We are now 15 or so months into a trucking freight recession that began in the third quarter of 2022. Prices for dry van truckload (hereafter DVTL) services have been hit particularly hard. Data from the Bureau of Labor Statistics for the Producer Price Index (PPI) for the primary services supplied by general freight trucking, long-distance, truckload firms (the government’s nomenclature for the DVTL industry) show that, including fuel, prices as of November 2023 have fallen 22.7% from their peak in May 2022. While there have been some predictions that DVTL pricing will recover in 2024, my analysis of existing data suggests this is unlikely to occur in the first half of the year for three reasons. After I summarize these reasons, I’ll provide guidance as to where carriers can expect DVTL rates to move as we enter the Q1 bid season.

Reason 1: Spot Market Pricing Dynamics Show No Signs of Turning

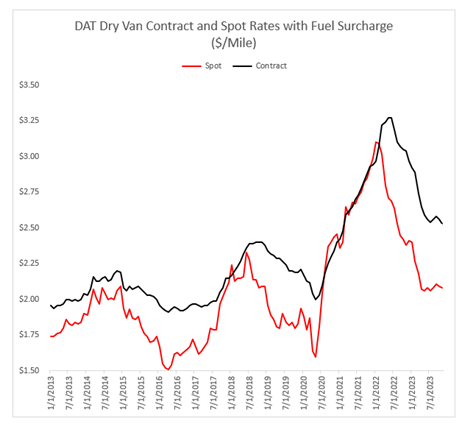

It is widely acknowledged that dry van spot market prices serve as the “canary in the coal mine” for reading the current balance of supply and demand; academic research further documents how changes in dry van spot prices predict changes in the PPI for general freight trucking, long-distance, truckload firms (which primarily capture contract prices). Critically, data from DAT Freight & Analytics shows no sign that broker buy contract prices or dry van spot prices (both including fuel) are set to increase in the coming months.

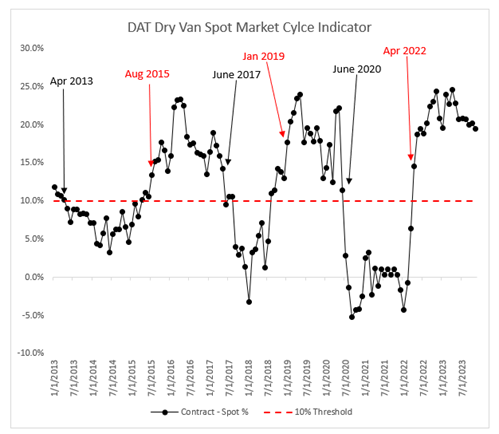

For those worried about the effect of fuel surcharges, my favorite way to read the current pricing cycle is to calculate the difference between DAT’s broker buy contract prices and dry van spot prices (including fuel for both) and then divide this difference by the average of the two series. I term this ratio the dry van spot market cycle indicator (DVSMCI). As shown below, past freight market cycles from a pricing standpoint seem to occur when the DVSMCI reaches ~10%. When the index is near or below 10%, we tend to see a bull market pricing cycle. In contrast, when it is at 15% or more, we tend to see prices decline or stay stagnant. The chart highlights changes in market cycles based on these rules, which correspond well to commonly recognized periods where carriers saw bull or bear market conditions. As of November, DVSMCI remains near 20%, suggesting spot prices are unlikely to turn in the near future.

Reason 2: Freight Demand Remains Weak

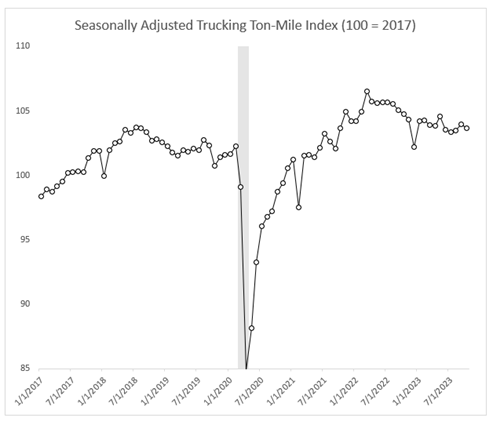

My preferred approach for measuring demand for truck transportation is the for-hire trucking ton-mile index (TTMI), produced by Yem Bolumole (University of Tennessee Knoxville) and I. This index captures implied ton-miles of trucking demand based on output from the 41 most important freight generating industries (mining/quarrying, manufacturing, wholesaling, retailing, and warehousing) as captured by the Census Bureau and Bureau of Transportation Statistics. The seasonally adjusted version of that index shows a drop-off in trucking demand that began in earnest in September 2022 that, while appearing to find a floor, remains unlikely to rebound over the coming months. For example, several key freight generating sectors like paper manufacturing, plastic & rubber product manufacturing, and machinery manufacturing have output today that is 5% or more below peak levels observed in 2022. As it is difficult to foresee a scenario where manufacturing output—which accounts for ~60% of for-hire trucking firms’ ton-miles per the Commodity Flow Survey—rebounds strongly in early 2024, it is difficult to envision a scenario where there is a robust increase in freight demand over the next six months.

Reason 3: Capacity Isn’t Exiting the Market as Quickly as Many Believe

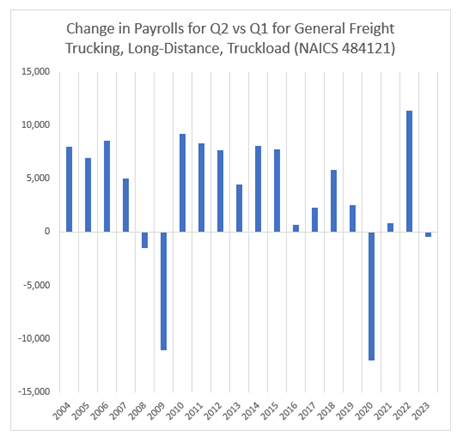

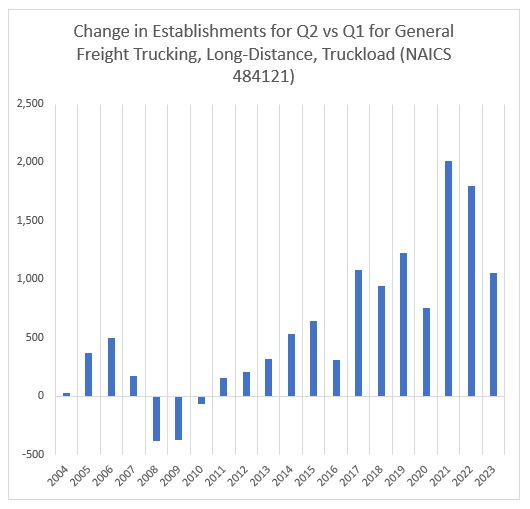

Following statements about weak spot market conditions as well as less demand, this reason may seem surprising. However, there are several reasons as to why we shouldn’t expect capacity to quickly exit the market. One reason is carriers made record profits in 2021 due to the record increases we observed in both contract and spot market prices. Second, despite spot prices falling as steeply as they have, the prices for other services that DVTL carriers offer (e.g., specialized freight hauling) haven’t fallen nearly as much as dry van services have, which manifests in the PPI for all services remaining over 30% above pre-COVID levels. Consistent with this, administrative record data from the Quarterly Census of Employment and Wages showed that payrolls at these carriers declined only 437 in Q2 2023 from Q1 2023. In comparison, we observed a decline of more than 10,000 payrolls over the same period in 2009 during the Global Financial Crisis. Moreover, while payrolls decline, the number of distinct establishments—physical locations where employees are domiciled (e.g., the headquarters of a single-establishment trucking firm)—in DVTL increased by over 1,000 in Q2 2023 from Q1 2023. In contrast, during the same period in 2008 and 2009, we saw sharp declines in the number of establishments. This suggests we aren’t seeing widespread closing of establishments with employees (and hence capacity exit).

Where Does This Leave Us for 2024?

As we look ahead to 2024, the primary services PPI for the general freight trucking, long-distance, truckload sector has been flat since May 2023. Assuming this pattern continues, this would mean that prices for Q1 2024 would be down ~8% from where they were in Q1 2023 (including fuel), with the caveat that they were rapidly falling as we entered 2023. Given where spot market prices are at and demand for services holding steady, slow attrition of capacity should help stave off further downward pressure on rates. As such, I would enter 2024 assuming “more of the same” as we have seen in the past few months of 2023: plentiful capacity will keep tender rejection rates low and, consequently, put limited upward pressure on DVTL spot prices. My sense is that the next bull market pricing cycle—which will happen sometime—will be much more gradual than the prior two cycles that started in Q3 2017 and June/July 2020. As such, don’t expect the market to change overnight and, instead, plan for market dynamics to evolve more slowly as we head further into 2024. The greatest wildcard I see is when the Federal Reserve begins interest rate cuts. Once those commence, I could see demand returning rather quickly, which may ultimately tip us back into a bull market.

About the author:

Jason Miller is the interim chairperson and Eli Broad Professor of Supply Chain Management in the Department of Supply Chain Management of the Eli Broad College of Business at Michigan State University.

SC

MR

More 3PL

- Orchestration: The Future of Supply Chain

- February and year-to-date U.S. import volume is solid, reports S&P Global Market Intelligence

- 2024 retail sales forecast calls for growth, says National Retail Federation

- ISM reports another month of services sector growth in February

- February manufacturing output declines, notes ISM

- How to Create Real Retailer-Brand Loyalty

- More 3PL

Latest Podcast

Explore

Explore

Business Management News

- Few executives believe their supply chains can respond quickly to disruptions

- Technology’s role in mending supply chain fragility after recent disruptions

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks