Whether you are utilizing one warehouse or 10 warehouses, there are optimal locations for where inventory should be stored. Chicago Consulting has released its 10 Best Warehouse Networks for 2024 to help businesses make better informed decisions.

While its research identifies the ideal location for warehouses, the list only looks at outbound transit time to the end customer. There are many other considerations that go into locating a warehouse, but this serves as a starting point, the company said.

“After all, the whole purpose of having regional warehouses is to get close to your customers, to minimize their lead-times to receive your products and buy from you because of it,” Jeff Haushalter, partner at Chicago Consulting, said in a statement.

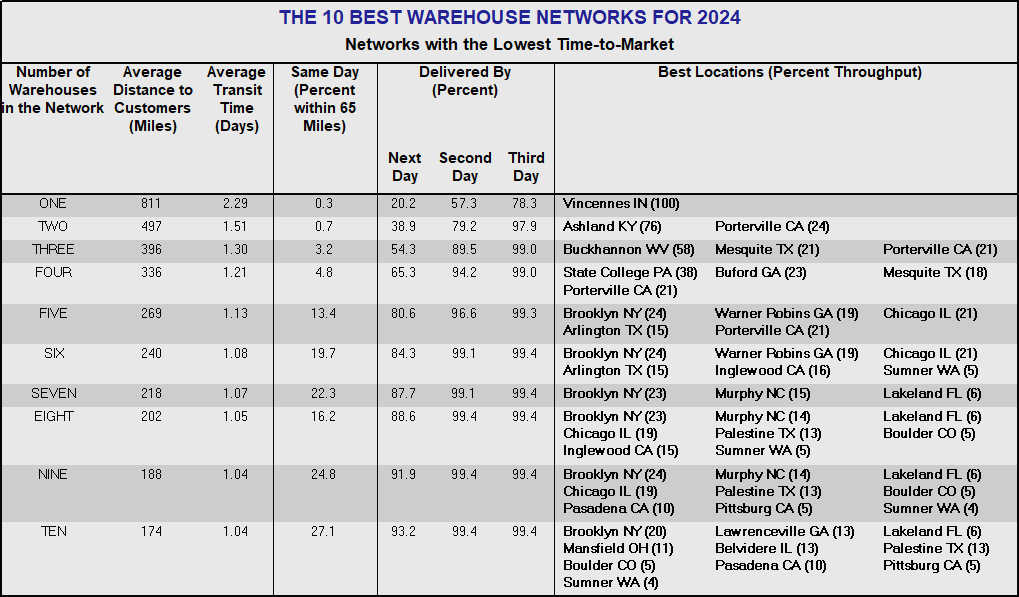

In 2024, the company said the ideal warehouse location for a firm with just one warehouse is Vincennes, Indiana. In this instance, the average distance to customers is 811 miles with an average transit time of 2.29 days and 78.3% of customers are reachable within three days.

A company looking for faster service time and deploying three warehouses might consider Buckhannon, West Virginia; Mesquite, Texas; and Porterville, California. In this case, the average transit time is 1.3 days with 89.% within two days and 99% within three days.

Setting up a network with 6 or more warehouses cuts the average transit time from 1.08 days for six to 1.04 days for 10. Same-day delivery is fastest with a 10-warehouse network, with 27.1% of deliveries reaching the end customer that day. Additionally, a 10-warehouse network also ensures 93.2% of deliveries take place the next day.

The consulting firm said setting up an optimal network can help “stave off competition from larger ‘Goliath’ megashippers.”

The research is based on analyzing population shifts from the most recent Census Bureau data. This year, due to new migration patterns, Texas and Florida play a larger role in the analysis while New York, Illinois and California have lost some prominence. Overall, four southern states – Texas, Florida, North Carolina and Georgia – drove 67% of the nation’s growth in 2023.

In an interview with Supply Chain Management Review, Haushalter noted the list provides a starting point for discussions and a variety of factors—cost, real estate, service requirements, customer base, labor, etc.—play a role in ultimately determining where a warehouse is located.

“We find that manufacturers, distributors and retailers like to be able to benchmark what they see and use that as a gauge to determine whether or not they have a problem, or an opportunity to revisit their warehouse networks,” he said.

Haushalter said the list is designed to consider “if you essentially had to mail a package to every person in the United States, from outbound to the customer, what would be the best location to put a warehouse.”

In discussions with clients, he said the list serves as a starting point and then Chicago Consulting will get into the main factors to consider when locating a warehouse—cost and service. Haushalter noted that while a location in New York may make some sense, if the majority of your customer base is in the south, then there are likely better locations. Also, this list doesn’t consider inbound costs or what the end customer’s desire is. For instance, are the company’s customers expecting next-day delivery, or are they comfortable with three-day in most cases?

The chart also suggests that there is a diminishing return at some point. While it may seem logical to locate merchandise in eight warehouses to speed up same-day delivery if that is important to customers, the chart suggests that may not be the right strategy. According to Chicago Consulting’s research, an 8-warehouse network is able to deliver same-day to 16.2 of customers, whereas a 7-warehouse network has a 22.3% rate.

There is no “right” number of warehouses, Haushalter said.

“Three warehouses can provide very good two-day coverage,” he says. “If I was a parcel shipper, I could get a package to almost everyone in two days.”

Haushalter also noted that the difference between one and two warehouses is significant—with an average distance drop of more than 300 miles (811 to 497), but from there, it becomes a difference of fewer than 60 miles in most cases for each additional warehouse location.

For companies focused on two-day or three-day shipping, there is little difference once you surpass three warehouses. Second-day delivery improves from 89.5% with three locations to 99.4% with 10. Three-day delivery at the 99% rate is achievable with three locations and above.

Next-day delivery does see significant jumps, going from 20.2% with one location, to 65.3% with four locations, but anything five and above has rates surpassing 80%.

Haushalter does caution about longer lead times, though.

“We try to understand where they need to be—is same-day really important or is it next day or two day?” he said. “We’ve had some say they are fine with five days service, but while you may be okay with five-day service now, you might be in danger of being disrupted by someone that can deliver in two days.”

The decision to locate a warehouse, though, is a critical one to the success of the business, and one that Haushalter noted requires more in-depth research than simply a delivery-time chart. But it is a starting point, and one that companies can use to identify if they may have an issue with their network.

“We would use this as a starting point—this is a service-based customer [network],” he said. “What would be equally important would be a cost-based network. Cost-based is more detailed because it accounts for inbound and outbound, also the customer’s actual/forecasted sales. [among other considerations].”

SC

MR

More Supply Chain Management

- MIT CTL offering humanitarian logistics course

- Bridging the ESG gap in supply chain management: From ambition to action

- Few executives believe their supply chains can respond quickly to disruptions

- Technology’s role in mending supply chain fragility after recent disruptions

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- More Supply Chain Management

Latest Podcast

Explore

Explore

Topics

Business Management News

- MIT CTL offering humanitarian logistics course

- Bridging the ESG gap in supply chain management: From ambition to action

- Few executives believe their supply chains can respond quickly to disruptions

- Technology’s role in mending supply chain fragility after recent disruptions

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks