Volatility is costly and disruptive to operations. CPG (consumer packaged goods) supply chains face volatile transportation flows due mostly to variations in consumer behavior. This article explains the causes and effects of this volatility and highlights the rewards for reducing it.

Consumer behavior and volatile operations

Consumers shop heavily on weekends, which leads to grocers and other volume retailers ordering from suppliers early in the week. As a result, shipments from suppliers’ customer-facing distribution centers (DCs) surge. The fluctuation in orders, including variation around holidays and random consumer behavior, triggers very lumpy replenishment of these DCs, the bullwhip effect.

There are also self-imposed sources of volatility:

• Month- and quarter-end sales “pushes”

• Manufacturer promotions

• Seasonal inventory builds and draw-downs

• Adjustments to safety stock inventories, both automatic and planned.

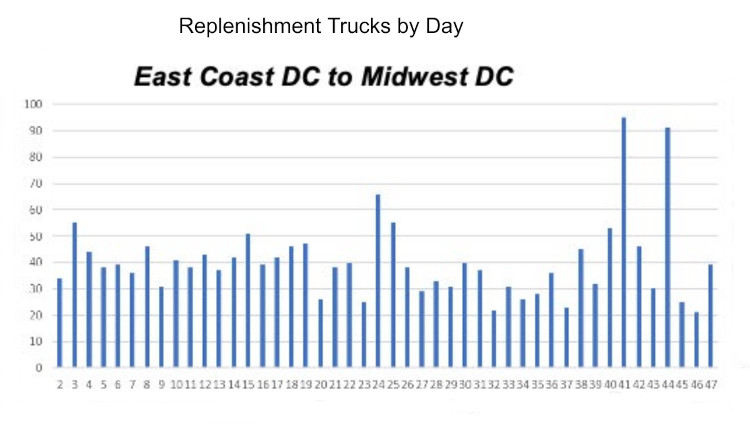

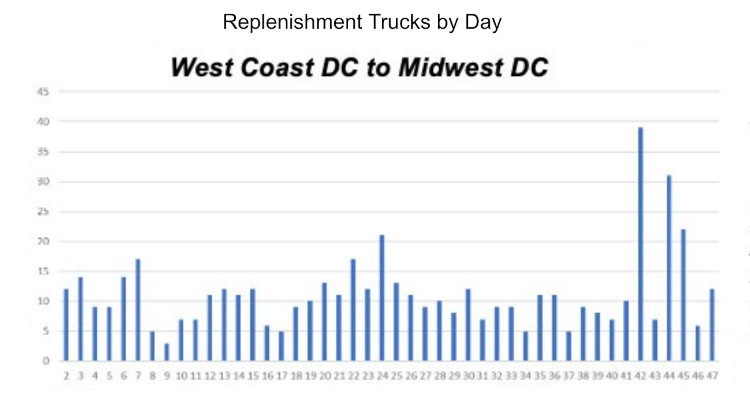

The diagrams below highlights the large variability of some typical replenishment lanes for a large CPG company.

Volatility impact and costs in supply chains

Volatility in supply chains leads to several challenges. It causes labor stress and increases overtime in both shipping and receiving. Often DCs experience a coincidence of replenishment receipts at the same time that customer shipments spike, overloading their capabilities and forcing inbound trailers to join a queue waiting for people or space to unload. The result is:

• Detention charges, as trailers wait well beyond their contracted free time

• Customer service cuts, as the product needed for shipment may still be in a van that has not been received.

Freight costs are the biggest and most easily measured cost of volatility. Preferred carriers may not be able to handle peak volumes. Transportation managers are forced to hire less-desirable truckers that cost more or provide worse service.

Another cost, less easily quantified but very real, is the portion of contract price that carriers include to cover the impact of volatility. Freight carriers experience frequent “boom-bust cycles,” and incur additional deadhead miles as well as other incremental costs. Shippers provide no data on what volatility is likely to be: is the 250 contractual annual loads 1 load per business day or 25 loads on 10 days of the year? Carriers know that there are real operating costs caused by volatility, and that cost gets built into bid prices.

Volatility mitigation requires a network perspective

The reality for the consumer products supply chain is that the customer must be served at almost any price. Maintaining service, or even improving it, is always the highest priority. There is little that shipper operations can do to affect consumer and retailer behavior. But there is a lot they can do to smooth the flows that replenish DCs, the “inventory deployment” step of the supply chain. They can even deploy so that they work around known peaks in shipments to customers.

Looking forward one day at a time is not going to be effective. Volatility must be viewed over a horizon that stretches out multiple weeks. In this way it is possible to mitigate the peaks and valleys of replenishment while considering the capability of each node in the supplier’s network to support shipping, receiving, storage space and carrier capacity to reverse the bullwhip effect and deliberately smooth their own operations.

In practice, it is hard. Software is needed

Current supply planning systems are not equipped to look at all the constraints, costs, and daily variability across the network. It’s hard. For large suppliers, multiple supply points are typically shipping to each DC. Managing inbound flow at each DC should be based on a systematic way of coordinating and ensuring that the highest priority items are always moved promptly or early, while lower priority items are delayed.

Adding to complexity is that in most large CPG distribution networks the standard increment for deployment is a full over-the-road truckload or “Intermodal” truckload, whereas the demand is in cases or pallets. So if a DC has only the capacity for, say, five trucks on a given day, it is important to determine which five trucks are most accretive of service.

In the same vein, managing a network cannot be done on a lane-by-lane or location-by-location incremental basis. Adjusting one place impacts other places. Thus, there needs to be a holistic look at the entire network that finds the most cost-effective way to maintain service while respecting the capacity of:

• Carriers vs. their cost

• DC’s throughput

• DC space

• Shipping points.

This is a job for optimization software – not the Excel solutions we see in some companies.

The reward for reducing volatility Is high

Level loading deployment operations has been fully implemented by one large shipper. Using technology to reduce volatility and bridge the gap between supply planning and operations has saved “many millions” of dollars annually while improving customer service.

The need for CPG shippers to level transportation flows and distribution center operations is clear. By smoothing volatility, shippers can enhance their supply chain efficiency, reduce cost and support customer service.

About the author:

Jeffrey H. Schutt, PhD, is director of ProvisionAI. His supply chain experience spans CSC Global, Chainalytics, Menlo Worldwide, and teaching at the University of Texas. Specializing in production planning, inventory management, and logistics optimization, Dr. Schutt has received multiple national and international awards for his work including Computer Sciences Corporation’s Award for Technical Excellence.

SC

MR

More Inventory Management

- When disaster strikes, the supply chain becomes the key to life

- Why we can’t ignore inventory rightsizing in industrial sectors

- Building resilience in manufacturing

- One door closes, a better one opens

- AI liftoff delayed?

- The key to good data management? Start with good data

- More Inventory Management

Latest Podcast

Explore

Explore

Topics

Procurement & Sourcing News

- AI-driven sourcing: Why the speed of change is going to only accelerate

- A Silk Road city

- U.S.-bound containerized import shipments are up in June and first half of 2024

- Boeing turned to Fairmarkit, AI to help land its tail spend

- When disaster strikes, the supply chain becomes the key to life

- A smarter approach to sustainability is vital for healthy, resilient supply chains

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks