Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

November 2023

Last month, I had the pleasure of attending the NextGen Supply Chain Awards in Chicago. It was my first time attending the conference, which was in its fifth year, and I came away impressed with both the content and the quality of professionals I met in Chicago. This year’s conference—Strategies for a Digital Future—featured nearly 50 speakers and included CEOs and senior vice presidents, founders and innovators, leading academics and researchers, and top consultants. Over two days of the event at the Chicago Athletic Association, we learned more about artificial intelligence and predictive analytics, robotics and machine learning, fulfillment… Browse this issue archive.Need Help? Contact customer service 847-559-7581 More options

Organizations face pressure from multiple directions when it comes to sustainability in the supply chain. Factors such as public perception, competitors’ actions, and regulatory compliance all influence how organizations approach their environmental practices to protect natural resources. Perhaps more so than other factors, regulatory requirements for sustainability loom large. With increasingly rigorous regulations, sustainability is becoming synonymous with compliance, and organizations face penalties and negative attention if they do not meet requirements.

Alongside increased regulation is an increase in labor concerns. Organizations must put forth more effort to measure, report, and reduce greenhouse gas (GHG) emissions while facing employee retention worries and talent shortages. Yet many organizations are making it work. Ever-increasing numbers are measuring their GHG emissions, but there is still room to improve their understanding of the impact made by their supply chains.

Check out the related Infographic from APQC.

The World Resources Institute and the World Business Council for Sustainable Development categorize GHG emissions into three scopes:

- Scope 1 emissions are those that occur from sources controlled by an organization;

- Scope 2 emissions are indirect emissions associated with the purchase of electricity, steam, heat, or cooling; and

- Scope 3 emissions are those that result from sources not owned or controlled by the organization, but that the organization indirectly affects.

In response to regulations and legislation, many organizations have to measure and report on their Scope 3 emissions. Yet this can be hard to do as organizations often lack the ability to efficiently collect this information from suppliers.

Why Scope 3 emissions matter

In perspective, supply chains’ Scope 3 emissions have a clear effect on the environment. Transportation is one of the top sources of emissions. According to Dr. Josué Velázquez Martínez of the Sustainable Supply Chain Lab at MIT’s Center for Transportation and Logistics, we can anticipate further increases in emissions related to supply chains given the increasing amount of e-commerce, urbanization, and omni-channel fulfillment.

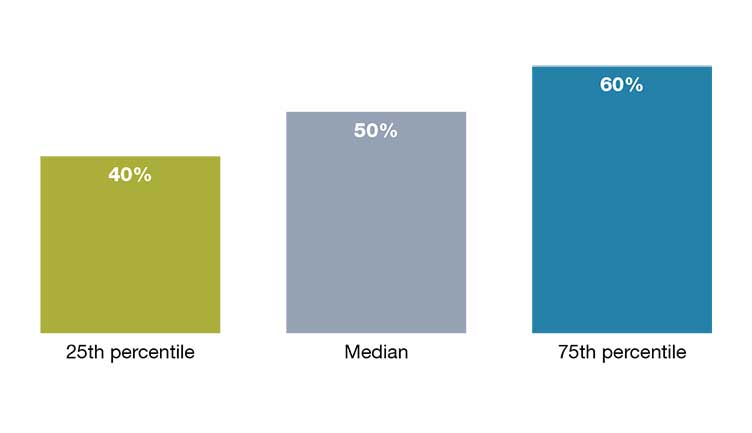

Figure 1: Percentage of active tier 1 suppliers asked to provide emissions data

Source: APQC

Further, the Carbon Disclosure Project (CDP) indicates that a company’s supply chain emissions are an average 5.5 times larger than its Scope 1 and Scope 2 emissions. This emphasizes the importance of efforts to tackle Scope 3 emissions and boost an organization’s sustainability.

Companies face additional pressure from new and revised governmental regulations related to GHG emissions. The Environmental Protection Agency is continuing its phased approach to adopting standards related to GHG emissions. Lawmakers in the United States continue to propose legislation related to companies’ disclosure of environmental data, and the European Commission has adopted its Corporate Sustainability Reporting Directive. These further developments highlight the need for organizations to identify, monitor, and report their Scope 3

GHG emissions.

Current state

Organizations seeking to monitor and reduce their Scope 3 emissions need to prioritize gathering emissions data from their suppliers. It is most logical to start with tier 1 suppliers as they are key to the business. According to APQC’s Open Standards Benchmarking research, at the median (or midpoint), organizations currently ask only 50% of their active tier 1 suppliers for emissions data (see Figure 1). Even at the 75th percentile, organizations ask only 60% of their active tier 1 suppliers for this information.

These results are concerning given that tier 1 suppliers make up a large portion of an organization’s total GHG emissions. Yet even among their closest suppliers, many companies are not prioritizing the collection and monitoring of this data.

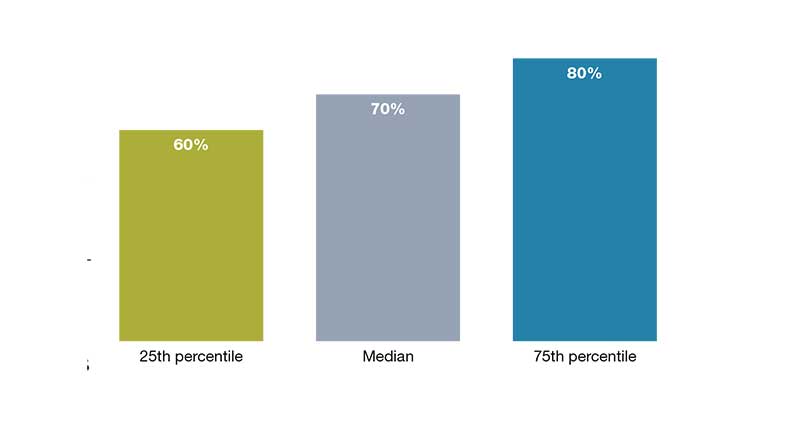

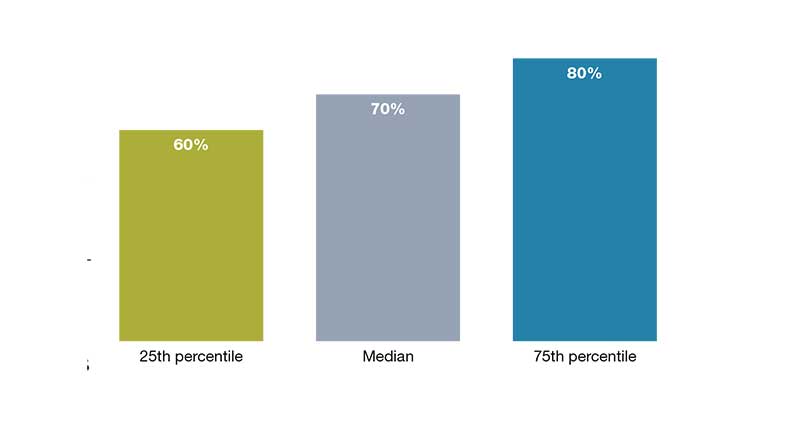

Figure 2: Percentage of total estimated supplier greenhouse gas emissions covered by active tier 1 suppliers asked to provide data

Source: APQC

The good news is that the median 50% of suppliers that have been asked to provide data represent 70% of the total GHG emissions across all suppliers for organizations in APQC’s research. At the 75th percentile, the 60% of suppliers asked to provide data represent 80% of the total emissions for all suppliers (Figure 2).

These results show that many organizations are on the right path to tracking their total impact on sustainability. Yet there is clearly room to grow. If an organization at the median receives data that covers 70% of its suppliers’ emissions, it still lacks data for nearly one-third of its suppliers’ emissions. This goes beyond simply tier 1 suppliers, as it highlights the need for organizations to consider how lower-tier suppliers fit into their overall sustainability strategy.

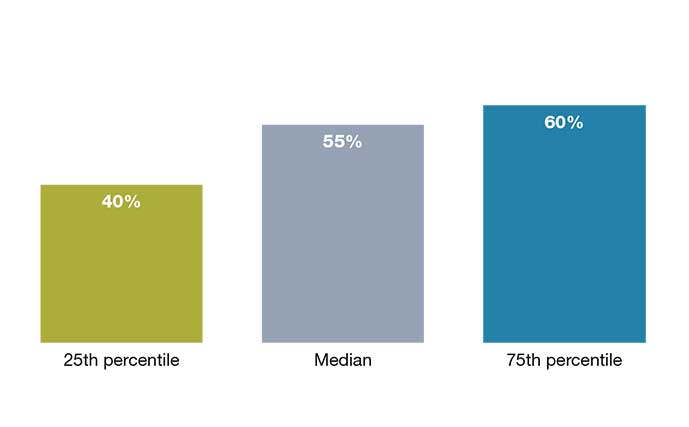

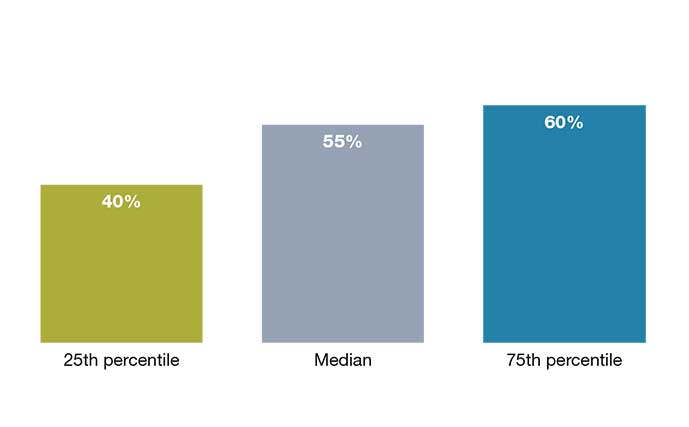

Figure 3: Percentage of active tier 1 suppliers that can provide greenhouse gas emissions data at individual product or service level

Source: APQC

Are we there yet?

Although obtaining emissions data is an essential part of sustainability efforts, there is more work to be done. This includes digging into GHG emissions data to determine the impact of individual products or services.

As shown in Figure 3, at the median only 55% of active tier 1 suppliers can provide emissions data at the product or service level. For the remaining suppliers, organizations must estimate carbon emissions based on aggregate or secondary data. Less precise estimates reduce the effectiveness of organizations’ monitoring programs. For companies to make informed decisions on ways to reduce their Scope 3 emissions, they need more precise data from suppliers.

Part of the challenge with collecting emissions data from suppliers is that it presents a change from the way business has been conducted in the past. Many companies have resisted sharing too much information to preserve their competitive advantage. In addition, collecting sustainability data requires an investment in resources and systems for collecting and storing information, and suppliers may not immediately see the return on investment. A movement toward transparency means that organizations must engage in change management with their suppliers.

Opportunity to improve

Regardless of why organizations have not collected Scope 3 emissions data, the pressure for companies to take action on sustainability has increased and continues to do so. With the addition of more regulations,

organizations have to innovate how they measure and report all scopes of GHG emissions.

Pressure from regulatory requirements. Tracking and disclosing GHG emissions are the subject of many new regulatory and legislative requirements. This is part of a broader effort focused on sustainability in supply chain. In addition to measuring emissions, organizations should also identify the origins of raw materials used in their products and any risks associated with sourcing and using those materials.

The goal is to ensure the long-term sustainability of an organization’s value chain. This includes awareness of potential risks, areas of weakness, and regulatory issues that can impact the business.

Governance matters. Ensuring efficient measurement and reporting of GHG emissions requires a strategic governance structure. Given that the majority of emissions fall under Scope 3, organizations may want to consider centralizing sustainability oversight within the supply chain function. In the past, many organizations created one role that monitored the organization’s sustainability work. The benefits of this model were limited because of a lack of authority granted to the role and because the role was removed enough from operations that it lacked insight into critical details of the business. The lesson from this is that one person cannot be responsible for sustainability oversight.

The question then is where should a team responsible for sustainability sit within an organization? According to Alexis Bateman, a supply chain sustainability expert, the location depends on the size of the organization. For a small company, it is feasible to have a central sustainability team focused on driving policy and execution in all aspects of the business, including supply chain.

For a large multinational company, Bateman believes there is an opportunity to have subject matter experts both within a centralized group and in smaller teams within each business unit. An overarching policy is established within the centralized group and then disseminated to the teams within business units who are responsible for implementation and monitoring.

For Scope 3 emissions, the procurement function can play a significant role in the visibility of supplier practices and data. Procurement can incorporate sustainability measures on supplier scorecards. It can also track data by product categories, materials, or regions to identify areas to target for emissions reduction efforts. Tracking emissions should be a collaborative effort between companies and their suppliers. Sharing information promotes transparency and encourages collaboration to improve performance, establish goals, and track progress of those goals.

Looking to the future

The work does not stop once companies identify how to track Scope 3 emissions in their value chains. The next step is for organizations to use the information they have to make improvements. By leveraging technology to help with measurement and reporting, companies can focus their efforts on identifying hot spots and investing resources to improve performance.

A key part of this process is creating a framework for the organization’s sustainability efforts, including supplier measurement criteria. Developing data standards and reporting practices ensures that information is accurate to inform decision-making. It is also important to keep in mind that although measurement and reporting are critically important, the ultimate goal is to reduce GHG emissions and not only report on them.

It is logical to focus on reporting from tier 1 suppliers, but also remember that lower-tier suppliers contribute to Scope 3 emissions as well. Companies may not have any contact with these suppliers, and it is challenging to collect information on entities when there is no direct relationship. In the absence of direct data on these emissions, companies can temporarily rely on estimates based on average emissions for a business sector. There are encouraging developments, such as the Net-Zero Data Public Utility, to help organizations access this critical data globally.

Tracking down and improving Scope 3 emissions is a long-term effort. While there are steps companies can take to address immediate needs for management and reporting, organizations should simultaneously consider boosting supplier relationships and using their influence to take action with suppliers to further reduce emissions.

About APQC

APQC helps organizations work smarter, faster, and with greater confidence. It is the world’s foremost authority in benchmarking, best practices, process and performance improvement, and knowledge management. APQC’s unique structure as a member-based nonprofit makes it a differentiator in the marketplace. APQC partners with more than 500 member organizations worldwide in all industries. With more than 40 years of experience, APQC remains the world’s leader in transforming organizations. Visit us at apqc.org and learn how you can make best practices your practices.

SC

MR

Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

November 2023

Last month, I had the pleasure of attending the NextGen Supply Chain Awards in Chicago. It was my first time attending the conference, which was in its fifth year, and I came away impressed with both the content and… Browse this issue archive. Access your online digital edition. Download a PDF file of the November 2023 issue.Organizations face pressure from multiple directions when it comes to sustainability in the supply chain. Factors such as public perception, competitors’ actions, and regulatory compliance all influence how organizations approach their environmental practices to protect natural resources. Perhaps more so than other factors, regulatory requirements for sustainability loom large. With increasingly rigorous regulations, sustainability is becoming synonymous with compliance, and organizations face penalties and negative attention if they do not meet requirements.

Alongside increased regulation is an increase in labor concerns. Organizations must put forth more effort to measure, report, and reduce greenhouse gas (GHG) emissions while facing employee retention worries and talent shortages. Yet many organizations are making it work. Ever-increasing numbers are measuring their GHG emissions, but there is still room to improve their understanding of the impact made by their supply chains.

Check out the related Infographic from APQC.

The World Resources Institute and the World Business Council for Sustainable Development categorize GHG emissions into three scopes:

- Scope 1 emissions are those that occur from sources controlled by an organization;

- Scope 2 emissions are indirect emissions associated with the purchase of electricity, steam, heat, or cooling; and

- Scope 3 emissions are those that result from sources not owned or controlled by the organization, but that the organization indirectly affects.

In response to regulations and legislation, many organizations have to measure and report on their Scope 3 emissions. Yet this can be hard to do as organizations often lack the ability to efficiently collect this information from suppliers.

Why Scope 3 emissions matter

In perspective, supply chains’ Scope 3 emissions have a clear effect on the environment. Transportation is one of the top sources of emissions. According to Dr. Josué Velázquez Martínez of the Sustainable Supply Chain Lab at MIT’s Center for Transportation and Logistics, we can anticipate further increases in emissions related to supply chains given the increasing amount of e-commerce, urbanization, and omni-channel fulfillment.

Figure 1: Percentage of active tier 1 suppliers asked to provide emissions data

Source: APQC

Further, the Carbon Disclosure Project (CDP) indicates that a company’s supply chain emissions are an average 5.5 times larger than its Scope 1 and Scope 2 emissions. This emphasizes the importance of efforts to tackle Scope 3 emissions and boost an organization’s sustainability.

Companies face additional pressure from new and revised governmental regulations related to GHG emissions. The Environmental Protection Agency is continuing its phased approach to adopting standards related to GHG emissions. Lawmakers in the United States continue to propose legislation related to companies’ disclosure of environmental data, and the European Commission has adopted its Corporate Sustainability Reporting Directive. These further developments highlight the need for organizations to identify, monitor, and report their Scope 3

GHG emissions.

Current state

Organizations seeking to monitor and reduce their Scope 3 emissions need to prioritize gathering emissions data from their suppliers. It is most logical to start with tier 1 suppliers as they are key to the business. According to APQC’s Open Standards Benchmarking research, at the median (or midpoint), organizations currently ask only 50% of their active tier 1 suppliers for emissions data (see Figure 1). Even at the 75th percentile, organizations ask only 60% of their active tier 1 suppliers for this information.

These results are concerning given that tier 1 suppliers make up a large portion of an organization’s total GHG emissions. Yet even among their closest suppliers, many companies are not prioritizing the collection and monitoring of this data.

Figure 2: Percentage of total estimated supplier greenhouse gas emissions covered by active tier 1 suppliers asked to provide data

Source: APQC

The good news is that the median 50% of suppliers that have been asked to provide data represent 70% of the total GHG emissions across all suppliers for organizations in APQC’s research. At the 75th percentile, the 60% of suppliers asked to provide data represent 80% of the total emissions for all suppliers (Figure 2).

These results show that many organizations are on the right path to tracking their total impact on sustainability. Yet there is clearly room to grow. If an organization at the median receives data that covers 70% of its suppliers’ emissions, it still lacks data for nearly one-third of its suppliers’ emissions. This goes beyond simply tier 1 suppliers, as it highlights the need for organizations to consider how lower-tier suppliers fit into their overall sustainability strategy.

Figure 3: Percentage of active tier 1 suppliers that can provide greenhouse gas emissions data at individual product or service level

Source: APQC

Are we there yet?

Although obtaining emissions data is an essential part of sustainability efforts, there is more work to be done. This includes digging into GHG emissions data to determine the impact of individual products or services.

As shown in Figure 3, at the median only 55% of active tier 1 suppliers can provide emissions data at the product or service level. For the remaining suppliers, organizations must estimate carbon emissions based on aggregate or secondary data. Less precise estimates reduce the effectiveness of organizations’ monitoring programs. For companies to make informed decisions on ways to reduce their Scope 3 emissions, they need more precise data from suppliers.

Part of the challenge with collecting emissions data from suppliers is that it presents a change from the way business has been conducted in the past. Many companies have resisted sharing too much information to preserve their competitive advantage. In addition, collecting sustainability data requires an investment in resources and systems for collecting and storing information, and suppliers may not immediately see the return on investment. A movement toward transparency means that organizations must engage in change management with their suppliers.

Opportunity to improve

Regardless of why organizations have not collected Scope 3 emissions data, the pressure for companies to take action on sustainability has increased and continues to do so. With the addition of more regulations,

organizations have to innovate how they measure and report all scopes of GHG emissions.

Pressure from regulatory requirements. Tracking and disclosing GHG emissions are the subject of many new regulatory and legislative requirements. This is part of a broader effort focused on sustainability in supply chain. In addition to measuring emissions, organizations should also identify the origins of raw materials used in their products and any risks associated with sourcing and using those materials.

The goal is to ensure the long-term sustainability of an organization’s value chain. This includes awareness of potential risks, areas of weakness, and regulatory issues that can impact the business.

Governance matters. Ensuring efficient measurement and reporting of GHG emissions requires a strategic governance structure. Given that the majority of emissions fall under Scope 3, organizations may want to consider centralizing sustainability oversight within the supply chain function. In the past, many organizations created one role that monitored the organization’s sustainability work. The benefits of this model were limited because of a lack of authority granted to the role and because the role was removed enough from operations that it lacked insight into critical details of the business. The lesson from this is that one person cannot be responsible for sustainability oversight.

The question then is where should a team responsible for sustainability sit within an organization? According to Alexis Bateman, a supply chain sustainability expert, the location depends on the size of the organization. For a small company, it is feasible to have a central sustainability team focused on driving policy and execution in all aspects of the business, including supply chain.

For a large multinational company, Bateman believes there is an opportunity to have subject matter experts both within a centralized group and in smaller teams within each business unit. An overarching policy is established within the centralized group and then disseminated to the teams within business units who are responsible for implementation and monitoring.

For Scope 3 emissions, the procurement function can play a significant role in the visibility of supplier practices and data. Procurement can incorporate sustainability measures on supplier scorecards. It can also track data by product categories, materials, or regions to identify areas to target for emissions reduction efforts. Tracking emissions should be a collaborative effort between companies and their suppliers. Sharing information promotes transparency and encourages collaboration to improve performance, establish goals, and track progress of those goals.

Looking to the future

The work does not stop once companies identify how to track Scope 3 emissions in their value chains. The next step is for organizations to use the information they have to make improvements. By leveraging technology to help with measurement and reporting, companies can focus their efforts on identifying hot spots and investing resources to improve performance.

A key part of this process is creating a framework for the organization’s sustainability efforts, including supplier measurement criteria. Developing data standards and reporting practices ensures that information is accurate to inform decision-making. It is also important to keep in mind that although measurement and reporting are critically important, the ultimate goal is to reduce GHG emissions and not only report on them.

It is logical to focus on reporting from tier 1 suppliers, but also remember that lower-tier suppliers contribute to Scope 3 emissions as well. Companies may not have any contact with these suppliers, and it is challenging to collect information on entities when there is no direct relationship. In the absence of direct data on these emissions, companies can temporarily rely on estimates based on average emissions for a business sector. There are encouraging developments, such as the Net-Zero Data Public Utility, to help organizations access this critical data globally.

Tracking down and improving Scope 3 emissions is a long-term effort. While there are steps companies can take to address immediate needs for management and reporting, organizations should simultaneously consider boosting supplier relationships and using their influence to take action with suppliers to further reduce emissions.

About APQC

APQC helps organizations work smarter, faster, and with greater confidence. It is the world’s foremost authority in benchmarking, best practices, process and performance improvement, and knowledge management. APQC’s unique structure as a member-based nonprofit makes it a differentiator in the marketplace. APQC partners with more than 500 member organizations worldwide in all industries. With more than 40 years of experience, APQC remains the world’s leader in transforming organizations. Visit us at apqc.org and learn how you can make best practices your practices.

SC

MR

More 3PL

- Orchestration: The Future of Supply Chain

- February and year-to-date U.S. import volume is solid, reports S&P Global Market Intelligence

- 2024 retail sales forecast calls for growth, says National Retail Federation

- ISM reports another month of services sector growth in February

- February manufacturing output declines, notes ISM

- How to Create Real Retailer-Brand Loyalty

- More 3PL

Latest Podcast

Explore

Explore

Business Management News

- Few executives believe their supply chains can respond quickly to disruptions

- Technology’s role in mending supply chain fragility after recent disruptions

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks