About the authors: Seokjin Kim, Ph.D., is an associate professor and Yurong Yao, Ph.D., is a professor in the Department of Information Systems and Operations Management at Suffolk University. They can be reached at [email protected] and [email protected].

Editor’s note: Despite the hype around blockchain, the technology has yet to find a killer app in supply chain management. That could change. For their research, Seokjin Kim and Yurong Yao undertook a comprehensive review of the progress of blockchain in supply chain management. The following article is the unedited version of Blockchain’s Second Act: While initial success of blockchain in the supply chain has been minimal, the technology may be ready for a resurgence, which appears in the March 2023 print edition of Supply Chain Management Review. You can read the print edition by clicking here.

Abstract

Numerous ambitious blockchain developments in recent years, extending to new domains other than cryptocurrencies, unfold a whole new technological landscape of supply chain management. Many blockchains in supply chains promise significant benefits, but it is still vague to evaluate them against potential challenges. We provide an evolutionary comparison of current applications in the two broad categories, enterprise-centered and customer-centered blockchains, to characterize them in key dimensions including purpose and scope, participants and data contents, data management, data security, governance, and costs.

Our critical evaluation of current applications in the two blockchains provides notable observations and insights such as partial decentralization in data management and governance, security risks in pre- and post-entry data, and higher trust at higher costs in customer-centered blockchains. We recommend that potential developments balance a tradeoff between efficiency and trust and take an incremental approach with modular designs. As a fresh new lens to view blockchains in supply chains, our framework illuminates the strategic fit of both categories with their supply chains to reveal the emergence of a customer-centric approach as a looming trend.

Keywords: supply chain management; blockchain; enterprise-centered blockchain; customer-centered blockchain

1: Blockchains in supply chains

In the near decade, blockchain technology has increasingly drawn attention from both academia and practitioners (Rossi et al. 2019) and is the upcoming frontier in information technology. Blockchain originally refers to a distributed infrastructure for data recording, storage, and sharing across a large peer-to-peer network and was first coined by Nakamoto (2008) in developing a new electronic cash system: Bitcoin. The concept of blockchain has also brought dramatic changes to supply chain management (Gurtu and Johny, 2019), beyond financial sectors.

While cryptocurrency blockchains (or cryptocurrencies, for short) are public and permissionless, blockchains in supply chains (BSCs) are mostly private and permissioned, which only allow permitted parties to read, edit, and validate data in the chain (Beck, Müller-Bloch, and King 2018). Thus, only enterprises that are invited to participate are authorized. We focus on permissioned blockchains and a flow unit in our framework is a tangible item, not an intangible activity or a digital item.

Features of BSCs are summarized below.

- Information sharing: Inter-firm data and business documents are communicated in a standardized manner on an infrastructure shared among participants.

- Tracking: Tracking a flow unit in real time using IoT (Internet of Things) technology through an entire supply chain keeps its provenance from the origin.

- Smart contract: Once a set of conditions in a code pre-specified by relevant parties are met, some inter- and intra-firm processes can be automatically triggered.

- Distributed ledger: Blocks are append-only. Data are replicated over distributed databases.

- Validation: Once entered into a protocol, data are validated by relevant parties before they are recorded in a distributed ledger.

These features of BSC bring unique benefits to a supply chain. Information sharing increases its visibility and efficiency by reducing paper-based administrative work among participating parties. Tracking increases its traceability. Blockchains coupled with smart IoT sensors embedded in flow units to enable secure records on databases and real-time communications. This feature also helps keep a flow unit in its authentic conditions and minimize quality issues or losses.

A smart contract could do better than other technologies in many practical scenarios where the contract execution process takes a significant amount of time and where a lot of paperwork and coordination are required. This feature can add significant value to a supply chain with many parties and their activities involved by automating repetitive processes (such as shipping orders and payments) to improve its efficiency and mitigate risks.

A distributed ledger frames the blockchain network with decentralized management, which, compared with centralized enterprise systems, is more risk-resistant, for example, against potential vulnerabilities and failures on some nodes (Wang, Han, and Beynon-Davies 2019). However, this feature may have more limited appeal in BSCs compared to the other properties such as smart contract and validation (Halaburda 2018).

Validations have all data entries authenticated by relevant parties. Validated data stored on a distributed ledger are difficult to tamper with and this immutability achieves the key objective of a blockchain, “trust by design,” a digital concept as proposed by Gartner (Gaehtgens and Allan 2017), which facilitates disintermediation of some trusted third parties. These two features are the bottom line of digital trust which will be a new normal in this COVID-19 era and beyond.

The integrity and quality of a flow unit are customers’ utmost concern in pharmaceutical and food supply chains, e.g., cold chains for vaccines or produce. A U.K. hospital network has become one of the first worldwide to use digital ledger technology to track COVID-19 vaccines (Kahn 2021).

From the perspective of supply chain management, BSC can be viewed as an inter-organizational system (IOS) (Kumar, Liu, and Shan 2020). While early forms of IOS primarily supported the automation of manual processes such as ordering and settling accounts, a range of new features for information sharing, communication, and collaboration has subsequently enhanced these systems (Subramani 2004).

Supply chain management systems (SCMS) are a particular example of IOS which supports transactions among supply chain parties, typically a dominant leader and many suppliers. Multiple IOS have existed to facilitate the digitalization of inter-company communications. Electronic data interchange (EDI), a predecessor among earlier IOS developments, refers to “the electronic exchange of standardized business documents which improve inter-organizational coordination” (Hart and Saunders 1997, p. 24).

Information sharing is the main feature of EDI which could lack the other features.

Tracking is the unique feature of BSC which is not present in cryptocurrencies.

Distributed ledger and validation are the building blocks of Bitcoin, and Ethereum adds smart contract.

While these three features are not novel, their combined application to cryptocurrencies was successful with properties such as shared governance and operation, verifiable state, and resilience to data loss (Ruoti 2020). Analogous to cryptocurrencies, algorithmic validations in BSCs include cryptographic verifications on relevant parties’ digital signatures. However, off-chain verifications, while not present in cryptocurrencies, are common in BSCs. For example, a flow unit, upon receipt, can be manually verified according to a pre-agreed endorsement policy.

Many large and small enterprises have started to develop and adopt blockchains in their supply chains, but they are still in infancy in many applications and the current understanding of their potential remains limited (Wang, Han, and Beynon-Davies 2019). Hence, we propose an evolutionary framework that compares current BSC applications into the two broad categories, enterprise-centered blockchain (ECB) and customer-centered blockchain (CCB) to characterize them and clarify their strategic fit with products and supply chains.

Our critical evaluation of current applications in the two categories provides notable observations and insights. This study identifies the structural characteristics of the three IOS and their managerial implications for supply chain strategies and operations. We also bring forth key dimensions for evaluating blockchain adoptions and suggest constructive recommendations for potential developments. Our framework reveals the emergence of customer-centric approach, and amid this ongoing trend, we aim to offer guiding perspectives on blockchain-enabled supply chains.

2: Enterprise-centered and customer-centered blockchains

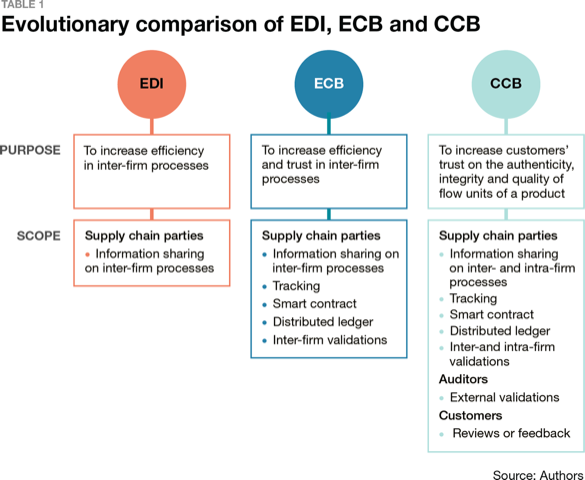

Since EDI has existed for a long time as an IOS, we consider it as a predecessor of BSC. From an evolutionary viewpoint in line with IOS developments, we include EDI in comparison with ECB and CCB. We characterize EDI, ECB, and CCB in key dimensions including purpose and scope, participants and data contents, data management, data security, governance, and costs. Each dimension is examined in the corresponding subsection. Table 1 compares the three IOSs in terms of purpose and scope.

2.1: Purpose and scope

EDI, though limited to the information sharing feature alone, shares some commonalities with ECB such as their focus on efficiency in inter-firm processes. ECB adds other features such as tracking, smart contract, distributed ledger, and inter-firm validations for higher efficiency and trust. CCB, however, is uncommon with its focus on customers’ trust. Extensive data and validations on the authenticity, integrity, and quality of a product span both inter- and intra-firm processes.

EDI directly links internal information systems of two companies to share data by following pre-specified formats and protocols. Commonly shared data regarding an inter-firm transaction include an order, acknowledgment, shipping notice, invoice, payment, and so on. EDIs are adopted to increase the efficiency of data sharing and coordinate activities of business partners (Banker et al. 2006).

ECB can increase the visibility and transparency of a supply chain even further than EDI. Communications in ECBs are more synchronous, and participants can share the same records in real time upon input. Validated data on a distributed ledger can help reduce conflicts and track responsibilities when any issues occur and thus increase trust among supply chain parties (Gurtu and Johny 2019). ECBs are widely used for repetitive inter-firm processes, such as shipping, payment, and distribution (Wang, Han, and Beynon-Davies 2019), which can be automated in a standardized manner.

By tracking flow units and enabling smart contracts based on pre-agreed conditions, a supply chain can automate transactions, improve efficiency and resolve disputes quickly (Beck, Müller-Bloch, and King 2018). For strategic decisions on a longer time horizon, smart contracts might become a “black box” which is not flexible in updating its terms according to changes in inter-firm relationships and market conditions (Babich and Hilary 2020).

An example of ECBs is Walmart Canada’s freight-and-payment blockchain which served over 70 trucking companies for smooth freight tracking and quick payment (Mearian 2019). An integrated container logistics provider, Maersk, used a blockchain to track its global shipping processes (Jensen, Hedman, and Henningsson 2019). ECBs are not limited to certain products but are typically found in supply chains with large-scale production and transportation.

Commodities such as oil and gas are also examples where enterprises process thousands of daily transactions vulnerable to discrepancies in freight rates, shipment routing, and invoice generation (WorldOil 2018).

CCB, though sharing similar technology infrastructures with ECB, stands out compared to the other two IOS by collecting extensive data on the authenticity, integrity, and quality of flow units throughout the supply chain to increase customers’ trust.

Customers are empowered to monitor their items and verify the provenance of audits and inspections collected through inter- and intra-firm processes in procurement, manufacturing, delivery, and stocking. Certificates from various internal and external auditors ensure that a flow unit and its materials are authentic and meet or exceed certain quality standards.

Fit with products whose customers demand high standards on authenticity, integrity, and quality, CCBs have been implemented to track fresh foods (e.g. egg, fish), drugs, and high-value products (e.g. diamond, airplane, car) (Wang, Han, and Beynon-Davies 2019; Bumblauskas et al. 2019; Gurtu and Johny, 2019). Everledger is a diamond blockchain on Hyperledger and Tracr is another platform to ensure that diamonds are non-conflict (O’Neal 2019). Provenance (2016) built a blockchain tracking tuna through supply chains of the southeast Asian fishing industry.

2.2: Participants and data contents

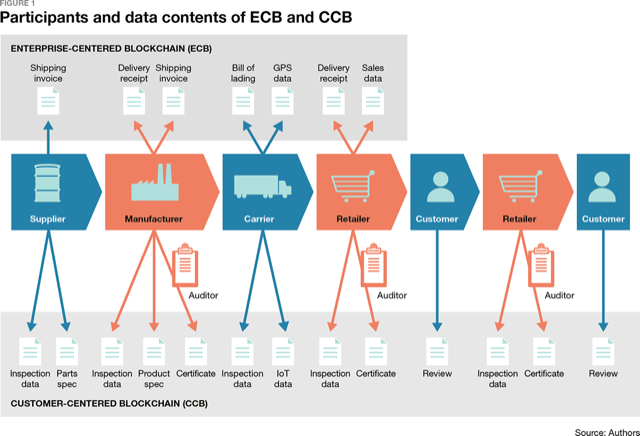

EDI, ECB, and CCB have different focuses on participants and data contents. Figure 1 illustrates potential participants and data contents of ECB and CCB. EDI is similar to ECB in terms of its participants such as suppliers, manufacturers, retailers, and carriers at various stages of a supply chain. In most cases, EDI and ECB do not include end-users.

EDI exchanges inter-firm documents associated with order, delivery, and payment. Thus, it is limited in data contents compared to ECB with tracking and validation data. We note that multiple participants at a stage are possible, e.g., a manufacturer can procure from many suppliers.

Adding participants such as auditors and customers, CCB amasses far richer data on the authenticity, integrity, and quality of a product. For example, Everledger includes miners, sorters, cutters, carriers, retailers, auditors (e.g., Gemological Institute of America (GIA)), and customers (O’Neal 2019) so that it provides a distributed ledger of diamond ownership and transaction history verification for owners, insurance companies, claimants, and law enforcement agencies.

Auditors perform external validations as needed by any supply chain party. Validations can also be internal, for example, a manufacturer can perform inspections before, during or after production. Customers also participate in a CCB to access information on the authenticity, integrity, and quality of an item purchased and share their reviews. The benefits of customers include greater transparency, self-service, automation, and disintermediation (Morkunas, Paschen, and Boon 2019). CCBs can include a “post supply chain”: multiple customers and retailers beyond the supply chain and the provenance of their ownerships (Toyoda et al. 2017).

2.3: Data management

EDI, ECB, and CCB vary significantly in data management. Data collection and entry are commonly manual in a conventional EDI but can be automatic in an advanced EDI with tracking sensors. EDI enables one-to-many and one-to-one data sharing, since it is usually designed to serve a leader’s needs for information sharing with its partners (Kumar, Liu, and Shan 2020). Data are stored in a centralized database on the leader’s premise and/or a third-party platform. The leader has full access to the data and controls other participants’ access.

Data in BSCs are collected either manually or automatically with tracking sensors. An ECB generates blocks on inter-firm processes along the supply chain. Walmart Canada uses IoT sensors and GPS (Global Positioning System) tracking in small trucks as well as a web portal and a mobile app where information can be input manually by operators and suppliers (Mearian, 2019). CCBs collect data more intensively on inter- and intra-firm processes.

In diamond blockchains, mine locations and 4Cs (color, clarity, cut, and carat weight) associated with each diamond are certified and recorded. In agri-food industries, IoT sensors collect data on soil moisture, fertilization, temperature, and so on. Each party in CCB can perform internal inspections or external audits to add new data to a CCB upon arrival or departure of a flow unit, or even during the production process.

Blockchain, by its design, supports many-to-many data sharing, but “some-to-many” modes are more common in BSCs (both ECBs and CCBs) since their data storage is partially decentralized (or largely centralized) on leaders’ premises and/or a third-party platform.

First, distributed nodes are limited, especially in BSCs with many participants. TradeLens (2020), launched by Maersk and IBM with more than 100 participants including 4 world’s largest ocean carriers, 3 inland carriers, and 61 ports around the globe, has only 14 distributed nodes. Cisco runs a track-and-trace system for hundreds of its suppliers worldwide, reportedly with 12 nodes and Walmart Canada’s freight-and-payment blockchain with hundreds of shipping companies has 27 distributed nodes (Mearian 2019). These nodes work as a distributed ledger and each of them maintains a replicated copy of complete blocks.

These limited nodes, in contrast with cryptocurrencies with thousands of nodes, render BSCs decentralized partially. A resulting blockchain is more efficient with fewer validations, but with less immutable data. Second, BSCs implement a “dual storage architecture” (Azzi, Chamoun, and Sokhn 2019) where metadata (e.g., hashes of blocks) are stored on chain, but the corresponding data contents (e.g. documents, contracts, personal information, pictures, videos, and links) are stored off chain for efficiency and confidentiality.

Such off-chain data can be stored on participants’ premises or in a cloud (IBM 2018), but modifications are not allowed for data integrity. Dual storages are more common in CCBs due to far more intensive data collection. Ambrosus, a blockchain vendor tracking food or pharmaceuticals, uses a dual architecture to develop a scalable solution where hashes and smart contracts are stored on its Ethereum-based blockchain but all sensor data are kept in separate storage (Ambrosus 2018).

Another vendor, Modum, also stores raw temperatures of drugs and user credentials in an off-chain database since such data are too large and sensitive to store on Ethereum (Azzi, Chamoun, and Sokhn 2019). Due to these dual structures, BSC participants’ data on their premises are limited to their own or even no off-chain contents, which indeed contrasts with cryptocurrency blockchains in which a complete set of data is replicated on participants’ nodes.

Leaders in BSCs access all data, but other participants are limited, e.g., carriers may access only the data associated with their shipping and transactions. The most salient feature of CCB, which is not present in ECB, is customers’ right to access data contributed by potentially many parties in the supply chain. Customers themselves are also a contributor by submitting their reviews or feedback.

2.4: Data security

Enterprises have three common security goals—integrity, availability, and confidentiality (Boyle and Panko 2015). We evaluate risks regarding these three goals across the three IOS. Our comparison does not assume particular security features which might be common in a type of IOS. But our framework focuses primarily on the nature of data and the intensity of validations.

EDIs tend to depend on a leader to protect data (Hart and Saunders 1997). EDI supports one-to-one or one-to-many transmission. Centralized data management increases risks in the integrity and availability of data. The single database on a central server is easy to be hacked and data could be manipulated during transmission (Kumar, Liu, and Shan 2020). Any downtime of the central server can result in denial of other participants’ access. Confidential data might be vulnerable (Subramanian 2018) and hacked in storage and transmission as well.

Blockchains are a good tool to improve security in data sharing (Wang, Han, and Beynon-Davies 2019). BSC is superior to EDI in terms of the integrity and availability of recorded data (“post-entry”). Once data are entered, BSCs invoke post-entry validations for multi-party consensus before they are recorded. After recorded, the immutable and decentralized data can mitigate potential risks due to cybercrimes and hacking and they are more likely to reduce potential local vulnerabilities or system failures (Min 2019). However, security should not be taken as a given for blockchain. Just because cryptographic hashes and proofs are being used does not mean the system itself is secure (Clint 2019).

None of the three IOSs, in fact, guarantee the integrity of collected data (“pre-entry”) since they might not correctly represent the corresponding real-world states due to flaws in input (“garbage in, garbage out”) (Babich and Hilary 2020). Conventional EDIs without IoT sensors must rely on manual checks, but BSC can automatically and frequently collect objective data via IoT sensors, which helps reduce such errors and generates convincible tracking records (Bumblauskas et al., 2019).

However, IoT devices, despite their wide applications, could easily breach the critical information of supply chains or the personal information of users (Pournader et al. 2020). Moreover, such IoT devices are maintained in a centralized system, which may raise more security concerns.

Furthermore, CCB achieves the highest integrity and availability since it is much more involved than ECB with more parties in pre-entry validations. When a manufacturer ships a diamond to the retailer, external or internal inspections can be performed by carriers, auditors, and retailers. Such repeated cross-validations mitigate potential pre-entry errors. Validation results stored in multiple parties’ premises also increase the availability.

In any IOS including BSCs, when off-chain data collection and entry are inevitably manual, installing error-proofing processes or smart contracts in a protocol, could be useful. For example, if a common range of fertilizer amounts is pre-set, a manual entrance out of the range can be identified and the protocol can call for further verifications. Also, errors in order fulfillment could be avoided once pre-agreed conditions are met.

The confidentiality of data generally depends on the design (e.g., access control) of an IOS, but a dilemma between visibility and confidentiality is unavoidable. Assuming the same confidentiality features in protocols, higher visibility in BSCs results in more confidentiality issues.

Among BSCs, CCBs are more vulnerable due to intra-firm data records and intense validations by more relevant parties, which poses potential intellectual property risks. Recent blockchain developments promise unparalleled visibility and traceability, possibly at the expense of confidentiality, but some protocols using a dual architecture are notable. Like Modum, UnicalCoin, a blockchain on Ethereum, stores sensitive data including customer reviews off chain and publishes on chain only the hash sums using smart contracts (Longo et al. 2019).

2.5: Governance

In contrast with EDI’s centralized governance, Blockchain 3.0, introducing the concept of decentralized applications and computing, typically requires governance modifications since the service provided and the underlying required support functions fall outside the focal organization’s direct control. Though blockchain governance is decentralized in nature, current BSCs are largely centralized.

EDIs are usually initiated by a single leader with higher power (Hart and Saunders 1997) and its business partners are often coerced to invest for enabling system-to-system data sharing. Most ECBs are also initiated by a single leader and add on its business partners. Walmart Canada’s freight-and-payment blockchain included 70 trucking companies and more than 400 retail stores (Mearian 2019). Maersk’s blockchain platform streamlines all its shipping transactions with numerous suppliers.

Most CCB was initiated by a group of leaders in the industry (Bocek et al. 2017; Kelley 2018). Leading diamond manufacturers, Diacore, Diarough, KGK Group, Rosy Blue NV, and Venus Jewel, worked together with IBM to adopt a new blockchain platform, Tracr (2019). Some automobile giants formed the Mobility Open Blockchain Initiative (MOBI) to track owners, control pollution, and provide maintenance (Castillo 2019).

Even though a blockchain leader might not hold a worldwide reputation, it exerts the dominant power in the local market. Chow Tai Fook, working with Everledger and GIA, used its blockchain to track diamonds from mines to stores, leaving stolen items and conflict-zone jewels outside the system (Vella 2018). Meeting customers’ requests for quality verification add value to the products. Aggregating many parties on the blockchain achieves economies of scale and allows to test the water in the market.

Decision rights determine the degree of centralization in governance; that is, whether decision-making power is concentrated in a single person, a small group (centralized governance), or dispersed (decentralized governance) (Sambamurthy and Zmud 1999). At the development stage of a blockchain, decision rights tend to be highly centralized, as a necessary “benevolent dictatorship” was recommended in Swarm City, an Ethereum-based infrastructure for ride sharing (Beck et al. 2018) and MediLedger, a blockchain project for preventing counterfeit drugs (Mattke et al. 2019).

We note that the governance of current BSCs is still far limited in decentralization compared to cryptocurrencies since their data management tends to be more centralized (e.g., with limited distributed nodes) for efficiency and scalability.

As BSCs get more mature over time, they could move towards decentralized governance which allows supply chain parties who are traditionally low in power to gain decision rights by contributing more data or validations. In a manufacturer-driven ECB, consensus mechanisms can empower suppliers. In a CCB that generates rich data and intense validations, central authority is less likely to be the case. A distinct feature of CCB is customers’ involvement which is not present in EDI and ECB, which allows customers to play a key role in governance decisions.

Incentives play a key in blockchain governance. As supply chain parties can benefit from participation in EDI, blockchain implementation eliminates the cost of intermediaries (Morkunas, Paschen, and Boon 2019). The strengths of BSC such as visibility, traceability, and automation lead into savings in potentially many parties’ administrative costs related to transactions, negotiation, and search. These foreseeable economic incentives motivate them to participate in an ECB.

However, benefits from customers’ higher trust achieved in CCB are somewhat indirect, leading to higher customer satisfaction which adds to the value of the product, resulting in higher demand and then a higher price. However, in a CCB where participants need to be more involved in data generations and validations, some parties’ belief that they are not rewarded fairly for their contributions is the biggest challenge to success.

Leaders in uneven inter-firm relationships need such incentives as a coordination mechanism to facilitate potentially self-interested parties in a supply chain to collaborate. For example, a manufacturer, as the leader, may ask suppliers to share parts’ quality information to provide customers with more details on a product. This additional information adds value to the product but can burden the suppliers. The manufacturer can offer incentives to motivate the suppliers.

2.6: Costs

Some features of the three IOS (EDI, ECB, and CCB) lower costs in a supply chain. Visibility due to information sharing in any IOS reduces administrative costs by streamlining inter-firm communications. ECBs might significantly reduce administrative costs to search for information on inter-firm transactions (Azzi, Chamoun, and Sokhn 2019).

Smart contracts automatically execute negotiations to reach an agreement. This facilitates “disintermediation” by which direct peer-to-peer transactions are allowed and saves significant administrative costs as a result. Immutable data on a distributed ledger reduce administrative costs incurred to validate such information, and help track the contract partner’s performance and thus reduce costs for post-contract control (Schmidt and Wagner 2019).

However, the high cost is the main hindrance to the adoption of blockchain technology. Therefore, trade-offs need to be examined by critically analyzing the benefits of implementation (Raut, Gotmare, Narkhede, Govindarajan, and Bokade 2020). We note that any of the three IOS would incur significant setup cost and overhead, and this is true even for EDI which is the most efficient of all.

Moreover, ECB and CCB would cost even more. The setup of any IOS includes costs for developing or outsourcing a platform to be shared, but administrative costs for getting supply chain parties on board (e.g., preparing them to adopt and standardizing their interfaces) account for even more.

High participation is critical, but also challenging due to the self-interests of supply chain parties, information asymmetry in supply chain processes, and uncertainty in potential benefits. Coordination costs can relate heavily to the evolution of governance modes and experiences in blockchain-based platforms (Pereira, Tavalaei, and Ozalp 2019).

The most efficient among the three IOS is EDI with a single leader and centralized data management. As the dominant leader can use powers over its partners, it is relatively easier to persuade them to adopt EDI to continue business (Kumar, Liu, and Shan 2020). EDI’s overhead includes costs for collecting and entering data on inter-firm processes. In contrast, BSC’s setup cost is higher in general due to its infrastructure for tracking (Helo and Hao 2019). Other features such as smart contract, validation, and distributed ledger add complexity to setup. Due to multi-party validations and data replications over a distributed ledger, the overhead of ECB is higher over time. CCB, dealing with additional data from intra-firm processes, incurs the highest overhead from potentially far more off-chain validations.

3: Managerial implications

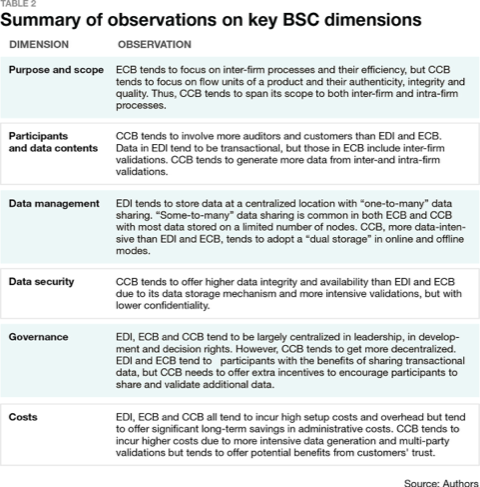

The major outcome of this research is to inform supply chain managers of the implications and insights on blockchain-enabled supply chains. We first summarize our observations on the key dimensions in Table 2.

Many firms have considered or started to pilot blockchain technology in their supply chain (Wang, Han, and Beynon-Davies 2019), but BSCs are still emerging, and most projects are not yet mature to full implementation. Since BSCs incur high setup cost and overhead, their developments, for economies of scale, has facilitated industry-wide collaborations such as a blockchain consortium.

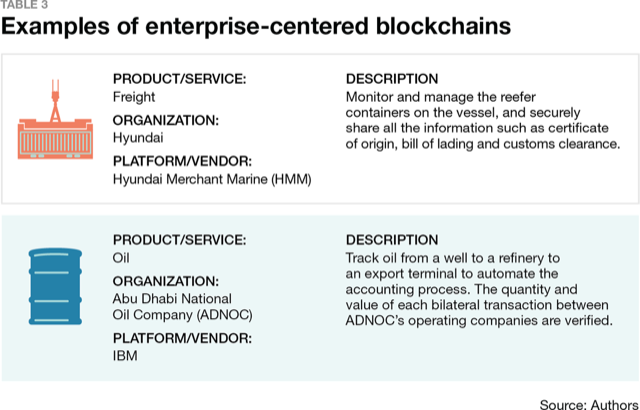

From 173 respondents associated with the Association of Supply Chain Management (ASCM), formerly APICS, “the need for collaborating with supply chain partners” is the most significant external motivator of blockchain implementation (Saberi, Kouhizadeh, and Sarkis 2019). Such diffusion would also alter the current operations of supply chain parties in an industry and form new standards in information sharing, process automation, quality assurance, and customer empowerment. However, ECB and CCB may follow different paths. Some ECB and CCB examples are illustrated in Tables 3 and 4, respectively.

Many ECB developments are initiated with the support from a platform vendor by a single leader in an industry such as Hyundai Merchant Marine’s shipping tracking blockchain and Barclays Corporate Bank’s payment blockchain (Wang, Han, and Beynon-Davies 2019). Maersk’s platform, TradeLens, was used by almost 50% of world ocean carriers (Jensen, Hedman, and Henningsson 2019).

Due to the leader’s numerous transactions aggregated on a single ECB platform, economies of scale can justify potentially high costs, and benefit other supply chain parties. The leader is recommended to take an extra step to commercialize an open-source ECB solution to other enterprises (including even competitors) with similar needs to make immediate profits and set industry standards for business processes.

Some CCB developments, in contrast with ECBs, have been initiated by multiple leaders in the diamond industry. The Mobility Open Blockchain Initiative (MOBI) was launched by some of the largest auto manufacturers (Castillo 2019). The consortium of leading manufacturers also aggregates many suppliers to reach a critical mass, though a single party might not be able to achieve such economies of scale due to intense data collection and validations in CCB. This will also create widely accepted norms to share data.

Supply chain parties considering adopting an ECB or CCB should embrace these trends. Their participation in industry-wide collaborations could offer opportunities for technological innovations as well as benefits from economies of scale.

Based on the observations, we recommend considerations for potential or ongoing BSC developments.

3.1: Balance between efficiency and trust

Validated data on a distributed ledger is to achieve high trust among participants with little or no mutual trust. However, BSC incurs high setup costs and overhead. For example, maintaining an IoT system in a supply chain involves significant costs (Pournader et al. 2020). Thus, BSC makes sense only when identified or potential benefits outweigh the high costs and would be beneficial when used selectively on inter- or intra-firm processes lacking trust.

In counterbalance with the levels of efficiency and trust, there might be many hybrid blockchains between the extremes of EDI and CCB as shown in Figure 2. An efficient blockchain incurring low costs tends to be close to EDI where trust is not a focus, while a trustful blockchain incurring high costs leans more towards CCB where trust is desired by supply chain parties as well as customers on both inter- and intra-firm processes.

When trust is not the main purpose, for example, a more sensible choice might be an EDI with tracking devices which lies between EDI and ECB. The balance point is also linked to the characteristics of a product and the profile of customers as it is leaning more towards CCB when customers are paying a premium and demanding high trust in the product.

Figure 2. Efficiency-trust continuum

3.2: Take an incremental approach with modular designs

It is the most critical and challenging to involve all relevant supply chain parties and motivate them to agree on the scope of data they contribute to the blockchain. A single-step adoption of a blockchain including various inter- or intra-firm processes at the same time is less likely to succeed. One way to avoid failures is to develop a blockchain using modular designs through incremental steps.

Supply chain parties can collaborate to implement ECB modules and then add CCB modules. We note that, although ECB and CCB differ in many ways, they are not mutually exclusive. Their features can be realized in the same platform/infrastructure by having their relevant data captured simultaneously, for example, inter-firm transactions on ECB and inspections/certifications on CCB. IBM Food Trust (IBM Food Trust 2020) is such an example. Relevant to ECB, trace module tracks items and enables transactions. Relevant to CCB, certification module collects certifications from supply chain parties, and fresh insight module collects IoT data.

Modular designs provide flexibility in transforming an existing IOS into a blockchain-enabled system. Instead of committing to the whole solution, modules can be tried and added one at a time to reach a desired balance point in the continuum in Figure 2. That way, the setup cost and overhead are spread out over existing resources, and the resulting blockchain is also customizable. Open-source Hyperledger solutions also allow modular architectures featuring pluggable consensus and membership protocols (Hyperledger 2018).

An actionable approach to modular adoption is to integrate with existing enterprise systems such as ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), and SCM (Supply Chain Management). Since some inter-firm data have been captured in such systems and need not be re-entered into a new blockchain infrastructure, the setup of ECBs can be efficient. CCBs are not likely to achieve efficiency due to their data-intensive nature. Still, interoperability and standardization are key challenges in BSC development for a global supply chain and cross-border trade (Chang, Iakovoua, and Shi 2020).

4: Conclusion

As the Bitcoin hype has been over, blockchain’s second coming is around the corner. Blockchain technology, extending its applications far beyond cryptocurrencies, has been driving innovations in the supply chains of numerous products. Blockchains in supply chains (BSCs) are not yet mature, and their potential benefits and challenges remain unclear. Narrowing the gaps, we critically evaluate current BSCs in the two categories to gain managerial implications and provide constructive recommendations for potential developments. Our contributions are summarized below.

- Our evolutionary framework comparing EDI, ECB, and CCB offers a new fresh view on BSCs, and sheds light on their strategic fit with their products and supply chains.

- We demonstrate the key dimensions (purpose and scope, participants and data contents, data management, data security, governance, and costs) which are useful for evaluating current BSCs or potential developments. Notable observations from our review include partial decentralization in data management and governance, security risks in pre- and post-entry data, and higher trust at higher costs in customer-centered blockchains.

- We highlight the trade-off between efficiency and trust. The choice and degree of features in a BSC depends on the purpose, scope, participants, and data contents. We thus recommend incremental BSC developments with modular designs.

CCB with its focus on customers sets itself apart from EDI and ECB with their focus on a single leading enterprise in a supply chain. In the customer-centric approach of CCB, trust is defined by customers, not by enterprises. We foresee that CCB will be a looming trend in BSC developments and span gradually over a wider range of products, as more efficient blockchain frameworks emerge so that broad participation in an industry achieves economies of scale.

CCB developments will be spurred during the COVID-19 era by customers’ higher standards and demand for the authenticity, integrity, and quality of a flow unit in pharmaceutical supply chains and get to spread to other products. This ongoing trend will facilitate transformations of current EDIs and ECBs into CCBs by strengthening digital trust for customers. Customers’ involvement and empowerment will serve as a key catalyst for potential blockchains with substantially more decentralized in data management and governance. Potential research in this direction can address the following questions:

- How would current EDIs and ECBs evolve incrementally towards CCBs?

- How could a blockchain with explicit involvement of customers be developed and managed (e.g., regarding participants’ data ownership and access control)?

- How would customers exert powers in blockchain governance? How would customers’ involvement empower or incentivize non-leaders in a supply chain?

- How could customers’ data (reviews and feedback) be managed on a distributed ledger?

Cyber-physical systems, the core foundation of Industry 4.0, synchronize real-time data between the physical objects and the cyber computational space (Xu, Xu, and Li 2018). Blockchain will result in considerable automation of many business functions, which will require little or no human intervention, just as with the newly developed self-driving vehicles.

Many humans might be replaced with faster, cheaper, and more meticulous blockchain technology (Kimani et al. 2020). In smart manufacturing, machines interact with flow units without human control. For example, blockchains can be applied to provide security in the IoT and machine learning within the smart factory context (Reyes, Visich, and Jaska 2020).

Blockchain 4.0 is an emerging generation including analytics and artificial intelligence (AI). Future BSCs will become an integrated platform to enable automated decision-making among participants. CCBs, in particular, are promising vast opportunities with analytics and AI algorithms applied to their rich amassed data.

References

Ambrosus. 2018. Whitepaper. Accessed Aug. 18, 2020 https://whitepaper.io/document/127/ambrosus-whitepaper

Azzi, R., Chamoun, R. K., and Sokhn, M. 2019. “The power of a blockchain-based supply chain.” Computers & Industrial Engineering 135: 582-592. doi: 10.1016/j.cie.2019.06.042

Babich, V. and Hilary, G. 2019. “Distributed ledgers and operations: What operations management researchers should know about blockchain technology.” Manufacturing & Service Operations Management 22(2): 223-240. doi:10.1287/msom.2018.0752

Banker, R. D., Bardhan, I. R., Chang, H., and Lin, S. 2006. “Plant information systems, manufacturing capabilities, and plant performance.” MIS Quarterly 30(20): 315-337. doi: 10.2307/25148733

Beck, R., Müller-Bloch, C., and King, J. L. 2018. “Governance in the blockchain economy: A framework and research agenda.” Journal of the Association for Information Systems 19(10): 1020-1034. doi: 10.17705/1jais.00518

Bocek, T., Rodrigues, B. B., Strasser, T., and Stiller, B. 2017. “Blockchains everywhere - A use-case of blockchains in the pharma supply-chain.” In Proceeding of IFIP/IEEE Symposium on Integrated Network and Service Management, 772-777. doi: 10.23919/INM.2017.7987376

Boyle, R. J. and Panko, R. R. Corporate Computer Security. (4th ed.). 2015. Upper Saddle River, New Jersey: Pearson Education.

Bumblauskas, D., Mann, A., Dugan, B., and Rittmer, J. 2020. “A blockchain use case in food distribution: Do you know where your food has been?” International Journal of Information Management 52 (2020).102008. doi: 10.1016/j.ijinfomgt.2019.09.004

Castillo, M. 2019, “Can blockchain jump-start Detroit? Ford, GM and others are helping make it so.” Forbes (Oct. 24, 2019). https://www.forbes.com/sites/michaeldelcastillo/2019/10/24/can-blockchain-jumpstart-detroit/#2c6d61b5313e

Chang, Y., Iakovoua E., and Shi, W. 2020. “Blockchain in global supply chains and cross border trade: A critical synthesis of the state-of-the-art, challenges and opportunities.” International Journal of Production Economics 58(7): 2082-2099. doi: 10.1080/00207543.2019.1651946

Clint, R. V. 2019. “DLT-Blockchain as a building block for enterprise transformation.” IEEE Engineering Management Review 47(1): 24-27. doi: 10.1109/EMR.2019.2895303

D’Alto, L. and Smith V. 2020. “Sustainable seafood gets a boost from IBM blockchain technology for insight into the journey from sea to table.” IBM (June 25. 2020); https://newsroom.ibm.com/2020-06-25-Sustainable-Seafood-Gets-a-Boost-from-IBM-Blockchain-Technology-for-Insight-into-the-Journey-from-Sea-to-Table

Gaehtgens, F. and Allan, A. 2017. “Digital trust - Redefining trust for the digital era: A gartner trend insight report.” Gartner (May 31, 2017); https://www.gartner.com/en/documents/3735817/digital-trust-redefining-trust-for-the-digital-era-a-gar

Gurtu, A. and Johny, J. 2019. “Potential of blockchain technology in supply chain management: a literature review.” International Journal of Physical Distribution & Logistics Management 49(9): 881-900. doi: 10.1108/IJPDLM-11-2018-0371

Halaburda, H. 2018. “Blockchain revolution without blockchain?” Communications of the ACM 61(7): 27-29. doi: 10.1145/3225619

Hart, P. and Saunders, C. 1997. “Power and trust: Critical factors in the adoption and use of electronic data interchange.” Organization Science 8(1): 23-42. doi:10.1287/orsc.8.1.23

Helo, P. and Hao, Y. 2019. “Blockchains in operations and supply chains: A model and reference implementation.” Computers & Industrial Engineering 136: 242-251. doi:10.1016/j.cie.2019.07.023

HMM. 2017. “HMM completes its first blockchain pilot voyage.” Aug. 18, 2020 https://www.hmm21.com/cms/company/engn/introduce/prcenter/news/1202833_18539.jsp

Hyperledger, 2018. “An introduction to Hyperledger.” Accessed Aug. 18, 2020. https://www.hyperledger.org/wp-content/uploads/2018/07/HL_Whitepaper_IntroductiontoHyperledger.pdf

IBM, 2018. “Storage needs for blockchain technology - Point of view.” Accessed Aug. 18, 2020. https://www.ibm.com/downloads/cas/LA8XBQGR

IBM Food Trust. 2020. “Focus on supply chain efficiencies.” Accessed Jan. 12, 2021 https://www.ibm.com/downloads/cas/LR8VR8YV

Jensen, T., Hedman, J., and Henningsson, S. 2019. “How TradeLens delivers business value with blockchain technology.” MIS Quarterly Executive 18 (4): 221-243. doi: 10.17705/2msqe.00018

Kahn, J., 2021. “A British hospital network is using blockchain technology to track COVID-19 vaccines.” Fortune Accessed Jan. 19, 2021. https://fortune.com/2021/01/19/hospital-uk-blockchain-vaccines/

Kimani, D., Adams, K., Attah-Boakyec, R., Ullah, S., Frecknall-Hughes, J., Kim, J. 2020. “Blockchain, business and the fourth industrial revolution: Whence, whither, wherefore and how?” Technological Forecasting & Social Change. 161: 120254. doi:10.1016/j.techfore.2020.120254

Kumar, A., Liu, R., and Shan, Z. 2020. “Is blockchain a silver bullet for supply chain management? Technical challenges and research opportunities.” Decision Sciences 51(1): 8-37. doi: 10.1111/deci.12396

Ledger Insights. 2020. “MediLedger creator Chronicled to collaborate with Deloitte to fight counterfeit COVID-19 drugs.” Accessed Dec. 12, 2020. https://www.ledgerinsights.com/mediledger-chronicled-deloitte-fight-counterfeit-covid-19-drugs-pharmaceuticals/

Lannquist, A. 2018. “Introducing MOBI: The Mobility Open Blockchain Initiative.” IBM. June 25, https://www.ibm.com/blogs/blockchain/2018/06/introducing-mobi-the-mobility-open-blockchain-initiative/

Longo, F., Nicoletti, L., Padovano, A., d’Atri, G., and Forte, M. 2019. “Blockchain-enabled supply chain: An experimental study.” Computers & Industrial Engineering 136: 57-69. doi:10.1016/j.cie.2019.07.026

Mattke, J., Maier, C., Hund, A., and Weitzel, T. 2019. “How an enterprise blockchain application in the U.S. pharmaceuticals supply chain is saving lives.” MIS Quarterly Executive 18 (4): 245-261. doi:10.17705/2msqe.00019

Mearian, L. 2019. “Walmart launches ‘world’s largest’ blockchain-based freight-and-payment network.” Computerworld. Nov. 19. https://www.computerworld.com/article/3454336/walmart-launches-world-s-largest-blockchain-based-freight-and-payment-network.html

Min, H. 2019. “Blockchain technology for enhancing supply chain resilience.” Business Horizons 62(1): 35-45. doi: 10.1016/j.bushor.2018.08.012

Morkunas, V. J., Paschen, J., and Boon, E. 2019. “How blockchain technologies impact your business model.” Business Horizons 62(3): 295-306. doi: 10.1016/j.bushor.2019.01.009

Nakamoto, S. 2008. “Bitcoin: A peer-to-peer electronic cash system.” Accessed Mar. 30, 2020. https://bitcoin.org/bitcoin.pdf

O’Neal, S. 2019. “Diamonds are blockchain’s best friend: How DLT helps tracking gems and prevents fraud.” Cointelegraph Accessed Jun.19, 2020. https://cointelegraph.com/news/diamonds-are-blockchains-best-friend-how-dlt-helps-tracking-gems-and-prevents-fraud

OriginTail, 2018. “Utilizing smart sensors to prevent wine fraud - OriginTrail’s pilot with TagItSmart.” Accessed Jun. 12, 2020. https://medium.com/origintrail/utilizing-smart-sensors-to-prevent-wine-fraud-origintrails-pilot-with-tagitsmart-1949dc62113f

Pereira, J., Tavalaei, M. M., Ozalp, H. 2019. “Blockchain-based platforms: Decentralized infrastructures and its boundary conditions.” Technological Forecasting & Social Change. 146: 94-102. doi: 10.1016/j.techfore.2019.04.030

Pournader, M., Shib, Y., Seuring S., Lenny Koh, S. C. 2020. “Blockchain applications in supply chains, transport and logistics: A systematic review of the literature.” International Journal of Production Research 58(7): 2063-2081. doi: 10.1080/00207543.2019.1650976

Provenance. 2016. “From shore to plate: Tracking tuna on the blockchain.” Accessed Jun. 12, 2020. https://www.provenance.org/tracking-tuna-on-the-blockchain

Raut, R., Gotmare, A., Narkhede, B., Govindarajan, U., Bokade, S. 2020. “Enabling technologies for Industry 4.0 manufacturing and supply chain: Concepts, current status, and adoption challenges.” IEEE Engineering Management Review 48(2): 83-102. doi: 10.1109/EMR.2020.2987884

Reyes, P., Visich, J., Jaska, P. 2020. “Managing the dynamics of new technologies in the global supply chain.” IEEE Engineering Management Review 48(1): 156-162. doi: 10.1109/EMR.2020.2968889

Rossi, M., Mueller-Bloch, C., Thatcher, J. B., and Beck, R. 2019. “Blockchain research in information systems: Current trends and an inclusive future research agenda.” Journal of the Association for Information Systems 20(9): 1390-1405. doi: 10.17705/1jais.00571

Ruoti, S., Kaiser, B., Yerukhimovich, A., Clark, J., Cunningham, R. 2020. “Blockchain technology: What is it good for?” Communications of the ACM 63(1): 46-53. doi:10.1145/3369752

Sambamurthy, V. and Zmud, R. 1999. “Arrangements for information technology governance: A theory of multiple contingencies.” MIS Quarterly 23(2): 261-290. doi: 10.2307/249754

Saberi, S., Kouhizadeh, M., Sarkis, M. 2019. “Blockchains and the supply chain: Findings from a broad study of practitioners.” IEEE Engineering Management Review 47(3): 95-103. doi: 10.1109/EMR.2019.292826

Schmidt, C. G. and Wagner, S. M. 2019. “Blockchain and supply chain relations: A transaction cost theory perspective.” Journal of Purchasing and Supply Management 25(4): 100552. doi: 10.1016/j.pursup.2019.100552

Subramani, M. 2004. “How do suppliers benefit from information technology use in supply chain relationships?” MIS Quarterly, 28(1): 45-73. doi: 10.2307/25148624

Subramanian, H. 2018. “Decentralized blockchain-based electronic marketplaces.” Communications of the ACM, 61(1): 78-84. doi: 10.1145/3158333

Toyoda, K., Mathiopoulos, P. T., Sasase, I., and Ohtsuki, T. 2017. “A novel blockchain-based product ownership management system (POMS) for anti-counterfeits in the post supply chain.” IEEE Access 5: 17465-17477. doi: 10.1109/ACCESS.2017.2720760

TradeLens. 2020. Accessed Jun. 12, 2020. https://www.tradelens.com/

Vella, H. 2018. “Blockchain is strengthening links in the supply chain. Raconteur” Feb. 23. https://www.raconteur.net/manufacturing/blockchain-strengthening-links-supply-chain

Vilkos, Y. 2018. “De Beers Group successfully tracks first diamonds from mine to retail on industry blockchain.” De Beers Group. May 10. https://www.debeersgroup.com/media/company-news/2018/de-beers-group-successfully-tracks-first-diamonds-from-mine-to-r

Vitasek, K. 2020. “Walmart Canada and DLT Labs launch world’s largest industrial blockchain application.” Forbes Jan. 31. https://www.forbes.com/sites/katevitasek/2020/01/31/walmart-canada-and-dlt-labs-launch-worlds-largest-industrial-blockchain-application/?sh=2ef3c0c83d2e

Wang, Y., Han, J. H., and Beynon-Davies, P. 2019. “Understanding blockchain technology for future supply chains: A systematic literature review and research agenda.” Supply Chain Management: An International Journal 24(1): 62-84. doi: http://dx.doi.org.ezproxysuf.flo.org/10.1108/SCM-03-2018-0148

WorldOil, 2018. ADNOC has implemented IBM blockchain technology to streamline daily transactions. Accessed Dec.13, 2020. https://www.worldoil.com/news/2018/12/10/adnoc-has-implemented-ibm-blockchain-technology-to-streamline-daily-transactions

Xu, L. D., Xu, E. L., Li, L. 2018. “Industry 4.0: State of the art and future trends.” International Journal of Production Research 56(8): 2941-2962. doi: 10.1080/00207543.2018.1444806

SC

MR

Latest Supply Chain News

- ‘Purple People’ and the evolution of supply chain talent

- Looking for the next frontier of margin enhancement? Think structurally

- ISM May Semiannual Report calls for growth in 2024, at a reduced rate

- Augmented reality’s role in upskilling the workforce

- Supply chain salaries top $100K for first time

- More News

Latest Podcast

Explore

Explore

Topics

Software & Technology News

- ‘Purple People’ and the evolution of supply chain talent

- Augmented reality’s role in upskilling the workforce

- Inflation continues to have a wide-ranging impact on supply chains

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- More Software & Technology

Latest Software & Technology Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks