Descartes Datamyne – a leading global trade database of up-to-date import-export information - unveiled its annual 2020 U.S. Ports Report. Ranking the Top 20 U.S. maritime ports by import volumes (in TEUs), the report offers a closer look at 2019 data and overall trends in U.S. imports, the impact of trade policy and tariff changes, supply chain and sourcing shifts, and early indications of the trade impact of COVID-19.

As reported in Supply Chain Management Review, Fitch Ratings reported last spring that North American ports generally have numerous safeguards and strong financial cushion on their side in being able to weather the sizable ripple effect of the coronavirus pandemic.

Descartes Datamyne gets a bit more granular.

Among top-line findings:

- The trade policy shifts and expanded tariffs between the U.S. & China pushed the import shipping volume trend line for 2019 to an early peak in July, before driving TEUs on a downward path through most of the rest of the year

- The volume of maritime imports fell 8.1% in Oct. ‘19 vs. Oct. ‘18.

- Vietnam saw a surge of 30.8% in total volume compared to ‘18, extending its position as the US as 2nd place maritime trade partner

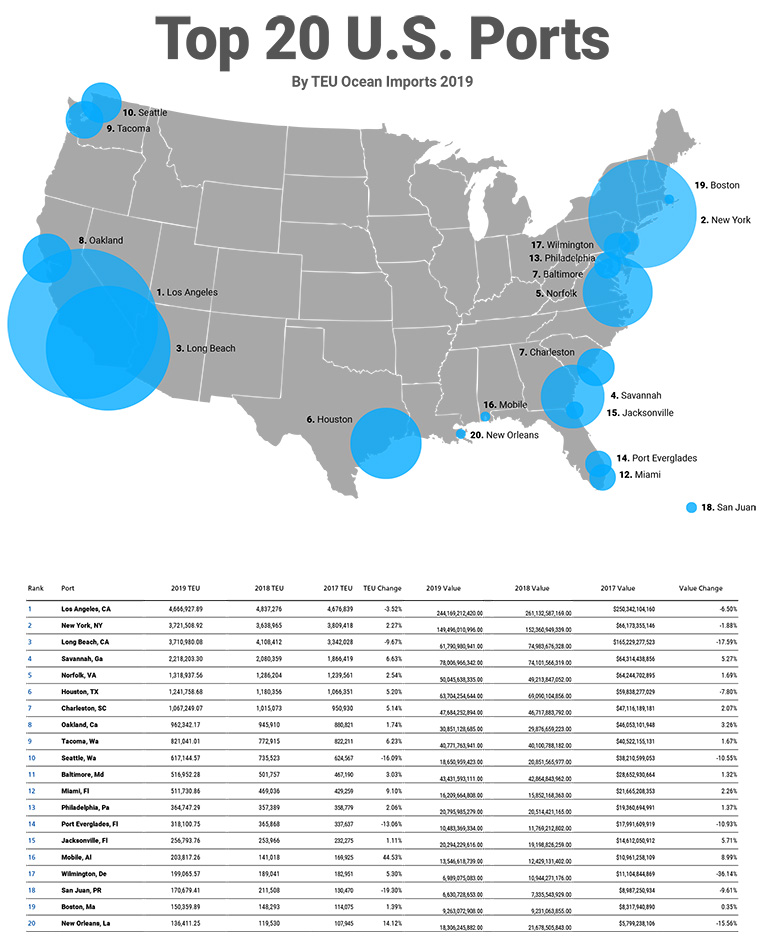

- The Port of L.A. ranked #1 on the list at 4.7M TEUs, NY/Newark ranked #2 at 3.72M TEUs (a record year for its import cargo), and closely behind at #3 was Long Beach, CA at 3.71M TEUs.

Mark Segner, Vice President of Descartes Datamyne, provides SCMR readers with more insight in this exclusive interview.

SCMR: Were researchers surprised by any of the port rankings in your latest report?

Mark Segner: Not really, as there was an anticipated fall-off of total cargo resulting from the pandemic, but there was a sort of even distribution of the impact. While there may be some ‘ups and downs’ if we drilled into the data by port on a week-by-week basis, that would be accounted for with the service strings readjusting/reallocating tonnage. When the first half of the year data is available, that will deserve a bit more scrutiny as we may then see some restocking of inventory after the immediate Q1 impact of the pandemic—the new inventory to replace seasonal items where retailers lost opportunity, some impact due to bankruptcy filing of large retailers, as well as some possible shifts to address states that appeared to be fully reopening.

SCMR: Some analysts are saying that U.S. West Coast ports may lose market share soon. Do your analysts agree?

Segner: Frankly, driven by what? The shift of cargo as a result of the third set of locks in Panama is really behind us, the service schedules for all strings have been adjusted, and the west coast (both PNW and PSW) do not absorb the majority of cargo for local consumption, but rather have the gateway infrastructure to deliver to the DCs established around the nation, linked by the rail network. Sure, there could be some uptick on the east coast, as some of the Asia/ECNA strings call at Med ports in their itinerary, therefore bringing some Med-based cargo on these longer strings as substitutes for dedicated strings, but the Transpacific trade calling the west coast will still be important to global trade. Some individual port commentary:

- The shortfall in Seattle may be a moot point, in a certain way. SEA and TAC are merged into the PNW Port Alliance, and so you see that TAC has increased, not as much as SEA has fallen, but the shortfall may be pandemic-related for sure.

- Puerto Rico is likely a couple of things: the earthquake that really wiped out the southern area where Ponce is a key port, as well the pandemic in Spain, from whom they receive a lot of goods.

- The LA/Long Beach downturn is minimal when you consider the impact on trade of the pandemic.

SCMR: What impact will the new North American trade agreement with Mexico and Canada have on ports next year?

Segner: Pretty hard to handicap this yet. Regarding maritime ports, it is likely to have very little effect since only about 1% of all waterborne imports into the U.S. are from Mexico, and less than 1% of waterborne imports are from Canada. Will we see more cargo go, say, from China to Mexico as components and then be assembled in Mexico as finished product to enter the U.S. under free trade? Maybe, but then the percentage of components and their true origin will need to stay below an agreed threshold. Can we see some impact with agricultural products or wood products that Canada may elect to export to China and bypass the U.S. market? It is possible, but most of the trade patterns for the USMCA were pretty well set under NAFTA, and aside from key labor/wage concessions forced on Mexico, is the new deal that radically changed from the original one?

SC

MR

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More News

Latest Podcast

Explore

Explore

Business Management News

- Technology’s role in mending supply chain fragility after recent disruptions

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks