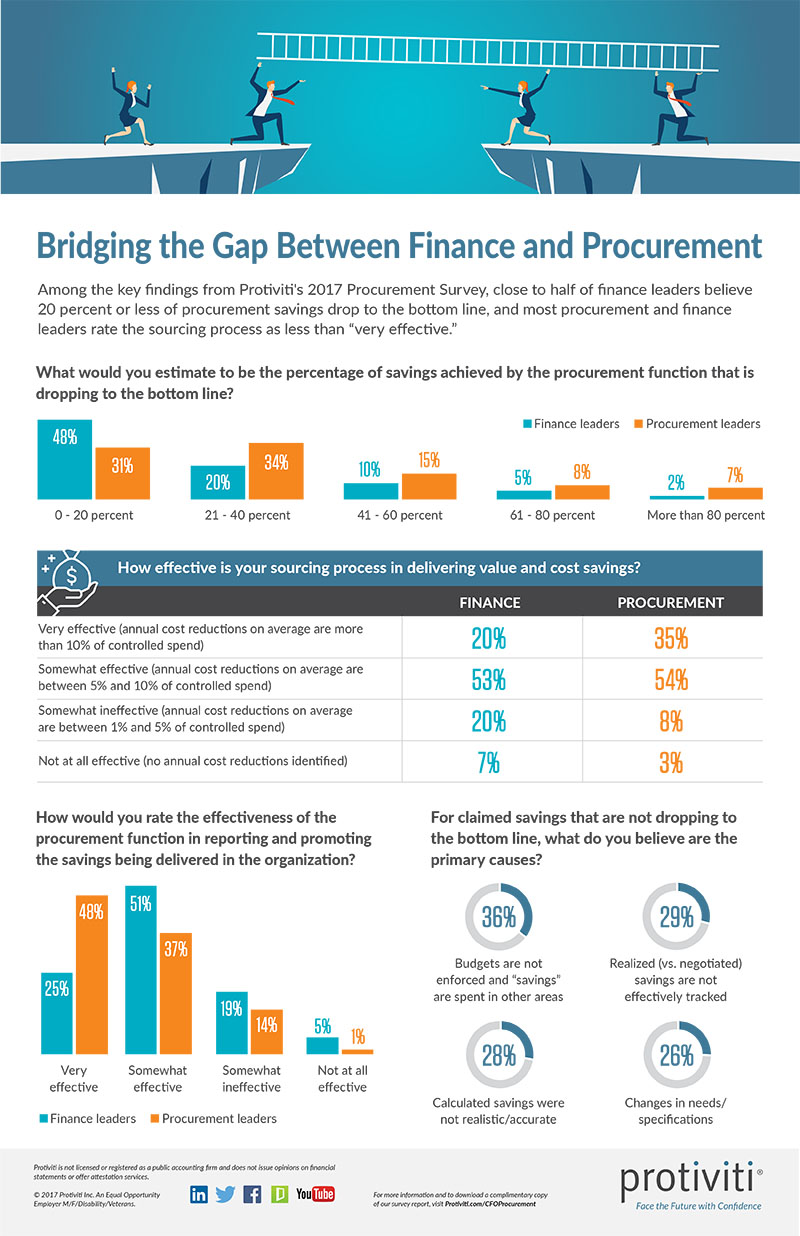

According to a new procurement study by global consulting firm Protiviti, nearly half of finance leaders claim that 20 percent or less of procurement savings wind up dropping to their companies' bottom line. Amid a business environment where monetary returns, business value and financial risk are under intense scrutiny, the survey report highlights a clear disconnect between corporate finance and procurement in the perceived value contributed by the procurement function to an organization's profitability.

The Protiviti survey report, Bridging the Gap between Finance and Procurement, is based on an in-depth survey of 440 finance and procurement executives, who were asked for their views on procurement's performance and value. The survey was conducted in the first quarter of 2017, and 41 percent of respondents' organizations have revenues of $1 billion or more. The survey was motivated by the frequency with which Protiviti observes opposing assessments of procurement's performance by these leaders.

According to the survey findings, the perceived disconnect stems from the way procurement functions track and communicate savings, as well as how they collaborate with finance departments and work with the business to ensure these savings positively affect the bottom line. Forty-one percent of those surveyed say that although procurement savings are being tracked (overall, less than half actually track absolute savings), the measurement and value are not being articulated across the organization. In addition, just over one in three view the working relationship between finance and procurement as collaborative, suggesting much room for improvement.

“A synergistic finance-procurement relationship appears aspirational for most organizations, as few are currently living up to this ideal,” says Bernie Donachie, a Protiviti managing director and leader of the firm's supply chain practice. “Although the two functions are not seeing eye-to-eye in terms of procurement's performance or the value it delivers, it's demonstrably clear that procurement functions have an opportunity to focus on how they drive value and quantify and communicate their performance across their organizations, which can lead to improved profitability.”

Donachie told SCMR in an interview that one of the most surprising findings in the survey was the 15% gap between the way finance and procurement leaders perceive the cost of procurement and its provided value.

“We were also surprised that nearly 1 in 4 (23%) procurement respondents view the cost of procurement as greater than the value,” he says.

Also surprising, says Donachie, is that 60% of respondents report spend-analysis as informal, ad-hoc, or not used.

Additionally, the survey results show that savings don't get to the bottom line because “budgets are not enforced,” he adds.

“Based on our survey question about operating models, the results make a strong case for centralization—when the finance and procurement functions are centralized, they appear to generate more bottom-line savings,” says Donachie. “

In the future, researchers are likely take a closer look at digitalization.

“Our research showed that most organizations need to work on savings-to-P&L traceability,” says Tony Abel, a Protiviti managing director and a leader within the supply chain practice. “Fewer than half of procurement leaders rate their function as ‘very effective' in reporting and promoting the savings it delivers. The views of finance leaders are significantly less positive still.”

However, of the 16 percent of procurement departments that are viewed internally by executives as profit centers, there are several common noteworthy characteristics, including:

- Utilizing spend analysis within budgeting and planning functions (85 percent)

- Using third-party tools to conduct spend analyses (55 percent)

- Tracking achieved savings generated by procurement (92 percent)

- Including cash flow and working capital as key elements of procurement savings goals (82 percent)

“Based on our analysis of the findings, a distinct set of traits emerge when comparing higher-performing procurement functions to lower-performing functions,” says Christopher Monk, a managing director with Protiviti and a leader within the supply chain practice. “Procurement can drive visible value across their organizations by improving their spend analysis capabilities and tools; centralizing core activities; and including cash flow and working capital as part of overall savings goals, thereby turning negotiated savings into realized savings that impact the bottom line. An added benefit of putting these best practices into motion is to bolster procurement's credibility throughout the enterprise.”

Infographic: Bridging the Gap Between Finance and Procurement

Download the full report “Bridging the Gap Between Finance and Procurement” here.

SC

MR

Latest Supply Chain News

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- Tips for CIOs to overcome technology talent acquisition troubles

- More News

Latest Podcast

Explore

Explore

Procurement & Sourcing News

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- How one small part held up shipments of thousands of autos

- Shining light on procurement’s dark purchases problem

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks