Editor’s note: While many/most large companies have made significant strides in elevating their supply chain performance, many mid-cap companies have only focused on getting product delivered and have yet to join the supply chain revolution. This article provides an overview of how mid-cap companies ($150,000 to $1.5 billion in revenue) can better use the supply chain to improve shareholder/equity value – both through lower cost and improved service. Future articles will focus on the individual levels listed below as a path to designing an effective supply chain.

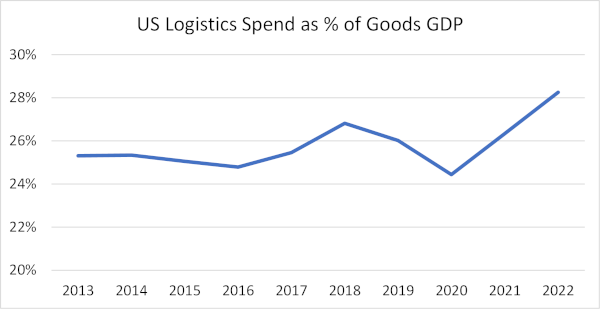

Numerous changes and disruptions have occurred in the supply chain over the past few years. Between COVID-19 and other changing industry trends, many shippers and receivers’ supply and demand patterns look nothing like they did five years ago. But, most importantly, the supply chain has gone from a relatively constant part of a company’s costs to a large and growing part of its costs as economy-wide businesses are spending more on their supply chains than in the past.

In many cases, business supply chains were whipsawed as never before by the COVID-19 response. First, a drop in demand followed by a rapid and somewhat unexpected recovery in demand challenged many companies. The inability to source products or inputs and transport them quickly (particularly imports) led to significant delays and shortages. E-commerce volumes skyrocketed as in-person shopping suffered. Labor issues, from COVID-19 quarantines to the inability to hire staff, compounded problems. While things somewhat “normalized” in 2023, in many cases a company’s supply chain looks very different than it did in 2019.

U.S. logistics spend as a percentage of GDP has been on a steady upward climb since 2020. (Photo: Authors)

Potentially the most significant impact of COVID-19 on supply chains was to highlight the importance of flexibility and resilience. For many years the priority had been efficient, low-cost supply chains. While this approach can be a successful strategy for calm or predictable markets, it demonstrated its weaknesses during the 2020-2022 period. Long supply chains, a small number of suppliers, and relatively low inventory levels, all proved detrimental to meeting customer demand in a rapidly changing environment. While the most common example of supply chain chaos resulting in lower sales is the auto industry (2022 U.S. new light vehicle sales were 19% below average 2015-2019 levels), the issue was broad across many industries.

Why now is the right time

There are many reasons to reevaluate your supply chain, but some basic rules are always true. Look at the key aspects of your business to determine what has changed.

Have your product sourcing locations changed? This could mean a shift from China to Indonesia, from a supplier in Michigan to one in Tennessee, or the addition of new suppliers.

Have your customers and products changed? Winning new contracts, while losing others, results in different customer delivery locations. New products, or shifting trends, may favor certain SKUs over others.

Has your business volume changed? The current supply chain needs to not only support current volumes, which may be higher than in the past, but also support continued growth.

Does your current supply chain support your current and future needs? Warehouse locations and sizes are key to ensuring adequate inventory and short delivery times. Companies with large consumer e-commerce volumes must also consider how to fulfill single-item order deliveries.

Finally, are you sourcing your supply chain components and partners efficiently? Cost will remain a driving factor for any supply chain changes. Considerations include whether to insource or outsource various components, whether the company is paying a competitive rate to its partners for service, who the best partners are based on company-specific needs and characteristics, and how much and where to hold inventory to meet service but minimize cost.

A period of slower demand growth, which many companies are experiencing right now, is the perfect time to make supply chain changes. Activities such as moving DCs, swapping out carriers, and changing to lower-cost transportation modes are easier to complete without the stressor of high volumes, and are typically best implemented outside of “peak” season.

Options for change

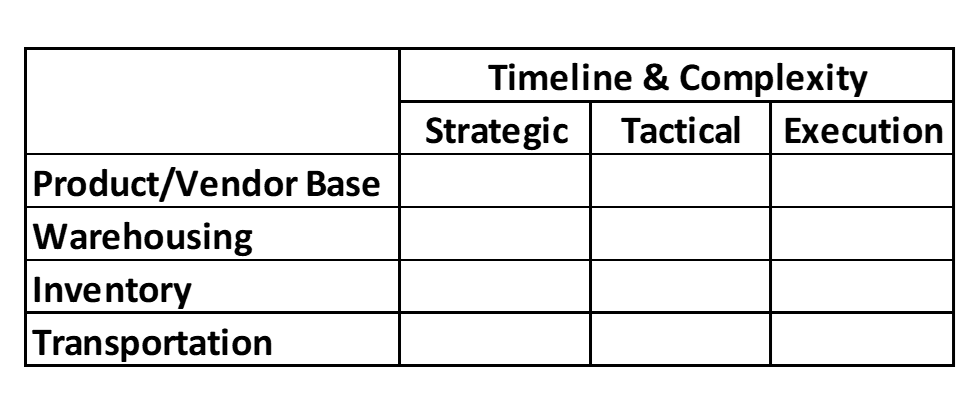

You can’t change everything at once, especially as an ongoing business. That is why we often use a framework to think about options across a spectrum of strategic, tactical, and execution changes and consider changes based on the timeline to get implemented and benefits flowing.

Creating a framework for making changes can help a business stay on track and determine which changes to implement first. (Photo: Authors)

Strategic changes take more than a year and typically have more complexity involved. These are decisions that supply chain executives or even company executives are likely to be involved in. They can be central to company operations and incorporate fundamental changes to the supply chain or how operations are performed. These can include decisions such as replacing foreign sourcing/production with domestic sourcing/production, the network of DCs to flow product through, and what the company wants to insource vs. outsource. Each of these decisions is likely to take one or more years to fully implement, as it takes time to find and ramp up new suppliers, determine sites for new facilities and get out of existing leases, or build up a company’s internal capability to operate and manage a function. These changes typically also require capital expenditures and/or long-term leases.

Tactical changes generally can be made in 6 to 12 months and are fundamental changes to improve the existing supply chain. They do not require capital expenditures (or, if so, very limited), but likely require some operating expenditures. Tactical changes can include changes in which SKUs to carry, which SKUs are held in which warehouses, utilizing domestic freight consolidation operations, converting from a private truck fleet to a third-party dedicated trucking option, implementing zone-skipping for parcel shipments, implementing vendor shipment to the customer (drop ship), and changing customer order sizes and order-to-delivery cycles (with the help of sales) to increase shipment sizes and better fill out trailers.

Execution changes, as the name suggests, can be implemented in as short as a few months, or even weeks, with little-to-no expenses. These are also changes to the existing supply chain that can have a meaningful impact on cost and/or service. Execution changes can include rebidding truckload or LTL transportation, putting in place processes to reign in “rogue” transportation spending, centralizing warehousing of low-turn SKUs, and outsourcing trailer/container unloading at warehouses.

Technology can be a part of the solution for a change at any level of complexity. Applications such as a warehouse management system, transportation management system, or inventory management system can take many months to more than a year to select and fully implement, while other systems, or functionality within an application, may be available now, but are not used by your company.

So what can be changed? Here is a starter set:

• The warehouse network

• The order or sales quantities

• The SKU portfolio

• The mode of transport

• Single mode vs. consolidation/deconsolidation and multi-mode movement

• The private fleet

• The order to deliver cycle

• Sourcing, vendor consolidation or adding vendors to create options and reduce risk

• E-commerce vs brick and mortar sales

• Locations for manufacturing

• Splitting packaging locations from manufacturing

While initiatives and opportunities do not always roll up perfectly, we also often categorize a change as being related to product or product vendors, warehousing, inventory, or transportation. Often these are separate groups within a company’s supply chain organization, so they require a different team to implement. Some changes will involve more than one group, such as a change to the warehouse network that will impact both inbound and outbound transportation. A change to the range of products carried or vendor locations would also impact warehousing and transportation.

Also, consider when you are designing the supply chain for – is it what is best for today? Or do you want it to be best for some point in the future? For many companies with high growth, the need to be flexible is paramount. For example, for low-volume e-commerce nationwide fulfillment, the best option is likely a single fulfilment center in the central Ohio area. However, when the volumes grow, it is likely that a two-point fulfilment structure will be best. But in most cases, when the move to two-point fulfillment is made the best option may not have either DC in central Ohio. Likely the best solution is one farther east and one on the west coast. Given the cost of change, the question is set up for now or for the future? And while assessing your business volumes, consider demographic shifts. People are moving out of the Northeast, Southern California, and Illinois, and into the Southeast and Southwest. While the net change per year is minor, over time it will likely be significant – so design for now, or for the future?

Even within a well-run supply chain/operations organization, there are always opportunities for improvement. Even well-planned supply chains can quickly become sub-optimal. Forecasts don’t always come true and there are unplanned events and trends. It’s the double-edged sword of the “perfect” supply chain. Distribution centers and transport vehicles are at their lowest cost when they are fully utilized but exceed that volume/capacity and costs explode. There is also only so much bandwidth to take on additional projects beyond executing on staff’s ongoing work and the cost of change can be significant. The question of how much change and how often is important. A structured approach to identifying potential opportunities and prioritizing them for analysis or implementation is a way to ensure the company achieves value from its efforts and has both a short-term and long-term roadmap to ongoing improvement.

About the authors:

Lee A. Clair is the managing partner of Transportation and Logistics Advisors. With more than two decades of consulting experience, Clair has significant experience assisting transportation service providers to grow and improve their financial performance, and in assisting shippers and 3PL’s to design and manage their supply chains. Most recently, he has been assisting both 3PLs and buyers of 3PL and transportation management services. His work has also included LTL and TL brokerage, transportation management systems, e-commerce and e-fulfillment, as well as intermodal, LTL, OEM auto parts, aftermarket auto parts, chemicals, fertilizers, steel and other metals, and agricultural products.

Steven Fox is a principal with Transportation and Logistics Advisors. He has experience managing client projects with companies in the transportation, logistics, and bulk products shippers and has over 20 years of consulting experience with an emphasis on market analysis and supply chain planning.

SC

MR

More Inventory Management

- When disaster strikes, the supply chain becomes the key to life

- Why we can’t ignore inventory rightsizing in industrial sectors

- Building resilience in manufacturing

- One door closes, a better one opens

- AI liftoff delayed?

- The key to good data management? Start with good data

- More Inventory Management

Latest Podcast

Explore

Explore

Topics

Procurement & Sourcing News

- AI-driven sourcing: Why the speed of change is going to only accelerate

- A Silk Road city

- U.S.-bound containerized import shipments are up in June and first half of 2024

- Boeing turned to Fairmarkit, AI to help land its tail spend

- When disaster strikes, the supply chain becomes the key to life

- A smarter approach to sustainability is vital for healthy, resilient supply chains

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks