It seems that by now no company is unscathed by the double trouble of inflation and supply shortages. Worse yet, the difference between winning and losing in this environment is stark.

Emerging winners are taking a strategic approach to procurement to keep costs below inflation. In some areas, they are even generating P&L gains while assuring supply security and quality. At the other end, for some companies, inflation and supply shortages are eroding earnings.

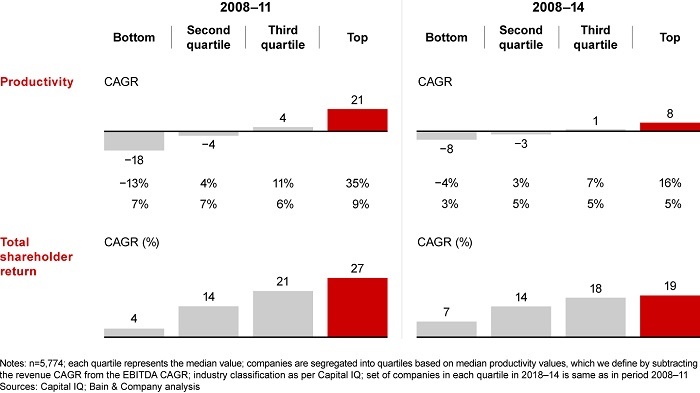

Past experience offers valuable lessons: Top-performing companies that accelerated out of the last period of high inflation were those that made productivity improvement a top priority (see figure below).

We expect leaders to repeat this pattern as inflation ticks up again. What’s different this time is that the capabilities that enabled procurement organizations to generate year-over-year cost reductions in the past are not enough in the face of today’s turbulent conditions.

While still important, should-cost modeling tools and competitive bidding practices are not as effective when underlying input costs are rising at double-digit rates and supply is tight. Leading companies ensure that their procurement organizations play a strategic role in bringing together internal and external stakeholders to take three essential actions:

1)Create transparency,

2)Revamp the firm’s sourcing strategies, and

3)Execute seamlessly.

Let’s take a closer look at how these actions make a difference.

Create transparency

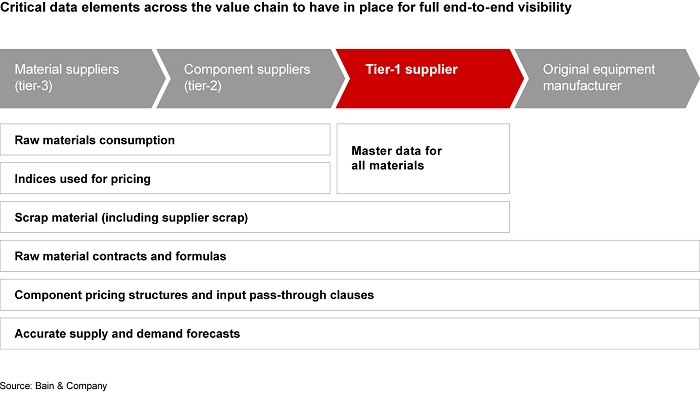

Procurement executives dread telling business stakeholders and CFOs about negative surprises on cost or supply availability. Yet those conversations are common due to limited upstream visibility and the lack of full traceability. Good data on third-party spending alone won’t solve the problem. Procurement functions need two additional things to mitigate the risk of nasty surprises: traceability across the entire value chain, and short- and long-term demand and supply forecasts.

Leading companies are enhancing internal spending visibility and analytics with supplier-provided reporting to improve transparency, creating a single source of truth on external outlays. Procurement teams are also partnering with the supply chain function to create end-to-end traceability within the value chain. Price and supply volatility now make it urgent to achieve full transparency on suppliers and raw materials, down to tier-3 or tier-4 suppliers (see figure below).

This allows them to forecast properly and mitigate supply availability issues. And, of course, improved transparency supports enterprise-wide environmental, social, and governance (ESG) efforts.

Finally, leading procurement teams are bringing together short- and long-term views of demand and supply forecasts, including constrained and unconstrained scenarios. They are integrating data into a robust category dashboard linked to internal and external inputs. Dashboards enable organizations to understand current inflation and supply-and-demand dynamics as well as to better anticipate future fluctuations.

Take the example of a tier-1 automotive supplier struggling to mitigate inflation and supply scarcity risks. The leadership team lacked full visibility into raw material pricing and sources. To address that problem, the procurement team wielded data-forecasting tools to gauge critical raw material price increases and shortages far down the value chain—and their implications on a specific customer product. The effort provided the company with powerful information for negotiations and indexing, both with suppliers and customers.

Revamp sourcing strategies

When procurement teams understand the full risk exposure their company faces, they have an incentive to act. Leading procurement organizations are deploying more sophisticated sourcing techniques including parametric pricing, consortium buying, index-based pricing and hedging strategies. These advanced techniques that focus on big-picture, holistic value are essential to minimizing the impact of inflation and scarcity.

The tier-1 auto supplier mentioned earlier struggled to use indices effectively in its raw material contracts. Its scattershot approach resulted in high internal complexity and failed to generate value. The solution was a customized strategy on how to use indexes across different raw material segments. That approach gave commodity managers a clear understanding of when to use specific indexes and how to use each index to maximize value.

The company was able to identify double-digit cost savings by tying index-based adjustments to the proper underlying material. The procurement team also helped dramatically simplify the number of indexes used. In one case, it found ways to cut the number of aluminum indexes by more than half. Finally, the firm launched an effort to reduce its global risk by making sure procurement and commercial teams aligned on pass-through price changes.

Execute seamlessly

Strategic procurement in an inflationary environment requires strong execution. The first step is to communicate clearly with all key stakeholders about implementing the procurement strategy and the expected outcomes. When the team initiates engineering redesigns or approves new suppliers to address scarcity concerns, for instance, leading organizations ensure that everyone involved is clear on the outcomes and is collaborating on critical issues.

Improving data visibility with the finance and commercial teams often surfaces opportunities to adjust budgets with improved forecasting and reporting accuracy, and to flow through price adjustments to customers, where contracts allow. Similarly, updating supply scarcity concerns and mitigation action plans with supply chain teams and other relevant business units helps to limit the risks associated with fulfilling customer contracts. Leading companies also adjust supplier pricing downward when inflation eases.

Inflation and supply insecurity present a major opportunity for procurement organizations. CPOs and CFOs can help position the business to accelerate out of turbulence by pushing for increased transparency across the entire supply chain and orchestrating an enterprise-wide strategy that can transform performance in an increasingly difficult business environment.

Karen Stansfield is an expert associate partner at Bain & Company. She can be reached at [email protected]. Tony Cape is a partner at Bain & Company. He can be reached at [email protected].

SC

MR

Latest Supply Chain News

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- Tips for CIOs to overcome technology talent acquisition troubles

- More News

Latest Podcast

Explore

Explore

Latest Supply Chain News

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks