Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

May-June 2016

The procurement function is at an inflection point.” So begins “The reinvention of procurement," an article by Jonathan Hughes and Danny Ertel, partners at the Boston-based consulting firm Vantage Partners. The authors argue that while many leading companies have transformed their procurement organizations into a linchpin of their enterprise strategy, far too many others remain trapped by procurement models that are out of date in today’s fastpaced economy, where the acquisition of innovation, collaboration, services and solutions is more important than transactions based on the lowest cost per unit. Reinvention is a fitting theme for… Browse this issue archive.Need Help? Contact customer service 847-559-7581 More options

In supply chain circles, MRO management has always been something out of an orphan. The function has struggled to escape its back office image, and typically is characterized by fragmented decisions made by multiple individuals who represent multiple sites and business units. None of the parties involved has a full view of the MRO value chain, resulting in management practices that are well intended, but sub-optimal. They manage MRO independently, with little communication among them, and rely on data collected and stored in siloed systems, without the benefits of any strategies for process governance or unified data maintenance.

With few standard processes in place to manage MRO—how supplies are purchased, stocked, consumed and analyzed—and little or no focus on performance measurement, MRO managers’ decisions tend to be based on subjective rationales expressed in statements such as: “I like that supplier,” “I don’t have the time to set up preferred suppliers,” or “I have always bought parts that way.”

MRO Revolution

Consequently, MRO management has been marked by signs rarely seen in supply chain activity of direct materials today: an expansive base of suppliers; minimal demand visibility; excess, obsolete and dormant inventory; and limited investment in both talent and information technology. If they’ve stopped to think about it at all, senior executives have tolerated such undesirability with rationales such as: “We have a hard time justifying MRO integration because we neither know what the actual MRO spend is, nor have an understanding of total cost of ownerships,” and “MRO involves low-cost items with little potential for savings or value gained from investing in improvement.”

|

This complete article is available to subscribers

only. Click on Log In Now at the top of this article for full access. Or, Start your PLUS+ subscription for instant access. |

SC

MR

Sorry, but your login has failed. Please recheck your login information and resubmit. If your subscription has expired, renew here.

May-June 2016

The procurement function is at an inflection point.” So begins “The reinvention of procurement," an article by Jonathan Hughes and Danny Ertel, partners at the Boston-based consulting firm Vantage Partners.… Browse this issue archive. Access your online digital edition. Download a PDF file of the May-June 2016 issue.In supply chain circles, MRO management has always been something out of an orphan. The function has struggled to escape its back office image, and typically is characterized by fragmented decisions made by multiple individuals who represent multiple sites and business units. None of the parties involved has a full view of the MRO value chain, resulting in management practices that are well intended, but sub-optimal. They manage MRO independently, with little communication among them, and rely on data collected and stored in siloed systems, without the benefits of any strategies for process governance or unified data maintenance.

With few standard processes in place to manage MRO—how supplies are purchased, stocked, consumed and analyzed—and little or no focus on performance measurement, MRO managers' decisions tend to be based on subjective rationales expressed in statements such as: “I like that supplier,” “I don't have the time to set up preferred suppliers,” or “I have always bought parts that way.”

MRO Revolution

Consequently, MRO management has been marked by signs rarely seen in supply chain activity of direct materials today: an expansive base of suppliers; minimal demand visibility; excess, obsolete and dormant inventory; and limited investment in both talent and information technology. If they've stopped to think about it at all, senior executives have tolerated such undesirability with rationales such as: “We have a hard time justifying MRO integration because we neither know what the actual MRO spend is, nor have an understanding of total cost of ownerships,” and “MRO involves low-cost items with little potential for savings or value gained from investing in improvement.”

That stance may once have been excusable but it certainly is not now. Costs associated with MRO are substantial, and rising; and the substandard management of MRO activities hurts performance in many unforeseen ways.

This article draws on recent research conducted by the Center for Supply Chain Research (CSCR) at the Smeal College of Business at The Pennsylvania State University to show how MRO management is changing for the better. The study combined quantitative data on 40 activities in the MRO value chain with qualitative findings to provide insights that the authors believe can be valuable for supply chain managers who are keen to professionalize and modernize their MRO operations. (See sidebar: About the research.)

First, though, it's important to do a reality check about MRO practices today.

About the research

This article is based on a research study conducted by the Center for Supply Chain Research (CSCR) at the Smeal College of Business at The Pennsylvania State University, in collaboration with Supply Chain Management Review, and supported by the CSCR's corporate sponsors.

The study combined data collected from 171 online survey respondents with insights from the literature, the authors' experiences working with companies and interviews with subject matter experts on indirect spend and integrated MRO supply execution. The largest group of survey respondents was from the manufacturing sector (41%), followed by the transportation, warehousing and distribution sectors (16%), wholesalers (9%), and retail companies (8%). More than 10 different industries make up the remaining 26%.

Respondents represented both smaller businesses with less than $50 million in annual revenue (45%) and large companies with revenues of more than $1 billion (45%). Respondents' annual MRO spend is mainly less than $1 million (40%), with the next largest groups tied (14%) between the next lowest spending range of $1 million to $4 million, and the highest spending band of more than $20 million.

The surprising costs of MRO management

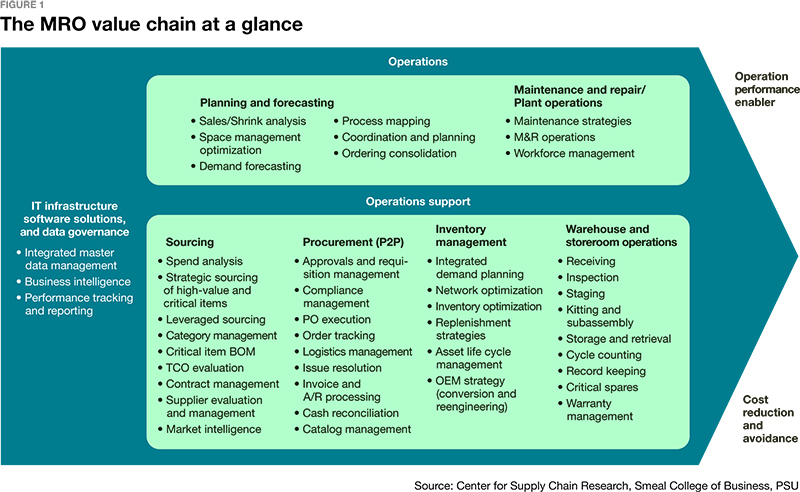

MRO management spans a host of activities across the MRO value chain (see Figure 1). Key management processes include identifying, sourcing, procuring, storing, record keeping and issuing the requisite MRO parts and tools to support operations activities. MRO management also requires the coordination of services such as outsourced procure-to-pay (P2P) processes, storeroom operations, inventory management and reliability. A company's maintenance strategies, demand planning and forecasting, IT infrastructure and applications and data governance are part of its MRO processes and support infrastructure.

Nowadays, aggregate activity across the MRO value chain accounts for 5% to 9% of total indirect spend in typical manufacturing companies, and as much as 10% to 20% for pharmaceutical manufacturers and utilities. That's a substantial increase compared to 20 years ago when MRO costs as a percentage of total indirect spend ranged between 3% and 12%.

Furthermore, the MRO category has steadily grown to account for a larger percentage of total procurement expenditure, largely because continued increases in automation and complexity of capital equipment necessitate more repairs and maintenance. To put that in perspective, our experiences suggest that MRO, if captured accurately, can represent nearly 10% of a company's expenditure, with higher percentages in manufacturing industries.

Costs related to MRO purchasing are just as startling. The sporadic nature of MRO demand—involving low-value, high-volume items mixed with high-value, low-volume specialized items—leads to purchasing processes that are complex, time-consuming and highly transactional. Our experience suggests that MRO purchasing can make up 50% to 70% of a company's total buying transaction volume.

Moreover, companies with poorly managed MRO suffer from extra costs and inefficiencies that their managers may not recognize—notably the inefficiencies associated with searching catalogs, quoting and not rationalizing inventory. Too often, highly-paid maintenance technicians spend their time searching parts catalogs, getting quotes from suppliers and foraging for parts in the storeroom rather than working on repairs and planned maintenance activities. Working capital is unnecessarily tied up in inventory of unwanted, duplicate and obsolete items.

Adding to the difficulties, inadequate stocks of spares and consumables and supply disruptions of critical parts can often occur, resulting in the equipment asset being offline and production schedules being disrupted. And there are many knock-on effects such as excess labor costs due to unplanned shutdowns and/or overtime, scrap and defective product, lost sales and slipshod customer service. It is still very difficult to identify such intangible effects.

Positive signs of change

The good news is that in recent years, more and more companies have been improving their MRO practices. Faced with rising pressures to cut costs and do more with their existing resources, they are recognizing that they can turn MRO from a headache into an enabler of operational excellence that contributes to overall revenue and profitability. The evolution of sophisticated MRO tools and technologies (for example, integrated software, analytics and KPI dashboards) provides further opportunities for MRO improvements.

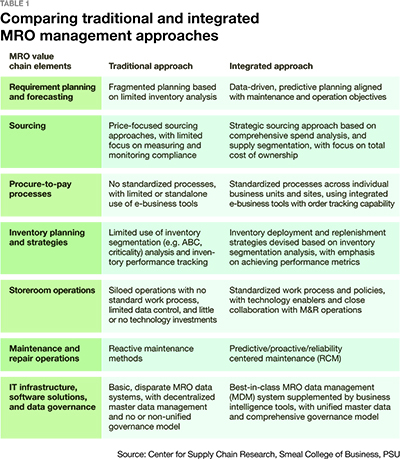

Leading companies are shifting away from the back-office mentality and toward integrated approaches that see and manage MRO as a true value chain. They emphasize best practices in areas such as process standardization, end-to-end alignment, outcome and reliability performance, performance measurement, and data-driven and intelligent-based decisions and planning. Based on the authors' collective experience, interviews with experts and insights from the literature,3 we have identified discrete areas in which an integrated approach to MRO best practice is most apparent.

Effective MRO management: Evolution and evidence

To further explore the shift toward MRO best practice and validate our empirical findings that the shift is accelerating, the authors surveyed 171 practitioners across a wide range of industries and company sizes. Acknowledging that companies are at various stages of MRO management evolution, the research challenged respondents to evaluate their companies' operations according to the following characteristics of integrated MRO management:

- Companies have established reliable strategies for their operations.

- Companies make decisions with ROI in mind.

- Companies make decisions with a payback period in mind.

- Companies use key performance indicators (KPIs) in evaluating suppliers/vendors.

The answers enabled the authors to classify respondents into three “MRO maturity” groups: We named them leaders, evolving and trailing. Most companies (75%) are indeed moving in the right direction along the maturity continuum, with the mainstream (55%) in an “evolving” stage and 20% far ahead in integrated MRO management. The remaining 25% have yet to shift from traditional, fragmented approaches. Thinking back 10 years ago and using the same MRO maturity criteria, we perceived that today's leaders would have looked more like what we now call evolving, and a significant percent of today's evolving companies would have resembled our current trailing group.

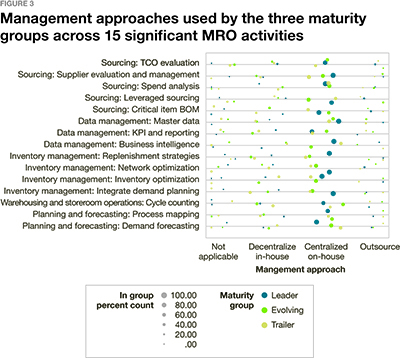

With a maturity classification system in place, we conducted an analysis to examine whether there are relationships between the maturity levels and approaches used in managing the 40 activities in the MRO value chain conceptualized in Figure 1. The analysis shows significant associations in 15 of the 40 activities, suggesting that there are indeed distinct patterns of activity that differentiate the three maturity groups.

Further analysis, focused on these 15 activities, revealed that centralized in-house management is the most often adopted approach by all three maturity levels. A closer look at the data showed that the leader group manages MRO activities centrally and in-house more widely (78% of leaders do so) and more consistently across all 15 activities. (About 57% of the evolving group and 50% of the trailing group use centralized in-house approaches.)

It is worth noting that despite limited use of outsourcing of MRO management by all three groups, the leader and evolving groups are distinctive in terms of the scope of their outsourcing implementation. Outsourcing is used in 14 of the 15 activities by some respondents in these two groups; the leader group is the only one to outsource demand forecasting, most likely because of the need to access the specialized technology and skills required in that activity. By contrast, outsourcing is used in only five activities by the trailing group, including critical-item bill of materials (BOM), integrated demand planning, network optimization, master data management and business intelligence.

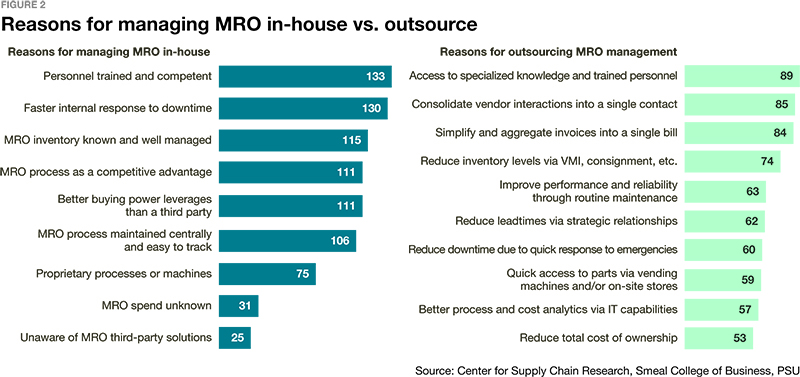

Respondents are divided fairly evenly between those that manage MRO using both in-house and outsourcing approaches (48%) and those that manage MRO entirely in-house (45%). The main reasons given for managing MRO internally are the existence of trained and competent personnel, faster internal response to downtime and the fact that MRO inventory is known and well-managed (see Figure 3). Interestingly, whether done in-house or outsourced, the top reason for taking either approach is the competence of the personnel employed.

The MRO maturity gaps

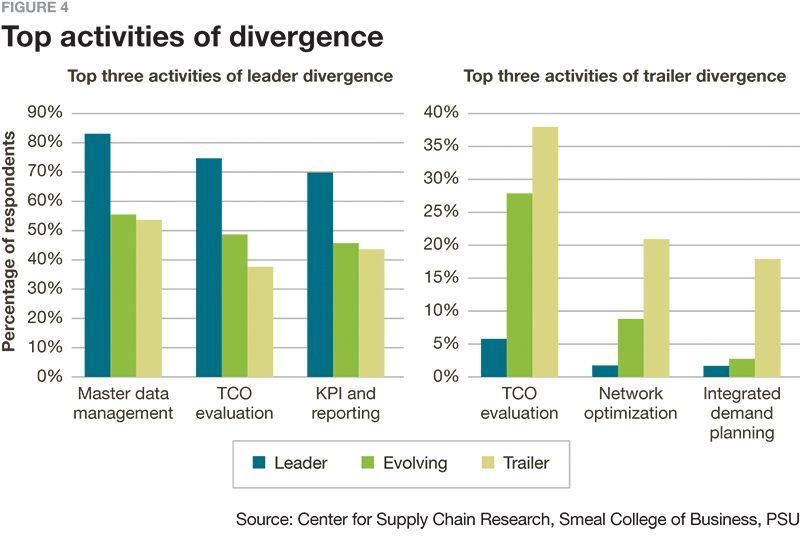

To determine where supply chain managers should put the most effort into moving along the MRO maturity curve, the study picked out two areas of divergence in the management approach employed—the first in which the leader group is outpacing the field in the widespread use of the centralized in-house approach to MRO management, and the second showing the management area in which the trailing group is lagging furthest behind the field.

Looking at those who use the centralized in-house approach, leaders use three areas more extensively than their peers: 83% of the leader group employs master data management, while only 56% and 54% of respondents in the evolving and trailing groups do so (27% and 29% gaps compared with leaders, respectively). The next largest gap is found in total cost of ownership (TCO) evaluation (26% and 37% gaps), followed by KPI and reporting (24% and 26% gaps).

Looking at the other dimension—where trailing groups are furthest behind as gauged by lack of coherent management strategy—it is clear to see that a 32% gap with the leaders is in TCO evaluation (only 6% of leaders lack management strategies whereas 38% of trailing group companies do). There are also big gaps in network optimization and integrated demand planning.

Overall, with the exception of TCO evaluation, the trailing group is most deficient in MRO activities related primarily to inventory management, while the leader group is furthest ahead in activities that reflect its data-driven and performance-oriented characteristics.

In fact, based on our experience, leading companies took a pragmatic approach to setting MRO performance baselines and building usable internal data systems as far back as 20 years ago. Inventory and maintenance systems were next in line for improvement, involving systems clean-up and maintenance. Throughout, the importance of total cost became apparent as the leading companies recognized that the real issues that affect MRO best practice center on “process” rather than “piece price.”

Key takeaways

So what can we conclude from this study? We envision three priority actions that can help both evolving and trailing groups advance along the continuum of MRO integration.

- Centralize more MRO activities. Most companies are already doing this to some extent, but they should expand the approach across a wider range of activities in the MRO value chain.

- Organize all the relevant data. Companies should focus on integrated master data management (MDM) with a comprehensive, unified governance model. Asset data should be collected and stored in a centralized data warehouse that is accessible to all business units and sites. MRO master catalogs and a centralized MRO catalog system should be developed for enterprise-wide use, leveraging industry-standard taxonomies, tools and knowledge bases. According to expert interviews, many of the leading MRO practitioners have invested in best-in-class MDM systems that link seamlessly to legacy systems (ERP/EAM/CMMS) and are supplemented by business intelligence tools.

- Strive for data-driven and performance-oriented practices. When companies have established an integrated MDM and governance structure, they should put their data to use to inform their MRO management decisions, focusing first on TCO evaluation.

We propose these two additional priorities for the trailing group:

- Get inventory in order. Because inventory management is an area in which trailing companies are very far behind, here is what can be done to progress from traditional to integrated approach:

- Adopt data-driven, predictive planning based on detailed analyses of inventory characteristics and requirements (for example, data on equipment bills of material and mean times between failure).

- Align inventory planning with maintenance and operation objectives.

- Devise strategies for inventory deployment and replenishment that cater to different MRO items, based on segmentation analysis (for example, by ABC, criticality, and/or consumption rates).

- Optimize inventory networks to increase availability, focusing not only on returns on invested capital, but also on operations support using facility-to-facility inventory transfer capabilities.

- Use scorecard to track KPIs (for example, stock-out frequency, fulfillment rate and percent of inactive inventory), and identify areas for improvements.

Leverage third-party expertise. Not all companies can train their teams to be MRO integration experts. Knowledgeable, experienced third parties can accelerate companies' progress along the MRO maturity

continuum.

SC

MR

Latest Supply Chain News

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- More News

Latest Resources

Explore

Explore

Topics

Latest Supply Chain News

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks