated page on the company website (9%). Other channels mentioned included charitable donations, outlet stores, refurbished and discounted, selling or giving away to employees and destroying.

Digital returns

Few of us would challenge the notion that e-commerce is affecting the way we do business and order fulfillment. Given easy return policies, there is certainly the perception that e-commerce is having an impact on reverse logistics processes. That is borne out by the 75% of respondents who said that the number of returns they are dealing with has increased and that e-commerce has affected their ability to manage their reverse logistics operations (39%). Only 28% of respondents indicated that their reverse logistics platform is very prepared to handle a growing e-commerce business, while 53% said they are somewhat prepared.

At the same time, 62% of respondents said that e-commerce is not changing the way they process returns at all or not very much. Another 22% said that it is only changing their processes to some extent. Only 16% said that e-commerce is changing their reverse logistics processes to a great extent. Of those who believe that e-commerce will affect their overall business operations in the next two years, 57% believe they will improve while only 3% believe they will deteriorate.

At the same time, 62% of respondents said that e-commerce is not changing the way they process returns at all or not very much. Another 22% said that it is only changing their processes to some extent. Only 16% said that e-commerce is changing their reverse logistics processes to a great extent. Of those who believe that e-commerce will affect their overall business operations in the next two years, 57% believe they will improve while only 3% believe they will deteriorate.

Of those respondents making plans to deal with more returns in the future, 26% are increasing their warehouse space, 22% are adding part-time labor and 16% are adding full-time labor, 22% have set up a dedicated department to handle e-commerce returns and 11% are outsourcing the function.

Given that e-commerce fulfillment has had a tremendous impact on order fulfillment and transportation strategies, we believe that it is only a matter of time before reverse logistics organizations will need to rethink their operations.

Given that e-commerce fulfillment has had a tremendous impact on order fulfillment and transportation strategies, we believe that it is only a matter of time before reverse logistics organizations will need to rethink their operations.

The Internet of Things (IoT) is also heavy in the supply chain discussion about the future. When it comes to return rates, only 20% of respondents believed that IoT is a driver to a great extent (7%) or to some extent (13%). The vast majority, 70%, said that it is not having much, if any, impact and 10% don't yet have an IoT strategy.

Those who do think that IoT is affecting their business said they are getting more analytics and data about sales, that IoT is providing more transparency and that they are using IoT data to predict and resolve failure events before they become an issue, reducing the need for returns.

Looking forward

Whether your organization is a manufacturer, wholesale distributor, retailer or e-tailer, returns are ingrained in the customer experience. Whether it's the ease of doing a return with Amazon, liberal return policies from fashion and apparel companies or the fact that service on electronics and appliances is often done by third parties, business customers and consumers alike judge the companies they do business with by their returns experience.

Our survey respondents clearly recognize that fact: 75% agreed that reverse logistics is a key component to a streamlined supply chain and only 3% stated that reverse logistics is a waste of time. At the same time, there was a complacency among respondents, where only 24% disagreed with the statement that their reverse logistics process needs to be re-engineered and only 39% disagreed that their process for handling returns lacks focus. Many more were in the middle—they didn't know. In an earlier question, only 33% indicated that their processes needed improvement. Clearly—or maybe not so clearly—it is a mixed bag.

Delivering Value at U.S. Cellular

Over the past five years, returns at U.S. Cellular has evolved from a cost of doing business to a process that gets the most value out of the more than 500,000 devices and accessories coming through the reverse supply chain each year. What changed?

According to Amy Augustine, senior manager of reverse logistics, the catalyst was an internal audit of her operations. “We discovered that my processes down at the DC were rock solid,” Augustine says. “We also discovered that any issues we were having were due to upstream processes before the devices came into my custody.”

Around that time, U.S. Cellular centralized it’s supply chain, which provided greater visibility across company leadership. “Now, there was a lens on the process,” Augustine says. “So much so that we've developed a suite of reports for leadership. They want to understand from soup to nuts what's reverse logistics, what are the cost impacts and where are the revenue drivers.” She adds that in 2017, her organization was cash flow positive.

Once returns had the attention of senior leadership, Augustine says the returns team took several steps to turn the process into a best practice. One was to launch continuous improvement initiatives, such as changes to the returns receiving process with its 3PL provider, and identifying opportunities within the DC that would increase revenues when product was sold on the secondary market. One example: asking stores to remove and dispose of screen protectors prior to returning a device. The team also worked with different groups across U.S. Cellular to develop financial reports that began getting rolled out about a year and a half ago. A third was the creation of “360 VUE,” a suite of reports on used equipment that is sent to leadership. The team tracks the inventory acquisition cost, the return freight cost, the labor associated with processing a return, the cost of any parts or return to the OEM for repair and revenue from selling inventory on the secondary market.

From a process standpoint, devices and accessories can come into the supply chain from a myriad of channels. U.S. Cellular has a 24-hour service level agreement with its 3PL partner to return any device received before noon the next day. Devices returned because of a mechanical failure in the first 15 days of a contract are verified and shipped to the OEM. Otherwise, items are received and graded on cosmetic appearance as an A, B, C or D item. Items for which there might be demand are sent to storage. Otherwise, they go to the re-commerce team to resell online. Items are auctioned off to revenue share partners that sell them on-line and share the revenue with U.S. Cellular.

When we asked what had changed in their reverse logistics operations over the last two years, 56% said that they had improved, but 41% said there had been no change at all with the remainder saying they had deteriorated. Driving those changes was a need to improve efficiencies (53%), more demanding customers (44%), the volume of returns (38%), and the volume of sales (23%).

When we asked how their processes will change over the next two years, we received almost identical responses: 57% expect them to improve, through better tools to forecast, track and manage returns. At the same time, 40% expect no change at all, and the rest expect them to deteriorate.

In reviewing the results, we came to two important conclusions. The first is that, as with U.S. Cellular, those respondents with a focus on reverse logistics are realizing benefits that have an impact on their bottom lines. Yet, too many respondents indicate that they aren't paying close enough attention or don't have enough resources. One example: Liquidation was the second most common way of handling returned items in a re-salable condition. While that might be a simple solution, it's leaving money on the table.

Those findings are consistent with the experiences of the two organizations that co-sponsored this research, WERC and the Reverse Logistics Association.

Tony Sciarrotta, the executive director of the Reverse Logistics Association and a former reverse logistics executive at Philips Electronics, was struck that more than two-thirds of respondents (68%) said that no one at the corporate level in their company was responsible for reverse logistics. “During my 15 years at Philips, everyone knew that I was accountable for returns,” says Sciarrotta. “If no one knows who is responsible, it doesn't get fixed.” He also noted that 42% of respondents said that reverse logistics was somewhat or not very important to their organizations. “What we do matters to your organization's bottom line, and not enough respondents said it was important.”

Michael Mikitka, the CEO of the Warehouse Education Research Council, similarly noted the number of respondents that said they lacked resources for their reverse logistics operations. “Those who are paying attention are experiencing a benefit, but not enough organizations are putting resources into their operations,” he said. He also noted that 70% of respondents said they were somewhat or not prepared to handle a growing e-commerce channel. Yet, we all know that e-commerce is only going to grow as a sales channel, resulting in even more returns. At the same time, Mikitka saw the glass half full. “When those companies that are doing it right see improvements in key areas that affect their bottom lines, such as reducing costs and waste, those are opportunities,” he said.

The second is to repeat the axiom that what gets measured gets managed. When only 27% said they could quantify the impact on annual revenues, that means that most don't understand their end-to-end costs. That makes it difficult to justify investments that can improve operations.

Judd Aschenbrand is the director of research for Peerless Research Group and can be reached at [email protected]. Michael Mikitka is the CEO of the Warehouse Education Research Council, or WERC, and can be reached at [email protected]. Tony Sciarrotta is the executive director of the Reverse Logistics Association and can be reached at [email protected]. Bob Trebilcock is the editorial director of Supply Chain Management Review and can be reached at [email protected].

SC

MR

Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

May-June 2018

Last month, I was in Atlanta at the Modex trade show. In one sense, it is a tribute to the automation technologies managing today’s distribution networks. And, I’m not only talking about automated materials… Browse this issue archive. Access your online digital edition. Download a PDF file of the May-June 2018 issue.It's a law of gravity that what goes up must come down. The corollary for e-commerce is that much of what goes out will come back—think of it as a circular supply chain. Or, as the Wall Street Journal put it last February: “Retailers still celebrating their strongest holiday sales in years now face the less-pleasant task of disposing of billions of dollars in returned merchandise.”

In the same article, Zac Rogers, an operations and supply chain professor at Colorado State University, estimated that post-retail sales, which includes returns and over-stock items, is growing at an estimated 7.5% a year. Meanwhile, Optoro, a third-party logistics provider, estimated that roughly 13%, or $90 billion, of this year's holiday sales, would pass through the reverse supply chain by the end of February.

While that estimate includes all verticals, in some fashion categories, such as shoes, the returns rate is estimated to be as high as 70%. Amy Augustine, the senior manager of reverse logistics for U.S. Cellular, estimates that her organization handled nearly 550,000 returned electronic devices and accessories in 2017. Those devices all had to be shipped, received, inspected and resold or disposed of in a way that delivers value to the organization.

At U.S. Cellular, reverse logistics is a mature operation. Augustine has been in her role for five years, with clear lines of responsibility. Not only does she have a team reporting directly to her, there is a line of command to the C suite. “Our leadership is aware that there is a cost associated with reverse logistics,” says Augustine. “They want to understand the holistic picture from soup to nuts.” Augustine points out that reverse logistics was cash flow positive last year.

But is U.S. Cellular the exception or the rule? Do most organizations have an executive who owns the reverse logistics process? Have most organizations implemented best practices for handling and disposing of returns in a manner that delivers value? Is the executive suite aware of the costs and potential revenue to be gleaned from returns? And, if not, are organizations preparing for the future or just muddling through?

Those are among the questions the Reverse Logistics Association, Supply Chain Management Review and WERC set out to answer in a recent survey of readers and members.

See “About the Research” below for information about the study.

To download the full Research Report click here.

Our bottom line: Organizations like U.S. Cellular that are paying attention to returns are realizing a benefit that either adds to or minimizes the hit to their bottom line. At the same time, the U.S. Cellulars of the world are the exceptions and not the rule as too few organizations are devoting sufficient resources to their reverse logistics processes.

About our research

This research was conducted in January 2018 by Peerless Research Group on behalf of the Reverse Logistics Association, Supply Chain Management Review and the Warehousing Education and Research Council. The study was conducted to better understand how organizations are handling their reverse logistics operations. The results are based on 272 qualified respondents and has a margin of error of +/- 6.1%.

This research was conducted in January 2018 by Peerless Research Group on behalf of the Reverse Logistics Association, Supply Chain Management Review and the Warehousing Education and Research Council. The study was conducted to better understand how organizations are handling their reverse logistics operations. The results are based on 272 qualified respondents and has a margin of error of +/- 6.1%.

Respondents represented a broad range of titles, including corporate/divisional director (11%), VP/general manager (14%), logistics/distribution director/manager (19%), warehouse/DC director/manager (8%), supply chain director/manager (7%), operations director/manager (7%), reverse logistics/returns director/manager (9%) and purchasing director/manager (2%). An additional 23% of respondents listed their title as engineer, inventory control manager, logistics supervisor, owner, product engineer, purchasing and logistics manager, sales or shipping supervisor.

More than one-third of respondents were manufacturers (34%), followed by 3PLs and transportation/warehousing service providers (33%), wholesale distributors (12%), retailers (7%), e-tailers (6%) and consultants (6%). More than one-third (34%) listed their primary business as business-to-business while 11% noted that they primarily sold directly to consumers; the remaining 55% sold into both channels. The average revenue of respondents was $862.7 million, with 27% indicating revenues of more than $1 billion; at the other end of the scale, 37% indicated revenues of less than $50,000.

The who's who of reverse logistics

One of the truisms of business, attributed to management guru Peter Drucker, is that what gets measured gets managed. Now, truth be told, Drucker went on to add that the practice is true “even when it's pointless to measure and manage it …” We would argue that when it comes to the sheer volume of returns coupled with the growth of e-commerce, failing to measure the logistics, labor and revenue associated with reverse logistics is far from pointless—it's no longer an option.

Survey respondents do recognize that when done right, reverse logistics delivers value to the organization. Nearly two-thirds, for instance, cited improved customer service and satisfaction as a benefit of their reverse logistics processes, followed by less waste (40%) and tangible cost savings (36%) At the same time, just 60% said that reverse logistics was extremely important (26%) or very important (34%) to their company. You have to wonder why.

Survey respondents do recognize that when done right, reverse logistics delivers value to the organization. Nearly two-thirds, for instance, cited improved customer service and satisfaction as a benefit of their reverse logistics processes, followed by less waste (40%) and tangible cost savings (36%) At the same time, just 60% said that reverse logistics was extremely important (26%) or very important (34%) to their company. You have to wonder why.

The first step in raising the visibility of returns is having someone responsible for the process. Yet, based on survey responses, in many respects returns and reverse logistics is an orphaned function, with no one clearly claiming parental responsibility. Only 17% reported that they had a department dedicated to reverse logistics and another 16% responded that reverse logistics was organized under a single group or department—which might have other priorities. The latter ranged from logistics (31%) to distribution (16%) to supply chain (14%) to sales (7%). Nearly 60% responded that reverse logistics is handled across more than one department, ranging from logistics (55%) to sales (30%) to finance (14%) to product marketing (7%).

The titles of respondents, which ranged from corporate directors to operations managers to purchasing managers, reflects that diversity. Indeed, only 9% of respondents were managers or directors of reverse logistics. You can read more about the breakdown of respondents in the “About our research” sidebar.

Perhaps the most telling response was that more than two-thirds of respondents (68%) said that no one at the corporate level in their company was responsible for reverse logistics. Nor are senior leaders overseeing the process as a rule: Only 15% of the reverse logistics managers reported to a vice president of operations while only 13% each reported to the CEO or president and only 9% reported to a vice president of supply chain.

Rather, the responsibility for reverse logistics was largely doled out to department managers (44%) or supervisors (13%) in logistics, warehousing, inventory management and other departments associated with traditional supply chain management functions. Senior leaders at the president/CEO (16%) or vice president (18%) level accounted for just over one-third of respondents. The list of titles to whom the individual in charge of reverse logistics reported was equally diverse, with some 26 titles; the question of who else was involved in reverse logistics operations produced a list of 50 other titles.

Rather, the responsibility for reverse logistics was largely doled out to department managers (44%) or supervisors (13%) in logistics, warehousing, inventory management and other departments associated with traditional supply chain management functions. Senior leaders at the president/CEO (16%) or vice president (18%) level accounted for just over one-third of respondents. The list of titles to whom the individual in charge of reverse logistics reported was equally diverse, with some 26 titles; the question of who else was involved in reverse logistics operations produced a list of 50 other titles.

The impression is that while the number of returns continues to grow, reverse logistics is largely in the hands of mid-level managers, with responsibility spread across a multitude of departments and with little oversight at the senior level.

Returns basics

The “make or buy” decision could be one of the most important decisions related to any logistics or distribution function. In the case of reverse logistics, more than two-thirds of respondents (68%) are handling their returns operations in-house and another 2% indicated that they outsource now but plan to pull those tasks back under their control. Meanwhile, 13% responded that they outsource all of their reverse logistics operations and an equal percentage outsource some tasks but keep others in-house. Only 4% of those who currently do it in-house plan to outsource to a 3PL in the future.

Why do it yourself? More than half (54%) said it allows them to keep better control, while 51% said they can be more responsive to customers, 47% have the resources to handle in-house and 45% believe they can do it for less expense.

Of those currently outsourcing, 60% said it is not their core competency and an equal percentage believe it's more cost-effective to outsource. Interestingly, 38% believe that a 3PL can be more responsive to customers, 33% said they just don't have the resources or labor to do it in house, and 25% are limited by space in their facilities.

Regardless of who handles returns, a surprising 39% of respondents said they have no visibility into returns—they just show up. A similar number (38%) receive scheduled reports and 32% track point of sale information at their returns center.

More surprising, 40% of respondents couldn't determine how much reverse logistics is saving their company and another 36% aren't sure. Only 24% said they were able to determine how much their reverse logistics operation is saving their company, with an estimated average annual revenue savings of 16.5%.

Some 44% of respondents accept returned items at a fulfillment or returns center, and another 15% of respondents said they were 3PLs who handle reverse logistics tasks for their customers, presumably at the 3PLs distribution center. Three-fourths of respondents don't expect that to change in the next two years.

Some 44% of respondents accept returned items at a fulfillment or returns center, and another 15% of respondents said they were 3PLs who handle reverse logistics tasks for their customers, presumably at the 3PLs distribution center. Three-fourths of respondents don't expect that to change in the next two years.

More than 70% of respondents are collecting information regarding returned items, and another 15% say they sometimes collect information. In fact, only 11% said that they never collect information about returned items. The most common collected data among retailers (R) and manufacturers (M) included who is returning the item (81% - R, 92% - M), the model number (79% - R, 81% - M) and the date sold (60% - R, 64% - M). Retailers were also collecting if the customer is a repeat returner (60%), where the item was purchased (44%) and how the item was purchased (35%), while 57% of manufacturers were also collecting the serial number.

The number one reason for returns, noted by 59% of respondents, was defective merchandise, estimated to account for 16.3% of returns. Forty-two percent of respondents identified buyer's remorse as a reason for returns while 29% noted that the product wasn't what the customers was expecting or that the product had been misrepresented as a reason for returns.

The most common challenges associated with processing returns: Damaged goods (52%), no reason given for a return (40%), missing parts (38%), incorrect or inaccurate manifests (36%), and a reverse logistics process that needs improvement (33%).

Last, respondents are utilizing a multitude of channels for the disposition of returned items that are in re-sellable condition, ranging from putting the item back on the shelf or a liquidation sale (both at 56%), selling to a discount retail chain such as Big Lots (21%), auctioning off inventory (18%) and utilizing a dedicated page on the company website (9%). Other channels mentioned included charitable donations, outlet stores, refurbished and discounted, selling or giving away to employees and destroying.

Digital returns

Few of us would challenge the notion that e-commerce is affecting the way we do business and order fulfillment. Given easy return policies, there is certainly the perception that e-commerce is having an impact on reverse logistics processes. That is borne out by the 75% of respondents who said that the number of returns they are dealing with has increased and that e-commerce has affected their ability to manage their reverse logistics operations (39%). Only 28% of respondents indicated that their reverse logistics platform is very prepared to handle a growing e-commerce business, while 53% said they are somewhat prepared.

At the same time, 62% of respondents said that e-commerce is not changing the way they process returns at all or not very much. Another 22% said that it is only changing their processes to some extent. Only 16% said that e-commerce is changing their reverse logistics processes to a great extent. Of those who believe that e-commerce will affect their overall business operations in the next two years, 57% believe they will improve while only 3% believe they will deteriorate.

At the same time, 62% of respondents said that e-commerce is not changing the way they process returns at all or not very much. Another 22% said that it is only changing their processes to some extent. Only 16% said that e-commerce is changing their reverse logistics processes to a great extent. Of those who believe that e-commerce will affect their overall business operations in the next two years, 57% believe they will improve while only 3% believe they will deteriorate.

Of those respondents making plans to deal with more returns in the future, 26% are increasing their warehouse space, 22% are adding part-time labor and 16% are adding full-time labor, 22% have set up a dedicated department to handle e-commerce returns and 11% are outsourcing the function.

Given that e-commerce fulfillment has had a tremendous impact on order fulfillment and transportation strategies, we believe that it is only a matter of time before reverse logistics organizations will need to rethink their operations.

Given that e-commerce fulfillment has had a tremendous impact on order fulfillment and transportation strategies, we believe that it is only a matter of time before reverse logistics organizations will need to rethink their operations.

The Internet of Things (IoT) is also heavy in the supply chain discussion about the future. When it comes to return rates, only 20% of respondents believed that IoT is a driver to a great extent (7%) or to some extent (13%). The vast majority, 70%, said that it is not having much, if any, impact and 10% don't yet have an IoT strategy.

Those who do think that IoT is affecting their business said they are getting more analytics and data about sales, that IoT is providing more transparency and that they are using IoT data to predict and resolve failure events before they become an issue, reducing the need for returns.

Looking forward

Whether your organization is a manufacturer, wholesale distributor, retailer or e-tailer, returns are ingrained in the customer experience. Whether it's the ease of doing a return with Amazon, liberal return policies from fashion and apparel companies or the fact that service on electronics and appliances is often done by third parties, business customers and consumers alike judge the companies they do business with by their returns experience.

Our survey respondents clearly recognize that fact: 75% agreed that reverse logistics is a key component to a streamlined supply chain and only 3% stated that reverse logistics is a waste of time. At the same time, there was a complacency among respondents, where only 24% disagreed with the statement that their reverse logistics process needs to be re-engineered and only 39% disagreed that their process for handling returns lacks focus. Many more were in the middle—they didn't know. In an earlier question, only 33% indicated that their processes needed improvement. Clearly—or maybe not so clearly—it is a mixed bag.

Delivering Value at U.S. Cellular

Over the past five years, returns at U.S. Cellular has evolved from a cost of doing business to a process that gets the most value out of the more than 500,000 devices and accessories coming through the reverse supply chain each year. What changed?

According to Amy Augustine, senior manager of reverse logistics, the catalyst was an internal audit of her operations. “We discovered that my processes down at the DC were rock solid,” Augustine says. “We also discovered that any issues we were having were due to upstream processes before the devices came into my custody.”

Around that time, U.S. Cellular centralized it’s supply chain, which provided greater visibility across company leadership. “Now, there was a lens on the process,” Augustine says. “So much so that we've developed a suite of reports for leadership. They want to understand from soup to nuts what's reverse logistics, what are the cost impacts and where are the revenue drivers.” She adds that in 2017, her organization was cash flow positive.

Once returns had the attention of senior leadership, Augustine says the returns team took several steps to turn the process into a best practice. One was to launch continuous improvement initiatives, such as changes to the returns receiving process with its 3PL provider, and identifying opportunities within the DC that would increase revenues when product was sold on the secondary market. One example: asking stores to remove and dispose of screen protectors prior to returning a device. The team also worked with different groups across U.S. Cellular to develop financial reports that began getting rolled out about a year and a half ago. A third was the creation of “360 VUE,” a suite of reports on used equipment that is sent to leadership. The team tracks the inventory acquisition cost, the return freight cost, the labor associated with processing a return, the cost of any parts or return to the OEM for repair and revenue from selling inventory on the secondary market.

From a process standpoint, devices and accessories can come into the supply chain from a myriad of channels. U.S. Cellular has a 24-hour service level agreement with its 3PL partner to return any device received before noon the next day. Devices returned because of a mechanical failure in the first 15 days of a contract are verified and shipped to the OEM. Otherwise, items are received and graded on cosmetic appearance as an A, B, C or D item. Items for which there might be demand are sent to storage. Otherwise, they go to the re-commerce team to resell online. Items are auctioned off to revenue share partners that sell them on-line and share the revenue with U.S. Cellular.

When we asked what had changed in their reverse logistics operations over the last two years, 56% said that they had improved, but 41% said there had been no change at all with the remainder saying they had deteriorated. Driving those changes was a need to improve efficiencies (53%), more demanding customers (44%), the volume of returns (38%), and the volume of sales (23%).

When we asked how their processes will change over the next two years, we received almost identical responses: 57% expect them to improve, through better tools to forecast, track and manage returns. At the same time, 40% expect no change at all, and the rest expect them to deteriorate.

In reviewing the results, we came to two important conclusions. The first is that, as with U.S. Cellular, those respondents with a focus on reverse logistics are realizing benefits that have an impact on their bottom lines. Yet, too many respondents indicate that they aren't paying close enough attention or don't have enough resources. One example: Liquidation was the second most common way of handling returned items in a re-salable condition. While that might be a simple solution, it's leaving money on the table.

Those findings are consistent with the experiences of the two organizations that co-sponsored this research, WERC and the Reverse Logistics Association.

Tony Sciarrotta, the executive director of the Reverse Logistics Association and a former reverse logistics executive at Philips Electronics, was struck that more than two-thirds of respondents (68%) said that no one at the corporate level in their company was responsible for reverse logistics. “During my 15 years at Philips, everyone knew that I was accountable for returns,” says Sciarrotta. “If no one knows who is responsible, it doesn't get fixed.” He also noted that 42% of respondents said that reverse logistics was somewhat or not very important to their organizations. “What we do matters to your organization's bottom line, and not enough respondents said it was important.”

Michael Mikitka, the CEO of the Warehouse Education Research Council, similarly noted the number of respondents that said they lacked resources for their reverse logistics operations. “Those who are paying attention are experiencing a benefit, but not enough organizations are putting resources into their operations,” he said. He also noted that 70% of respondents said they were somewhat or not prepared to handle a growing e-commerce channel. Yet, we all know that e-commerce is only going to grow as a sales channel, resulting in even more returns. At the same time, Mikitka saw the glass half full. “When those companies that are doing it right see improvements in key areas that affect their bottom lines, such as reducing costs and waste, those are opportunities,” he said.

The second is to repeat the axiom that what gets measured gets managed. When only 27% said they could quantify the impact on annual revenues, that means that most don't understand their end-to-end costs. That makes it difficult to justify investments that can improve operations.

Judd Aschenbrand is the director of research for Peerless Research Group and can be reached at [email protected]. Michael Mikitka is the CEO of the Warehouse Education Research Council, or WERC, and can be reached at [email protected]. Tony Sciarrotta is the executive director of the Reverse Logistics Association and can be reached at [email protected]. Bob Trebilcock is the editorial director of Supply Chain Management Review and can be reached at [email protected].

SC

MR

Latest Supply Chain News

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- More News

Latest Podcast

Explore

Explore

Procurement & Sourcing News

- How S&OP provides the answer to in-demand products

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- How one small part held up shipments of thousands of autos

- Shining light on procurement’s dark purchases problem

- 40% of procurement leaders ignoring sustainability, study reveals

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks