Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

January-February 2021

This morning, I turned on the television and watched the first stretch-wrapped pallets of the just-authorized vaccine being loaded onto a truck at a Pfizer plant in Michigan. From there, the pallets were headed to FedEx’s logistics hub in Memphis where they would be delivered to 153 locations across the 50 states. The event was both historic and mundane: Historic in that the shipments represent the hope of a nation that in the coming months, we’ll begin to put 2020—and COVID—in the rearview mirror; mundane in that this is a scene repeated millions of times a day, without fanfare, in plants and distribution centers across the country. Two of… Browse this issue archive.Need Help? Contact customer service 847-559-7581 More options

With the unpredictable nature of 2020, many supply chain professionals are ready for a fresh start in the new year. The previous year was one in which supply chain staff had to be creative to minimize supply chain risks and optimize the supply chain so that business could continue.

Through heroic efforts, supply chain professionals ensured not only that their organizations would survive, but also that there were critical products on shelves for consumers and supplies at health care facilities. Organizations that were able to thrive in 2020 did so as a result of their efforts to develop strategy and culture, supplier relationships, processes, measurement frameworks and supporting technology.

With the new year, supply chains are regrouping to either get themselves back on track or build on the gains they made in 2020. An essential part of this effort is determining the organization’s current state with regard to supply chain planning. Without an accurate assessment of its starting point, the organization cannot make a realistic determination of where it should go.

APQC strongly encourages organizations to assess their current state by benchmarking their performance against that of others. In its research on supply chain planning, APQC has identified several key performance indicators (KPIs) that provide an overarching look at how an organization fares on its supply chain planning. Moreover, APQC recommends that organizations look at the practices adopted by top performers to identify opportunities to refine and develop their capabilities.

Supply chain planning challenges

Traditionally, supply chain planning has prioritized efficiency and lower costs as a priority to both save the organization money and increase customer satisfaction. With the pandemic and resulting economic downturn, the emphasis has shifted to balancing efficiency with risk mitigation.

Organizations face supply chain risks beyond the potential for disruptive events like the pandemic. Even before COVID, organizations were trying to tackle discrepancies in supply and demand, secure real-time access to data, improve cycle times and increase supply chain visibility. The key to beginning to address these challenges is to improve processes. Before an organization can start this effort, it must first lay the groundwork by defining its processes and setting key indicators of success.

The groundwork for benchmarking

Organizations can define their processes using tools like APQC’s Process Classification Framework (PCF). A robust framework like the PCF breaks down processes into activities and tasks. This helps organizations place structure around what they do and gives them a common language they can use when benchmarking their performance.

An essential part of the benchmarking process is identifying key performance indicators (KPIs) for the organization to track and use to direct process improvements. Ultimately, which KPIs an organization selects will depend on which measures best align with the strategic goals of the organization. This article examines four overarching KPIs for supply chain planning:

- total supply chain planning costs per $1,000 in revenue;

- number of FTEs for the supply chain planning process per $1 billion revenue;

- cash-to-cash cycle time, in days; and

- perfect order performance.

These indicators are a great starting point for any organization, regardless of its strategic goals.

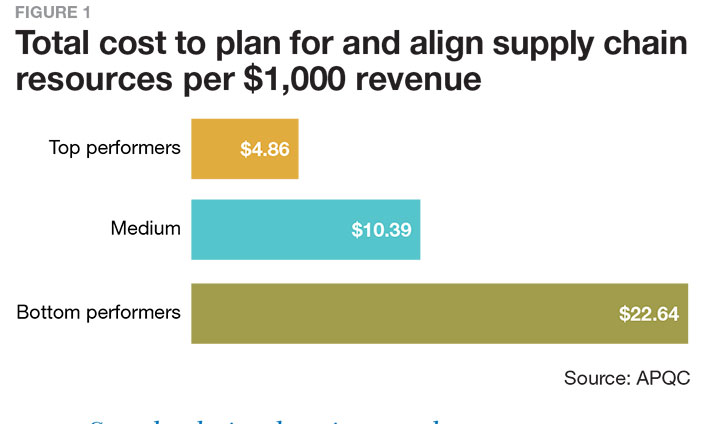

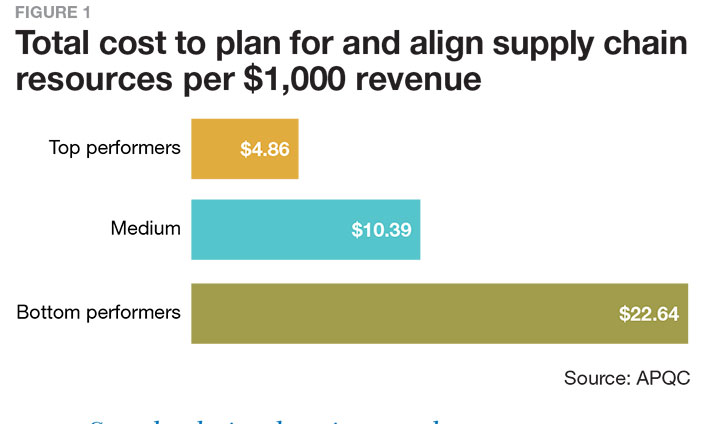

Supply chain planning costs

Most organizations will look at a cost measure to assess opportunities for improvement. In its calculation of the costs for the supply chain planning process, APQC includes costs for both the internal resources of the organization (e.g., personnel, systems and overhead) and any external or outsourced resources that perform supply chain planning. As shown in Figure 1, there is quite a difference between the supply chain planning costs of top performers and the costs of bottom performers. In fact, an organization making $1 billion in annual revenue stands to save $17.8 million by moving into top performer status.

Top-performing organizations make greater use of data. These organizations regularly evaluate the data sources they use to make key business decisions. They also share real-time inventory information with their customers and collaborate with their key suppliers to make forecasts. They also maintain flexibility by using analytics to identify potential risks to the supply chain. They ensure that their supply chain is capable of supporting both their existing and future business models so that they can pivot when needed.

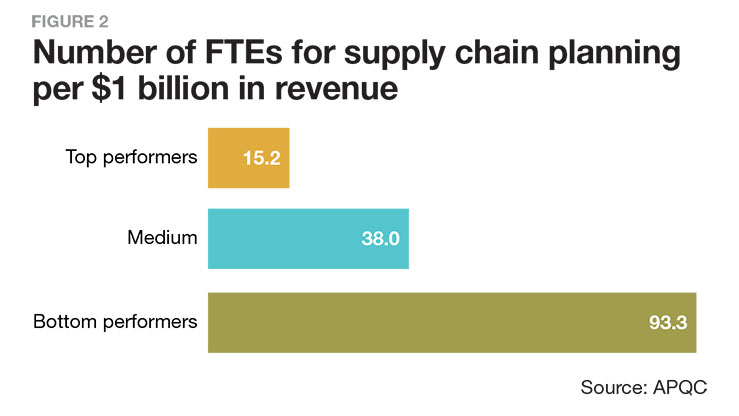

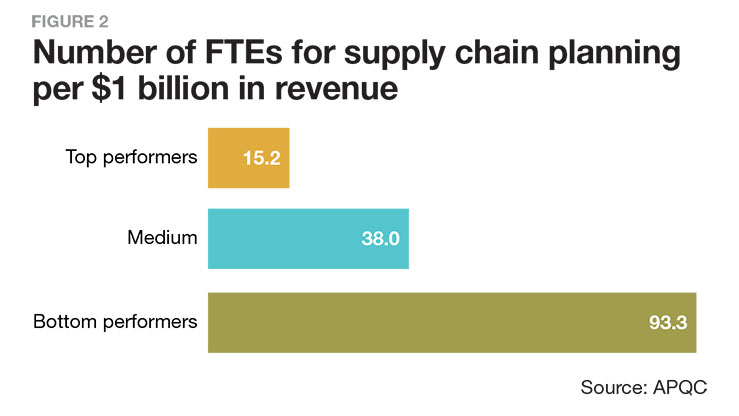

Supply chain planning employees

Efficiency ensures that the many areas involved in supply chain planning are as productive as possible. By maximizing the output of full-time equivalent (FTE) employees, an organization can minimize the number of individuals involved in supply chain planning regardless of the number of functions involved.

As shown in Figure 2, bottom performers require significantly more FTEs for supply chain planning per $1 billion in revenue: 78 more FTEs than top performers. Even at the median, organizations need nearly 23 more FTEs per $1 billion in revenue for supply chain planning than do top performers.

APQC has found that leading organizations use technology to help streamline planning and thus reduce the number of FTEs needed to complete the process. Another option for streamlining is to create a shared services center or other centralized group providing supply chain planning resources. Through consolidation and the use of supporting technology, organizations can free up staff to focus on value-added activities without sacrificing supply chain planning efforts.

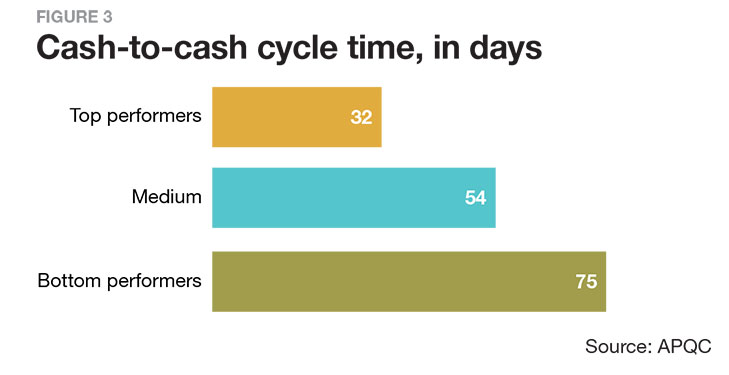

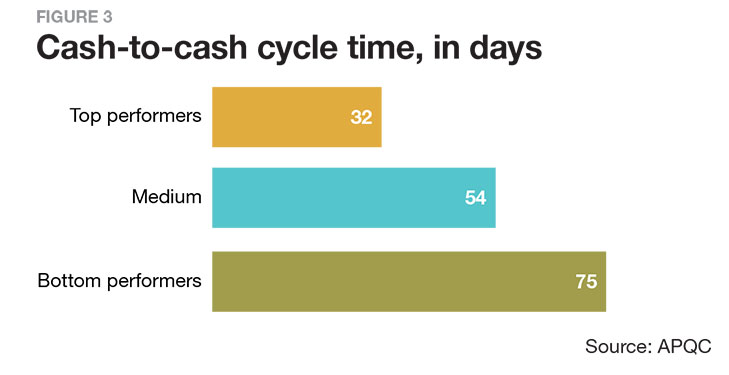

Cycle time

Cash-to-cash cycle time is another indicator of whether an organization is successful in its supply chain planning efforts. The faster the cash-to-cash cycle time, the less time that an organization’s working capital is tied up in managing its supply chain. This means that an organization has capital available to address disruptions or market fluctuations.

As shown in Figure 3, top performers have a cash-to-cash cycle time of just over one month (32 days). By contrast, bottom performers have a cycle time of two and a half months (75 days).

A simple way for an organization to reduce its working capital is to reduce its inventory. Although reducing the amount of inventory on hand can lead to a shorter cash-to-cash cycle time, it is possible for an organization to get too lean and put itself at risk for shortages should there be a disruption in supply or a change in demand. As 2020 has shown us, organizations must incorporate risk planning into their supply chain strategies to ensure their resilience and longevity.

It may make sense for an organization to pay more to source materials—especially those on the critical path—from a closer supplier that provides a more secure pipeline of materials than to pay less for materials from a distant supplier. Given the widespread supply chain disruptions organizations have experienced in 2020, mitigating risk is worth the extra expense.

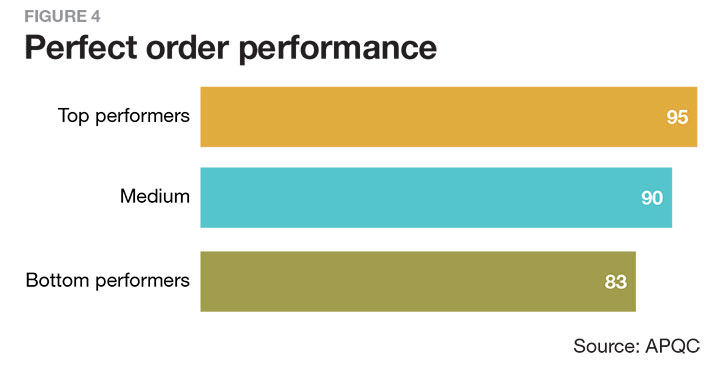

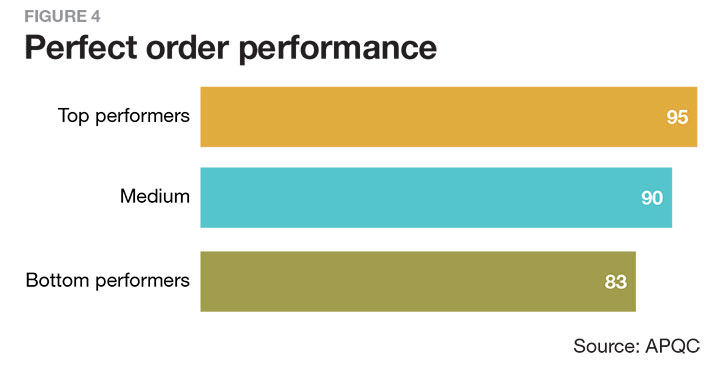

Perfect order performance

An organization’s perfect order performance is the culmination of its efforts across the supply chain. Accurate and efficient planning enables an organization to deliver orders on time, damage free, complete, and with accurate documentation. As shown in Figure 4, there is a 12% difference in the perfect order performance between top performers and bottom

performers. Even at the median, 10% of organizations’ orders have some form of failure.

Such a high rate of failure signals that many organizations are placing their customer satisfaction at risk. Perfect order performance is a valuable KPI because it looks at the

accuracy of the total order rather than only one aspect, such as on-time shipments or orders received damage free. To improve their performance, organizations can evaluate each aspect of the order and determine where focus is needed.

Top performers assign ownership for their master data processes and data points to ensure accuracy, and they automate processes when they can to enable the quick identification of errors. Top performers also work closely with their key customers to create demand forecasts and get early warnings of impending changes, and they use modeling tools to create visibility into their entire supply network from sourcing to distribution. By ensuring that all relevant functions provide input into sales and operations planning, they increase the amount of orders delivered without errors.

Flexibility and collaboration

Supply chain planning provides a strategic advantage as it gives organizations an opportunity to optimize their processes and technology and improve performance. More mature organizations do this through greater investment in advanced analytics, predictive algorithms, and decision support tools. This enables them to gain more visibility into their supply networks and become more flexible to meet changes in demand, address disruptions, and pivot to new business models.

Top performers are also enabling greater collaboration both within and outside of their organizations. They facilitate streamlined, more thorough supply chain planning by encouraging collaboration among functions and throughout the entire order and fulfillment chain. They also develop strategic partnerships with their key suppliers and top customers as a way of better anticipating supply and demand needs.

Improved supply chain planning can help organizations to either move forward in the new year or get back on track. How top performers fare on overarching KPIs provides a point of comparison for organizations looking to gauge whether their planning efforts can use closer examination and improvement. The use of benchmarking ensures organizations have a solid planning foundation before they begin to make improvements.

About APQC

APQC helps organizations work smarter, faster and with greater confidence. It is the world’s foremost authority in benchmarking, best practices, process and performance improvement, and knowledge management. APQC’s unique structure as a member-based nonprofit makes it a differentiator in the marketplace. APQC partners with more than 500 member organizations worldwide in all industries. With more than 40 years of experience, APQC remains the world’s leader in transforming organizations. Visit us at apqc.org, and learn how you can make best practices your practices.

SC

MR

Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

January-February 2021

This morning, I turned on the television and watched the first stretch-wrapped pallets of the just-authorized vaccine being loaded onto a truck at a Pfizer plant in Michigan. From there, the pallets were headed to… Browse this issue archive. Access your online digital edition. Download a PDF file of the January-February 2021 issue.With the unpredictable nature of 2020, many supply chain professionals are ready for a fresh start in the new year. The previous year was one in which supply chain staff had to be creative to minimize supply chain risks and optimize the supply chain so that business could continue.

Through heroic efforts, supply chain professionals ensured not only that their organizations would survive, but also that there were critical products on shelves for consumers and supplies at health care facilities. Organizations that were able to thrive in 2020 did so as a result of their efforts to develop strategy and culture, supplier relationships, processes, measurement frameworks and supporting technology.

With the new year, supply chains are regrouping to either get themselves back on track or build on the gains they made in 2020. An essential part of this effort is determining the organization’s current state with regard to supply chain planning. Without an accurate assessment of its starting point, the organization cannot make a realistic determination of where it should go.

APQC strongly encourages organizations to assess their current state by benchmarking their performance against that of others. In its research on supply chain planning, APQC has identified several key performance indicators (KPIs) that provide an overarching look at how an organization fares on its supply chain planning. Moreover, APQC recommends that organizations look at the practices adopted by top performers to identify opportunities to refine and develop their capabilities.

Supply chain planning challenges

Traditionally, supply chain planning has prioritized efficiency and lower costs as a priority to both save the organization money and increase customer satisfaction. With the pandemic and resulting economic downturn, the emphasis has shifted to balancing efficiency with risk mitigation.

Organizations face supply chain risks beyond the potential for disruptive events like the pandemic. Even before COVID, organizations were trying to tackle discrepancies in supply and demand, secure real-time access to data, improve cycle times and increase supply chain visibility. The key to beginning to address these challenges is to improve processes. Before an organization can start this effort, it must first lay the groundwork by defining its processes and setting key indicators of success.

The groundwork for benchmarking

Organizations can define their processes using tools like APQC’s Process Classification Framework (PCF). A robust framework like the PCF breaks down processes into activities and tasks. This helps organizations place structure around what they do and gives them a common language they can use when benchmarking their performance.

An essential part of the benchmarking process is identifying key performance indicators (KPIs) for the organization to track and use to direct process improvements. Ultimately, which KPIs an organization selects will depend on which measures best align with the strategic goals of the organization. This article examines four overarching KPIs for supply chain planning:

- total supply chain planning costs per $1,000 in revenue;

- number of FTEs for the supply chain planning process per $1 billion revenue;

- cash-to-cash cycle time, in days; and

- perfect order performance.

These indicators are a great starting point for any organization, regardless of its strategic goals.

Supply chain planning costs

Most organizations will look at a cost measure to assess opportunities for improvement. In its calculation of the costs for the supply chain planning process, APQC includes costs for both the internal resources of the organization (e.g., personnel, systems and overhead) and any external or outsourced resources that perform supply chain planning. As shown in Figure 1, there is quite a difference between the supply chain planning costs of top performers and the costs of bottom performers. In fact, an organization making $1 billion in annual revenue stands to save $17.8 million by moving into top performer status.

Top-performing organizations make greater use of data. These organizations regularly evaluate the data sources they use to make key business decisions. They also share real-time inventory information with their customers and collaborate with their key suppliers to make forecasts. They also maintain flexibility by using analytics to identify potential risks to the supply chain. They ensure that their supply chain is capable of supporting both their existing and future business models so that they can pivot when needed.

Supply chain planning employees

Efficiency ensures that the many areas involved in supply chain planning are as productive as possible. By maximizing the output of full-time equivalent (FTE) employees, an organization can minimize the number of individuals involved in supply chain planning regardless of the number of functions involved.

As shown in Figure 2, bottom performers require significantly more FTEs for supply chain planning per $1 billion in revenue: 78 more FTEs than top performers. Even at the median, organizations need nearly 23 more FTEs per $1 billion in revenue for supply chain planning than do top performers.

APQC has found that leading organizations use technology to help streamline planning and thus reduce the number of FTEs needed to complete the process. Another option for streamlining is to create a shared services center or other centralized group providing supply chain planning resources. Through consolidation and the use of supporting technology, organizations can free up staff to focus on value-added activities without sacrificing supply chain planning efforts.

Cycle time

Cash-to-cash cycle time is another indicator of whether an organization is successful in its supply chain planning efforts. The faster the cash-to-cash cycle time, the less time that an organization’s working capital is tied up in managing its supply chain. This means that an organization has capital available to address disruptions or market fluctuations.

As shown in Figure 3, top performers have a cash-to-cash cycle time of just over one month (32 days). By contrast, bottom performers have a cycle time of two and a half months (75 days).

A simple way for an organization to reduce its working capital is to reduce its inventory. Although reducing the amount of inventory on hand can lead to a shorter cash-to-cash cycle time, it is possible for an organization to get too lean and put itself at risk for shortages should there be a disruption in supply or a change in demand. As 2020 has shown us, organizations must incorporate risk planning into their supply chain strategies to ensure their resilience and longevity.

It may make sense for an organization to pay more to source materials—especially those on the critical path—from a closer supplier that provides a more secure pipeline of materials than to pay less for materials from a distant supplier. Given the widespread supply chain disruptions organizations have experienced in 2020, mitigating risk is worth the extra expense.

Perfect order performance

An organization’s perfect order performance is the culmination of its efforts across the supply chain. Accurate and efficient planning enables an organization to deliver orders on time, damage free, complete, and with accurate documentation. As shown in Figure 4, there is a 12% difference in the perfect order performance between top performers and bottom

performers. Even at the median, 10% of organizations’ orders have some form of failure.

Such a high rate of failure signals that many organizations are placing their customer satisfaction at risk. Perfect order performance is a valuable KPI because it looks at the

accuracy of the total order rather than only one aspect, such as on-time shipments or orders received damage free. To improve their performance, organizations can evaluate each aspect of the order and determine where focus is needed.

Top performers assign ownership for their master data processes and data points to ensure accuracy, and they automate processes when they can to enable the quick identification of errors. Top performers also work closely with their key customers to create demand forecasts and get early warnings of impending changes, and they use modeling tools to create visibility into their entire supply network from sourcing to distribution. By ensuring that all relevant functions provide input into sales and operations planning, they increase the amount of orders delivered without errors.

Flexibility and collaboration

Supply chain planning provides a strategic advantage as it gives organizations an opportunity to optimize their processes and technology and improve performance. More mature organizations do this through greater investment in advanced analytics, predictive algorithms, and decision support tools. This enables them to gain more visibility into their supply networks and become more flexible to meet changes in demand, address disruptions, and pivot to new business models.

Top performers are also enabling greater collaboration both within and outside of their organizations. They facilitate streamlined, more thorough supply chain planning by encouraging collaboration among functions and throughout the entire order and fulfillment chain. They also develop strategic partnerships with their key suppliers and top customers as a way of better anticipating supply and demand needs.

Improved supply chain planning can help organizations to either move forward in the new year or get back on track. How top performers fare on overarching KPIs provides a point of comparison for organizations looking to gauge whether their planning efforts can use closer examination and improvement. The use of benchmarking ensures organizations have a solid planning foundation before they begin to make improvements.

About APQC

APQC helps organizations work smarter, faster and with greater confidence. It is the world’s foremost authority in benchmarking, best practices, process and performance improvement, and knowledge management. APQC’s unique structure as a member-based nonprofit makes it a differentiator in the marketplace. APQC partners with more than 500 member organizations worldwide in all industries. With more than 40 years of experience, APQC remains the world’s leader in transforming organizations. Visit us at apqc.org, and learn how you can make best practices your practices.

SC

MR

Latest Supply Chain News

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- Tips for CIOs to overcome technology talent acquisition troubles

- More News

Latest Podcast

Explore

Explore

Business Management News

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks