A leading supply chain management company has launched a Cloud platform for trading, treasury and risk mitigation. According to spokesmen for OpenLink, energy, commodities, corporate and financial services industries will be among those to first use OpenLink Cloud.

OpenLink Cloud is designed to transform trading, treasury and risk departments, combining the best of OpenLink's flagship products with an extensible and transparent platform.

OpenLink Cloud is designed to transform trading, treasury and risk departments, combining the best of OpenLink's flagship products with an extensible and transparent platform.

Scott Rompala, Head of the Cloud Solutions Group at OpenLink, told SCMR in an interview that supply chain managers be able to purchase part of this solution at lower price point initially, and then be able to “scale up.”

“It's the client's choice as to whether to start with just procurement and commodity price risk management and scale up in terms of integrating with treasury, hedging, operations planning and sales,” he says. “The beauty being that it is one single integrated system with full transparency to break down silos as demanded.”

Rompala adds that OpenLink has many corporates with significant commodities exposure and OpenLink Cloud includes a “fit-for-purpose enterprise CPRM (Commodity Procurement Risk Management) technology.”

“This includes core functionality around complex instruments, and advanced capabilities over the full lifecycle of a trade or purchase from basic pricing, risk analysis and position management, all the way through to settlements and hedge accounting,” he says.

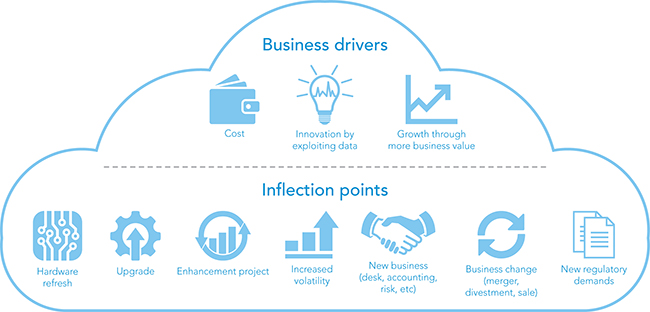

Rompala emphasized that it's important for supply chain managers to understand why “integrated risk management” is crucial.

“For instance, at times of crisis, volatile input commodity prices can be accompanied by elevation in other types of risk,” he says. “Collateral calls on hedges may become more onerous in periods of market stress, restricting corporate cash flows.”

Furthermore, says Rompala, hedges may need to be re-balanced in a stressed market when trading liquidity is diminished:

“Supplier disruption may also be more likely due to credit crunches that accompany market turbulence.”

SC

MR

More Cloud

- AI Simulation Takes Its Place Among Supply Chain Forecasting Tools

- 52% of Enterprises Have Moved to the Cloud

- Cloud computing needs installed based planning

- The cloud hovers over fast software supply chains

- Cloud gains favor for supply chain labeling

- 7 business-boosting benefits of cloud labeling solutions

- More Cloud

Latest Podcast

Explore

Explore

Topics

Procurement & Sourcing News

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- How one small part held up shipments of thousands of autos

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks