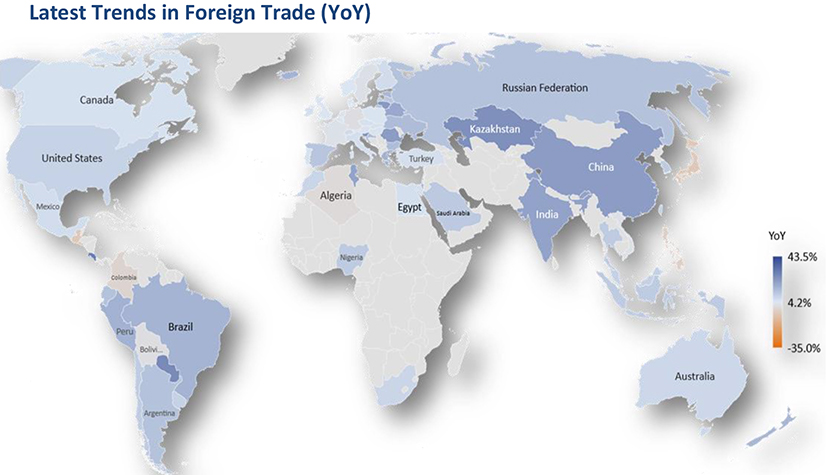

The economies in Asia and Latin America posted a relatively high growth rate in May, say analysts for Kuehne + Nagel Group.

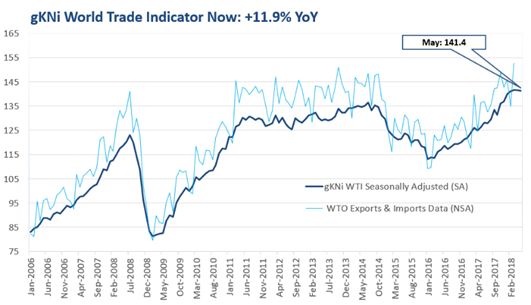

According to the “gKNi World Trade Indicator,” powered by LogIndex – the Group's data company – this trend is expected to continue in June.

The highest rate of increase is predicted for China. As for Japan, the data company of Kuehne + Nagel Group forecasts a negative foreign trade trend in June.

The two largest economies in the world are experiencing a “diametral” development of their trade balances: China is showing a strengthening of the trade balance in May and June. By contrast, the U.S. trade deficit is likely to widen further, after a surprising countertrend in March.

“Cross-border trade seems to be returned to normal year-on-year growth after 12-months of robust growth,” João Monteiro, Managing Director LogIndex, and Global Head of New Business Kuehne + Nagel Management. “However momentum has been decreasing and the second quarter could be heading towards the negative territory.”

World Trade Indicator at the end of May 2018, seasonally and working-day adjusted (SA), in USD: 141.4 points, Jan 2010 = 100 points. Export and import data from World Trade Organization (WTO) at the end of March 2018 (NSA), in USD: 152.7 (+9.2% YoY); Jan 2010 = 100 points.

In terms of regional developments, China dominates the view on Emerging Markets with good import and exports, he told SCMR in an interview.

“By contrast, Europe is digesting the high euro in the first quarter. The recent pressure on the EUR should lead to some relief,” added Monteiro.

The gKNi World Trade Indicator summarizes LogIndex's seasonally adjusted export and import estimates of the most relevant trade partners, which account for over 75% of global GDP.

The differences between countries and regions are “remarkable,” analysts contend.

The report notes that Emerging markets accelerated the speed in May to 16.7% YoY from 10.8% in April, driven by Asian countries. Trade growth in advanced economies slowed to 5.4% from a year earlier, compared with 7.2% in April.

Six economies signal a positive momentum (direction of YoY-change in May compared to the previous month), while eleven countries in the sample are trending downward. China, India, South Korea and Brazil expanded their foreign trade activities by 13.6 to 22.8 percent.

SC

MR

Latest Supply Chain News

- Few executives believe their supply chains can respond quickly to disruptions

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- More News

Latest Podcast

Explore

Explore

Business Management News

- Few executives believe their supply chains can respond quickly to disruptions

- Technology’s role in mending supply chain fragility after recent disruptions

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks