Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

November 2020

Supply chains have been in the spotlight like never before over the last eight months. That hasn’t always been a good thing. The perception, reinforced by shortages of products essential to our daily lives, is that supply chains were not up to the task and failed. The reality, as argued by MIT’s Yossi Sheffi in his new book, “The New (Ab)Normal: Reshaping Business and Supply Chain Strategy Beyond COVID-19,” is that supply chains performed as designed—they did what we expected them to do. Browse this issue archive.Need Help? Contact customer service 847-559-7581 More options

As in any field, supply chain professionals are susceptible to prioritizing and focusing on their own tasks to the extent that they unfortunately can create silos. Within these organizational silos, work may be optimized, but at the level of the entire enterprise, the result may be sub-optimized processes that are not as productive as possible. Although many organizations recognize the impact that supply chain can have on the bottom line, it is easy for supply chain staff to lose sight of how their functions interact with others and affect processes across the organization.

This is especially true with end-to-end order-to-cash processes, or the interconnected chain of activities that spans from the time a customer places an order, through the fulfillment of that order, to payment receipt and collections. Although supply chain is only a part of this process, by working closely with other relevant departments it can have a significant impact on an organization’s revenue stream.

APQC recently conducted research on how organizations optimize their end-to-end order-to-cash processes. The research looked at how organizations are increasing collaboration within and across supply chain and other relevant departments to standardize processes. It also examined how leading organizations are transforming their order-to-cash processes to be more

efficient and high performing.

Driving process efficiency

Optimizing order-to-cash is a critical area for process efficiency efforts. In fact, 65% of organizations surveyed by APQC are in the process of an optimization effort for this area. However, this is a recent development. In the same survey, only 16% of organizations indicated that they have completed a transformation of order-to-cash within the last five years.

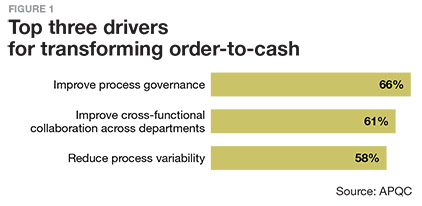

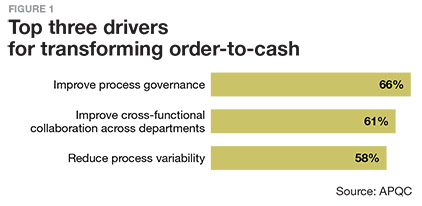

As shown in Figure 1, process drivers are the key reasons organizations seek to transform order-to-cash. The top driver is improving process governance, closely followed by improving collaboration among departments and reducing process variability.

As shown in Figure 1, process drivers are the key reasons organizations seek to transform order-to-cash. The top driver is improving process governance, closely followed by improving collaboration among departments and reducing process variability.

Organizations desire to standardize order-to-cash processes to benefit the business overall. They also recognize the need for departments to tear down silos to improve performance as well as the overall customer experience. To a lesser extent, organizations are interested in performance improvement in the form of shorter cycle times and decreased errors. Although this also benefits the business, it misses the strategic goals of process standardization and increased collaboration.

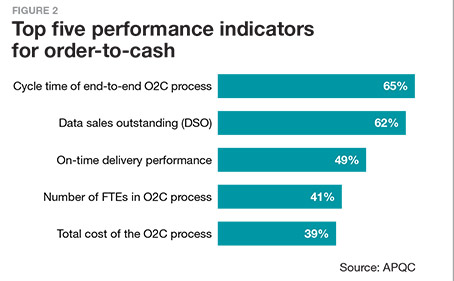

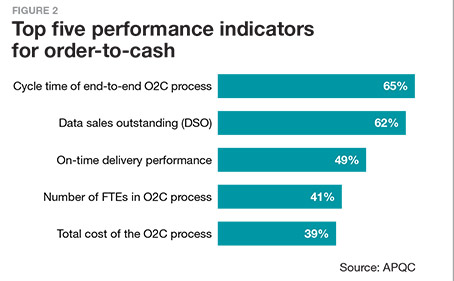

When it comes to setting key performance indicators for order-to-cash, organizations are focusing on the time needed to complete activities. As shown in Figure 2, a majority of organizations look at the cycle time needed for the entire end-to-end process. Behind that are measures related to specific activities, such as days sales outstanding, focused on the accounts receivable portion of the process, and on-time delivery performance, related to the order processing and supply chain portions of the process.

When it comes to setting key performance indicators for order-to-cash, organizations are focusing on the time needed to complete activities. As shown in Figure 2, a majority of organizations look at the cycle time needed for the entire end-to-end process. Behind that are measures related to specific activities, such as days sales outstanding, focused on the accounts receivable portion of the process, and on-time delivery performance, related to the order processing and supply chain portions of the process.

With their emphasis on process standardization and collaboration, organizations are paying less attention to measures of efficiency (such as the number of FTEs in the process), cost or quality. APQC recommends that organizations not lose sight of quality measures. Focusing exclusively on shorter cycle times and faster delivery may mean that an organization is sacrificing the quality of its customer orders.

The importance of order management

As part of a broader focus on the end-to-end order-to-cash process, supply chain professionals should recognize the importance of order management on the overall business as well as their own activities. Order management is often the initial touch point in a customer transaction. Without accurate information from the start, valuable time can be spent correcting order errors. Further, errors can affect an organization’s inventory management, which can then affect additional customer orders and quickly lead to customer dissatisfaction.

Order accuracy also affects the accounting activities at the end of the order-to-cash process. When information is incorrect at the front end, it is harder for accounting to reconcile invoices with the actual orders placed by customers. APQC has found that successful organizations increase collaboration between the order and cash sides of the process to reduce errors that can affect an organization’s bottom line.

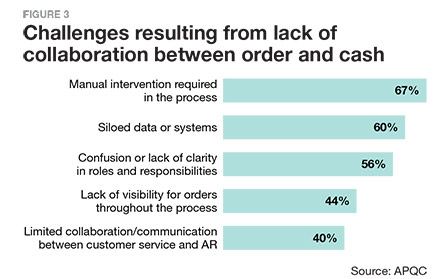

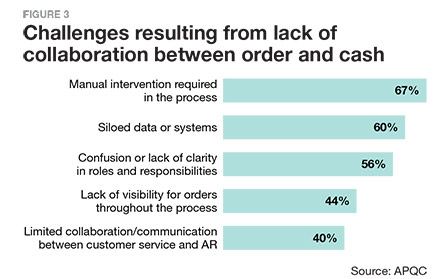

A lack of collaboration creates challenges for organizations looking to achieve greater efficiency. As shown in Figure 3, a lack of collaboration creates the need for manual intervention during order-to-cash processes—which greatly increases the likelihood of errors—and the challenge of siloed data or systems.

A lack of collaboration creates challenges for organizations looking to achieve greater efficiency. As shown in Figure 3, a lack of collaboration creates the need for manual intervention during order-to-cash processes—which greatly increases the likelihood of errors—and the challenge of siloed data or systems.

As part of its research, APQC interviewed a global manufacturing organization that improved its order-to-cash process by improving the

collaboration between its accounts receivable staff and other functions, such as warehousing and supply chain. Through the increased collaboration, the organization was able to improve its ability to apply customer payments to invoices and reduce the number of past due accounts.

Effective order-to-cash

APQC has found that successful organizations adopt three practices for effective end-to-end order-to-cash processes: global management of the order-to-cash process, the use of mobile and cloud technology and identification of the right system for the process.

Process ownership. Only about one-quarter of organizations manage order-to-cash as an end-to-end process. About half have made some effort to manage it as an end-to-end process in some departments or regions. This leaves nearly one-third of organizations still managing their order-to-cash activities in silos.

Many best-practice organizations have a global-level process owner responsible for standardizing systems and processes across the many departments involved in order-to-cash. These owners standardize the systems used in the process and the metrics assigned to determine success. As one might guess, these individuals must have a broad knowledge of the different activities that go into order-to-cash, from order

management to supply chain to AR. However, organizations that have implemented such a role have a much higher percentage of customer invoices paid on time than those with process ownership at the business level.

Use of mobile and Cloud technology

Some organizations are adopting the use of mobile and cloud technology to increase access to information and provide additional opportunities for collaboration. Mobile technology can be quickly adopted, as employees already understand its use from other aspects of their lives. In fact, over 70% of order-to-cash professionals participating in APQC’s research have access to their finance function’s technology through mobile devices.

Cloud technology offers additional benefits for the order-to-cash process. Potential benefits include increased data security, lower costs, greater access to data, and shorter cycle times. However, organizations have adopted this technology to a lesser extent. APQC’s research indicates that only 31% of organizations use it, but an additional 56% plan to increase its use soon.

Both mobile and cloud technology provide organizations with the opportunity to increase efficiency and reduce costs. Those that have adopted mobile access to data need fewer

full-time equivalent employees (FTEs) for order-to-cash. Both organizations that have adopted mobile technology and organizations that use cloud technology report a lower cost to perform order-to-cash processes.

Determining the right system fit. With the standardization of processes and the potential for technology to provide greater access to data across departments, organizations need to consider which systems best support order-to-cash. The systems traditionally used by different departments are often unable to connect with each other, furthering the historically siloed nature of activities within order-to-cash.

Organizations must consider their circumstances (such as unique organizational goals and the types of orders for their particular industry/business model) and determine whether they can adopt a commercial system for use across the order-to-cash process, or whether it makes more sense to create a system in-house. There are both pros and cons to each option, and which to select will depend on the organization’s needs, budget and willingness to invest time in the project and ongoing maintenance and management of systems.

Moving toward automation

The taking and processing of customer orders, as well as invoicing and collection based on those orders, are central to an organization’s business. The order-to-cash process both establishes a customer’s perception of an organization and directly affects the organization’s bottom line. Although supply chain is only part of the process, supply chain professionals must recognize that their collaboration efforts are integral to the success of order-to-cash as an end-to-end process.

Creating an efficient and effective order-to-cash process also means standardizing processes and adopting systems that enable increased data access and visibility. A natural next step in this is automation, and best-practice organizations recognize that they benefit from automating as much of the order-to-cash processes as possible. For the global manufacturing organization interviewed by APQC, automating its accounts receivable activities was another element to the improvement of its order-to-cash process.

Automation overall reduces the cost and time needed for order-to-cash and also lowers the cost of managing sales orders. It lowers operational costs and increases working capital. It also frees up employees so that they can engage in more value-added activities.

Optimizing the end-to-end order-to-cash process gives organizations a more strategic approach to their activities. By viewing the process as a valuable chain of interconnected activities, an organization can improve coordination among departments, improve performance, better communicate with customers and increase customer satisfaction.

About APQC

APQC helps organizations work smarter, faster, and with greater confidence. It is the world’s foremost authority in benchmarking, best practices, process and performance improvement, and knowledge management. APQC’s unique structure as a member-based nonprofit makes it a differentiator in the marketplace. APQC partners with more than 500 member organizations worldwide in all industries. With more than 40 years of experience, APQC remains the world’s leader in transforming organizations. Visit us at apqc.org and learn how you can make best practices your practices.

SC

MR

Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

November 2020

Supply chains have been in the spotlight like never before over the last eight months. That hasn’t always been a good thing. The perception, reinforced by shortages of products essential to our daily lives, is that… Browse this issue archive. Access your online digital edition. Download a PDF file of the November 2020 issue.As in any field, supply chain professionals are susceptible to prioritizing and focusing on their own tasks to the extent that they unfortunately can create silos. Within these organizational silos, work may be optimized, but at the level of the entire enterprise, the result may be sub-optimized processes that are not as productive as possible. Although many organizations recognize the impact that supply chain can have on the bottom line, it is easy for supply chain staff to lose sight of how their functions interact with others and affect processes across the organization.

This is especially true with end-to-end order-to-cash processes, or the interconnected chain of activities that spans from the time a customer places an order, through the fulfillment of that order, to payment receipt and collections. Although supply chain is only a part of this process, by working closely with other relevant departments it can have a significant impact on an organization’s revenue stream.

APQC recently conducted research on how organizations optimize their end-to-end order-to-cash processes. The research looked at how organizations are increasing collaboration within and across supply chain and other relevant departments to standardize processes. It also examined how leading organizations are transforming their order-to-cash processes to be more

efficient and high performing.

Driving process efficiency

Optimizing order-to-cash is a critical area for process efficiency efforts. In fact, 65% of organizations surveyed by APQC are in the process of an optimization effort for this area. However, this is a recent development. In the same survey, only 16% of organizations indicated that they have completed a transformation of order-to-cash within the last five years.

As shown in Figure 1, process drivers are the key reasons organizations seek to transform order-to-cash. The top driver is improving process governance, closely followed by improving collaboration among departments and reducing process variability.

As shown in Figure 1, process drivers are the key reasons organizations seek to transform order-to-cash. The top driver is improving process governance, closely followed by improving collaboration among departments and reducing process variability.

Organizations desire to standardize order-to-cash processes to benefit the business overall. They also recognize the need for departments to tear down silos to improve performance as well as the overall customer experience. To a lesser extent, organizations are interested in performance improvement in the form of shorter cycle times and decreased errors. Although this also benefits the business, it misses the strategic goals of process standardization and increased collaboration.

When it comes to setting key performance indicators for order-to-cash, organizations are focusing on the time needed to complete activities. As shown in Figure 2, a majority of organizations look at the cycle time needed for the entire end-to-end process. Behind that are measures related to specific activities, such as days sales outstanding, focused on the accounts receivable portion of the process, and on-time delivery performance, related to the order processing and supply chain portions of the process.

When it comes to setting key performance indicators for order-to-cash, organizations are focusing on the time needed to complete activities. As shown in Figure 2, a majority of organizations look at the cycle time needed for the entire end-to-end process. Behind that are measures related to specific activities, such as days sales outstanding, focused on the accounts receivable portion of the process, and on-time delivery performance, related to the order processing and supply chain portions of the process.

With their emphasis on process standardization and collaboration, organizations are paying less attention to measures of efficiency (such as the number of FTEs in the process), cost or quality. APQC recommends that organizations not lose sight of quality measures. Focusing exclusively on shorter cycle times and faster delivery may mean that an organization is sacrificing the quality of its customer orders.

The importance of order management

As part of a broader focus on the end-to-end order-to-cash process, supply chain professionals should recognize the importance of order management on the overall business as well as their own activities. Order management is often the initial touch point in a customer transaction. Without accurate information from the start, valuable time can be spent correcting order errors. Further, errors can affect an organization’s inventory management, which can then affect additional customer orders and quickly lead to customer dissatisfaction.

Order accuracy also affects the accounting activities at the end of the order-to-cash process. When information is incorrect at the front end, it is harder for accounting to reconcile invoices with the actual orders placed by customers. APQC has found that successful organizations increase collaboration between the order and cash sides of the process to reduce errors that can affect an organization’s bottom line.

A lack of collaboration creates challenges for organizations looking to achieve greater efficiency. As shown in Figure 3, a lack of collaboration creates the need for manual intervention during order-to-cash processes—which greatly increases the likelihood of errors—and the challenge of siloed data or systems.

A lack of collaboration creates challenges for organizations looking to achieve greater efficiency. As shown in Figure 3, a lack of collaboration creates the need for manual intervention during order-to-cash processes—which greatly increases the likelihood of errors—and the challenge of siloed data or systems.

As part of its research, APQC interviewed a global manufacturing organization that improved its order-to-cash process by improving the

collaboration between its accounts receivable staff and other functions, such as warehousing and supply chain. Through the increased collaboration, the organization was able to improve its ability to apply customer payments to invoices and reduce the number of past due accounts.

Effective order-to-cash

APQC has found that successful organizations adopt three practices for effective end-to-end order-to-cash processes: global management of the order-to-cash process, the use of mobile and cloud technology and identification of the right system for the process.

Process ownership. Only about one-quarter of organizations manage order-to-cash as an end-to-end process. About half have made some effort to manage it as an end-to-end process in some departments or regions. This leaves nearly one-third of organizations still managing their order-to-cash activities in silos.

Many best-practice organizations have a global-level process owner responsible for standardizing systems and processes across the many departments involved in order-to-cash. These owners standardize the systems used in the process and the metrics assigned to determine success. As one might guess, these individuals must have a broad knowledge of the different activities that go into order-to-cash, from order

management to supply chain to AR. However, organizations that have implemented such a role have a much higher percentage of customer invoices paid on time than those with process ownership at the business level.

Use of mobile and Cloud technology

Some organizations are adopting the use of mobile and cloud technology to increase access to information and provide additional opportunities for collaboration. Mobile technology can be quickly adopted, as employees already understand its use from other aspects of their lives. In fact, over 70% of order-to-cash professionals participating in APQC’s research have access to their finance function’s technology through mobile devices.

Cloud technology offers additional benefits for the order-to-cash process. Potential benefits include increased data security, lower costs, greater access to data, and shorter cycle times. However, organizations have adopted this technology to a lesser extent. APQC’s research indicates that only 31% of organizations use it, but an additional 56% plan to increase its use soon.

Both mobile and cloud technology provide organizations with the opportunity to increase efficiency and reduce costs. Those that have adopted mobile access to data need fewer

full-time equivalent employees (FTEs) for order-to-cash. Both organizations that have adopted mobile technology and organizations that use cloud technology report a lower cost to perform order-to-cash processes.

Determining the right system fit. With the standardization of processes and the potential for technology to provide greater access to data across departments, organizations need to consider which systems best support order-to-cash. The systems traditionally used by different departments are often unable to connect with each other, furthering the historically siloed nature of activities within order-to-cash.

Organizations must consider their circumstances (such as unique organizational goals and the types of orders for their particular industry/business model) and determine whether they can adopt a commercial system for use across the order-to-cash process, or whether it makes more sense to create a system in-house. There are both pros and cons to each option, and which to select will depend on the organization’s needs, budget and willingness to invest time in the project and ongoing maintenance and management of systems.

Moving toward automation

The taking and processing of customer orders, as well as invoicing and collection based on those orders, are central to an organization’s business. The order-to-cash process both establishes a customer’s perception of an organization and directly affects the organization’s bottom line. Although supply chain is only part of the process, supply chain professionals must recognize that their collaboration efforts are integral to the success of order-to-cash as an end-to-end process.

Creating an efficient and effective order-to-cash process also means standardizing processes and adopting systems that enable increased data access and visibility. A natural next step in this is automation, and best-practice organizations recognize that they benefit from automating as much of the order-to-cash processes as possible. For the global manufacturing organization interviewed by APQC, automating its accounts receivable activities was another element to the improvement of its order-to-cash process.

Automation overall reduces the cost and time needed for order-to-cash and also lowers the cost of managing sales orders. It lowers operational costs and increases working capital. It also frees up employees so that they can engage in more value-added activities.

Optimizing the end-to-end order-to-cash process gives organizations a more strategic approach to their activities. By viewing the process as a valuable chain of interconnected activities, an organization can improve coordination among departments, improve performance, better communicate with customers and increase customer satisfaction.

About APQC

APQC helps organizations work smarter, faster, and with greater confidence. It is the world’s foremost authority in benchmarking, best practices, process and performance improvement, and knowledge management. APQC’s unique structure as a member-based nonprofit makes it a differentiator in the marketplace. APQC partners with more than 500 member organizations worldwide in all industries. With more than 40 years of experience, APQC remains the world’s leader in transforming organizations. Visit us at apqc.org and learn how you can make best practices your practices.

SC

MR

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More News

Latest Podcast

Explore

Explore

Procurement & Sourcing News

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- How one small part held up shipments of thousands of autos

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks