Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

July-August 2021

We all know the old saying: “When the going gets tough, the tough get going.” It has been repeated so often it’s cliché. I’d like to suggest a variation: “When the going gets tough, leadership matters.” To say that supply chains have had a tough time of it would be an understatement. Despite the positive vaccine news here in the United States, global supply chains are not out of the woods yet. Browse this issue archive.Need Help? Contact customer service 847-559-7581 More options

Our “2021 Warehouse and Distribution Center (DC) Equipment Survey” reflects the challenging times that many DC operations face in early 2021: They know they need to invest in more equipment and technology to fulfill more orders efficiently without adding hard-to-find labor, but many are coming off a highly disruptive year of dealing with COVID-19 challenges.

For the short term at least, there’s more hesitancy on moving forward with investments than this time last year. This year’s survey, conducted in January 2021, is the first annual equipment outlook survey that we’ve conducted since the pandemic spread globally—a reality that affected many industries negatively, but lead to demand spikes in others.

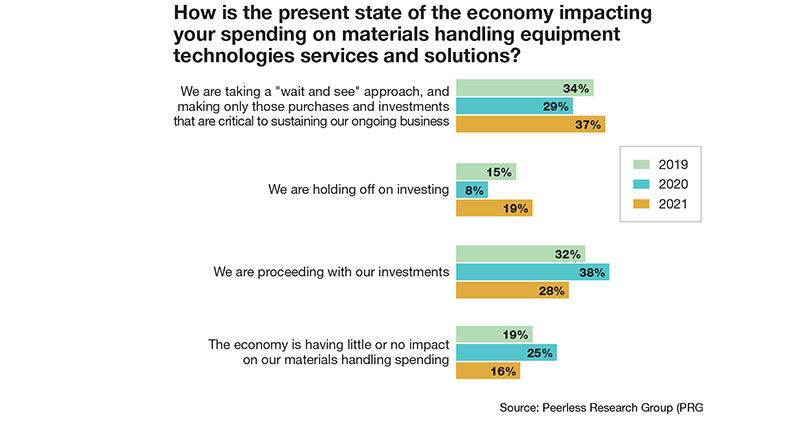

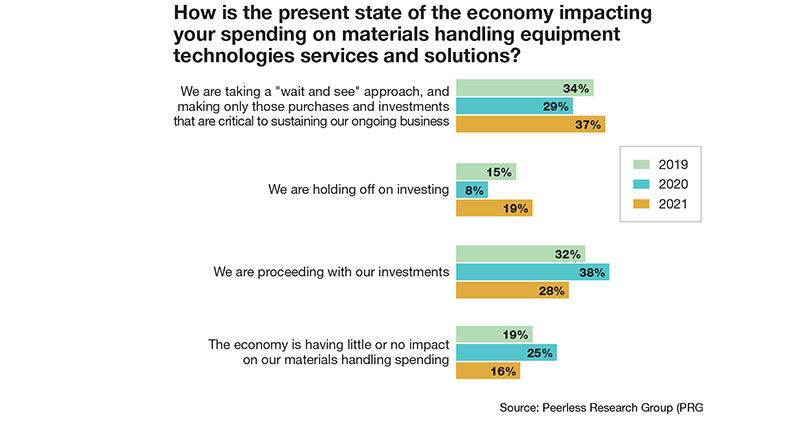

Perhaps not surprisingly, one of the results of this timing is that the percentage of respondents saying they’re currently “holding off” on DC equipment and systems investments given the state of the economy grew from only 8% in early 2020 to 19% this year. The percentage of those saying they’re proceeding with investments also took a hit—dropping by 10%.

2021 Respondent Demographics

Peerless Research Group’s (PRG) e-mail survey questionnaire was sent to readers of sister magazines Logistics Management and Modern Materials Handling in January 2021, yielding 129 qualified respondents. The respondents were from sites whose primary activity is corporate headquarters (37%), manufacturing (29%), warehouse/distribution (22%), and warehousing supporting manufacturing (3%). The median annual revenue of responding companies is $50 million, while the average is $189 million, compared with an average of $268 million last year, and a median of $58 million. Qualified respondents—managers and personnel involved in the purchase decision process for materials handling solutions—hold influence over an average of 111,250 square feet of DC space.

However, the survey also shows optimism around a fairly rapid return to increased spending on materials handling equipment and systems. Another top finding of this year’s survey was the increased interest in spending on information technology (IT) systems and software, including labor management system (LMS) software.

In answers to multiple questions, respondents expressed concerns about labor availability and issues such as workload planning. Respondents are also placing a strong emphasis on doing more over the next two years to automate the gathering of data needed for metrics such as throughput, inventory accuracy and order fulfillment costs.

In short, this latest survey reflects a highly challenging past year with some lingering near-term uncertainty. However, the findings also show that DC operators realize that without continued investment in DC systems and equipment over the next year or two, keeping up with fulfillment expectations, while also coping with ongoing labor scarcity, will be next to impossible.

Don’t get caught short

According to Norm Saenz, managing director and partner with St. Onge, a supply chain engineering and consulting company and our research partner, companies don’t want to be caught on the back foot again with outdated systems and labor-intensive methods. Companies feel the pressure around e-commerce fulfillment, and know that steps need to be taken—even if they aren’t a mega-DC.

“Everyone feels the challenges around labor availability, and the pressure to be more competitive with the Amazons of the world,” says Saenz. “I think they also realize that technologies are getting better and more affordable, and many of these investments will help them be more productive with fewer people.”

Donald Derewecki, a senior consultant with St. Onge, concurs that companies with DC operations are considering ways to automate, as well as ways to make people more productive via investments in areas like better metrics, and other types of IT and software spending.

“The thing about investing in information technology is that it’s not necessarily tied to a major automation project or materials handling equipment technology,” says Derewecki. “It’s possible to get some significant improvements in existing operations without implementing a high level of automation, and spending a huge amount of capital.”

Optimism going forward

Every year, the survey asks how the present state of the economy is affecting spending on materials handling equipment and related technologies. This being the first “post pandemic” equipment survey, it’s not surprising to see some significant changes on spending trends.

This year, 19% said they’re “holding off” on investing, up from only 8% last year.

Additionally, this year, 28% said they’re proceeding with investments, which is 10% lower than last year. Those taking a “wait and see” approach also climbed to 37% from 29% last year, and those saying the current economy is having “little or no impact” shrunk from 25% last year to 16% this year.

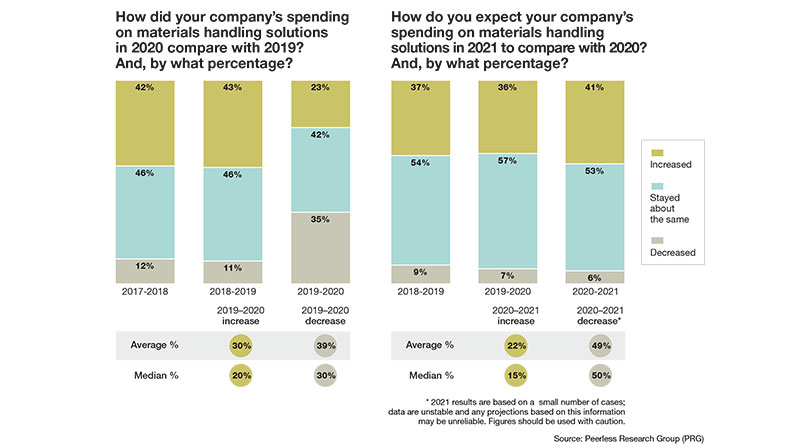

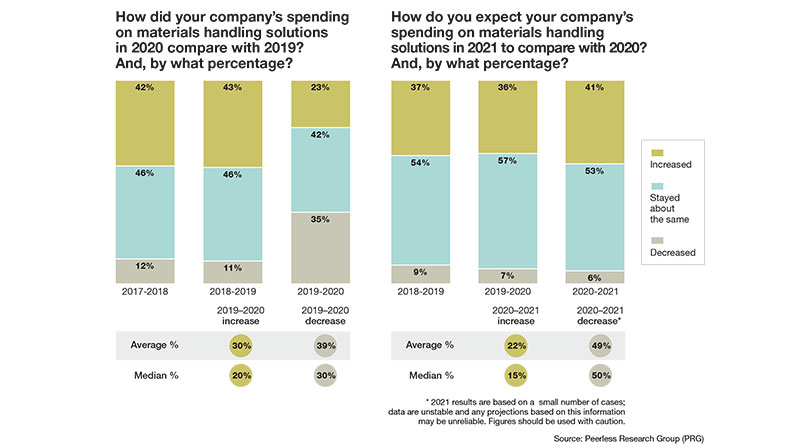

In terms of how spending on materials handling in 2020 compared with 2019, 35% said their spending decreased, compared to only 11% on this question last year (2019 compared with 2018). While there were 23% who said their spending increased during 2020, that compares to 43% the previous year.

These findings indicate that pandemic-challenged 2020 did likely act to curb some DC spending trends—and also likely contributed to some lingering caution. However, the 2021 survey also showed optimism around increased spending on DC equipment and systems going forward.

When asked how present year spending will compare to the previous year, 41% foresee increased spending, up from 36% on this question last year.

Additionally, when asked how spending will change in the next two years to three years, the respondents were fairly bullish. This year, 53% said they expect an increase over the next two years to three years, up from 48% on this question last year, and equal to 2019’s answer as to their long-term spending outlook.

Every year brings a new respondent pool, so findings around respondent budgets for materials handling solutions fluctuate. This year, 20% have pre-approved annual budgets of $1 million or more, and another 20% had budgets of between $250,000 to $999,999. However, a combined 46% this year have budgets of $99,999 or less, which contributed to an average pre-approved budget of $369,000.

Average anticipated spending over the next 12 months is $306,990, down from $355,175 last year. Median anticipated spending over the next 12 months is $85,552, down from $97,905 last year.

When asked about areas of investment over the next 12 months across broad categories such as new equipment, IT and software, maintenance, staffing, and third-party logistics (3PL) services, the categories on the upswing were IT, cited by 52% this year, compared to 43% last year. Additionally, 53% foresee the need to add staff this year, up from 40% last year.

“Prioritizing information technology investments is consistent with what we see among our clients,” says Derewecki. “Investment in technology and software can help you with issues like maximizing productivity, and in establishing good data and metrics.”

Saenz and Derewecki add that among their clients, the mood is quite optimistic, with many moving forward with projects, and most every client assessing how automation and software can help them cope with pressures around rapid order fulfillment without having to bump up staffing levels. “Among our clients, everyone at least wants to consider the automation that is out there,” says Saenz. “They’re itching to see what makes sense for them.”

IT as a priority

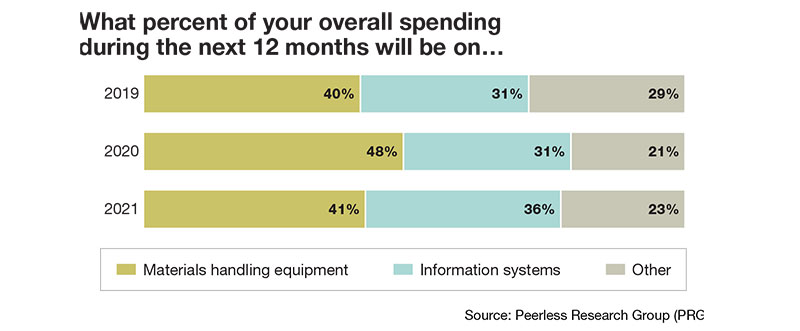

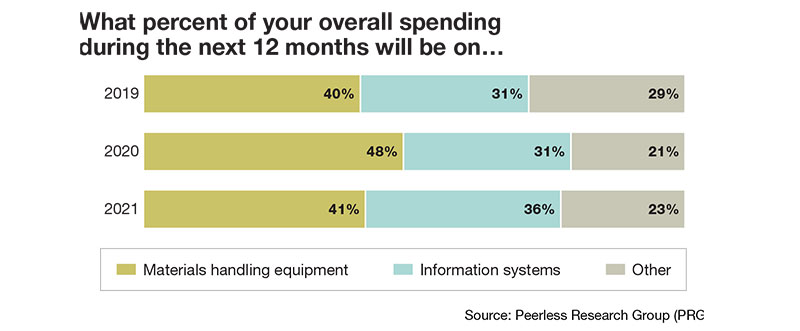

Interest in increased investment in software and IT solutions is seen in multiple results from this year’s survey. When asked what percentage of overall spending will be on either materials handling equipment, information systems (IS), or “other,” over the next 12 months, 41% is for equipment, 36% on IS, and 23% on other. Last year, this breakdown was 48% on equipment, 31% on IS, and 21% on other.

When asked to break down which IS subcategories they will be spending on during the next 12 months, categories on the upswing this year include bar coding and data capture (up 9% from 2020); warehouse control system (up 10%); LMS (up by 9%); and voice-directed work solutions (up by 6%). Warehouse management system (WMS) and warehouse execution system (WES) software also increased slightly.

In terms of interest in various types of materials handling equipment over the next 12 months, several categories declined slightly from last year’s findings or held steady, but a few saw growth compared to last year. Those on the upswing include rack and shelving (up 10% versus last year); dock equipment (up 6%); order picking and fulfillment systems (up 3%); mezzanines (up 7%); and totes, bins and containers (up 8%).

While the survey didn’t ask why these were on the upswing, some facilities may be shifting to narrow aisle layouts to create greater storage density or accommodate extra space for social distancing in value-added services areas, which bodes well for interest in racks and shelving. The surge in e-commerce fulfillment work in DCs can also be seen as increasing the need for mezzanines, as well as totes and bins.

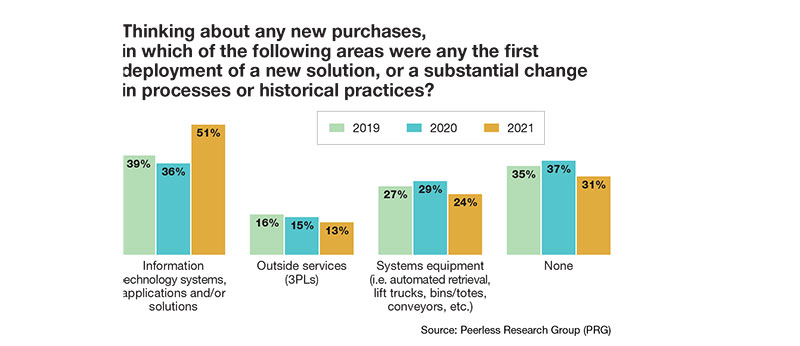

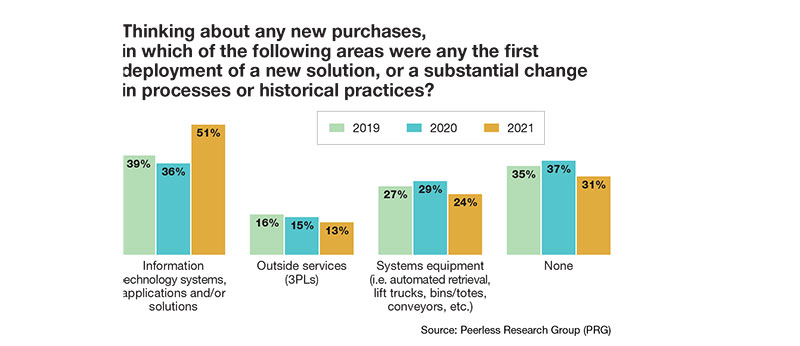

The survey also asked about which new purchases or substantial changes to existing systems fell into one of three broad areas of investment: IT; use of 3PLs; and various “system equipment” such as automated retrieval, lift truck and conveyors. The big gainer here was IT, going from a 36% response last year, to 51% this year.

While there was a slight decline for 3PL engagements under this question, a separate question asking about investment areas over the next 12 months, found a 5% rise in those indicating they will use outside services (3PLs) over the coming year.

“Part of that forward-looking interest in using 3PLs may be tied to the recognition by many companies that they need to find a way to bring distribution closer to customers,” says Derewecki. “Using 3PLs allows you to accomplish that virtually immediately.”

Another finding in the survey that ties into the healthy interest in IT and software is the strong level of respondent interest in having automated processes for gathering and using metrics. This question asked if they use a manual process for certain metrics, an automated one, or are they currently not monitoring the metric area, as well as what they anticipate that process to be in two years.

For example, today, daily throughput is monitored via automated methods by 44%, but 69% want gathering of this metric to be automated in two years. Likewise, order fulfillment costs are automated by 35% now, but in two years, 58% want this metric automated.

Robots level out

Current use and anticipated interest in robotics held fairly steady, which could be considered a victory for the category given the smaller size of many companies in the response base, as well as the unusual pandemic conditions of 2020 including tighter controls on outside visitors as a health precaution.

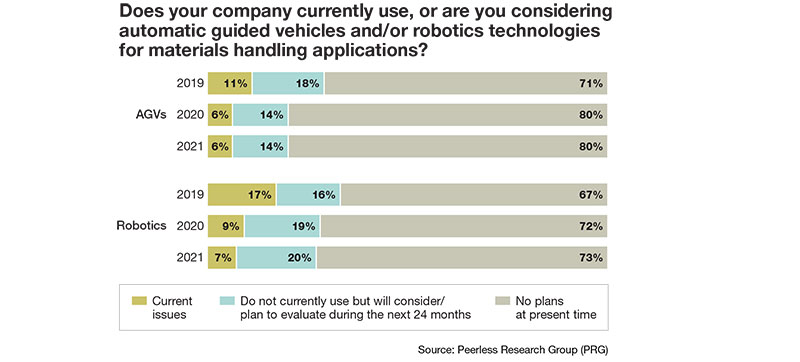

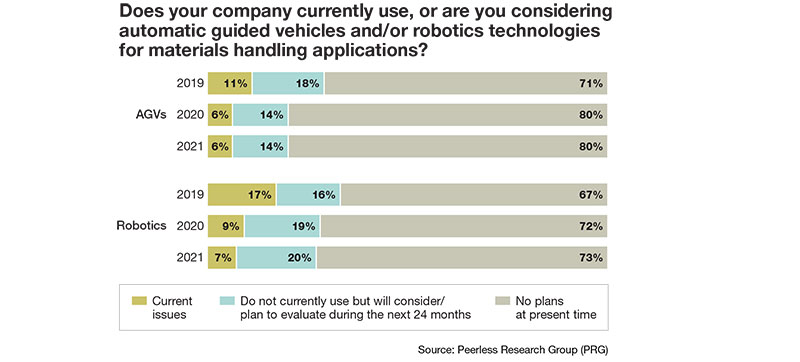

Current reported use of robotics was at 7% this year, down 2% from last year’s response, though 20% this year are considering or evaluating robotics for materials handling applications—1% higher than those answering that way last year. Use of automated guided vehicles (AGVs) held steady, with 6% currently using and 14% considering/evaluating, which are the same percentages as in 2020.

The survey also asked about applications for robotics that respondents are using or considering. In fact, these are becoming a bit more diverse, though picking remains a top use case. For 2021, pick and place was the top use case for robotics (54%) followed by “order fulfillment, part to picker” and “order fulfillment, picker to part,” as well as palletizing. All three come in at 38%. The palletizing role, however, has remained fairly steady in recent years, whereas use and interest in using robotics for picking has grown more in recent years.

The survey also asked about AGV use and applications. This year, higher growth uses include storage, for which 47% are using or considering AGVs, compared to 33% last year, and bin picking, which rose from 11% last year to 32% this year.

Apart from the survey, the use of robotics by many larger DC operators and 3PLs is growing and even becoming more mainstream. For this respondent mix, interest in robotics and AGVs is at least holding steady. What’s more, it may be that the market is entering a stage in which robotics and AGVs are no longer novelties, but rather another set of options to be used in combination with fixed automation—or with each other.

“Some of these applications for robotics, like palletizing, have been around for a long-time, and AGVs have also been around a very long time, so in that sense, robotics and AGVs are nothing new, but there is a trend toward wanting greater flexibility in automated transport,” explains Derewecki. “There is definitely strong interest in the market in both of these categories as a way of automating various workflows. Some of our clients are also combining AMRs and AGVs with other technologies to create highly automated material flows.”

When it comes to mobile technologies, there weren’t any big shifts compared to last year’s findings, with 53% either using or having plans for mobile solutions, down 2% from last year. This year, 38% said they’re providing more employees with mobile solutions, up from 31% last year.

We also ask about current use and 12-month plans for specific types of mobile devices and bar code scanning and printing equipment. Bar code scanners, for example, are utilized by 55% today, and 40% have plans to deploy scanners during the next 12 months. Similarly, voice-directed technology is used by 28%, and 22% have voice system plans during the next 12 months.

Generally, rugged bar code scanning equipment and other devices can run adequately for years in a DC before needing replacement. As Saenz sees it, it’s an area which is often overlooked and not invested in often enough, given the importance of data capture processes to feeding warehouse management and execution functions, as well as other areas such as labor performance metrics.

“It’s an area that needs more attention, because you can’t do much without good data and information to inform your facility design and daily operations,” says Saenz.

Another equipment concern the survey looks at annually is what role staff, vendors or other parties play in maintaining automated materials handling systems. This year, 53% said they use internal staff for maintenance, down 1% from last year’s 54%. Thirty-five percent use a combination of internal staff and some outsourcing, up 3% from last year, and 11% completely outsource it, down from 18% last year. The pandemic conditions may explain part of that decline in full outsourcing of maintenance.

E-comm effects

The survey asked about the most common method of fulfilling online orders today, and which method respondents believe will be most common in two years. The most common practice today is “buy online, ship to customer from a DC,” used by 44% today, and expected to be used by 47% in two years.

Other methods expected to be more commonly used in two years include “buy online, ship to customer from store,” now used by 5%, but growing to 8% in two years, and “buy online, ship to customer from supplier,” now utilized by 5%, but doubling to 10% in two years. “Buy-online, pick up in store,” or BOPIS, is also expected to grow in two years, but only by 2%.

The survey also asked if e-commerce activity will or is already prompting change in where distribution and manufacturing activities take place. This year, 47% said e-commerce is prompting more distribution functions in manufacturing, up slightly from 46% last year. The steeper change was in terms of more manufacturing in DCs, which 47% said is happening or has happened, up 11% from last year’s 36%.

When asked “where does your packaging and fulfillment occur,” the most common type of location is a warehouse, used by 47% of respondents this year, down from 49% last year. The second most common place is a manufacturing location, cited by 40% this year, up from 32% last year. Additionally, 19% said packaging and fulfillment take place at a “fulfillment center,” compared to 20% last year, while 30% said these processes take place in a DC, up from 17% last year. Finally, only 2% said these processes occur in retail stores, down from 9% last year.

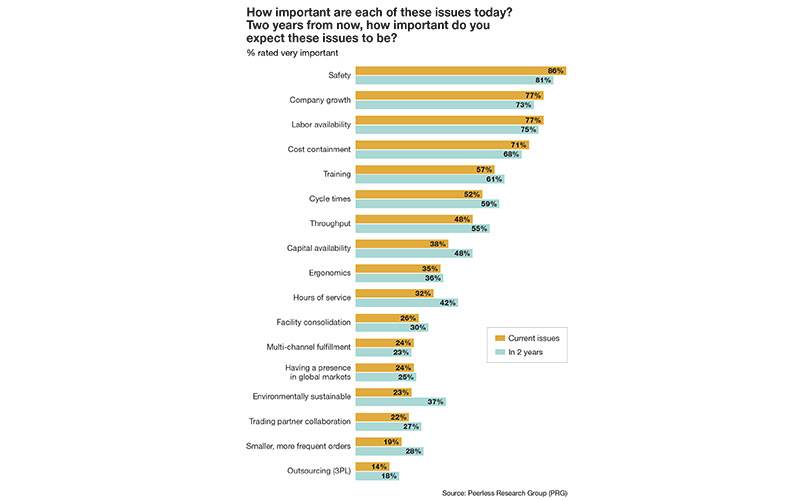

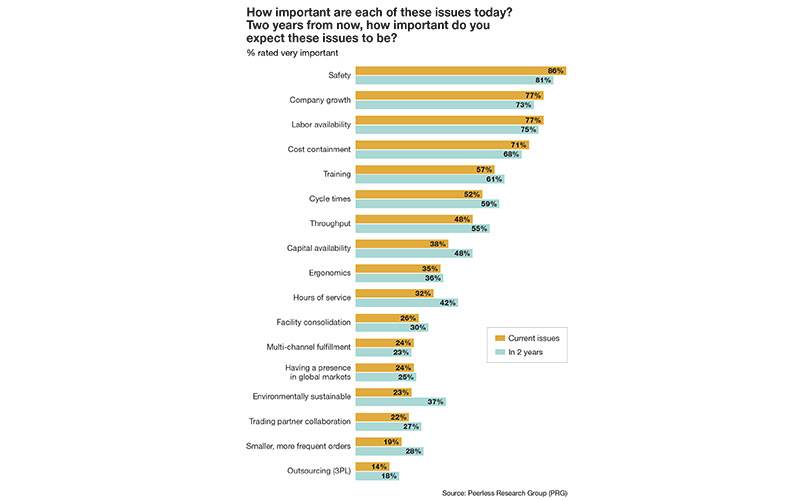

Pressures associated with e-commerce fulfillment, such as labor availability and tighter cycle times, are reflected in the survey. When asked about the most important issues affecting DCs today as well as two years from now, traditional concerns such as safety, growth, and cost containment still head up the list. But in terms of what rates as “very important” two years from now, some other issues are growing more rapidly.

For example, “cycle time” pressures are rated as important by 52% today, but seen as very important by 59% two years from now. Likewise, “smaller, more frequent orders” gets a 9% bump up in importance two years from now, while “throughput” is up 7%, “capital availability” jumps by 10%, and “environmental sustainability” gains 14%.

A separate question asks respondents to rate the importance of various DC practices like continuous improvement, labor productivity measurement, and workload planning, today as well as two years out. Here too there are areas seen as growing sharply in importance, such as workload planning, rated as “highly important” by 53% today, but by 66% of respondents two years out. Likewise, labor management sees a 7% rise, concerns over same-day shipping grows by 7%, reverse logistics gains 7% in two years, and outsourcing to 3PLs grows 12%.

Many of these areas seen as growing in importance in two years involve labor, and being able to flex the distribution operation to keep up with the pace of fulfillment. At least respondents see the storm clouds looming, notes Saenz.

“I think people realize that there will be more economic rebound going forward, and that volumes will go up, but challenges like labor availability and e-commerce pressures will persist and could become even more problematic if another major disruption occurs,” says Saenz. “That’s why people are looking at how to use more automation, and have better supply chain visibility and better metrics. They don’t want to be caught in the same situation again, with over reliance on manual processes. Most operations managers I know want to automate more so that they can handle more volume with fewer people.”

Future-proofing

This annual survey also asks about supply chain risk, and oddly, only 39% said they have a plan for identifying and reducing risks, which is down from 52% last year. When those with a program were asked “for which areas,” one growing concern in 2021 was “in-house production or operations,” up to 76% this year from 60% last year. Other risk areas that gained in response level include supplier risks (up 5%) and data breaches (up 9%).

The survey’s finding on capacity levels in DCs and manufacturing sites stayed relatively steady. However, for stand-alone DCs, a combined 31% of respondents said that their current capacity level was at 81% or higher, indicating that these operations are in a space crunch and need to find ways to add more capacity.

Overall, the survey points to an industry coming out of a highly disruptive era, but it also one that’s well aware of the need to layer in further automation to keep up with the unrelenting growth of e-commerce and lessen the reliance on labor. Not only are such investments needed for operational effectiveness, notes Derewecki, a company’s ability to excel at on-time, accurate order fulfillment is essential to customer perceptions of quality and trust.

Automating more can help ensure reliable, fast order fulfillment, but so can smaller investments in software or applications that deliver insights to managers on key metrics such as on-time shipping, or “dock-to-stock” cycle times. In fact, while only 25% automate the gathering of dock-to-stock cycle time data today, in two years, 55% want to handle this metric in an automated way.

“One of the factors that’s going to motivate more companies to improve on both their information systems, and their equipment and automation, is the perceived quality of their product or service level,” says Derewecki. “If someone is happy with a service or product you provide, that person might not tell anyone, but the moment a customer is unhappy, everyone is going to hear about it. No one in business can ignore quality, so in addition to needing more automation to contain costs and deal with labor scarcity, the other big driver is ensuring high quality.”

Saenz agrees that it’s clear the market is looking at using more automation and software, or for some operations, more basic improvements in areas like new racking and conveyor. Not only do operations managers want to avoid being stuck with over-reliance on manual processes when the next major disruption occurs, he explains, “even without another big disruption, they know they can be more effective with more technology and automation.”

SC

MR

Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

July-August 2021

We all know the old saying: “When the going gets tough, the tough get going.” It has been repeated so often it’s cliché. I’d like to suggest a variation: “When the going gets tough, leadership matters.”… Browse this issue archive. Access your online digital edition. Download a PDF file of the July-August 2021 issue.Our “2021 Warehouse and Distribution Center (DC) Equipment Survey” reflects the challenging times that many DC operations face in early 2021: They know they need to invest in more equipment and technology to fulfill more orders efficiently without adding hard-to-find labor, but many are coming off a highly disruptive year of dealing with COVID-19 challenges.

For the short term at least, there’s more hesitancy on moving forward with investments than this time last year. This year’s survey, conducted in January 2021, is the first annual equipment outlook survey that we’ve conducted since the pandemic spread globally—a reality that affected many industries negatively, but lead to demand spikes in others.

Perhaps not surprisingly, one of the results of this timing is that the percentage of respondents saying they’re currently “holding off” on DC equipment and systems investments given the state of the economy grew from only 8% in early 2020 to 19% this year. The percentage of those saying they’re proceeding with investments also took a hit—dropping by 10%.

2021 Respondent Demographics

Peerless Research Group’s (PRG) e-mail survey questionnaire was sent to readers of sister magazines Logistics Management and Modern Materials Handling in January 2021, yielding 129 qualified respondents. The respondents were from sites whose primary activity is corporate headquarters (37%), manufacturing (29%), warehouse/distribution (22%), and warehousing supporting manufacturing (3%). The median annual revenue of responding companies is $50 million, while the average is $189 million, compared with an average of $268 million last year, and a median of $58 million. Qualified respondents—managers and personnel involved in the purchase decision process for materials handling solutions—hold influence over an average of 111,250 square feet of DC space.

However, the survey also shows optimism around a fairly rapid return to increased spending on materials handling equipment and systems. Another top finding of this year’s survey was the increased interest in spending on information technology (IT) systems and software, including labor management system (LMS) software.

In answers to multiple questions, respondents expressed concerns about labor availability and issues such as workload planning. Respondents are also placing a strong emphasis on doing more over the next two years to automate the gathering of data needed for metrics such as throughput, inventory accuracy and order fulfillment costs.

In short, this latest survey reflects a highly challenging past year with some lingering near-term uncertainty. However, the findings also show that DC operators realize that without continued investment in DC systems and equipment over the next year or two, keeping up with fulfillment expectations, while also coping with ongoing labor scarcity, will be next to impossible.

Don’t get caught short

According to Norm Saenz, managing director and partner with St. Onge, a supply chain engineering and consulting company and our research partner, companies don’t want to be caught on the back foot again with outdated systems and labor-intensive methods. Companies feel the pressure around e-commerce fulfillment, and know that steps need to be taken—even if they aren’t a mega-DC.

“Everyone feels the challenges around labor availability, and the pressure to be more competitive with the Amazons of the world,” says Saenz. “I think they also realize that technologies are getting better and more affordable, and many of these investments will help them be more productive with fewer people.”

Donald Derewecki, a senior consultant with St. Onge, concurs that companies with DC operations are considering ways to automate, as well as ways to make people more productive via investments in areas like better metrics, and other types of IT and software spending.

“The thing about investing in information technology is that it’s not necessarily tied to a major automation project or materials handling equipment technology,” says Derewecki. “It’s possible to get some significant improvements in existing operations without implementing a high level of automation, and spending a huge amount of capital.”

Optimism going forward

Every year, the survey asks how the present state of the economy is affecting spending on materials handling equipment and related technologies. This being the first “post pandemic” equipment survey, it’s not surprising to see some significant changes on spending trends.

This year, 19% said they’re “holding off” on investing, up from only 8% last year.

Additionally, this year, 28% said they’re proceeding with investments, which is 10% lower than last year. Those taking a “wait and see” approach also climbed to 37% from 29% last year, and those saying the current economy is having “little or no impact” shrunk from 25% last year to 16% this year.

In terms of how spending on materials handling in 2020 compared with 2019, 35% said their spending decreased, compared to only 11% on this question last year (2019 compared with 2018). While there were 23% who said their spending increased during 2020, that compares to 43% the previous year.

These findings indicate that pandemic-challenged 2020 did likely act to curb some DC spending trends—and also likely contributed to some lingering caution. However, the 2021 survey also showed optimism around increased spending on DC equipment and systems going forward.

When asked how present year spending will compare to the previous year, 41% foresee increased spending, up from 36% on this question last year.

Additionally, when asked how spending will change in the next two years to three years, the respondents were fairly bullish. This year, 53% said they expect an increase over the next two years to three years, up from 48% on this question last year, and equal to 2019’s answer as to their long-term spending outlook.

Every year brings a new respondent pool, so findings around respondent budgets for materials handling solutions fluctuate. This year, 20% have pre-approved annual budgets of $1 million or more, and another 20% had budgets of between $250,000 to $999,999. However, a combined 46% this year have budgets of $99,999 or less, which contributed to an average pre-approved budget of $369,000.

Average anticipated spending over the next 12 months is $306,990, down from $355,175 last year. Median anticipated spending over the next 12 months is $85,552, down from $97,905 last year.

When asked about areas of investment over the next 12 months across broad categories such as new equipment, IT and software, maintenance, staffing, and third-party logistics (3PL) services, the categories on the upswing were IT, cited by 52% this year, compared to 43% last year. Additionally, 53% foresee the need to add staff this year, up from 40% last year.

“Prioritizing information technology investments is consistent with what we see among our clients,” says Derewecki. “Investment in technology and software can help you with issues like maximizing productivity, and in establishing good data and metrics.”

Saenz and Derewecki add that among their clients, the mood is quite optimistic, with many moving forward with projects, and most every client assessing how automation and software can help them cope with pressures around rapid order fulfillment without having to bump up staffing levels. “Among our clients, everyone at least wants to consider the automation that is out there,” says Saenz. “They’re itching to see what makes sense for them.”

IT as a priority

Interest in increased investment in software and IT solutions is seen in multiple results from this year’s survey. When asked what percentage of overall spending will be on either materials handling equipment, information systems (IS), or “other,” over the next 12 months, 41% is for equipment, 36% on IS, and 23% on other. Last year, this breakdown was 48% on equipment, 31% on IS, and 21% on other.

When asked to break down which IS subcategories they will be spending on during the next 12 months, categories on the upswing this year include bar coding and data capture (up 9% from 2020); warehouse control system (up 10%); LMS (up by 9%); and voice-directed work solutions (up by 6%). Warehouse management system (WMS) and warehouse execution system (WES) software also increased slightly.

In terms of interest in various types of materials handling equipment over the next 12 months, several categories declined slightly from last year’s findings or held steady, but a few saw growth compared to last year. Those on the upswing include rack and shelving (up 10% versus last year); dock equipment (up 6%); order picking and fulfillment systems (up 3%); mezzanines (up 7%); and totes, bins and containers (up 8%).

While the survey didn’t ask why these were on the upswing, some facilities may be shifting to narrow aisle layouts to create greater storage density or accommodate extra space for social distancing in value-added services areas, which bodes well for interest in racks and shelving. The surge in e-commerce fulfillment work in DCs can also be seen as increasing the need for mezzanines, as well as totes and bins.

The survey also asked about which new purchases or substantial changes to existing systems fell into one of three broad areas of investment: IT; use of 3PLs; and various “system equipment” such as automated retrieval, lift truck and conveyors. The big gainer here was IT, going from a 36% response last year, to 51% this year.

While there was a slight decline for 3PL engagements under this question, a separate question asking about investment areas over the next 12 months, found a 5% rise in those indicating they will use outside services (3PLs) over the coming year.

“Part of that forward-looking interest in using 3PLs may be tied to the recognition by many companies that they need to find a way to bring distribution closer to customers,” says Derewecki. “Using 3PLs allows you to accomplish that virtually immediately.”

Another finding in the survey that ties into the healthy interest in IT and software is the strong level of respondent interest in having automated processes for gathering and using metrics. This question asked if they use a manual process for certain metrics, an automated one, or are they currently not monitoring the metric area, as well as what they anticipate that process to be in two years.

For example, today, daily throughput is monitored via automated methods by 44%, but 69% want gathering of this metric to be automated in two years. Likewise, order fulfillment costs are automated by 35% now, but in two years, 58% want this metric automated.

Robots level out

Current use and anticipated interest in robotics held fairly steady, which could be considered a victory for the category given the smaller size of many companies in the response base, as well as the unusual pandemic conditions of 2020 including tighter controls on outside visitors as a health precaution.

Current reported use of robotics was at 7% this year, down 2% from last year’s response, though 20% this year are considering or evaluating robotics for materials handling applications—1% higher than those answering that way last year. Use of automated guided vehicles (AGVs) held steady, with 6% currently using and 14% considering/evaluating, which are the same percentages as in 2020.

The survey also asked about applications for robotics that respondents are using or considering. In fact, these are becoming a bit more diverse, though picking remains a top use case. For 2021, pick and place was the top use case for robotics (54%) followed by “order fulfillment, part to picker” and “order fulfillment, picker to part,” as well as palletizing. All three come in at 38%. The palletizing role, however, has remained fairly steady in recent years, whereas use and interest in using robotics for picking has grown more in recent years.

The survey also asked about AGV use and applications. This year, higher growth uses include storage, for which 47% are using or considering AGVs, compared to 33% last year, and bin picking, which rose from 11% last year to 32% this year.

Apart from the survey, the use of robotics by many larger DC operators and 3PLs is growing and even becoming more mainstream. For this respondent mix, interest in robotics and AGVs is at least holding steady. What’s more, it may be that the market is entering a stage in which robotics and AGVs are no longer novelties, but rather another set of options to be used in combination with fixed automation—or with each other.

“Some of these applications for robotics, like palletizing, have been around for a long-time, and AGVs have also been around a very long time, so in that sense, robotics and AGVs are nothing new, but there is a trend toward wanting greater flexibility in automated transport,” explains Derewecki. “There is definitely strong interest in the market in both of these categories as a way of automating various workflows. Some of our clients are also combining AMRs and AGVs with other technologies to create highly automated material flows.”

When it comes to mobile technologies, there weren’t any big shifts compared to last year’s findings, with 53% either using or having plans for mobile solutions, down 2% from last year. This year, 38% said they’re providing more employees with mobile solutions, up from 31% last year.

We also ask about current use and 12-month plans for specific types of mobile devices and bar code scanning and printing equipment. Bar code scanners, for example, are utilized by 55% today, and 40% have plans to deploy scanners during the next 12 months. Similarly, voice-directed technology is used by 28%, and 22% have voice system plans during the next 12 months.

Generally, rugged bar code scanning equipment and other devices can run adequately for years in a DC before needing replacement. As Saenz sees it, it’s an area which is often overlooked and not invested in often enough, given the importance of data capture processes to feeding warehouse management and execution functions, as well as other areas such as labor performance metrics.

“It’s an area that needs more attention, because you can’t do much without good data and information to inform your facility design and daily operations,” says Saenz.

Another equipment concern the survey looks at annually is what role staff, vendors or other parties play in maintaining automated materials handling systems. This year, 53% said they use internal staff for maintenance, down 1% from last year’s 54%. Thirty-five percent use a combination of internal staff and some outsourcing, up 3% from last year, and 11% completely outsource it, down from 18% last year. The pandemic conditions may explain part of that decline in full outsourcing of maintenance.

E-comm effects

The survey asked about the most common method of fulfilling online orders today, and which method respondents believe will be most common in two years. The most common practice today is “buy online, ship to customer from a DC,” used by 44% today, and expected to be used by 47% in two years.

Other methods expected to be more commonly used in two years include “buy online, ship to customer from store,” now used by 5%, but growing to 8% in two years, and “buy online, ship to customer from supplier,” now utilized by 5%, but doubling to 10% in two years. “Buy-online, pick up in store,” or BOPIS, is also expected to grow in two years, but only by 2%.

The survey also asked if e-commerce activity will or is already prompting change in where distribution and manufacturing activities take place. This year, 47% said e-commerce is prompting more distribution functions in manufacturing, up slightly from 46% last year. The steeper change was in terms of more manufacturing in DCs, which 47% said is happening or has happened, up 11% from last year’s 36%.

When asked “where does your packaging and fulfillment occur,” the most common type of location is a warehouse, used by 47% of respondents this year, down from 49% last year. The second most common place is a manufacturing location, cited by 40% this year, up from 32% last year. Additionally, 19% said packaging and fulfillment take place at a “fulfillment center,” compared to 20% last year, while 30% said these processes take place in a DC, up from 17% last year. Finally, only 2% said these processes occur in retail stores, down from 9% last year.

Pressures associated with e-commerce fulfillment, such as labor availability and tighter cycle times, are reflected in the survey. When asked about the most important issues affecting DCs today as well as two years from now, traditional concerns such as safety, growth, and cost containment still head up the list. But in terms of what rates as “very important” two years from now, some other issues are growing more rapidly.

For example, “cycle time” pressures are rated as important by 52% today, but seen as very important by 59% two years from now. Likewise, “smaller, more frequent orders” gets a 9% bump up in importance two years from now, while “throughput” is up 7%, “capital availability” jumps by 10%, and “environmental sustainability” gains 14%.

A separate question asks respondents to rate the importance of various DC practices like continuous improvement, labor productivity measurement, and workload planning, today as well as two years out. Here too there are areas seen as growing sharply in importance, such as workload planning, rated as “highly important” by 53% today, but by 66% of respondents two years out. Likewise, labor management sees a 7% rise, concerns over same-day shipping grows by 7%, reverse logistics gains 7% in two years, and outsourcing to 3PLs grows 12%.

Many of these areas seen as growing in importance in two years involve labor, and being able to flex the distribution operation to keep up with the pace of fulfillment. At least respondents see the storm clouds looming, notes Saenz.

“I think people realize that there will be more economic rebound going forward, and that volumes will go up, but challenges like labor availability and e-commerce pressures will persist and could become even more problematic if another major disruption occurs,” says Saenz. “That’s why people are looking at how to use more automation, and have better supply chain visibility and better metrics. They don’t want to be caught in the same situation again, with over reliance on manual processes. Most operations managers I know want to automate more so that they can handle more volume with fewer people.”

Future-proofing

This annual survey also asks about supply chain risk, and oddly, only 39% said they have a plan for identifying and reducing risks, which is down from 52% last year. When those with a program were asked “for which areas,” one growing concern in 2021 was “in-house production or operations,” up to 76% this year from 60% last year. Other risk areas that gained in response level include supplier risks (up 5%) and data breaches (up 9%).

The survey’s finding on capacity levels in DCs and manufacturing sites stayed relatively steady. However, for stand-alone DCs, a combined 31% of respondents said that their current capacity level was at 81% or higher, indicating that these operations are in a space crunch and need to find ways to add more capacity.

Overall, the survey points to an industry coming out of a highly disruptive era, but it also one that’s well aware of the need to layer in further automation to keep up with the unrelenting growth of e-commerce and lessen the reliance on labor. Not only are such investments needed for operational effectiveness, notes Derewecki, a company’s ability to excel at on-time, accurate order fulfillment is essential to customer perceptions of quality and trust.

Automating more can help ensure reliable, fast order fulfillment, but so can smaller investments in software or applications that deliver insights to managers on key metrics such as on-time shipping, or “dock-to-stock” cycle times. In fact, while only 25% automate the gathering of dock-to-stock cycle time data today, in two years, 55% want to handle this metric in an automated way.

“One of the factors that’s going to motivate more companies to improve on both their information systems, and their equipment and automation, is the perceived quality of their product or service level,” says Derewecki. “If someone is happy with a service or product you provide, that person might not tell anyone, but the moment a customer is unhappy, everyone is going to hear about it. No one in business can ignore quality, so in addition to needing more automation to contain costs and deal with labor scarcity, the other big driver is ensuring high quality.”

Saenz agrees that it’s clear the market is looking at using more automation and software, or for some operations, more basic improvements in areas like new racking and conveyor. Not only do operations managers want to avoid being stuck with over-reliance on manual processes when the next major disruption occurs, he explains, “even without another big disruption, they know they can be more effective with more technology and automation.”

SC

MR

More WMS

- Inflation continues to have a wide-ranging impact on supply chains

- How to Create Real Retailer-Brand Loyalty

- Six Factors to Consider Before Automating Warehouses

- 2023 Warehouse/DC Operations Survey: Automating while upping performance

- Six emerging supply chain software trends to watch

- WMS + OMS: Maximize ROI & Win Customers for Life

- More WMS

Latest Resources

Explore

Explore

Topics

Business Management News

- Inflation continues to have a wide-ranging impact on supply chains

- Strategic cost savings differ from cutting costs

- Planning fatigue may be settling in

- Inflation, economic worries among top supply chain concerns for SMBs

- April Services PMI declines following 15 months of growth, reports ISM

- Attacking stubborn COGS inflation with Digital Design-and-Source-to-Value

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks