If the theme of the logistics industry in 2021 was “absorb the growth,” the theme today is “accommodate the growth.” While the financials are still coming in for third-party logistics operators (3PLs), all indicators show that 2022 shaped up as a very good growth year.

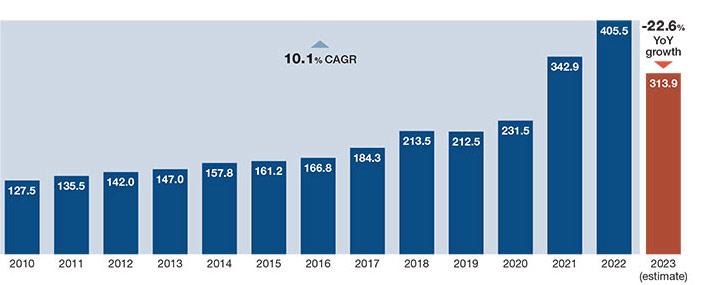

Armstrong & Associates’ (A&A’s) current estimates show U.S. 3PL market net revenues (gross revenues less purchased transportation) grew 24% to $148 billion, while overall gross revenues increased 18.3%, bringing the total U.S. 3PL market to $405.5 billion in 2022.

While year-over-year growth was significantly less than the 48.1% gross revenue growth registered in 2021, 2022 at 18.3% was the fourth best growth year on record since A&A began developing 3PL market estimates in 1995,” says Evan Armstrong, A&A president.

A&A ranks Kuehne + Nagel as the most profitable global 3PL, with 2022 gross revenues at more than $46.9 billion. DHL Supply Chain & Global Forwarding came in second at $45.6 billion, and DSV third with $34.9 billion. On the U.S. side, the top three 3PLs in terms of gross revenues were C.H. Robinson ($23.9 billion), Expeditors ($17.1 billion), and Kuehne + Nagel Americas ($16.3 billion).

U.S. 3PL market gross revenue Gross revenue/turnover (U.S. $, billions)

Source: Armstrong & Associates

According to Armstrong, the main growth drivers making an impact on 3PL players are the extraordinary inventory buildup from the pandemic supply chain disruption as well as the 3PL market’s ability to efficiently decrease purchased transportation costs while staving off significant price concessions to shippers.

Armstrong & Associates Top 50 U.S. 3PLs (Largest U.S. 3PLs Ranked by 2021 Logistics Gross Revenue/Turnover)

|

2022 |

Third-party Logistics Provider |

2022 Gross Logistics Revenue |

|

1 |

23,874 |

|

|

2 |

17,071 |

|

|

3 |

16,308 |

|

|

4 |

14,294 |

|

|

5 |

13,766 |

|

|

6 |

8,993 |

|

|

7 |

8,900 |

|

|

8 |

8,849 |

|

|

9 |

6,947 |

|

|

10 |

6,506 |

|

|

11 |

6,410 |

|

|

12 |

5,400 |

|

|

13 |

5,340 |

|

|

14 |

4,903 |

|

|

15 |

4,900 |

|

|

16 |

4,860 |

|

|

17 |

4,796 |

|

|

18 |

4,699 |

|

|

19 |

4,433 |

|

|

20 |

4,400 |

|

|

21 |

4,200 |

|

|

22 |

4,000 |

|

|

23 |

3,900 |

|

|

24 |

3,465 |

|

|

25 |

3,050 |

|

|

26 |

2,915 |

|

|

27 |

2,900 |

|

|

28 |

2,660 |

|

|

29 |

2,566 |

|

|

30 |

2,550 |

|

|

31 |

2,350 |

|

|

32 |

2,289 |

|

|

33 |

2,257 |

|

|

34 |

2,140 |

|

|

34 |

2,140 |

|

|

35 |

2,025 |

|

|

36 |

2,020 |

|

|

37 |

2,018 |

|

|

38 |

2,000 |

|

|

39 |

1,785 |

|

|

40 |

1,763 |

|

|

41 |

1,681 |

|

|

42 |

1,600 |

|

|

43 |

1,466 |

|

|

44 |

1,459 |

|

|

45 |

1,382 |

|

|

46 |

1,338 |

|

|

47 |

1,327 |

|

|

48 |

1,283 |

|

|

49 |

1,275 |

*Revenues cover all four 3PL Segments (DTM, ITM, DCC and VAWD), are company reported or A&A estimates, and have been converted to $US using the annual average exchange rate, as of April 2023. Copyright © 2023 Armstrong & Associates, Inc.

*In-house logistics revenues were capped at 50% for fairness.

Pressure on margins

Despite the profits many 3PLs have realized, input costs related to fuel, labor, and real estate have been rising for years and accelerated during the pandemic.

“The good news is that in 2020 and 2021 those increasing input costs came with increased demand fueled by underlying economic growth, e-commerce, and supply chain rebalancing,” says John Murnane, senior partner at global management consulting firm McKinsey & Co. And this meant two things for 3PLs: demand was growing and customers understood the underlying situation that increased rates were in line with costs.

Volumes grew between 2020 and 2021, with truckload (TL) shipments growing approximately 8%, less-than-truckload (LTL) shipments 6%, and intermodal units 4%. Accordingly, TL rates increased by approximately 32%; LTL by 14%; and intermodal by 15%. “So, despite tough headwinds on costs, the performance of the sector was overall good,” says Murnane.

Carrier demand remained tight for the first half of 2022, and then shipper demand and rates started to trend down in the third quarter of 2022 into 2023. However, experts now find that in the latter half of 2022 and into 2023 input costs continued to rise while demand decelerated.

“The 3PL market is now beginning to normalize to pre-pandemic conditions as we move into a potential Federal Reserve induced economic recession as it tries to stave off inflation,” says Armstrong. “Shippers are focused on drawing down on-hand inventories to reduce associated carrying costs for consumer and retail products, and that’s driving a downshift in international and domestic transportation demand and rates.”

In its “2023 3PL State of the Market Survey,” London-based Transport Intelligence (Ti) found that 90% of its provider respondents are currently experiencing increased pressures on margins, driven mainly by increased costs and increased competition.

“Given the current economic climate, these results are not surprising. Costs for 3PLs have been increasing across the board as record-high inflation persists. Third-party logistics providers are also having to contend with a new wave of fulfillment competitors chasing e-commerce market share—from single location warehousing companies that cater to fulfilling orders for online retailers and Amazon preparation and fulfillment services, to multi-location providers offering on-demand warehouse solutions.” ” says Nia Hudson, Ti research analyst.

Furthermore, the Ti survey found that 50.7% of respondents believed that pressures will continue to intensify over the next 12 months, having a negative effect on margins. “We’re also seeing a rebalancing of customer demand, particularly in the e-commerce vertical, driven by the effects of the war in Ukraine, inflation, disrupted global supply chains, and a general feeling of economic uncertainty,” says Hudson.

Armstrong & Associates Top 50 Global 3PLs (Largest U.S. 3PLs Ranked by 2022 Logistics Gross Revenue/Turnover)

|

2022 |

Third-party Logistics Provider |

2022 Gross Logistics Revenue |

|

1 |

46,864 |

|

|

2 |

45,590 |

|

|

3 |

34,883 |

|

|

4 |

28,325 |

|

|

5 |

23,874 |

|

|

6 |

19,932 |

|

|

7 |

18,700 |

|

|

8 |

17,071 |

|

|

9 |

16,405 |

|

|

10 |

14,423 |

|

|

11 |

14,294 |

|

|

12 |

13,766 |

|

|

13 |

12,624 |

|

|

14 |

10,483 |

|

|

15 |

8,993 |

|

|

16 |

8,918 |

|

|

17 |

8,849 |

|

|

18 |

8,710 |

|

|

19 |

8,243 |

|

|

20 |

7,788 |

|

|

21 |

7,466 |

|

|

22 |

6,947 |

|

|

23 |

6,600 |

|

|

24 |

6,506 |

|

|

25 |

6,410 |

|

|

26 |

6,300 |

|

|

27 |

6,053 |

|

|

28 |

5,340 |

|

|

29 |

4,900 |

|

|

30 |

4,796 |

|

|

31 |

Hellmann Worldwide Logistics |

4,718 |

|

32 |

4,699 |

|

|

33 |

4,433 |

|

|

34 |

4,400 |

|

|

35 |

4,200 |

|

|

36 |

4,076 |

|

|

37 |

4,000 |

|

|

38 |

3,946 |

|

|

39 |

3,900 |

|

|

40 |

3,842 |

|

|

41 |

3,711 |

|

|

42 |

3,665 |

|

|

43 |

3,538 |

|

|

44 |

3,465 |

|

|

45 |

3,274 |

|

|

46 |

2,985 |

|

|

47 |

2,915 |

|

|

48 |

2,660 |

|

|

49 |

2,566 |

|

|

50 |

2,550 |

*Revenues cover all four 3PL Segments (DTM, ITM, DCC and VAWD), are company reported or A&A estimates, and have been converted to $US using the annual average exchange rate, as of April 2023. Copyright © 2023 Armstrong & Associates, Inc.

*In-house logistics revenues were capped at 50% for fairness.

Many of the top contract logistics providers indicate that they will experience less revenue growth in 2023. GXO, for example, expects organic revenue growth of 6% to 8% in 2023, versus 13.3% year-over-year growth in 2022. Similarly, UPS chief executive Carol Tome described the outlook for 2023 as “cloudy at best.”

“It will be interesting to see the first quarter 2023 revenue data of those top contract logistics providers, which should give us a clearer picture of the market’s current state,” Hudson adds.

Efficiency and differentiation

To manage this pressure, 3PLs are focusing on efficiency and differentiation and are investing in initiatives such as labor retention, asset utilization, and automation.

“Logistics providers are pushing hard to invest in efficiency to deal with increasing inflation, a tough labor environment, and the need to drive better service,” says Murnane. “The efforts are aimed to shield shippers for a full pass through of the rising costs. Providers are also trying to do more to justify the price increases needed to justify the pass through of cost increases.”

While 3PLs don’t expect an immediate impact from investments in automation, many are using it in increasingly sophisticated ways. “The ROI for some of the automation opportunities are becoming more attractive, thus expected to be leveraged,” says Murnane.

To distinguish themselves, some are also investing in sustainable programs and equipment and also adding value by either growing organically (near-shore/cross-border solutions and reverse logistics) or through programmatic merger and acquisition (M&A). “M&A is becoming attractive as strategic players are finding that rising interest rates are proving more challenging for financial sponsors than strategic investors,” adds Murnane.

Economic factors

Today, global economics is making an impact on 3PLs. E-commerce revenue, which became a major profit sector for 3PLs during the pandemic, is especially being affected. “The revenue growth that many 3PL providers saw in 2021—often in the double digits—will likely not be repeated this year, particularly in the first half of the year,” predicts Hudson.

However, e-commerce does continue to grow, albeit at a slower pace. Consequently, 3PLs continue to invest rigorously in warehouse robotics and automation to meet customer expectations for fast, reliable deliveries and an abundance of product choices. For example, DHL Supply Chain announced plans in 2022 to invest $15 million to further automate its warehouses as part of DHL Supply Chain’s Accelerated Digitalization agenda.

Armstrong finds that a lot of shippers are examining their supply chain networks and providers to improve inventory management and on-time delivery performance. “We anticipate continued focus on supply chain network flexibility and warehouse optimization throughout 2023,” he adds.

3PL market segments by the numbers

A closer look at the 3PL industry indicates variations of strengths and weaknesses within its various segments.

Armstrong & Associates (A&A) find that the non-asset-based domestic transportation management segment (DTM) led all other 3PL segments with net revenue growth of 33.8% to $26.4 billion, while overall gross revenue increased a healthy 14.4% to $159 billion.

Of the $159 billion in DTM gross revenue, 84% is from freight brokerage and 16% is from managed transportation services. DTM gross profit margins grew to 16.6%, reversing a downward margin trend from 16.1% in 2019 to 14.2% in 2021.

“The increase in DTM gross margin can be attributed to shippers continuing to pay contracted or agreed to rates to 3PLs, while 3PLs in turn paid less for spot-market truckload carrier capacity,” says Armstrong, who surmises that the true leaders are those 3PLs with strong carrier management skills that have technologically innovated.

“This allows them to efficiently tap long-standing carrier relationships to cover shipper demand versus being over reliant on load boards to buy capacity at spot-market rates,” says Armstrong.

Compared to 2021 when the international transportation management (ITM) 3PL market segment realized an unheard of 74.9% gross revenue gain and 44.6% net revenue increase from COVID-driven demand from shippers focused on replenishing inventories to meet strong consumer demand, A&A finds ITM’s 2022 gross revenue growth of 19.3% to $146 billion and net revenue growth of 19.7% to $42.6 billion

seemingly underwhelming.

ITM includes air and ocean freight forwarding, associated inland transportation, shipment consolidation and deconsolidation, customs house brokerage, and related warehousing services.

In the third quarter of 2022, ocean shipping rates and domestic transportation rates began to “disinflate” in the United States, as consumer demand moderated and supply chain operations stabilized.

This has caused freight rates from Asia to the United States to trend downward to pre-pandemic levels. China to the United States and European ocean shipping rates have declined as much as 90% since the peak in early 2022.

The asset-heavy dedicated contract carriage (DCC) market segment delivered the second largest year-over-year net revenue growth of 27.4% to $29.2 billion in 2022. Gross revenue increased 27.7% to $29.5 billion.

“DCC’s growth benefited from shippers wanting to lock in capacity after a turbulent 2021, an increased ability to attract drivers through wage increases and better recruiting, and having ample capital to invest in equipment,” says Armstrong. “In addition, those 3PLs with freight brokerages that could handle ‘overflow’ business from DCC operations as dedicated or spot truckload capacity tended to do well.”

Traditional DCC contracts have one- to three-year terms with specific trucking assets being dedicated to customers. “This makes DCC contracts much ‘stickier’ than standard shipper/carrier trucking contracts and less susceptible to declines in the truckload spot market,” says Armstrong. “So, DCC has an advantage when truckload capacity is increasing from softer demand and rates are declining.”

A&A finds that the value-added warehousing and distribution (VAWD) market segment did extremely well in 2022 and had the third highest 3PL segment net revenue growth of 21.1% to $49.8

billion. Gross revenue increased 22.7% to $67 billion.

“Most VAWD 3PLs had full warehouses in 2022 and were scrambling to find more, as warehouse inventory space increased 10% to 2.6 billion square feet,” says Armstrong.

A&A research also found that 2022 marked the first year that multi-client warehouse space at 54% of total warehouse space in the United States exceeded that of dedicated space primarily due to strong growth in e-commerce fulfillment.

“E-commerce fulfillment continues to be one of the fastest growing domestic 3PL subsegments, having a compound annual growth rate of 28.5% from 2016 to 2022,” Armstrong adds.

- Karen Thuermer

SC

MR

Explore

Explore

Topics

Procurement & Sourcing News

- Three frameworks for creative problem-solving in supply chain

- Mitigating geopolitical uncertainty: 4 essential tactics for industrial CSCOs

- Supply chain strategy for medical devices: A Q&A with industry expert Sanjay Gupta

- Inventory Management and the Supply Chain: Outlook 2025

- How technological innovation is paving the way for a carbon-free future in logistics and supply chains

- Parcel shipping spend: The untamed holdout in today’s supply chains

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks