Not so long ago, physical retail space was viewed by many analysts as an anchor weighing down brick-and-mortar retailers. How could they hope to compete with all that real estate in an increasingly digital world.

What a difference a pandemic makes. As more and more people opt to buy online, the increase in e-commerce orders and constraints on timely fulfillment from distribution centers is having a significant impact on conventional retailers. Without question, there has been a decrease in store traffic, a trend that accelerated during COVID-19 as stores were initially forced to close or reduce store traffic and shoppers turned to the web. For instance, between March and May 2020, when many stores were shuttered, online commerce increased 21% from March 2019 to March 2020; that was accompanied by a 45% rise in online purchases that used to be in-store purchases. In the view of many analysts, those behavioral changes may be permanent.

If those predictions turn out to be correct, and if consumer expectations about the timeliness of order fulfillment and delivery, that physical space may turn out to be an asset rather than an anchor, enabling retailers to convert “dark stores” that have been shuttered or a portion of the floor space in still operational stores into mini-, or micro-, fulfillment centers that can fill and ship e-commerce orders – including orders for same-day and next-day delivery – as well as buy-online and curbside pickup orders.

In this article, we’ll analyze the concept of converting existing retail stores to mini-fulfillment centers. Done right, we contend the conversion can enable small and medium sized companies to compete with the big players and take advantage of the opportunities presented by digital retail.

Facing the challenge

Figure 1 shows that retail store closures in the U.S. have grown significantly, with a 100% increase in 2019 to 18,600 retail closures. Furthermore, due to the COVID-19 it is estimated that retails store closures will exceed 25,000 in 2020, a record.

Figure 1: Retail store closures from 2017 to 2020 (estimated, based on Business Insider data)

At the same time global e-commerce has experienced substantial growth as shown in Figure 2.

Figure 2: Global retail e-commerce sales 2014-2023 (Statistica (2020)

Increased e-commerce and the Amazon Effect has caused a change in the consumer’s shopping experience, forcing retailers to change the dynamics of the traditional business. Consumers’ demand for integrated multi-channel experiences is another challenge. Multi-channel experience refers to the satisfaction of customers by offering a complete experience across different purchase and service channels. Among omnichannel consumers, showrooming and webrooming stand out as significant shopping trends. Webrooming consumers look for information about the products on the Internet and then go to a retail store to purchase them. Showrooming consumers go to the store to evaluate a product but buy it online.

It is necessary to analyze customer interactions across multiple channels to understand showrooming and webrooming trends. The channel preference in the purchase process depends on the benefits customers are looking for in the different stages before, during or after the purchase. Retailers can take advantage of showrooming by enhancing the in-store experience with online resources. Further, the trend of showrooming has changed over the years as customers tend to buy online with their phones even as they are inside the store. Retailers must provide customers with enough information about their products and being able to offer useful and creative content in customer’s mobile phones.

How to compete

While buying online has several advantages, retailers can compete by providing unique and memorable in-store experiences as a point of differentiation, through a combination of proper human resources, products and services. Another strategy is to become a brand that offers a differentiated and unique value proposition. One example is UNIQLO, a retailer that offers high quality laidback clothes at an affordable price.

Another option is to reward clients through loyalty programs by offering discount coupons, loyalty cards or rewards for shopping in a store. For example, Ulta Beauty offers its customers “Ultimate Rewards.” For each dollar spent, customers receive points they can redeem on their next shopping trip or in beauty services. An app allows customers to check the balance on their points and receive special offers based on their preferences.

While the first two options may bring customers back into the store, the best option, and the greater opportunity in a digital retail world, is to convert retail space into mini-distribution centers located close to the customer to service the last step of the supply chain.

Making the conversion

Retailers have a number of options in providing e-commerce fulfillment from their stores. The first is to enable customers to buy online and pick up their online orders in the stores or curbside. This could lead to a substantial saving in time, and if the request includes clothes or accessories they can try them in the store in case they need to change the order. There has certainly been an increase in both of those options, with retailers as diverse as Gap Inc. and JOANN Stores investing in those capabilities.

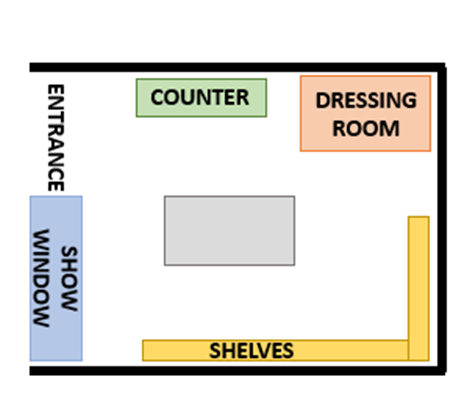

The second alternative, and the main focus of this article, is to convert the retail stores which are being closed into mini fulfillment centers in which customers’ online orders are shipped from the stores. Once a decision has been made to repurpose a retail store to serve as a mini distribution center, detailed planning is needed, starting with the physical layout. Figure 3 shows the layout of a retail clothing store.

Figure 3: Sample layout of a retail clothing store

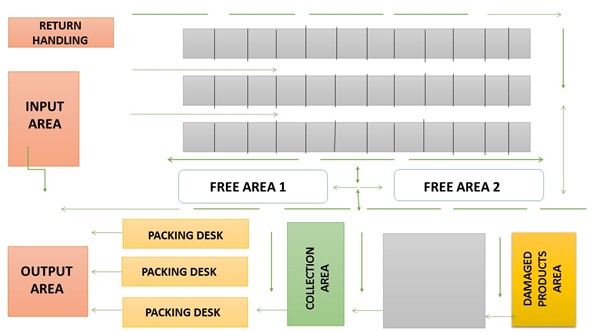

The primary purpose of a mini DC is to offer clients same-day delivery or pickup. The changes required, and the resulting layout is shown in Figure 4.

Figure 4: Example of a Mini or Micro- fulfillment center Layout

To ensure higher customer satisfaction inventory visibility and management in the new mini- fulfillment centers will be one of the critical factors. The best choice will be the use of Radio Frequency Identification (RFID) technology, which can offer solutions regarding item-level inventory lookup, and improve inventory accuracy while reducing out of stocks and overstocks. RFID can count several items per second, and can improve inventory accuracy levels from 65%-75without using RFID to 93%-99% with the technology.

Human resources

One crucial aspect to consider when converting a retail store into a mini-fulfillment center is that the workers in the retail store need to be trained to work in fulfillment processes, such as scanner- or voice-directed picking, packing and labeling for shipping. In a standard retail store of about 2,000 square feet, there might be ten employees per shift. Two of those ten employees could be parcel delivery drivers, with the remaining eight trained in order fulfillment operations. Managers will need to have a solid background e-commerce order fulfillment.

Inventory management and control in a mini DC is essential to satisfy customer expectation. That calls for an effective warehouse management system (WMS) to direct picking and packing activities in the store to meet customer service level expectations, update inventory levels in real time and improve visibility across the supply chain.

The last mile

Retail is more digital than ever. But last mile delivery still takes place in a physical world, with the same unpredictable delays any of us experiences trying to drive from Point A to Point B. It is historically inefficient and accounts for 40 to 50 percent of a company’s logistic cost. In rural areas, the high cost is due to long distances between stops while urban areas involve traffic congestion and inefficient routes. Large companies have already faced this challenge, but small and medium-sized shippers still have to address the issue.

By converting to a mini DC, small retail stores can get closer to their customers, and better meet their customer expectations while competing with the bigger players.

Last mile costs and mini-DCs: a case study

For this project, a reference cost model developed by European researchers was applied to the city of Chicago, where this study took place (Figure 5).

Figure 5: Chicago area

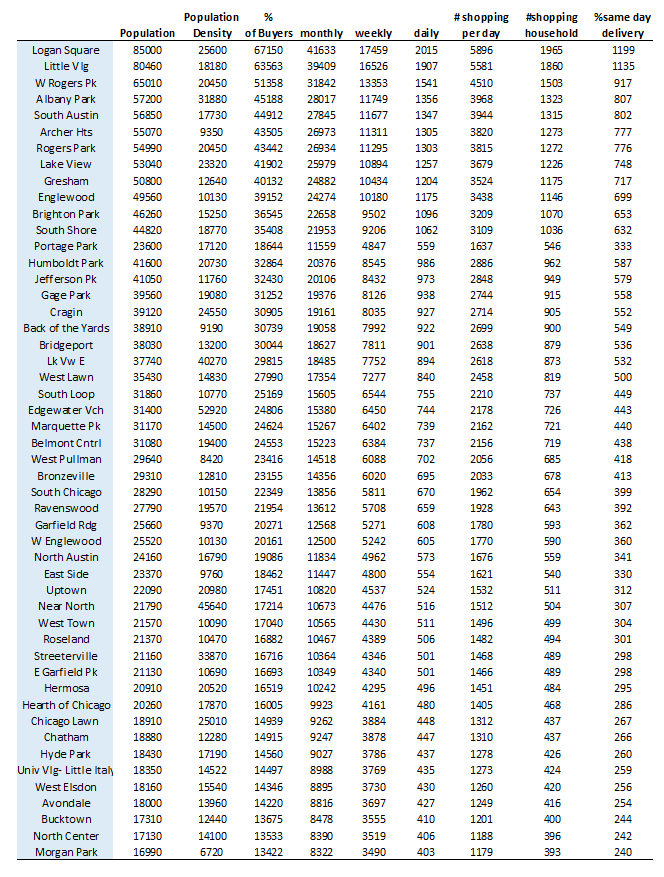

Table 1 shows the neighborhood population, density and a forecast of the daily online demand for each neighborhood in Chicago.

Table 1: Online shopping by neighborhood in Chicago

What’s the impact of converting one retail store?

There are a number of benefits of converting conventional retail space into e-fulfillment space.

- The conversion of just one retail store in each of the 50 areas of Chicago into a mini DC has the potential to reduce last mile costs in the distribution network for the City’s population by more than 60% compared to current costs. If there is a fulfillment center in each area, those centers are closer to the customers, and it is easier to schedule the route of the drivers and to ensure that the parcel is delivered when customers are at home. It also allows customers to order online and pick up from the local mini DC. This not only improves customer satisfaction, it also increases the average number of packages delivered per drop.

- A common problem in the last-mile is the large percentage of incomplete deliveries, driven by the growth in e-commerce. One cause of incomplete delivery is the ´not at home´ situation. This occurs as customer orders are fulfilled from distribution centers located on the outskirts of the city, and it is highly probable that at the moment of the delivery, the customer is not able to receive it. The reason is that it is difficult to optimize transport routes while simultaneously ensuring deliveries at the right time, due to the long distances to be covered. Converting retail stores into the mini-fulfillment center alleviates this problem by locating the inventory closer to the customer and optimizing the transportation route because of shorter distances. Converting ONE retail store in each of the 50 areas of Chicago into a mini DC and guaranteeing attended delivery can generate cost savings in excess of 40% compared to the current network. While this is less than the 60% savings in item 1, these savings accrue while guaranteeing attended delivery.

- Order delays also affect the overall satisfaction of the customers. According to the Laufer Group International, the average percentage of delays in e-commerce deliveries in 2019 was 25.89 %. If at least one store is transformed into a mini fulfillment center for each area of Chicago, there will be a considerable reduction of delays.

Further improvements

Converting retail space into distribution space creates other opportunities for improvement, such as:

Transportation alternatives

A 5 ton lorry or cube truck might be economical if making deliveries across long distances. However, if one retail store is converted to a mini DC in each of the 50 areas of Chicago, it would be possible to reduce costs by using other means of transportation. Using a half-ton delivery van can reduce delivery costs by more than 10%. Using bicycle delivery can reduce delivery costs by nearly 37%.

However, this solution is not feasible because there are packages that cannot be transported by bike due to their size, and in some areas, it would not be possible to deliver all the parcels at the right time. In the current case study of Chicago, using a combination of 30% of bicycle-based deliveries and 70% with 0.5-ton delivery vans during March to October and 100% deliveries by 0.5-ton delivery vans during the remaining months could reduce costs by around 22%.

More collection points

When one retail store is converted to a mini DC in each of the 50 areas of Chicago, it could allow customers to pick up their order instead of a delivery. Stores are now the collection points and the last step of the delivery process. Customers would have to be willing to collect all their parcels in these centers. The savings from collection points depend on the percentage of orders picked up from these centers.

There is a future for brick-and-mortar

Physical retail stores are struggling, with the growth of e-commerce and now the COVID-19 driven buyer behavior and governmental regulations. Transforming those physical stores into mini-fulfillment centers offers a future for store owners and employees and other stakeholders.

The analysis shows that these transformations have the potential to generate significant reductions in ‘last mile’ delivery costs and improve on-time and attended deliveries, thus improving customer satisfaction. Further, the use of bicycles and smaller delivery vans can generate further savings. Retail stores have to adapt again, as they have done over the decades.

About the authors

Gurram Gopal is Industry Professor, Industrial Technology and Management (INTM) at the Illinois Institute of Technology and a frequent author on supply chain management issues.

Laura Bravo Fernandez is a shift manager at Amazon.

SC

MR

Latest Supply Chain News

- April Services PMI declines following 15 months of growth, reports ISM

- Attacking stubborn COGS inflation with Digital Design-and-Source-to-Value

- Despite American political environment, global geopolitical risks may be easing

- Joseph Esteves named CEO of SGS Maine Pointe

- Employees, employers hold divergent views on upskilling the workforce

- More News

Latest Podcast

Explore

Explore

Procurement & Sourcing News

- April Services PMI declines following 15 months of growth, reports ISM

- Despite American political environment, global geopolitical risks may be easing

- April manufacturing output slides after growing in March

- World Trade Centers offers a helping hand to create resilient, interconnected supply chains

- Bridging the ESG gap in supply chain management: From ambition to action

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks