It seems clear that this summer is a time of economic transition around the world. We have been emerging from a long pandemic and business headlines have been mixed lately. Amazon.com plans to shed some warehouse space, and there is angst about a “Great Purge” in trucking. However, there is some good news: national representative employment data suggests that June saw robust job gains in the transportation and warehousing super-sector, which suggests that conditions may not be as dire as many fear.

One of the greatest transitions has been the movement of employees. People are rethinking their lives in the shadow of the pandemic, and they are refocusing and moving to new opportunities. And, there are plenty of new opportunities. In this column we take a look at movement within the logistics sector.

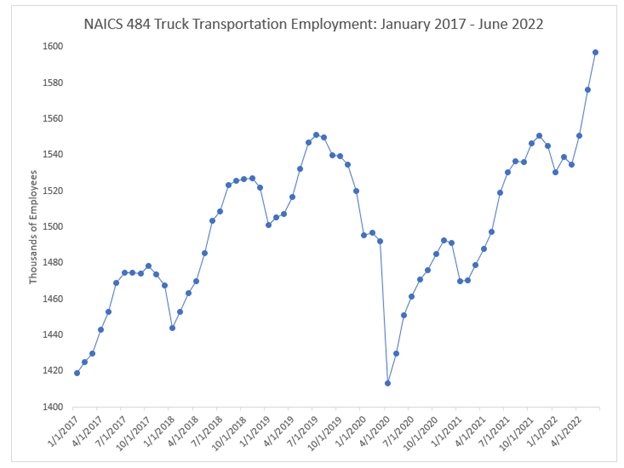

We begin by focusing on non-seasonally adjusted employment for truck transportation establishments (NAICS 484). June’s preliminary reading saw payrolls increase by 20,600 workers from May 2022. Payroll in June 2022 was 50,000 (3.2%) higher than in June 2019 representing a new record. Between January and June 2022, carriers added 66,300 workers to their payrolls, even with the dip we saw in March.

By comparison, between January and June 2018, which was the previous trucking boom, the corresponding truck transportation payroll increase was 59,400. That is a substantial difference. While the seasonally adjusted trucking employment statistics suggest June’s gain was less pronounced, the fact remains that payrolls at trucking companies continue to expand. It seems unlikely that carriers would increase payrolls more in 2022 than during the height of the previous boom if conditions were rapidly degrading. Thus, it appears that concerns of an “imminent” freight recession that were raised at the end of March have not come to pass.

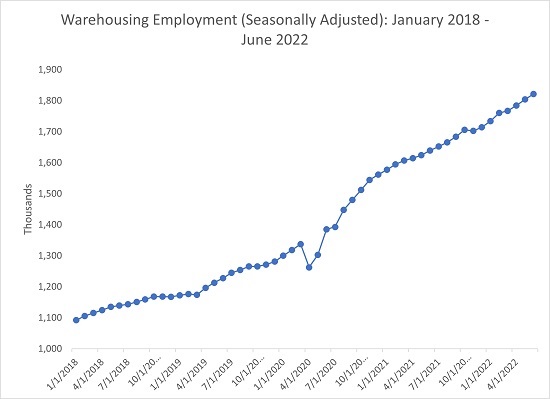

Turning to warehousing, seasonally adjusted payrolls continue to increase steadily, albeit at a slower rate than the very rapid gains we saw in 2020 with the surge of demand for e-commerce. The non-seasonally adjusted warehousing employment statistics suggest actual payroll levels are moving sideways, which is consistent with e-commerce sales remaining at elevated levels.

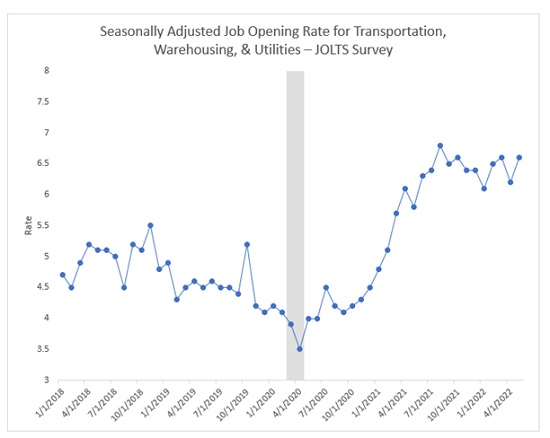

The natural question someone may ask is whether these recent increases in payroll represent a last gasp of employment gains before a downturn. To try and get a better sense of this, we turn to a separate survey—the Job Openings and Labor Turnover Survey (JOLTS)—also conducted by the Bureau of Labor Statistics. This statistic has shown a tremendous amount of employment churn over the last four years. While the most granular level of data we can obtain in this survey is for transportation, warehousing, and utilities, utilities openings are generally static and the majority of up or downward shifts can be attributed to transportation and warehousing. The data suggest a labor market showing few signs of weakening. The job opening rate for 2018 averaged 5.0%. Through the first five months of 2022, the job opening rate averaged 6.4%, a 28 percent increase.

Beyond higher rates of job openings, the rate of job quits also remains elevated. The job quit rate for 2018 averaged 2.1%. Through the first five months of 2022, the job opening rate has averaged 2.6%, a 24 percent increase.

As the quit rate is considered one of the strongest indicators of labor market strength, these data suggest that workers at transportation, warehousing and utilities firms have confidence they can find employment elsewhere. This is consistent with what is observed in the broader nonfarm sector, where the quit rate averaged 2.3% in 2018 and has averaged 2.9% through the first five months of 2022, a 26 percent increase.

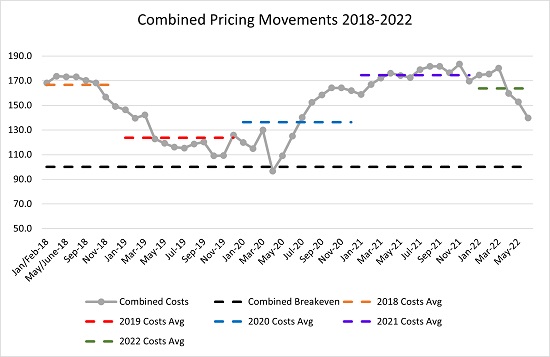

A potential explanation for the employment expansion can be found in the Transportation and Warehouse Prices metrics from the Logistics Managers’ Index (LMI). Price is helpful in this context as it can act as a barometer for demand.

The figure below charts the aggregate movements in the two price metrics from January 2018 through June 2022. Any reading above 100 (the dashed black line) indicates price expansion. We also show yearly averages. While there has been a downward trend in the rate of price growth in 2022, the aggregate metrics is still clearly well into expansion territory. The average rate of expansion through the first six months of 2022 is well above averages from 2019 and 2020, and quite comparable (2.8 points lower) than 2018’s reading.

Warehouses are still full of goods and firms are still shipping inventory all over the world at a heightened rate. There have been slowdowns and even contraction in some sectors of the economy, the spread between retail and wholesale diesel prices has certainly been difficult for smaller carriers. Most of what prognosticators have been reading as the signs of a coming freight recession is simply a decrease in the rate of growth. But growth is still growth, and the way to facilitate that growth is through continued expansion of the logistics labor pool.

The difference between the growth now and the growth in 2021 is that it may appear to be slowing to a more sustainable rate. There is of course a possibility that the continued pace of job expansion will lead the Fed to further increase interest rates, which could slow the growth even further or potentially push the warehousing and transportation markets into a state of contraction. Hopefully the Fed will be somewhat judicious in the use of its tools, and the market will drift to a soft landing after the runaway growth of late 2020 and 2021.

There are many confusing signals that managers and policymakers are receiving. The summer 2022 economic data is confusing. But there are several encouraging signs that even as the economy cools a bit this summer, there are reasons to be optimistic.

As supply chains adapt to the new realities and employees continue to jump around to new opportunities, the job of a supply chain manager will continue to be more difficult as the already rapid pace of change accelerates. Filling open positions is not easy, but firms will be able to refresh their employment rolls and think through exactly where they need, or maybe do not need people. While it can be difficult to lose employees, it can also be an opportunity to restructure the jobs a firm has. It is unfortunate, but it is also a great opportunity.

Jason Miller is an associate professor of supply chain management at Michigan State University. He can be reached at [email protected].

Zac Rogers is an assistant professor of supply chain management at Colorado State University. He can be reached at [email protected].

Dale Rogers is the ON Semiconductor Professor of Supply Chain Management at Arizona State University. He can be reached at [email protected].

SC

MR

Latest Supply Chain News

Latest Podcast

Explore

Explore

Latest Supply Chain News

- AI-driven sourcing: Why the speed of change is going to only accelerate

- A Silk Road city

- U.S.-bound containerized import shipments are up in June and first half of 2024

- Do net-zero goals matter?

- Boeing turned to Fairmarkit, AI to help land its tail spend

- Expand supply chain metrics to cover the complete customer experience

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks