Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

July-August 2021

We all know the old saying: “When the going gets tough, the tough get going.” It has been repeated so often it’s cliché. I’d like to suggest a variation: “When the going gets tough, leadership matters.” To say that supply chains have had a tough time of it would be an understatement. Despite the positive vaccine news here in the United States, global supply chains are not out of the woods yet. Browse this issue archive.Need Help? Contact customer service 847-559-7581 More options

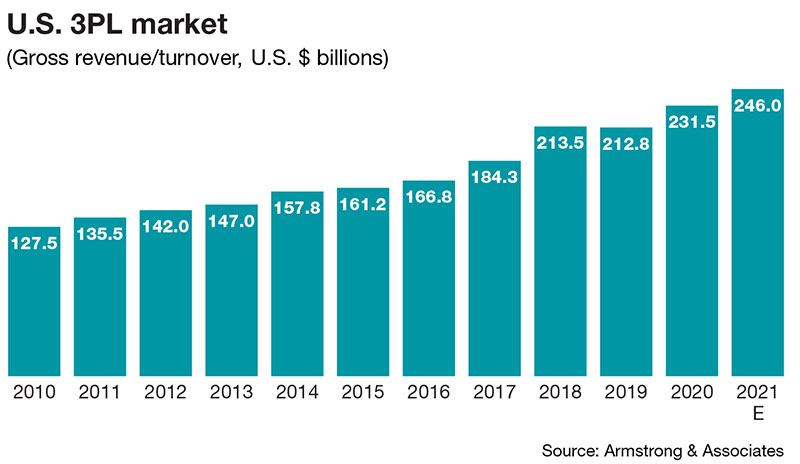

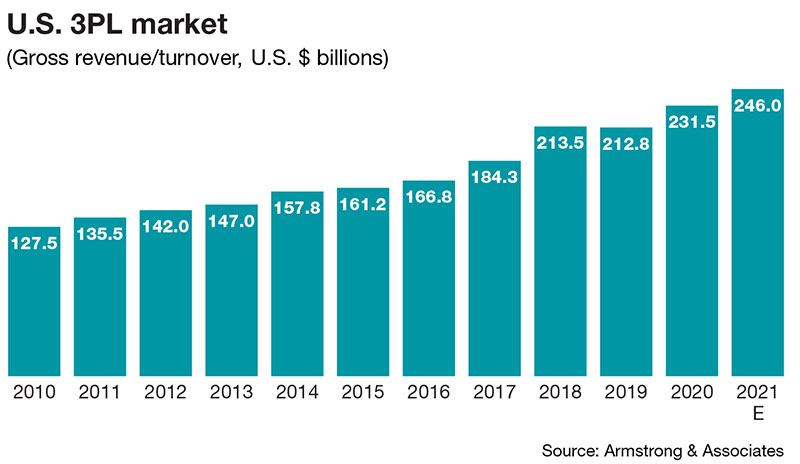

Armstrong & Associates (A&A) reports that the third-party logistics (3PL) providers industry will realize an estimated $246 billion in gross revenues in 2021, up 6.3% compared to $231.5 billion in 2020. The 2020 revenues were up 8.8% over 2019.

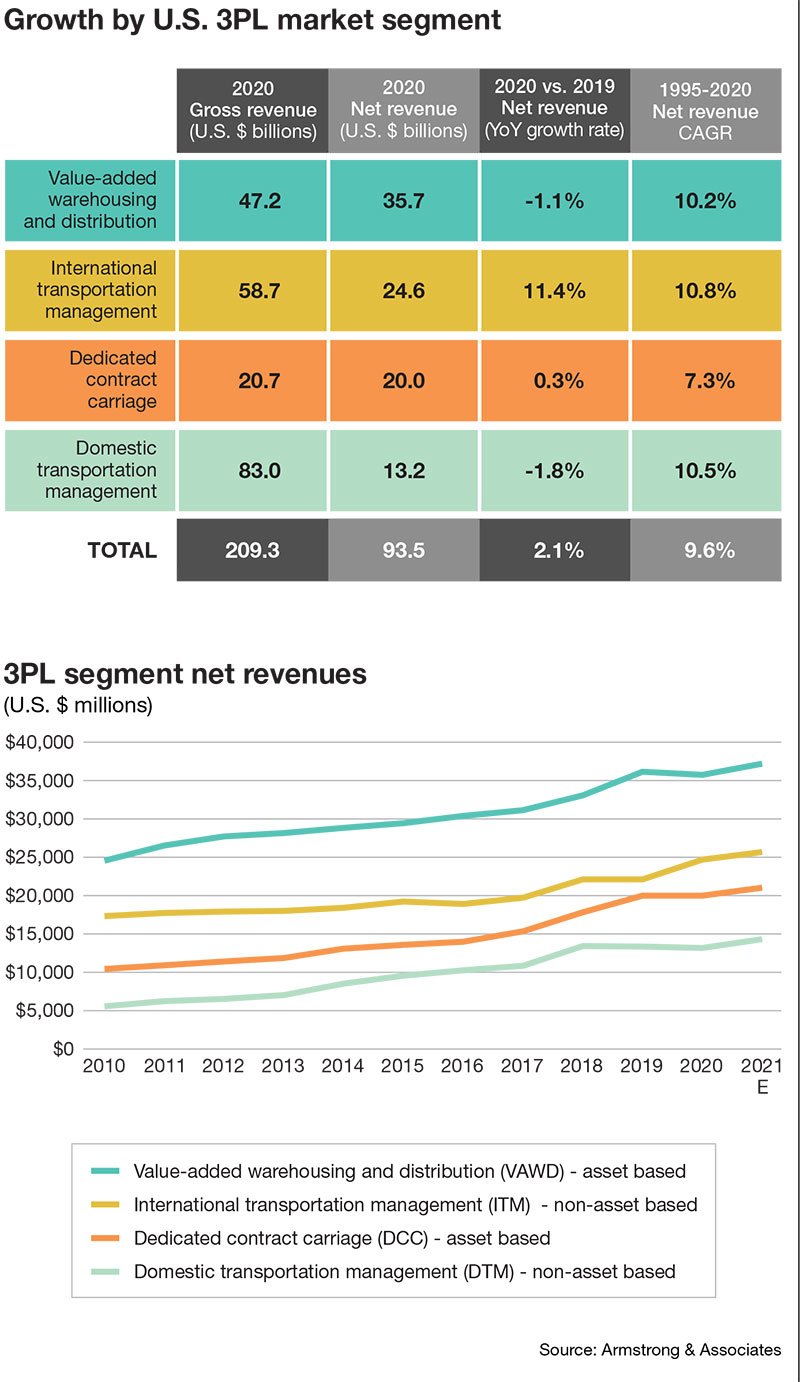

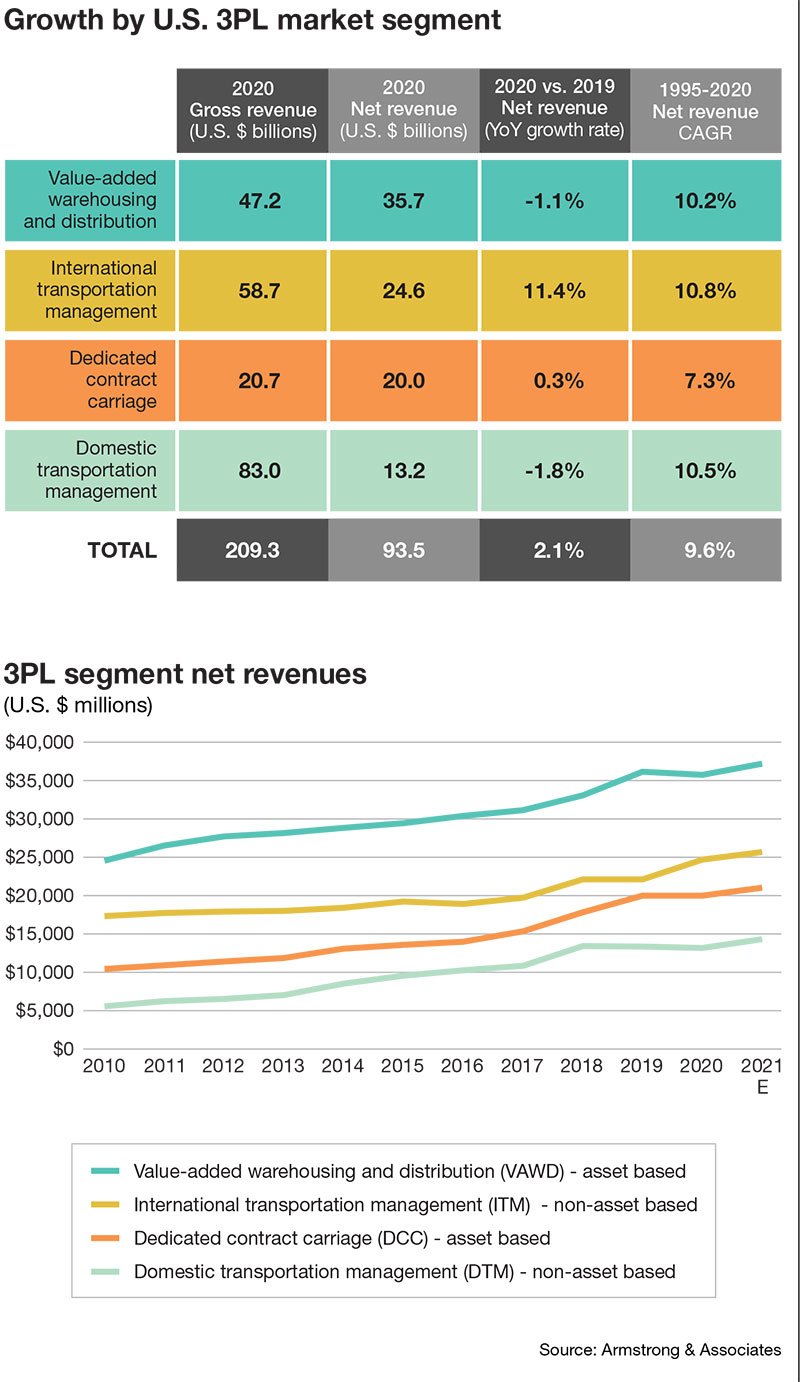

“Most of that growth in 2020 came from international and domestic transportation management, which responded to COVID-related demands for PPE and to restock inventories upon economic reopenings,” reports Evan Armstrong, A&A president.

While revenue rankings changed little for the top U.S. 3PLs in 2020 compared to 2019, J.B. Hunt did move from a No. 4 position to No. 5 and was replaced by Expeditors, which moved up from No. 5 to No. 4. DHL Supply Chain & Global Forwarding and Kuehne + Nagel retained the top two positions for in A&A’s 2020 Top 50 Global 3PLs. DB Schenker moved from a No. 4 ranking in 2019 to No. 3, and Nippon Express slipped from No. 3 in 2019 to No. 4. (See charts.)

3PLs fared better overall in 2020 than in 2019, which registered the industry’s first decline since 2009, but A&A reports that segment growth was uneven.

“Total 3PL segment net revenues [gross revenues less purchased transportation] grew 2.1% to $93.5 billion, reflecting gross margin compression due to a volatile carrier sourcing market and transportation management 3PLs spending more to secure hard-to-find carrier capacity,” Armstrong says. “The overall gross margin for all segments declined from 44% to 41%.”

Numerous factors continue to have an impact on the 3PL industry, most notably consolidation, e-commerce, and digitalization as well as the need to be resilient and responsive. Following is a look at each.

Consolidation

While the pandemic made for limited merger and acquisition activity, Nick Bailey, head of research for Transport Intelligence Ltd., observes that early 2021 indicates the appetite for 3PL M&A sector is as healthy as ever.

“We’ve seen big moves from Kuehne + Nagel (K+N), SF Express and most recently DSV Panalpina with its acquisition of Agility’s Global Integrated Logistics operations,” Bailey says. “Each added scale and established or deepened geographic coverage and service offerings.”

Bailey attributes this to changes in global trade patterns, including China’s impact on global supply chains, digitalization, the rapid development of technologies that increase the strategic value of supply chain operations to shippers, and the fallout of the COVID-19 pandemic. “3PLs are looking to M&A to increase competence and market share,” he says.

|

2020 Rank | Third-party Logistics Provider (3PL) | 2020 Gross Logistics Revenue |

1 | 15,490 | |

2 | 12,107 | |

3 | 11,048 | |

4 | 10,116 | |

5 | 9,198 | |

6 | 6,789 | |

7 | 4,415 | |

8 | 4,280 | |

9 | 4,270 | |

10 | 4,138 | |

11 | 4,100 | |

12 | 4,020 | |

13 | 3,774 | |

14 | 3,646 | |

15 | 3,400 | |

16 | 3,200 | |

17 | 2,814 | |

18 | 2,631 | |

19 | 2,627 | |

20 | 2,543 | |

21 | 2,512 | |

22 | 2,300 | |

23 | 2,196 | |

24 | 2,100 | |

24 | 2,100 | |

25 | 2,000 | |

26 | 1,983 | |

27 | 1,651 | |

28 | 1,650 | |

29 | 1,645 | |

30 | 1,552 | |

31 | 1,527 | |

32 | 1,430 | |

33 | 1,300 | |

33 | 1,300 | |

34 | 1,223 | |

35 | 1,220 | |

36 | 1,203 | |

37 | 1,200 | |

38 | 1,190 | |

39 | 1,172 | |

40 | 1,115 | |

41 | 1,040 | |

42 | 1,018 | |

43 | 1,011 | |

44 | 1,010 | |

45 | 974 | |

46 | 916 | |

47 | 876 | |

48 | 874 |

*Revenues are company reported or Armstrong & Associates, Inc. estimates and have been converted to US$ using the average annual exchange rate in order to make non-currency related growth comparisons. Copyright © 2020 Armstrong & Associates, Inc.

Affecting these factors are sky-high freight rates, which are expected to remain throughout most of 2021, and available capital to fund deals.

Bailey suggests that as 3PLs looks to add geographic coverage and complementary services, shippers may find a shifting landscape of services and potentially increased price competition as 3PLs compete for share on key trade lanes.

“Large 3PLs will also look to M&As to kickstart their digital forwarding offer,” Bailey adds. Case in point: Bollore’s acquisition of Ovrsea.

Mid-sized 3PLs may not be able to compete on scale or provide the technology shippers’ demand, he warns.

E-commerce

McKinsey & Co. hit the nail on the head when it said e-commerce moved 10 years ahead in just 90 days. According to the consulting firm, e-commerce jumped 15% to 35% during the U.S. lockdown in Q1 2020. E-commerce continues to be the fastest growing domestic 3PL segment, with a compound annual growth rate of 28% since 2017, states A&A.

Cathy Morrow Roberson, president of consulting firm Logistics Trends and Insight, emphasizes: “Today, everything coming into a warehouse needs to be processed and fulfilled fast.” She attributes this to the “Amazon effect” whereby consumers now expect same-day rather than two-day deliveries. “3PLs providers are jumping into this. It’s no longer a space for UPS or Fedex,” she says. “3PLs need to link every part of the supply chain.”

Just as shipments must move fast, so must 3PLs in order to adjust their business models if they want to compete. Roberson notes that some 3PLs, such as SEKO, are building and partnering with startup tech companies that offer Cloud technology to help not only fulfill orders quickly, but create last-mile options around urban areas. “It’s an investment that has become a requirement,” she says.

3PLs are particularly re-engineering processes and evaluating automation to increase productivity. “They are procuring software, such as distributive order management, that allows them to offer services outside their four walls,” reports Bob Thomson, senior director, enVista. “They also continue to focus on reverse logistics and value-added service that helps reduce labor requirements.”

Such a shift, Thomson notes, has also created new customers for legacy big box consumer packaged goods (CPG) 3PLs. “They now have to learn, along with their customers, how to fulfill package-size shipments and deliver them efficiently,” he says. “Consequently, 3PLs are seeing an increase in service level agreements and smaller order profiles.”

A&A observes how value-added warehousing and distribution (VAWD) 3PLs continue to benefit from growth in retail e-commerce business. “Many VAWD 3PLs are supporting retail brands’ strategies to manage their own order fulfillment channels and avoid being captive to large e-retailer platforms such as Amazon,” Armstrong says.

Operationally, the growth in e-commerce has also meant an expansion in multi-client warehousing/fulfillment operations, many of which have footprints under 100,000 square feet. But an ongoing headwind for VAWD 3PLs, A&A maintains, is the “Amazon effect.”

“3PLs are continuing to see increased competition from Fulfillment by Amazon (FBA), which controls 60% of the U.S. e-commerce 3PL market,” says Armstrong. The result has been dramatic on warehouse worker wages and lease rates in key distribution locations. These factors are consequently driving significant interest from 3PLs to evaluate the benefits of automation and how it can eliminate mundane tasks and physical job requirements. This includes autonomous robotic solutions.

“With some autonomous robots costing less than $500 per month to operate, the cost/benefit and positive return on investment are increasing 3PLs’ interest in warehouse robots to support activities such as picking, put away, and cycle counting,” Armstrong says.

|

2020 Rank | Third-party Logistics Provider (3PL) | 2020 Gross Logistics Revenue |

1 | DHL Supply Chain & Global Forwarding | 28,453 |

2 | Kuehne + Nagel | 25,787 |

3 | DB Schenker | 20,761 |

4 | 19,347 | |

5 | 18,269 | |

6 | C.H. Robinson | 15,490 |

7 | XPO Logistics | 12,107 |

8 | Sinotrans | 11,959 |

9 | UPS Supply Chain Solutions | 11,048 |

10 | Expeditors | 10,116 |

11 | J.B. Hunt (JBI, DCS & ICS) | 9,198 |

12 | 9,135 | |

13 | 7,400 | |

14 | 7,260 | |

15 | 7,174 | |

16 | 6,963 | |

17 | 6,867 | |

18 | 6,591 | |

19 | 6,346 | |

20 | 5,365 | |

21 | 5,265 | |

22 | 5,003 | |

23 | 4,280 | |

24 | 4,270 | |

25 | 4,248 | |

26 | 4,138 | |

27 | 4,100 | |

28 | 4,018 | |

29 | 3,774 | |

30 | 3,646 | |

31 | 3,400 | |

32 | 3,202 | |

33 | Penske Logistics | 3,200 |

34 | Schneider Logistics & Dedicated | 2,814 |

35 | 2,740 | |

36 | NFI | 2,631 |

37 | Echo Global Logistics | 2,512 |

38 | 2,491 | |

39 | 2,334 | |

40 | 2,300 | |

41 | 2,274 | |

42 | 2,196 | |

43 | 2,155 | |

44 | 2,100 | |

44 | 2,100 | |

45 | 1,990 | |

46 | 1,983 | |

47 | 1,930 | |

48 | 1,925 | |

49 | 1,651 |

*Revenues are company reported or Armstrong & Associates, Inc. estimates and have been converted to US$ using the average annual exchange

rate in order to make non-currency related growth comparisons.

**In-house logistics operations were capped at 50% for fairness.

Copyright © 2021 Armstrong & Associates, Inc.

Digitalization

The last decade has seen an explosion of data created around logistics operations as sensor technology and internet connectivity have both become increasingly cheap and ubiquitous. As a result, 3PLs are set to undergo a shift in the short- and medium-term that promotes greater use and sharing of data captured and created.

“Those 3PLs that can most effectively expand the core of their value proposition to include the capturing, contextualisation and sharing of logistics and supply chain information will be best placed to navigate the opportunities digitalization offers,” says Bailey.

Already, services available through the industry has seen a huge boost thanks to digitization. “The speed at which digitalized services and business models are becoming standard in the industry is changing the relationship between 3PLs and shippers,” Bailey adds. “3PLs are increasingly being pushed to provide information alongside the physical movement of goods which empowers shippers to make decisions that improve their own business processes.”

Armstrong points out how the ongoing digitalization of transactional truckload domestic transportation management (DTM)/freight brokerage continues at a rapid pace, as more large shippers have built integrations to 3PL’s transportation management systems (TMS) for API truckload spot-market rate quoting and automated load tendering and booking.

In turn, most of the top freight brokers are strategically looking at ways to digitalize operations while adding value through improved carrier management, and customer and carrier experiences.

“About 20 3PLs have built TMS interfaces that provide these shippers instant rate quotes and the ability to complete load tendering and booking through the system APIs,” says Armstrong. “This process automates traditional spot-market freight brokerage sales functions and is increasing shipper’s use of more spot versus contract pricing.”

Armstrong notes how increasingly important it is for shippers to build APIs with their top transportation management 3PLs to reduce tendering friction and more efficiently secure spot-market truckload capacity. “Getter closer to 3PLs via technology is one way to better manage your supply chain and keep enough carrier capacity available to meet demand,” he says.

In addition, sales automation for spot-market truckload automation is happening in conjunction with the automation of carrier sales functions within freight brokers using intelligent capacity management systems to digitally match shippers’ loads to carriers based on historical and real-time carrier capacity data analyzed via machine learning/artificial intelligence algorithms.

“This digital freight matching [DFM] capability has become a competitive differentiator within the DTM segment, as DTM 3PLs look to increase the number of shipments they manage per person per day,” Armstrong says. “Ultimately, this automation will put further pressure on freight brokerage gross margins, while it should improve overall profitability.”

Takeaways

Given the rapid changes occurring within the 3PL industry, providers are increasingly called upon to address such topics as network analysis, inventory optimization, and packing design. In addition, they can provide network solutions to warehousing to cover most of the domestic market within two-day delivery.

“The additional benefit we see now is spreading the demand to help with capacity issues as well as having an additional node if the one DC goes down due to the pandemic,” Thomson says.

3PLs are also having to offer new delivery service types. Particularly attractive for 3PLs that also operate warehouses is the ability to offer final- mile capacity. “They’re also responding to freight capacity more proactively to utilize spot markets,” Thomson says.

Going forward industry experts expect more M&A activity within the 3PL industry. Digitalization and automation will only increase as the industry becomes more competitive. Sourcing will become even more critical as manufacturers work to replenish the low inventories that resulted during the pandemic. China is expected to be a factor impacting 3PLs as shippers and manufacturers increasingly consider locations in which goods can be sourced and produced.

“As China’s role in global value chains evolves and stages of manufacturing spread regionally, and perhaps globally, 3PLs and shippers will potentially face a number of complex challenges around the timing and sequencing of production stages that rely more heavily on coordinated supply chain movements over larger geographies,” comments Bailey.

Roberson recalls: “A few years ago Fred Smith, CEO of FedEx said on an earnings call, ‘gone are the days of traditional peak season. Expect a continuous peak throughout the year. It will be like waves.’”

SC

MR

Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

July-August 2021

We all know the old saying: “When the going gets tough, the tough get going.” It has been repeated so often it’s cliché. I’d like to suggest a variation: “When the going gets tough, leadership matters.”… Browse this issue archive. Access your online digital edition. Download a PDF file of the July-August 2021 issue.Armstrong & Associates (A&A) reports that the third-party logistics (3PL) providers industry will realize an estimated $246 billion in gross revenues in 2021, up 6.3% compared to $231.5 billion in 2020. The 2020 revenues were up 8.8% over 2019.

“Most of that growth in 2020 came from international and domestic transportation management, which responded to COVID-related demands for PPE and to restock inventories upon economic reopenings,” reports Evan Armstrong, A&A president.

While revenue rankings changed little for the top U.S. 3PLs in 2020 compared to 2019, J.B. Hunt did move from a No. 4 position to No. 5 and was replaced by Expeditors, which moved up from No. 5 to No. 4. DHL Supply Chain & Global Forwarding and Kuehne + Nagel retained the top two positions for in A&A’s 2020 Top 50 Global 3PLs. DB Schenker moved from a No. 4 ranking in 2019 to No. 3, and Nippon Express slipped from No. 3 in 2019 to No. 4. (See charts.)

3PLs fared better overall in 2020 than in 2019, which registered the industry’s first decline since 2009, but A&A reports that segment growth was uneven.

“Total 3PL segment net revenues [gross revenues less purchased transportation] grew 2.1% to $93.5 billion, reflecting gross margin compression due to a volatile carrier sourcing market and transportation management 3PLs spending more to secure hard-to-find carrier capacity,” Armstrong says. “The overall gross margin for all segments declined from 44% to 41%.”

Numerous factors continue to have an impact on the 3PL industry, most notably consolidation, e-commerce, and digitalization as well as the need to be resilient and responsive. Following is a look at each.

Consolidation

While the pandemic made for limited merger and acquisition activity, Nick Bailey, head of research for Transport Intelligence Ltd., observes that early 2021 indicates the appetite for 3PL M&A sector is as healthy as ever.

“We’ve seen big moves from Kuehne + Nagel (K+N), SF Express and most recently DSV Panalpina with its acquisition of Agility’s Global Integrated Logistics operations,” Bailey says. “Each added scale and established or deepened geographic coverage and service offerings.”

Bailey attributes this to changes in global trade patterns, including China’s impact on global supply chains, digitalization, the rapid development of technologies that increase the strategic value of supply chain operations to shippers, and the fallout of the COVID-19 pandemic. “3PLs are looking to M&A to increase competence and market share,” he says.

|

2020 Rank |

Third-party Logistics Provider (3PL) |

2020 Gross Logistics Revenue |

|

1 |

15,490 |

|

|

2 |

12,107 |

|

|

3 |

11,048 |

|

|

4 |

10,116 |

|

|

5 |

9,198 |

|

|

6 |

6,789 |

|

|

7 |

4,415 |

|

|

8 |

4,280 |

|

|

9 |

4,270 |

|

|

10 |

4,138 |

|

|

11 |

4,100 |

|

|

12 |

4,020 |

|

|

13 |

3,774 |

|

|

14 |

3,646 |

|

|

15 |

3,400 |

|

|

16 |

3,200 |

|

|

17 |

2,814 |

|

|

18 |

2,631 |

|

|

19 |

2,627 |

|

|

20 |

2,543 |

|

|

21 |

2,512 |

|

|

22 |

2,300 |

|

|

23 |

2,196 |

|

|

24 |

2,100 |

|

|

24 |

2,100 |

|

|

25 |

2,000 |

|

|

26 |

1,983 |

|

|

27 |

1,651 |

|

|

28 |

1,650 |

|

|

29 |

1,645 |

|

|

30 |

1,552 |

|

|

31 |

1,527 |

|

|

32 |

1,430 |

|

|

33 |

1,300 |

|

|

33 |

1,300 |

|

|

34 |

1,223 |

|

|

35 |

1,220 |

|

|

36 |

1,203 |

|

|

37 |

1,200 |

|

|

38 |

1,190 |

|

|

39 |

1,172 |

|

|

40 |

1,115 |

|

|

41 |

1,040 |

|

|

42 |

1,018 |

|

|

43 |

1,011 |

|

|

44 |

1,010 |

|

|

45 |

974 |

|

|

46 |

916 |

|

|

47 |

876 |

|

|

48 |

874 |

*Revenues are company reported or Armstrong & Associates, Inc. estimates and have been converted to US$ using the average annual exchange rate in order to make non-currency related growth comparisons. Copyright © 2020 Armstrong & Associates, Inc.

Affecting these factors are sky-high freight rates, which are expected to remain throughout most of 2021, and available capital to fund deals.

Bailey suggests that as 3PLs looks to add geographic coverage and complementary services, shippers may find a shifting landscape of services and potentially increased price competition as 3PLs compete for share on key trade lanes.

“Large 3PLs will also look to M&As to kickstart their digital forwarding offer,” Bailey adds. Case in point: Bollore’s acquisition of Ovrsea.

Mid-sized 3PLs may not be able to compete on scale or provide the technology shippers’ demand, he warns.

E-commerce

McKinsey & Co. hit the nail on the head when it said e-commerce moved 10 years ahead in just 90 days. According to the consulting firm, e-commerce jumped 15% to 35% during the U.S. lockdown in Q1 2020. E-commerce continues to be the fastest growing domestic 3PL segment, with a compound annual growth rate of 28% since 2017, states A&A.

Cathy Morrow Roberson, president of consulting firm Logistics Trends and Insight, emphasizes: “Today, everything coming into a warehouse needs to be processed and fulfilled fast.” She attributes this to the “Amazon effect” whereby consumers now expect same-day rather than two-day deliveries. “3PLs providers are jumping into this. It’s no longer a space for UPS or Fedex,” she says. “3PLs need to link every part of the supply chain.”

Just as shipments must move fast, so must 3PLs in order to adjust their business models if they want to compete. Roberson notes that some 3PLs, such as SEKO, are building and partnering with startup tech companies that offer Cloud technology to help not only fulfill orders quickly, but create last-mile options around urban areas. “It’s an investment that has become a requirement,” she says.

3PLs are particularly re-engineering processes and evaluating automation to increase productivity. “They are procuring software, such as distributive order management, that allows them to offer services outside their four walls,” reports Bob Thomson, senior director, enVista. “They also continue to focus on reverse logistics and value-added service that helps reduce labor requirements.”

Such a shift, Thomson notes, has also created new customers for legacy big box consumer packaged goods (CPG) 3PLs. “They now have to learn, along with their customers, how to fulfill package-size shipments and deliver them efficiently,” he says. “Consequently, 3PLs are seeing an increase in service level agreements and smaller order profiles.”

A&A observes how value-added warehousing and distribution (VAWD) 3PLs continue to benefit from growth in retail e-commerce business. “Many VAWD 3PLs are supporting retail brands’ strategies to manage their own order fulfillment channels and avoid being captive to large e-retailer platforms such as Amazon,” Armstrong says.

Operationally, the growth in e-commerce has also meant an expansion in multi-client warehousing/fulfillment operations, many of which have footprints under 100,000 square feet. But an ongoing headwind for VAWD 3PLs, A&A maintains, is the “Amazon effect.”

“3PLs are continuing to see increased competition from Fulfillment by Amazon (FBA), which controls 60% of the U.S. e-commerce 3PL market,” says Armstrong. The result has been dramatic on warehouse worker wages and lease rates in key distribution locations. These factors are consequently driving significant interest from 3PLs to evaluate the benefits of automation and how it can eliminate mundane tasks and physical job requirements. This includes autonomous robotic solutions.

“With some autonomous robots costing less than $500 per month to operate, the cost/benefit and positive return on investment are increasing 3PLs’ interest in warehouse robots to support activities such as picking, put away, and cycle counting,” Armstrong says.

|

2020 Rank |

Third-party Logistics Provider (3PL) |

2020 Gross Logistics Revenue |

|

1 |

DHL Supply Chain & Global Forwarding |

28,453 |

|

2 |

Kuehne + Nagel |

25,787 |

|

3 |

DB Schenker |

20,761 |

|

4 |

19,347 |

|

|

5 |

18,269 |

|

|

6 |

C.H. Robinson |

15,490 |

|

7 |

XPO Logistics |

12,107 |

|

8 |

Sinotrans |

11,959 |

|

9 |

UPS Supply Chain Solutions |

11,048 |

|

10 |

Expeditors |

10,116 |

|

11 |

J.B. Hunt (JBI, DCS & ICS) |

9,198 |

|

12 |

9,135 |

|

|

13 |

7,400 |

|

|

14 |

7,260 |

|

|

15 |

7,174 |

|

|

16 |

6,963 |

|

|

17 |

6,867 |

|

|

18 |

6,591 |

|

|

19 |

6,346 |

|

|

20 |

5,365 |

|

|

21 |

5,265 |

|

|

22 |

5,003 |

|

|

23 |

4,280 |

|

|

24 |

4,270 |

|

|

25 |

4,248 |

|

|

26 |

4,138 |

|

|

27 |

4,100 |

|

|

28 |

4,018 |

|

|

29 |

3,774 |

|

|

30 |

3,646 |

|

|

31 |

3,400 |

|

|

32 |

3,202 |

|

|

33 |

Penske Logistics |

3,200 |

|

34 |

Schneider Logistics & Dedicated |

2,814 |

|

35 |

2,740 |

|

|

36 |

NFI |

2,631 |

|

37 |

Echo Global Logistics |

2,512 |

|

38 |

2,491 |

|

|

39 |

2,334 |

|

|

40 |

2,300 |

|

|

41 |

2,274 |

|

|

42 |

2,196 |

|

|

43 |

2,155 |

|

|

44 |

2,100 |

|

|

44 |

2,100 |

|

|

45 |

1,990 |

|

|

46 |

1,983 |

|

|

47 |

1,930 |

|

|

48 |

1,925 |

|

|

49 |

1,651 |

*Revenues are company reported or Armstrong & Associates, Inc. estimates and have been converted to US$ using the average annual exchange

rate in order to make non-currency related growth comparisons.

**In-house logistics operations were capped at 50% for fairness.

Copyright © 2021 Armstrong & Associates, Inc.

Digitalization

The last decade has seen an explosion of data created around logistics operations as sensor technology and internet connectivity have both become increasingly cheap and ubiquitous. As a result, 3PLs are set to undergo a shift in the short- and medium-term that promotes greater use and sharing of data captured and created.

“Those 3PLs that can most effectively expand the core of their value proposition to include the capturing, contextualisation and sharing of logistics and supply chain information will be best placed to navigate the opportunities digitalization offers,” says Bailey.

Already, services available through the industry has seen a huge boost thanks to digitization. “The speed at which digitalized services and business models are becoming standard in the industry is changing the relationship between 3PLs and shippers,” Bailey adds. “3PLs are increasingly being pushed to provide information alongside the physical movement of goods which empowers shippers to make decisions that improve their own business processes.”

Armstrong points out how the ongoing digitalization of transactional truckload domestic transportation management (DTM)/freight brokerage continues at a rapid pace, as more large shippers have built integrations to 3PL’s transportation management systems (TMS) for API truckload spot-market rate quoting and automated load tendering and booking.

In turn, most of the top freight brokers are strategically looking at ways to digitalize operations while adding value through improved carrier management, and customer and carrier experiences.

“About 20 3PLs have built TMS interfaces that provide these shippers instant rate quotes and the ability to complete load tendering and booking through the system APIs,” says Armstrong. “This process automates traditional spot-market freight brokerage sales functions and is increasing shipper’s use of more spot versus contract pricing.”

Armstrong notes how increasingly important it is for shippers to build APIs with their top transportation management 3PLs to reduce tendering friction and more efficiently secure spot-market truckload capacity. “Getter closer to 3PLs via technology is one way to better manage your supply chain and keep enough carrier capacity available to meet demand,” he says.

In addition, sales automation for spot-market truckload automation is happening in conjunction with the automation of carrier sales functions within freight brokers using intelligent capacity management systems to digitally match shippers’ loads to carriers based on historical and real-time carrier capacity data analyzed via machine learning/artificial intelligence algorithms.

“This digital freight matching [DFM] capability has become a competitive differentiator within the DTM segment, as DTM 3PLs look to increase the number of shipments they manage per person per day,” Armstrong says. “Ultimately, this automation will put further pressure on freight brokerage gross margins, while it should improve overall profitability.”

Takeaways

Given the rapid changes occurring within the 3PL industry, providers are increasingly called upon to address such topics as network analysis, inventory optimization, and packing design. In addition, they can provide network solutions to warehousing to cover most of the domestic market within two-day delivery.

“The additional benefit we see now is spreading the demand to help with capacity issues as well as having an additional node if the one DC goes down due to the pandemic,” Thomson says.

3PLs are also having to offer new delivery service types. Particularly attractive for 3PLs that also operate warehouses is the ability to offer final- mile capacity. “They’re also responding to freight capacity more proactively to utilize spot markets,” Thomson says.

Going forward industry experts expect more M&A activity within the 3PL industry. Digitalization and automation will only increase as the industry becomes more competitive. Sourcing will become even more critical as manufacturers work to replenish the low inventories that resulted during the pandemic. China is expected to be a factor impacting 3PLs as shippers and manufacturers increasingly consider locations in which goods can be sourced and produced.

“As China’s role in global value chains evolves and stages of manufacturing spread regionally, and perhaps globally, 3PLs and shippers will potentially face a number of complex challenges around the timing and sequencing of production stages that rely more heavily on coordinated supply chain movements over larger geographies,” comments Bailey.

Roberson recalls: “A few years ago Fred Smith, CEO of FedEx said on an earnings call, ‘gone are the days of traditional peak season. Expect a continuous peak throughout the year. It will be like waves.’”

SC

MR

More 3PL

- Orchestration: The Future of Supply Chain

- February and year-to-date U.S. import volume is solid, reports S&P Global Market Intelligence

- 2024 retail sales forecast calls for growth, says National Retail Federation

- ISM reports another month of services sector growth in February

- February manufacturing output declines, notes ISM

- How to Create Real Retailer-Brand Loyalty

- More 3PL

Latest Podcast

Explore

Explore

Business Management News

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- Supply chain salaries, job satisfaction on the rise

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks