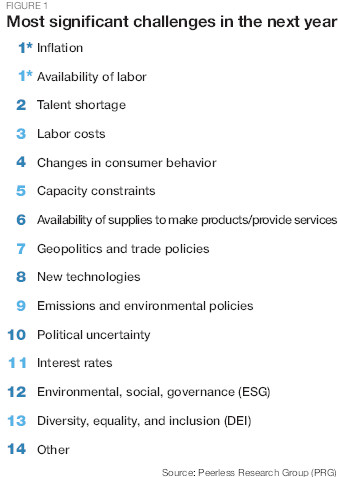

This year, our Annual Study of Logistics and Transportation Trends asked respondents to identify the most significant challenges for logistics and transportation operations in the coming year. The top-ranked factors, such as inflation, availability of labor, talent shortage, and labor costs suggest the industry is facing a human capital crisis.

These findings are consistent with data from the U.S. Chamber of Commerce, which showed an average of approximately 0.71 workers available for each open job position during the first seven months of 2023. This presents a particularly challenging workforce environment for our labor-intensive and evolving industry.

Our survey also sought insights into how organizations can recruit and retain critical talent and skills. The results suggest organizations need to be proactive and intentional about talent management.

For instance, only 60% of respondents believe their organization is doing an “above average” or “excellent” job of identifying required skills and competencies, while only 51.7% believe they are “effectively planning” for future talent needs. Fewer than half (49.2%) believe that their organizations have implemented an effective strategy to attract, retain, and develop talent.

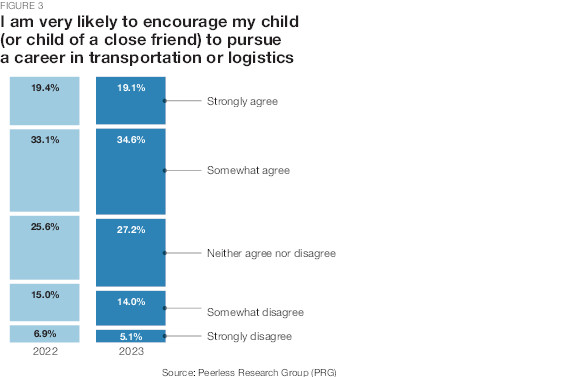

Adopting such an indifferent approach to talent is a risky strategy for an industry burdened by negative perceptions. For the second year in a row, a mere 19% of professionals are highly likely to encourage their child or the child of a close friend to pursue a career in transportation or logistics (Figure 3). When asked why they would not recommend a career in logistics and transportation, participants cited concerns about career progression, work-life balance, salary prospects, and industry volatility.

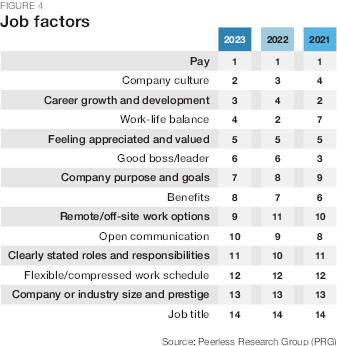

As an industry, we must strive to address these issues and negative perceptions. As shown in Figure 4, pay; career growth and development; work-life balance; and feeling appreciated and valued are consistently among the most important contributing factors to job choice and satisfaction.

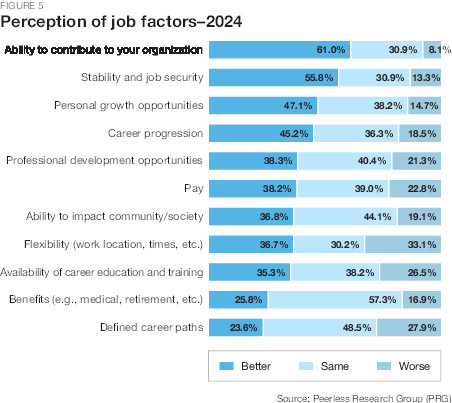

When asked to compare how careers in logistics and transportation compared to other industries, only two factors—“stability and job security” and “ability to contribute to your organization”—were rated by more than 50% of participants as being better in logistics and transportation than in other careers. All other factors were considered to be the same or worse. To compete for talent in the increasingly shallow talent pool, organizations must re-think work and adapt roles to offer career opportunities that will attract and retain talent.

Respondents also shared one thing that their organization “had done” and “could do” to significantly improve employee engagement, satisfaction, and retention. As seen in Figure 5, the responses further highlight the importance and value of providing a positive and supportive culture; clearly defined opportunities for career and personal growth; a competitive salary; and flexibility to ensure work-life balance.

Strategic and technological trends

This year’s study also identified and investigated a couple key strategic and technological trends.

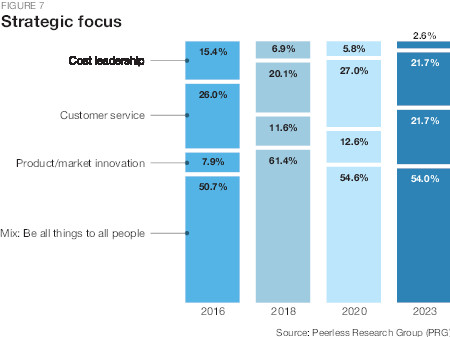

Competitive shift. From price to value. Logistics and transportation companies have shifted their strategies to remain competitive. Our results indicate that “mix: be all things to all people” remains the predominant focus in the industry, reflecting a preference for balanced, diversified strategies (Figure 7).

Results also show a declining trend in “cost leadership” from 2016 to 2023. This trend highlights the industry’s increasing operational costs and the realization that competing solely on price is not a sustainable source of competitive advantage.

This shift, coupled with the rise in “product/market innovation” and the consistent emphasis on “customer service” suggests a strategic shift from price-based competition to customer service and value-based differentiation.

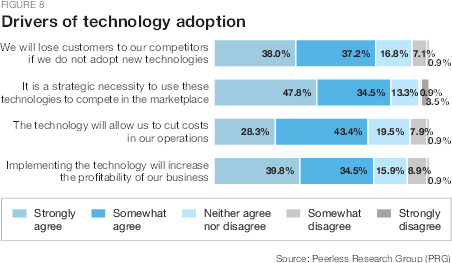

Technology wavefront. With the rapid evolution of technology, logistics and transportation operations face a proverbial wave of advanced, innovative tools. Our results indicate that embracing modern technologies is no longer an option, it’s a strategic imperative.

More than 82% of participants (34.5% “somewhat agree” + 47.8% “strongly agree”) view the use of modern technologies as a strategic necessity to compete in the marketplace. More than 75% of participants (combining “somewhat agree” + “strongly agree”) believe not adopting modern technologies would cause them to lose customers to their competitors, and more than 74% believe adopting modern technologies is essential to increasing profitability (Figure 8).

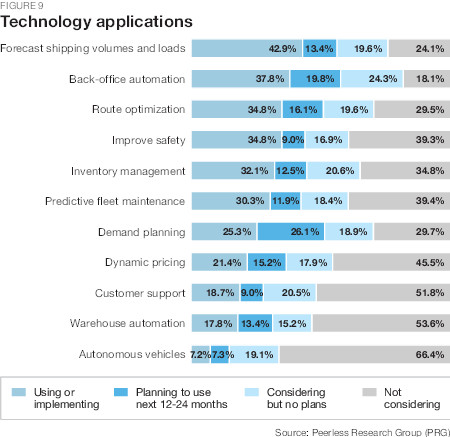

When selecting which technologies to adopt, companies are opting for those that offer immediate efficiencies and cost savings while proceeding cautiously with emerging technologies or those that would require significant operational changes.

For example, technologies related to freight forecasting, route optimization, safety, and back-office automation were among the most common applications while warehouse automation and autonomous vehicles were the least common.

The Logistics & Transportation Titans (firms with more than $3 billion in revenue) indicated higher implementation and usage rates for all of the technologies, most by double digits.

The trend to adopt technologies offering immediate benefits is a prudent approach. However, companies should keep an eye on emerging technologies as they mature and be wary of potential vulnerabilities and risks such as cyber attacks, double-brokering, and load-board scams.

Performance and spending in an evolving environment

Despite operating in a dynamic and volatile environment, logistics and transportation organizations have proven resilient and continued to deliver. Results indicate firm profitability has improved from an average rating of 3.59 in 2021 to 3.71 in 2023, and revenue growth has increased from 3.57 in 2021 to 3.75 in 2023.

Competitive position remained consistent at 3.7 over the last two years while customer satisfaction increased in 2023. Only return on assets saw a slight downward trend from 3.72 in 2021 to 3.6 in 2023. This suggests an overall trend of companies prioritizing customer satisfaction and revenue growth over asset optimization.

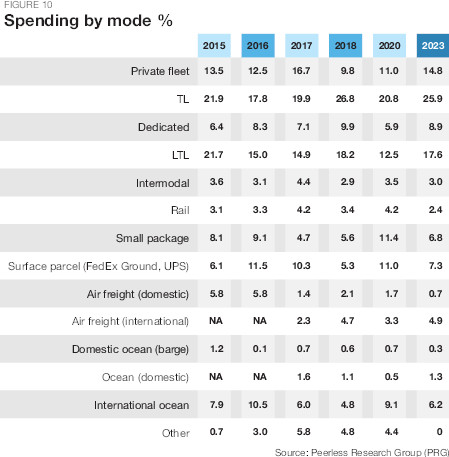

Our results also highlighted trends in freight spending. Compared to 2020 (the last time we included this question), there was an overall increase in the percentage of freight dollars spent to move freight via private fleet, truckload (TL), dedicated, and less-than-truckload (LTL). (Figure 10)

Rail, small package, and parcel all saw decreases in the percentage of freight spending. When we narrowed our focus on the Logistics & Transportation Titans (revenue greater than $3 billion), we saw similar trends for a private fleet, TL, and dedicated but more spending on rail and less on LTL.

We also explored how carriers performed across commonly used modes. Specifically, we asked shippers to report carrier performance based on three key metrics—correct invoice, on-time delivery, and damaged shipments.

In 13 of 15 cases, shippers reported a decline in the reported metrics (i.e., decreased performance). Only rail and TL showed improvement in the percentage of correct invoices. Interestingly, the Logistics & Transportation Titans reported that shippers in all modes except LTL improved the percentage of on-time deliveries.

However, similar to the overall trends, the Logistics & Transportation Titans experienced decreased performance across all other modes and performance. It’s difficult to suggest specific reasons for this performance given the three-year gap. However, this is a trend we will monitor more closely.

Key takeaways

Human capital crisis. The logistics and transportation industry is grappling with significant challenges related to talent recruitment and retention. The talent pool is becoming increasingly shallow, making it critical for organizations to be proactive in their talent strategies.

Negative industry perceptions. Addressing the negative perceptions of logistics and transportation careers is vital for the industry’s future.

Strategic shift from price to value. Companies are increasingly emphasizing value and a customer focus over cost leadership.

Technological imperative. Modern technology adoption is now a strategic necessity. Organizations that fail to integrate modern technologies risk losing their competitive edge.

Organizational resilience. Despite the volatile environment, many logistics and transportation organizations have managed to maintain or improve their profitability, by adopting technologies offering immediate returns and emphasizing customer satisfaction and revenue growth.

Conclusion

The logistics and transportation industries are facing both challenges and opportunities. While a human capital crisis poses a risk to performance and growth, technological advancements represent new possibilities for improvement and differentiation.

The future of logistics and transportation will be shaped by those that prioritize people, harness the power of technology, and create value for their customers.

SC

MR

More Research

- Supply chain salaries, job satisfaction on the rise

- Supply Chain’s Top Trends for 2024 Require Talent Investment for Success

- 32nd Annual Study of Logistics and Transportation Trends: Navigating a Shallow Pool of Resources

- Top 50 Third Party Logistics (3PLs) 2023: Ripe market conditions

- Top 25 Trucking Companies 2023: Is this year normal?

- New study sheds light on root cause of higher food prices

- More Research

Latest Podcast

Explore

Explore

Topics

Business Management News

- Joseph Esteves named CEO of SGS Maine Pointe

- Employees, employers hold divergent views on upskilling the workforce

- April manufacturing output slides after growing in March

- Q1 sees a solid finish with positive U.S.-bound import growth, notes S&P Global Market Intelligence

- 6 Questions With … Sandeep Bhide

- MIT CTL offering humanitarian logistics course

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks