The headlines for 2020 can seem full of bad news for multinational executives, maintains Ryan Connelly, a senior analyst for global economics at DuckerFrontier (formerly the Frontier Strategy Group). But supply chain managers remain vigilant.

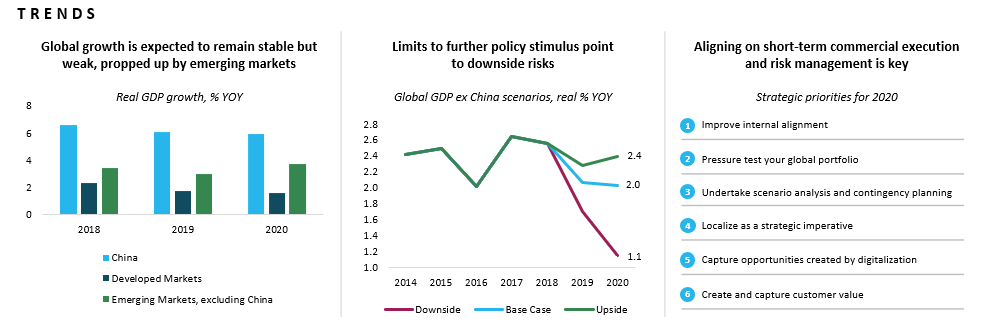

He's the author of the firm's “Global Outlook for 2020,” which notes that global growth forecasts have fallen steadily since Q4 2018.

“This was far lower than expected,” says Connelly. “As a result, firm-level output is sliding, inventories are rising, and global inflation is weakening.”

He adds that “myriad” trade and disruptions—Brexit and U.S. trade tensions chief among them—that unsettled multinationals in 2019 are expected to continue.

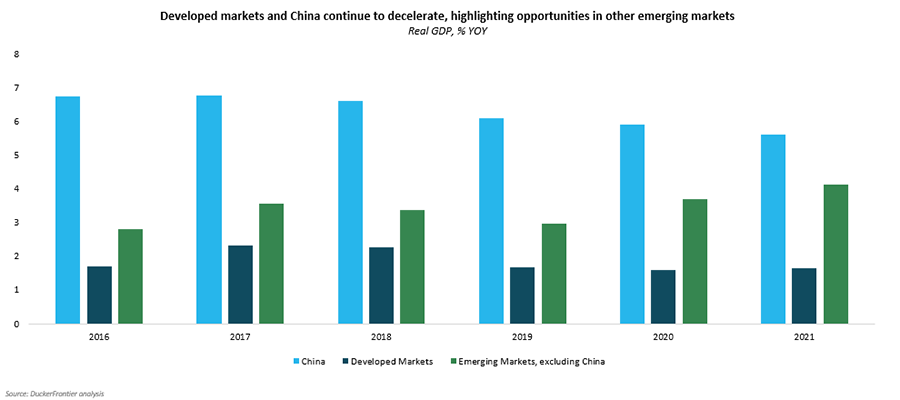

“The risk of a global slowdown is elevated as economic weakness persists in China and Western Europe and the uncertainty surrounding U.S. President Donald Trump holds back investment growth,” says Connelly.

And while it may be true that executives will enter strategic planning season for 2020 with less certainty on the future demand and regulatory environments than at any point in the past decade, the headlines don't tell the full story.

“The news will generate a lot of noise about the immediate negatives, but multinationals can take advantage of pockets of opportunity in 2020 as they prepare for stronger growth going into 2021,” observes Connelly.

Emerging Market Upside

DuckerFrontier analysts believe that the global economy will stabilize in 2020 from the volatility of the previous two years. Their “base-case” forecast calls for an acceleration in global growth to 2.8%, up from 2.7% in 2019, driven by a strong rebound in many emerging markets outside of China and stable consumer spending growth.

“Firms should approach 2020 cautiously because there is a high amount of uncertainty in the global outlook and there are significant risks to the downside, but there are also plenty of bright spots,” says Connelly.

Many large emerging markets that suffered slowdowns in 2019 are rebounding. Consequently, investment in Latin America (LATAM), the Commonwealth of Independent States region, and the Middle East and North Africa should also recover.

The Russian fiscal spending program, for example, will boost investment in 2020 with a focus on infrastructure and health. Investment will rebound in most major LATAM markets and even accelerate in Brazil following the passage of pension reform in 2019.

DuckerFrontier contends that the ongoing U.S.-China trade war, though a concern for developed markets, has actually created some positive spillover effects for LATAM, emerging Asia Pacific, and Sub- Saharan Africa that will support local investment and exports.

Stable Consumer Spending

Even though industrial production and investment slowed more than expected in 2019, consumer spending has held up global growth.

Analysts expect that to continue in 2020, especially as central banks and governments step in with monetary and fiscal easing to support consumer demand.

“The U.S. Federal Reserve ended a cycle of policy rate hikes when it cut interest rates in July 2019, and will make more cuts as needed,” says Connelly.

He further maintains that China will continue to fine tune policy support to hit its GDP targets, while the Central Bank is getting ready to implement new policy support to offset a domestic slowdown caused by weak external demand.

“Easier monetary and fiscal policy across these major markets has created the space that smaller markets need to ease their own domestic monetary policy,” he says.

A recent Aberdeen Group Survey finds that a further boost to consumer spending growth, labor markets in North America will continue to add new jobs and see real wage increases while many Western European workers are already locked in wage gains for 2020 during union negotiations.

The negative effects of lower-than-expected growth in 2018—sliding output and rising inventories—will gradually reverse in 2020, the Aberdeen study states.

The manufacturing slowdown that has weighed on global activity in 2019 is expected to fade as firms adjust their production accordingly. Falling prices—a result of discounting and weaker currencies—will help stabilize world trade volume growth heading into 2020.

Although prices may remain weak in the short term, lower prices will create demand for export goods, helping clear out inventories and driving future demand for export goods. As inventories clear and weaker prices lead to a rebound in demand, the growth outlook will gradually improve across 2020 and pave the way for a stronger recovery in 2021.

While multinational companies can and should take advantage of these pockets of opportunity in 2020, they should also lay their growth plans for the end of the year into 2021.

“A stabilizing global economy in 2020 will pave the way for a manufacturing and demand rebound the following year, so executives should use 2020 to prepare their plans for growth,” analysts for Aberdeen assert.

SC

MR

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More News

Latest Resources

Explore

Explore

Business Management News

- Technology’s role in mending supply chain fragility after recent disruptions

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks