Editor’s Note: John Brown is a former director of strategy and marketing at UPS, and the co-founder of Droppoint, with over 40 years of in logistics and supply chain management. Itamar Zur is the founder and CEO of Veho Technologies – a technology and crowdsourcing platform for final mile delivery. Veho is winner of the 2017 Harvard Business School New Venture Competition.

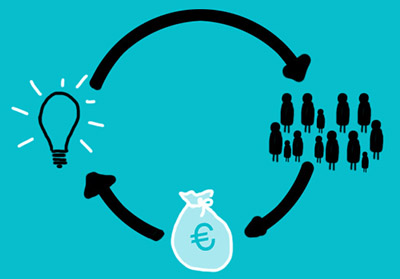

The rapid growth of ecommerce and fast-changing consumer expectations require delivery companies to think and act out of the box. To win in tomorrow's final mile market, carriers will not only need to handle record-peak volumes, but also master same day, on-demand, and night-time delivery. How can delivery companies best capitalize on these trends while protecting their market shares from disruptive new entrants? We believe the answer lies in crowdsourcing.

While crowdsourcing is not a completely new phenomenon, few carriers other than Amazon have so far harnessed the model to final mile delivery. A common conventional wisdom is that crowdsourcing works well in ride-sharing or point-to-point deliveries (as with restaurant delivery apps UberEats and Deliveroo), but that the model is unfit for large volume distribution. We, however, hold a different view. Based on Amazon's success with the model as well as our own experience, we believe that crowdsourcing presents one of the largest opportunities for package delivery companies today. When properly understood and leveraged, crowdsourcing can yield major operational benefits, help provide exceptional customer experience, and enable delivery companies to better capitalize on the growing demand for final mile delivery.

The Economics of Crowdsourcing

Let us begin by addressing two misconceptions around the crowdsourcing model: First, that crowdsourcing is more cost-effective than traditional distribution models since market rates for crowdsourced drivers are lower than those of professional drivers; and second, that crowdsourcing is disruptive to traditional delivery companies because it allows shippers to ‘cut the middleman' and connect directly with the driver. In reality, neither of these arguments is accurate.

In the US, ride-sharing platforms Uber and Lyft, or delivery platform Flex (Amazon's final mile crowdsourcing app) typically pay their drivers $18-25 per hour, depending on the market. Most on-demand restaurant delivery platforms pay about the same. While these rates are certainly lower than the hourly income of a unionized UPS or DHL driver, they are surprisingly comparable to what most regional carriers or local delivery businesses pay. Moreover, the competition for crowdsourced drivers – who are increasingly becoming the bottleneck for growth in the on-demand space – has constantly been on the rise. As a result, companies like Uber must spend heavily on marketing, referral fees and other driver retention bonuses to maintain and grow the size of their fleets. Crowdsourcing, in other words, is not always cheaper.

What about ‘cutting the middleman'? It is true that most crowdsourcing platforms have eliminated, at least to some extent, the role of the flesh-and-blood operator. However, the truth is that this has nothing to do with crowdsourcing itself, but everything to do with the automation technology that these companies have developed. For example, by leveraging machine learning algorithms, crowdsourcing platforms are able to automatically assign delivery tasks to drivers based on each driver's real time location and availability. These smart algorithms can also bundle delivery addresses to routes, determine the fastest way to complete a route, and provide the consignee with an accurate ETA and real-time visibility. All these tasks have been traditionally conducted by a dispatcher or operator, and their automation translates into higher productivity and margins. However, one does not need to run a crowdsourced operation to benefit from these technologies – as they work just as well with an employee-based delivery model.

Leveraging a Flexible Capacity Model

If cost savings or increased productivity are not the key benefits of crowdsourcing, then what makes it so attractive to Amazon and its retail rivals? the answer lies in the incredibly flexible nature of the model, and its scalability potential.

Compare carriers who utilize a ‘fixed' pool of professional full-time drivers, with Amazon Flex who utilizes a ‘flexible' pool of crowdsourced, part-time drives. When parcel volume spikes – as usually occurs during the holiday season – fixed-capacity carriers must extend their fleet and undertake the cumbersome process of recruiting and on-boarding temporary employees or contractors, who are not easy to find. Driver shortage has in fact become a major challenge for common carriers in recent years, not only during the holidays, but also on a weekly basis as parcel volume and capacity needs tend to constantly fluctuate. Often this result in delivery delays, disappointed customers and lost business opportunities. Amazon, on the hand, can instantly scale its capacity in times of high demand, simply by posting more routes on its Flex app to drivers who have already been vetted and are available for single-day tasks. This benefit also works at times of low demand: since Amazon does not have a contractual obligation to use its crowdsourced drivers, it can easily drop the number of active drivers whenever needed, and avoid the cost of underutilization. In other words, Amazon is much better positioned to ‘flex' its capacity and perfectly match its supply of drivers with demand for deliveries.

There are two other important benefits that make the flexible-capacity model highly attractive to Amazon. First, from a service level standpoint, crowdsourcing allows Amazon to protect itself from last minute drop out of drivers, and ensure that there is always a driver available for any delivery task. Amazon can do so because it only pays its crowdsourced drivers when assigning a route. Therefore, it can practically recruit and on-board an unlimited number of drivers without bearing high employment costs (and indeed – in the US alone Amazon has already on-boarded more than 100,000 crowdsourced drivers in only two years since launching Flex). Second, from a scalability standpoint, Amazon can easily launch new delivery markets, simply by turning on its app and enrolling new drivers, while circumventing lengthy recruiting processes. This is how Amazon has rolled out Flex to over 50 US markets (and more recently - 7 new UK markets) in only two years. The scalability of crowdsourcing gives Amazon an immense competitive advantage over fixed-capacity carriers when capitalizing on the fast growth of ecommerce and need for final mile delivery.

The Customer Experience Advantage

Perhaps of the highest importance to Amazon, owning a flexible fleet allows the company to offer customers a variety of delivery services that fixed-fleet carriers traditionally found expensive to provide. Two-hour, same-day and night-time deliveries are all made possible with crowdsourcing: Amazon can always find an available driver at any hour of the day, and enable the customer to choose her preferred delivery window while minimizing the likelihood (and cost) of failed delivery attempts. This gives Amazon another powerful way to delight its customers and further increase trust, loyalty, and customer life time value.

Can Crowdsourcing be harnessed by Traditional Delivery Businesses?

In light of these benefits, we believe that crowdsourcing should not be sole domain of disruptive technology companies such as Uber and Amazon. Yet, implementing the model in more traditional delivery companies requires a change in mindset and proper investments in technology. The key to harnessing final mile crowdsourcing is the need to simplify and standardized delivery tasks such that almost anyone could complete them in their own vehicle, just as well as a professional driver.

To demonstrate this latter point, take ride sharing platforms, for example. Companies like Uber were able to replace taxi drivers with ‘anyone in their own vehicle' by leveraging the proliferation of GPS apps such as Google Maps and Waze. With GPS technology, an Uber driver does not need to know every street and shortcut like a professional taxi driver, yet she can still drive passengers to their destination just as effectively.

The implementation of crowdsourcing to final mile delivery requires additional considerations. For one thing, GPS locations are not always accurate, especially outside of city centers. While an Uber driver can ask her passenger to show her the exact drop-off location, delivery drivers cannot do the same with packages. Second, delivery drivers must also learn how to enter buildings that require an access code; where to park the car on a busy street; and which commercial deliveries should be prioritized. To become efficient at running a delivery route, most drivers need a few weeks to learn and adjust. Unfortunately, this ‘adjustment period' is far too long for any gig-economy driver who could simply opt to drive with Uber and start making money from day one.

To truly enable final mile crowdsourcing, delivery companies must help drivers jump over the lengthy ‘learning curve'. Rather than give the driver a manifest and expect her to figure out the route on her own, carriers should provide the driver with technology that takes her step by step through the delivery process and eliminates any opportunity for error.

The good news is that such technologies already exist in the market. Dynamic routing, geofencing, online routebook to correct any GPS errors, and a photo database of all drop-off locations – are all features of smart mobile apps that provide drivers with easy step-by-step instructions. Live tracking, chat tools and an instant settlement system can help operators gain control over any crowdsourced operation while removing unnecessary friction. These technologies can also be adapted for any kind of operation regardless of crowdsourcing. It is only a question of whether one is willing to make the investment, and there has never been a better time to make it.

The Bottom Line: It is time to re-think innovation

The benefits of crowdsourcing do not lead to the conclusion that companies should completely replace their existing fleets with crowdsourced drivers. After all, the cost of maintaining a large crowdsourced fleet can be cumbersome, and experienced delivery drivers will still perform better at customized, bulky or ‘white glove' deliveries. Yet, we believe that carriers can no longer afford to ignore the success of crowdsourced programs like Amazon Flex, or else they risk being left behind. By understanding the economics, key benefits and the technology required to harness crowdsourcing, carriers too can use the model as a means to complement their existing fleets, differentiate on customer experience, and better capitalize on the growing demand for drivers in the final mile.

SC

MR

Latest Supply Chain News

- Early bird pricing expires soon for NextGen Supply Chain Conference registration

- A $125M Portland project seeks to revitalize a historic community, U.S. manufacturing

- Innovations in last-mile delivery and their strategic impact

- Embrace resistance for greater success with change management

- 6 Questions With … Steve Johanson

- More News

Latest Resources

Explore

Explore

Business Management News

- Early bird pricing expires soon for NextGen Supply Chain Conference registration

- A $125M Portland project seeks to revitalize a historic community, U.S. manufacturing

- Innovations in last-mile delivery and their strategic impact

- Embrace resistance for greater success with change management

- Canada Industrial Relations Board orders binding arbitration, halting potential rail strike

- Delivery costs continue to drive shopper preferences

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks