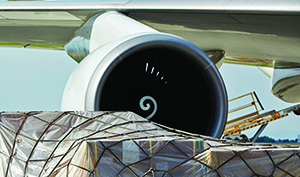

One of the most positive developments so far this year in the global supply chain sector has been the rebound in the fortunes of air cargo.

According to The International Air Transport Association (IATA) air freight markets worldwide showed that demand rose 8.5% in April 2017 compared to the year-earlier period. While this was down from the 13.4% year-on-year growth recorded in March 2017, it is well above the average annual growth rate of 3.5% over the past five years.

“Demand eased in April,” observes Alexandre de Juniac, IATA's Director General and CEO. “Growth rates, however, are still much more robust than anything we have seen in the last six years.”

That's good news, he adds, but it should not be taken as a message that all is well in air cargo.

“The industry's antiquated processes need modernization,” says de Juniac. “With e-air waybill utilization topping 50% in April, progress is being made. And we must harness the momentum to drive transformational change across the way the industry operates,” said

Meanwhile, IATA says business confidence indicators remain consistently upbeat, suggesting year-on-year cargo growth will remain strong for through the summer. However, there are signs that the cyclical growth peak for air cargo has passed, particularly given that the inventory-to-sales ratio stopped falling at the end of last year.

IATA analysts note that air cargo often sees a boost in demand at the beginning of an economic upturn as companies look to restock inventories quickly. This tapers as inventories are adjusted to new demand levels. Over the whole year, air freight is headed for a healthy growth rate of 7.5%, supported by strong pharmaceuticals and e-commerce.

All regions, with the exception of Latin America, reported year-on-year increases in demand so far in 2017, but Asia-Pacific airlines' freight volumes were especially healthy, expanding by 8.4% in April 2017 compared to the same period a year earlier and capacity increased by 3.7%. The increase in volumes reflects the strength of the order books reported by exporters across the region.

Cargo volume figures released by the Association of Asia Pacific Airlines (AAPA) confirm these observations, suggesting that business conditions continued to improve across Asian economies, in turn lending support to international trade activity.

“The broad-based expansion in global economic activity, coupled with renewed demand on selected routes, particularly between Europe and Asia, has contributed to growth in long-haul travel markets in recent months, whilst regional travel markets remain strong supported by a combination of competitive air fares and expansion in the region's economies,” says Andrew Herdman, AAPA Director General.

Within the same period, Asian airlines recorded a solid 9.5% increase in air cargo demand, supported by a pick-up in export orders across the region's economies, says AAPA analysts.

Evan Armstrong president of the consultancy firm Armstrong & Associates, observes that there has been increased spot market buying of carrier capacity by air freight forwarders in Asia as well.

In his report from the recently-concluded 3PL Value Creation Asia Summit in Hong Kong, his forecast is positive:

“Air freight is expected to be slightly better than 2016 in Asia this year,” he says.

SC

MR

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More News

Latest Podcast

Explore

Explore

Business Management News

- Technology’s role in mending supply chain fragility after recent disruptions

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks