Dun & Bradstreet’s and E2open’s team of data and analytics experts, joined together to provide insights on the impact of this incident on global supply chains, focusing on the global business impact that this blockage will cause industries and countries long-term.

Using proprietary supply chain and shipping data, the team found that Europe is the region that will feel the strongest impact due to the blockage of the canal.

Companies located in Asia will be impacted not only by the delay of shipments from Europe, but also by a shortage of empty containers returning to their region - further stalling their abilities to deliver goods around the world.

As reported in SCMR, the Ever Given, which ran aground in the Suez Canal last week has been freed, but the ripple effect of its lodging in the Canal will have continued ramifications for global supply chains as global trade resumes, goods start to be unloaded at destination ports and suppliers look to replenish shortfalls in essential materials that threatened downstream production and manufacturing of consumer goods.

Brian Alster, General Manager, Third-Party Risk & Compliance, Dun & Bradstreet, says the disaster of the moment becomes a global phenomenon because it is yet another reminder of the interconnectedness that comes with globalization and our reliance of each other as contributors to the global supply chain.

“Companies have developed a higher level of dependency on suppliers and third parties from other countries, and that dependency is highlighted when a link in the supply chain is impacted,” he says.

Alster adds that the Suez Canal incident gives us yet another reason for businesses to invest in data and technology to create an agile, geographically dispersed supply chain that can quickly pivot during unexpected events.

Pawan Joshi, Executive Vice President of Product Management and Strategy for E2open, notes that while considerable attention has focused on the economic value of cargo trapped on vessels and their inability to move through the Suez Canal, the financial impacts on downstream production that depend on the timely delivery of these materials is magnitudes greater.

“For instance, the delay of an inexpensive but crucial automotive part en route from China can prevent the sale of the entire vehicle in Germany,” he says. Joshi concludes that the ability to peer inside containers, understand downstream business impacts of transport delays and systematically take corrective actions, provides a distinct competitive advantage for global businesses.”

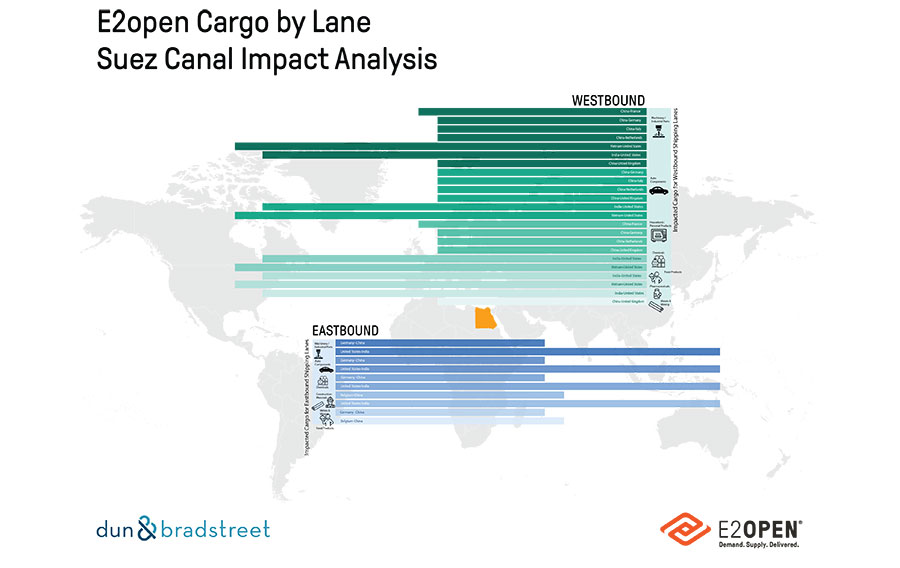

E2open map highlights the vessels en route to Eastbound and Westbound countries, and pinpoints top goods and materials onboard.

Based on annual shipping data that tracks the vessels and materials found onboard that travel through the Suez Canal, Dun & Bradstreet data and analytics experts found:

In Europe:

- The top countries most impacted by the Suez Canal blockage include: the United Kingdom, Germany, Belgium, France, Netherlands, Italy, Switzerland, Spain, Turkey and Austria.

- The top 10 materials found in shipments thr ough the Canal to Eur ope include: V ehicle parts and accessories, garments, electrical and photosensitive materials, wheeled toys such as tricycles and scooters, copper, machines and mechanical appliances, plastics, pharmaceutical goods, wine, plastics.

- The top industries that will be most impacted by this incident include: Eating and drinking establishments, construction, wholesale trade, chemicals and allied product-related businesses, health services, food retailers, industrial and commercial machinery and equipment, metal production and automotive repair services.

In the United States:

- The top 10 materials found on shipments through the Canal to the U.S. include: Kitchen and bathroom linens, electrical and photosensitive materials, construction materials such as floor, wall and ceiling polymers, vehicle parts and accessories, wheeled toys such as tricycles and scooters, furniture, plastics, athletic equipment, rubber and pharmaceutical materials.

- The top 10 industries most impacted by this incident include: Grocery stores, department stores, auto and home supply stores, hardware stores, surgical and medical equipment suppliers, plumbing, heating and air-conditioning, semiconductor, general warehousing and storage, trucking and sporting goods.

SC

MR

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More News

Latest Podcast

Explore

Explore

Business Management News

- Technology’s role in mending supply chain fragility after recent disruptions

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks