Amazon Business recently released the first 2021 B2B E-commerce in Evolution Report, which shares B2B trends and new insights from U.S. procurement professionals across industries and organizations of every size.

For the report, which examines the rapid transformation B2B e-procurement has undergone in recent years, Amazon Business surveyed 250 B2B buyers and 250 B2B sellers who hold influential procurement roles across government, education, healthcare, and commercial industries in the U.S. This report also provides actionable insights for business decision- makers, on both the buying and selling sides, as they continue their digital transformation journey in 2021 and beyond.

According to the findings, 85% of business buyers said that as a result of the pandemic, their organizations were propelled to move more of their procurement online, and 96% said they anticipate their organizations will continue doing more purchasing online, even after pre-pandemic business functions resume. The vast majority (91%) of buyers said they prefer e-procurement over traditional and offline purchasing methods.

“Our 2021 B2B E-commerce in Evolution report underlines the fact that simply leveraging e- procurement is no longer enough,” said Todd Heimes, director of Amazon Business. “Ultimately, we think that organizations have a significant opportunity to maximize e-procurement technologies that will help them overcome operational challenges that diminish efficiency and waste budget. For seller organizations, adapting to meet buyer demands will allow them to remain relevant with their B2B customers. At Amazon Business, we’re committed to helping buyers and sellers navigate the next chapters in their transformation journeys with our technology and expertise.”

Heimes told SCMR in an interview that one notable finding of our report was that smaller commercial organizations were especially driven to accelerate their digital transformation efforts in the last year.

“Fifty-six percent of small-and-medium businesses (SMBs) said they more fully digitized their purchasing process due to COVID-19, compared to only 42% of enterprise commercial companies,” he says. “This is an indication that smaller organizations had to play catch up with large enterprises when the shift to remote work upended in-person operations.”

Key takeaways include:

- The pandemic accelerated digital transformation, helping organizations achieve new goals.

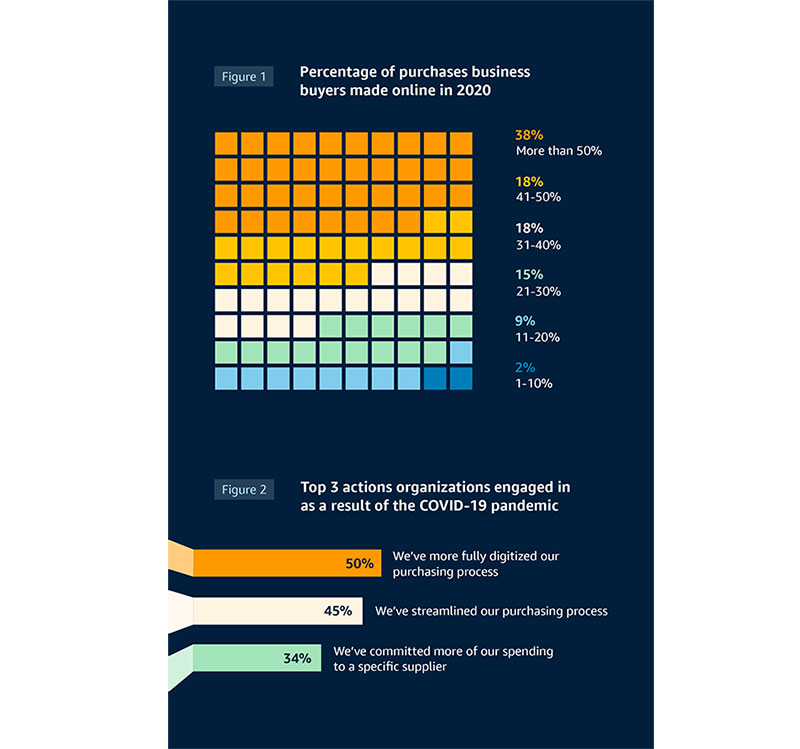

- The COVID-19 pandemic further accelerated organizations’ efforts to digitize procurement. According to the report’s findings, 38% of buyers made more than 50% of purchases for their organizations online in 2020.

- Smaller commercial organizations were especially motivated to accelerate their digital transformation efforts in the last year. Fifty-six percent of small and-medium businesses (SMBs) said they more fully digitized their purchasing process due to COVID-19, compared to only 42% of enterprise commercial companies. This indicates that smaller organizations had to play “catch up” to large enterprises when the pandemic upended in-person operations and forced a shift to remote work. Ultimately this acceleration to adopt and adapt to purchasing online has resulted in additional benefits for buyers and sellers by unlocking new features and technologies that will enable them to do more—impacting their entire organization.

Online features significantly outrank traditional ones in buyers’ purchasing decision processes.

When ranking the most valuable features of the purchasing process, buyers overwhelmingly indicated that online features, such as product comparisons or product videos, were more valuable than traditional ones, such as phone calls or viewing products in a store. Sellers, by contrast, ranked online features much lower than buyers. In the report, when looking at respondents who rated features a “4” or “5” (where 5 was most valuable):

- Buyers ranked online product comparison features the highest 83% of the time, whereas sellers only ranked them the highest 67% of the time.

- Buyers ranked product videos the highest 74% of the time, whereas sellers only ranked the feature highest 66% of the time.

- Sellers ranked viewing products in a physical store highest 68% of the time, compared to buyers who only ranked it highest 57% of the time.

- Sellers ranked phone and/or video calls with a sales rep highest 69% of the time, compared to buyers who only ranked it highest 63% of the time.

For 2021, the top priority identified by sellers is providing a positive customer experience (62% of respondents), followed by expanding customer bases (59%), and selling products globally (40%). Meanwhile, the top priority for buyers is increasing efficiency, with 40% of respondents selecting this option. However, more than one-third (34%) of buyers said reducing costs is a top procurement priority this year—though cost reduction is a higher priority in the education, government, and healthcare industries than in commercial industries.

Social and environmental considerations are playing a larger role in the procurement process.

Increasingly, over the past year, expectations between consumer and business purchasing experiences have become blurred as business buyers expect the same fast, convenient, and personalized digital buying capabilities they’ve grown accustomed to at home. And consumers want to support diversity and sustainability products and initiatives from the brands they give their dollars to. The 2021 Amazon Business B2B E-commerce in Evolution report revealed that the consumer push to prioritize social and environmental issues is also important to both B2B buyers and sellers, in all industries.

- While increasing efficiency was the top buyer procurement priority for 2021 at 40%, improving sustainability in purchasing (39%), supporting local businesses within our community (37%), and increasing diversity among suppliers (35%) were all close behind.

- Additionally, 83% of buyers surveyed said their companies plan to increase their purchasing budgets reserved for Black and minority-owned businesses in 2021; and of those, almost half (48%) plan to increase their budgets by 20% or more. Priorities for 2021 vary across healthcare, education, government, and commercial industries. According to the report, the top priorities per industry for 2021 are:

- Education - Reducing costs (48%)

- Government - Supporting remote work (50%)

- Healthcare - Increasing efficiency (52%)

- Commercial - Improving sustainability (49%)

Additionally, 32% of healthcare respondents said accessing suppliers that meet the needs of their business was the top pain point in 2020, which aligns with the prioritization of increasing efficiency this year in an industry where stringent product specifications and regulatory requirements can make sourcing necessary supplies challenging.

Of note, commercial business respondents identified the next two top procurement priorities for 2021 as supporting local businesses within the community (46%) and increasing diversity (39%); this indicates the growing importance of corporate social responsibility in the commercial sector.

SC

MR

Latest Supply Chain News

- Despite American political environment, global geopolitical risks may be easing

- Joseph Esteves named CEO of SGS Maine Pointe

- Employees, employers hold divergent views on upskilling the workforce

- April manufacturing output slides after growing in March

- Q1 sees a solid finish with positive U.S.-bound import growth, notes S&P Global Market Intelligence

- More News

Latest Podcast

Explore

Explore

Business Management News

- Joseph Esteves named CEO of SGS Maine Pointe

- Employees, employers hold divergent views on upskilling the workforce

- April manufacturing output slides after growing in March

- Q1 sees a solid finish with positive U.S.-bound import growth, notes S&P Global Market Intelligence

- 6 Questions With … Sandeep Bhide

- MIT CTL offering humanitarian logistics course

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks