Editor’s Note: Brian Broadhurst is vice president transportation solutions, Spend Management Experts.

Traditionally, many of the efforts with initiating a shipment have been concentrated to a finite number of locations (i.e. shipments originated at the shippers' facilities). In the parcel industry, this often means a dense delivery location, as opposed to a dense pickup location for outbound shipments.

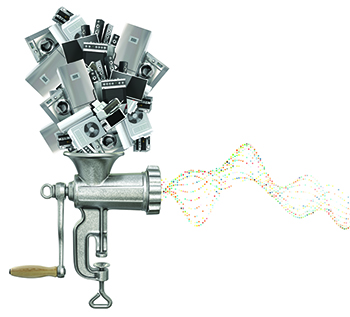

Reverse Logistics requires that shipment creation to be available at all potential customer locations

- This requires everything from technology enabled shipment label creation, to customer instructions for shipping a package

- In addition, shippers need to decide if they want to collect payment for the return shipment, and decide how to collect that payment if they elect to charge the customer for return shipping

As the e-commerce industry expands into more markets, returns are increasing at a rapid pace and therefore making reverse logistics a primary focus area for parcel shippers.

To expand on that, outbound shipments are typically tied to revenue and shipping is an acceptable cost of doing business. However return shipments are often less time sensitive and at most indirectly tied to revenue, thereby making them a very cost-sensitive part of the supply chain.

Done correctly, reverse logistics can enhance the customer experience and drive brand loyalty.

Additional Market Information

- When managing small parcel costs, you, as the retailer, need to not only worry about delivery to the end customer but also any potential returns. According to CBRE, returns of items bought online could be as much as $32 billion in 2017.

- UPS deemed January 3, as its National Returns Day, with expectations of 1.4 million packages returned, an 8% annual gain and a new record for the fifth straight year.

- Items returned in-store cost as little as $3 for a retailer to process and are often available for resale within a day, but items shipped back to a distribution center or to a 3PL can cost twice as much to process and take at least four days before they're available for resale, according to AlixPartners. That's if the returns aren't damaged or opened, in which case they might be written off as a loss.

- Data from U.S. Census Bureau and National Retail Federation show that the return rate is about 8% for the entire retail sector, although the percentage rises to between 13% and 30% for e-commerce sales. The difference: shoppers can inspect, sample or try an item at the store before buying it.

- To encourage in-store returns, FedEx teams with Walgreens to bring discarded items back to more than 7,500 convenience stores nationwide. This past September, Amazon Inc. joined with Kohl's to accept returns at 82 stores in Los Angeles and Chicago. In November, Wal-Mart Stores Inc. began “Mobile Express Returns” at about 4,700 stores nationwide. Shoppers initiate the return on the Wal-Mart app, then scan a QR code at a express station in the store and leave the item.

- “Speed and efficiency in processing e-commerce returns, with an eye toward preserving as much value of the merchandise as possible, often separates the top-performing retailers from the not-so-successful ones in the weeks after Christmas,” CBRE's Egan said.

- Returns cost retailers $260 billion in 2015, according to the NRF. Retailers can ease the expense if they can convince customers to return web-purchased items to stores in person. On average, returns to stores cost companies half as much as returns to distribution centers, and allow retailers to get the items back on shelves faster, according to research from AlixPartners, a consulting firm.

SC

MR

Latest Supply Chain News

Latest Resources

Explore

Explore

Business Management News

- Inflation continues to have a wide-ranging impact on supply chains

- Strategic cost savings differ from cutting costs

- Planning fatigue may be settling in

- Inflation, economic worries among top supply chain concerns for SMBs

- April Services PMI declines following 15 months of growth, reports ISM

- Attacking stubborn COGS inflation with Digital Design-and-Source-to-Value

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks