The unabated rise in distribution costs and resulting profit squeeze has become prominent in corporate commentary on financial results. Retailers such as Home Depot and Target are blaming high supply chain costs for margin deteriorations, amplified by the move to online sales as digital revenues grow 20-40% annually for most major retailers. The trend of margin deterioration due to rising distribution cost is not just limited to retailers but extends to industrials, chemicals, automotive and others.

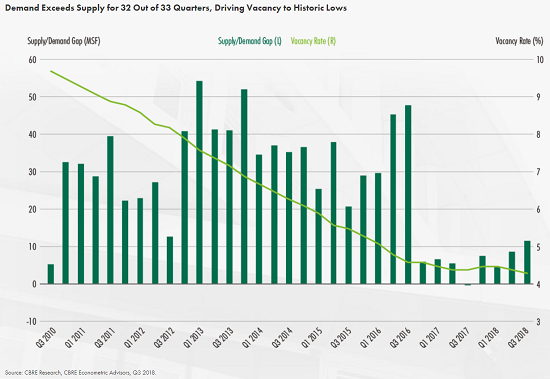

Warehouse vacancy rates continue to flirt with all-time lows

According to CBRE, industrial-and-logistics real estate vacancy rates are near historic lows at nearly 4% with demand exceeding supply for last 32 out of 33 quarters. Warehouse rental rates have been rising 5-6% per year on average, far above commercial real estate rate increase of 2-3%.

Figure 1

Stacking factors (indicating how many pallets can be stacked on top of each other) are trending down due to greater need for pick profile flexibility driven by smaller sized e-commerce orders vs. full pallet orders by big box retailers. This is leading to greater needs for additional warehouse locations or overflow spaces when rates are already high and supply tight. Companies are therefore increasingly looking for ways to better use vertical space through multi-level racking investments to support single-unit picking.

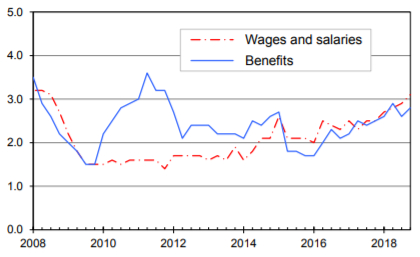

Warehousing employment cost index is accelerating at a speed not seen since the recovery period after the Great Recession, due to a shortage of warehouse workers and minimum wage increases

As per BLS, overall employment cost index jumped by 3% in 2018 (see chart below), whereas for transportation and warehousing workers, the corresponding jump was even higher at 3.5%.

Figure 2

Source: Bureau of labor Statistics (BLS) Employment Cost Index Percent Change y-o-y (Dec 2018)

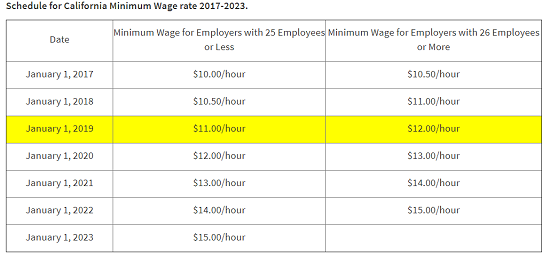

Labor and staff typically constitute 40-60% of the warehouse operations cost, so changes in the employment cost index correlate tightly with warehouse rates and contractual price adjustments. Minimum wage increases are pushing up wages for all low skilled labor. California minimum wage will go up from $10 in 2017 to $15 in 2023 which translates to a nearly 7% annual increase. Proposed legislation in other states indicates that the minimum wage could approach $15 in the next 3-5 years. Demand for highly skilled labor is accelerating in warehouses and employee requirements have evolved as service levels, performance and efficiency become paramount. According to Logistics Management both logistics salaries and the number of functions that warehouse staff are being asked to do have risen. BLS reported separation rates for “Transportation, warehousing and utilities” have been consistently going up for last 5 years from 38% in 2014 to 44.2% in 2018. While this article looks closely at technology innovation in warehousing, one simple area to work on is the boosting of employee working conditions and morale.

Figure 3

Tariff uncertainty creates planning nightmare

Retailers pulled forward orders in Q4 2018 to beat tariff deadlines but that meant high levels of inventory and warehouses at record capacity. Although this could be seen as a one-off event, the ongoing trade dispute resulted in companies scrambling to re-plan their supply chains, often at high logistics cost as they ran out of storage space.

Impact – Acceleration in warehousing costs, focus on efficiency and innovation

Although e-commerce is adding complexity to warehouse operations, shorter delivery lead times and deployment of inventory across the supply chain, including the last mile, have become the norm. Third party logistics providers are now quoting 10-20% rate increases for standard warehousing activities such as receiving, storage, delivery, returns, etc. Increased complexity and rising rates pose a multifaceted issue for logistics sourcing teams. Those lacking procurement discipline and a proactive bid planning roadmap are struggling due to an inability to leverage market competition or explore alternative solutions.

A focus on emerging technologies has increased but traditional firms underinvesting to improve logistics efficiency are seeing limits to cost cutting initiatives and a sharper rise in warehousing costs. An alternative or complement to a robust bid strategy is a good collaborative supplier development policy. Even though the onus is on 3PLs to invest in new technologies to improve productivity, partnering approaches and assurances involving cost-benefit sharing as part of the shipper-supplier relationship encourages them to invest.

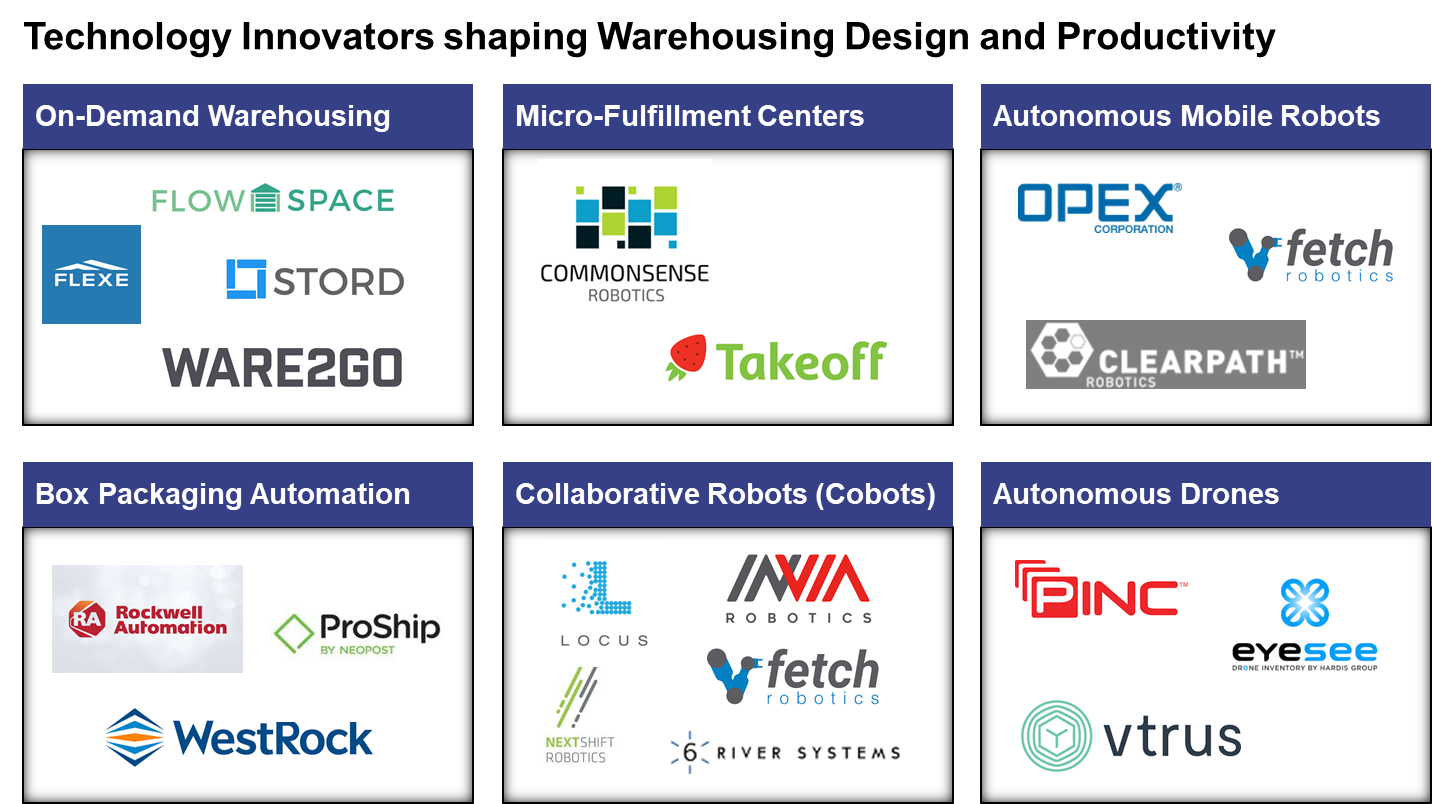

Innovative ideas are often transportation and fleet focused (e.g. real time route optimization, uberization of freight, autonomous trucks) but interesting concepts in warehousing and technology-driven productivity initiatives have emerged. Traditional warehousing operations are evolving dramatically with the help of technology innovators and logistics leaders must stay on top of these developments.

Figure 4

Source: A.T. Kearney research

Pop-up warehousing start-ups such as Flexe, Flow Space, Ware2go have emerged in the market, first to support e-commerce business and peak season demand but also as a safety valve for large shippers and 3PLs seeking flexibility. Major retailers such as Walmart.com, Walgreens, Staples and Bath & Body Works are already working with these and other startups. Also known as on-demand warehousing, benefits such as no start-up costs, short implementation lead times of 3-4 weeks and flexibility to pay for short term usage outweigh the disadvantage of paying higher unit costs than typical long-term contracts.

Retail-to-warehouse conversion concept is also taking off with MH&L (Material Handling & Logistics Group) reporting empty stores and shopping malls being converted into distribution centers. Brick-and-mortar store closures is a key enabler of this concept.

Micro-fulfillment centers which are located in urban areas near consumers with a fraction of the size of a typical store, are being tested to support fast inexpensive grocery delivery. CommonSense Robotics, an Israeli micro-fulfillment startup has launched autonomous sorting and shipping capabilities to prepare orders in less than three minutes. According to CSR, retailers incur a loss of $5 to $15 on every manually picked online grocery order. In fall 2018, CB Insights reported that grocery retailer Albertsons partnered with warehousing robotics startup Takeoff Technologies to pilot a small urban fulfillment center.

Autonomous Mobile Robots (AMRs) are more advanced than older AGVs (Automated guided vehicles) and finding adoption in warehouses that require faster, smarter, more flexible robots that are easy to set up and require less capital investment. AGVs have been around for decades but primarily used to support operations around production lines such as transportation of raw materials, semi-finished goods and finished goods between manufacturing and attached plant buffers. AGVs are being tested in large warehouses where repetitive tasks dominate but manually operated forklifts are still preferred for smaller operations. AMRs are more advanced as they can use dynamic navigation instead of being restricted to fixed routes and operate safely in an environment of workers and forklifts. Using AI-driven software, for instance, inVia Robotics’ Picker robots autonomously retrieve and move goods throughout warehouses as part of the order fulfillment process. Meanwhile, in October 2018, Honeywell announced a strategic collaboration with Fetch Robotics to fulfill growing volumes of e-commerce orders.

Box packaging automation and robots have been mainly used at the end of manufacturing assembly lines and but still in nascent stages when it comes to automation in warehouse and fulfillment centers.

Collaborative Robots (Cobots) have enabled a step change in pick productivity and help warehouses scale in peak seasons without the need to add proportionate number of warehouse workers. XPO and Geodis have started using Cobots at several locations to mimic zone picking. Cobots minimize travel for warehouse workers by making the journey from pick zone to pack station, clustering picking and allowing hands free scanning as workers don't need to carry a scanner. Locus, 6 River Systems, Fetch Robotics and NextShift Robotics are most active in this space.

Autonomous drones for stock counting have started finding their way into warehouses to automate the inventory management function. Drones require use of RFID technology to track the data and feed it into the warehouse management system. In August 2018, Walmart's EVP of Logistics joined PINC's board of directors. PINC is the leading provider of aerial inventory robots (drones) for digital inventory solutions. Drones use optics technology along with autonomous navigation features and cloud orchestrated platform to locate and scan inventory. The core difficulty is identifying where the inventory is and a lot of research is focused on enhancing navigation and inventory identification capabilities.

WMS Integration is key to success from technology innovation

Use of technology and automation solutions requires time to test, pilot and roll out, and does not solve near term cost challenges. Most wireless devices and solutions rely on cloud-based platforms and an IoT (Internet of Things) sensor network for WMS integration. Technology is not just relevant to automation technologies but also to implementation of new warehouse concepts such as on demand warehousing. It requires the ability to quickly connect a forward deployed location as another zone in the WMS and necessary infrastructure needs to be in place. Digitization of supply chain and warehousing thus requires a more holistic view of system architecture and support tools for it to work seamlessly rather than simply introducing the latest technology and innovation within the four walls.

The key challenge facing logistics managers is how best to contain rising distribution costs in the near term while planning for long term productivity gains. Companies were not fully prepared for sudden increase in warehousing costs in 2018. Now they are trying to build agility in their supply chains through flexible assets and strategic partnerships, not only to get closer to customers but also to react quickly to changing market conditions without paying inflated rates. While pressure may drop as the business cycle turns, the structural drivers of high warehousing costs are here to stay, think shift towards e-commerce or home delivery of nearly all consumer products and further minimum wage increases. Logistics executives who prepare to address these challenges are far more likely to succeed.

Michael Zimmerman is a partner in the Solutions Practice of A.T. Kearney, the global management consulting firm.

Alberto Oca is a principal in the Operations & Performance Transformation Practice of A.T. Kearney, the global management consulting firm.

Akash Agrawal is a senior manager in the Solutions Practice of A.T. Kearney, the global management consulting firm.

SC

MR

Latest Supply Chain News

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- More News

Latest Podcast

Explore

Explore

Topics

Latest Supply Chain News

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks