Manufacturing output fell again in May, according to the new edition of the Manufacturing Report on Business, which was issued today by the Institute for Supply Management (ISM).

The report’s key metric, the PMI, registered a 46.9 reading (a reading of 50 or higher indicates growth), falling 0.2% off of April’s 47.1 reading.

The past seven months of contraction, through May, were preceded by a stretch of 29 consecutive months of growth. ISM also said that the overall economy contracted, at a faster rate, in May, for the seventh consecutive month, which was preceded by 30 consecutive months of growth.

The May PMI is 2.8% below the 12-month average of 49.4, with June 2022 marking the high, for that period, at 53.1, and March 2023, at 46.3, marking the lowest.

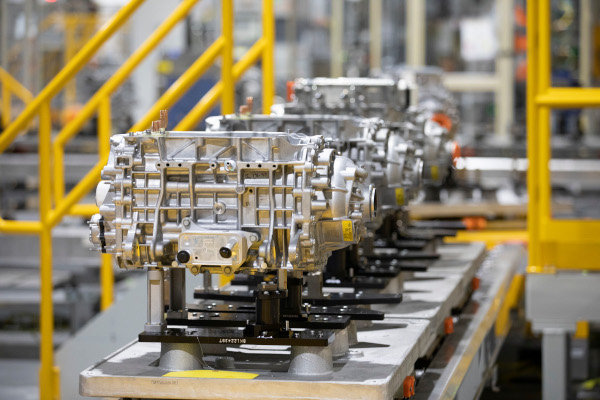

ISM reported that four manufacturing sectors— Nonmetallic Mineral Products; Furniture & Related Products; Transportation Equipment (the only one of the six biggest manufacturing sectors to grow in May); and Fabricated Metal Products—saw growth in May. And 14 sectors reported contraction, including: Wood Products; Primary Metals; Apparel, Leather & Allied Products; Textile Mills; Paper Products; Printing & Related Support Activities; Petroleum & Coal Products; Chemical Products; Food, Beverage & Tobacco Products; Computer & Electronic Products; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Miscellaneous Manufacturing; and Machinery.

The report’s key metrics were mixed in April, including:

-New Orders, which are commonly referred to as the engine that drives manufacturing, fell 3.1%, to 42.6, contracting, at a faster rate, for the ninth consecutive month, with three sectors reporting growth;

-Production increased 2.2%, to 51.1, growing after five months of contraction (which were preceded by 30 consecutive months of growth), for its highest reading since October 2022’s 51.9, with seven sectors reporting growth;

-Employment rose 1.2%, to 51.4, growing, at a faster rate, for the second consecutive month, with five sectors reporting growth;

-Supplier Deliveries, at 43.5 (a reading above 50 indicates contraction), moved faster, at a faster rate, for the eighth consecutive month, for its fastest supplier delivery performance since March 2009’s 43.2 reading, with two sectors reporting slower deliveries;

-Backlog of orders, at 37.5, fell 5.6%, contracting, at a faster rate, for the eighth consecutive month, following 27 months of expansion, with no industries reporting growth in order backlogs, down to its lowest level since February 2009’s 33.6;

-Inventories, at 45.8, were down 0.5%, contracting, at a faster rate, for the third consecutive month with two sectors reporting higher inventories, falling to its lowest level since August 2020’s 44.9, at the beginning of the pandemic recovery period;

-Customer Inventories, at 51.4, were up 0.1%, heading up too high, at a faster rate, for the second consecutive month, with eight sectors reporting customer inventories were too high; and

-Prices, at 44.2, fell 9.0%, following a 4.0% April gain, which followed contraction in March and growth in February, with five sectors reporting higher prices paid for raw materials

Comments submitted by the ISM member respondents again highlighted various themes related to the economy and market conditions.

A fabricated metals respondent said that there is less volatility in customer demand from one month to six months out, coupled with signs of slowing in the second half of 2023 and potentially into early 2024.

“Logistics, particularly from East Asia, continue to return to historical-level transit times; Europe and India remain elevated,” he said. “Supply shortages are limited to select items only. Suppliers are still seeking price increases but are too late to be asking now.”

And a transportation equipment respondent signaled that her company continues to have a strong backlog for customer orders while new orders are slowing.

“Our supplier on-time delivery continues to be a challenge for us, and we still face price increases on a weekly basis,” said the respondent. “Labor shortages are getting better within our organization and throughout our supply chain.”

Tim Fiore, Chair of the ISM’s Manufacturing Business Survey Committee, said in an interview that manufacturing is positioned for a recovery, with the direct caveat that it is not guaranteed.

“The first thing is [manufacturing] revenue is strong,” he said. “Production is at 51.1, with production really being a surrogate for revenue, so the sector is actually expanding its billings compared to April. You don’t see that in a recessionary environment. New orders is the future; it is not what is happening today. So, today we are getting the revenue that we need to make the P&L work pretty much, but we are still maintaining a high level of headcount, in anticipation of future growth in demand. That future growth in demand is extremely uncertain.”

As for the headcount, Fiore described the current situation as generally stable, with a near equal 1:1 positive to not so positive ratio, which he said is more aligned with the positive side and companies are holding on to their headcount, because they worked hard to get people in positions and do not want to let them go. And with strong revenues, he said, they can afford to hold on to them.

Addressing manufacturing inventories, Fiore said they are extremely low, which indicates that most manufacturers have managed their input flow very well, to the point that they are actually contracting inventory, in preparation for future lower demand.

“That means that nobody is really getting stuck with the hot potato,” he said, “and that is a benefit of the soft landing…we had more than a year to wean ourselves out of all this overordering and that [excess] inventory that would result in and is a real positive. New Export Orders, at 50.0, is really good in the markets we thought would be down, Europe and China. They are maintaining a decent level of pace and is a positive. If that was down in the low 40s, there would be New Orders in the low 40s, and it would be a lot bleaker, but we are not there and that is good.”

Looking at prices, he said that while prices declined quite a bit in May, they have gone through a stretch of fluctuations in recent months.

“There are indications that steel prices are coming down and could likely stay down this time,” he said. “Aluminum is coming down. Copper is coming down, because China’s so weak. That’s good, because that’s causing buyers to re-enter the market because prices are much more aligned with their expectations.”

For manufacturing lead times, Fiore observed that they are finally responding and down 8%-to-10%, from April to May, which is good for the sector. But conversely, manufacturing backlogs have been decreased so significantly and are down to 2009 recession levels.

“People are wondering what they are going to be working on next month, due to the softness in new order levels, which represented 22% of the report’s general comments,” he said. “The new order levels are still sluggish and that is really about the uncertainty in the future, due to interest rates.”

The percentage of manufacturing sectors with a PMI reading below 45 jumped to 31% in May, up from 12% in April, while having peaked at 35% in December, according to Fiore.

“The 31% by itself would not bother me, but there were two or three big industry sectors that were sitting at 45.4 and 45.8 and could have easily gotten to 49.5 and could have fallen into that big bucket. We could easily have been sitting here with 60% of manufacturing GDP in contraction under 45, and that is going to be a big warning going forward. The positive side is that we are positioned the best that we have been in since the pandemic to respond to an improvement in demand. The question is: where is that and is it going to show up? Or is it not going to show up and is that a function of consumer confidence and the Fed’s interest rate actions?”

When he was asked about the Fed holding interest rates constant in its June meeting appropriate, he said it depends on if a soft landing is good or if a hard landing is better.

“If we had a hard landing, we would probably already be recovering, but we have not even started the recession yet,” he said. “It is having an impact on confidence, because we went from a capex of 6% to zero in six months. That is because people are not confident about the future, because we don’t know what the trough looks like.”

SC

MR

Latest Supply Chain News

- Few executives believe their supply chains can respond quickly to disruptions

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- More News

Latest Podcast

Explore

Explore

Latest Supply Chain News

- Few executives believe their supply chains can respond quickly to disruptions

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks