Last week, President Trump and European leaders agreed to negotiating a resolution over the steel and aluminum tariffs disputes, but the lack of clarity on the issue may already be disrupting U.S. manufacturing supply chains.

According to Alvarez & Marsal's (A&M) Corporate Performance Improvement Group the time for managers to mitigate this risk is now.

A&M's Managing Director Geoff Pollak points to the fact that both the George W. Bush administration and that of Barack Obama briefly imposed tariffs on these commodities to address trade imbalances.

“But it was not a sweeping global policy like the one President Trump is promising,” says Pollak. “Some companies may be numb by past pain, and have forgotten how disruptive this can be to their supply chains.”

In the past, many U.S. manufacturers moved production to emerging nations with lower wages to save on cost. Today, however, these same companies must now consider where they will face more exposure to risk from retaliatory tariffs.

“No one expected trade conflicts to emerge with countries in the EU because of long and traditional relationships formed over a number of years,” notes A&M's Senior Director Matt Stanfield. “But the threat of revamping the duty structures on automobiles, for example, upsets that whole legacy.”

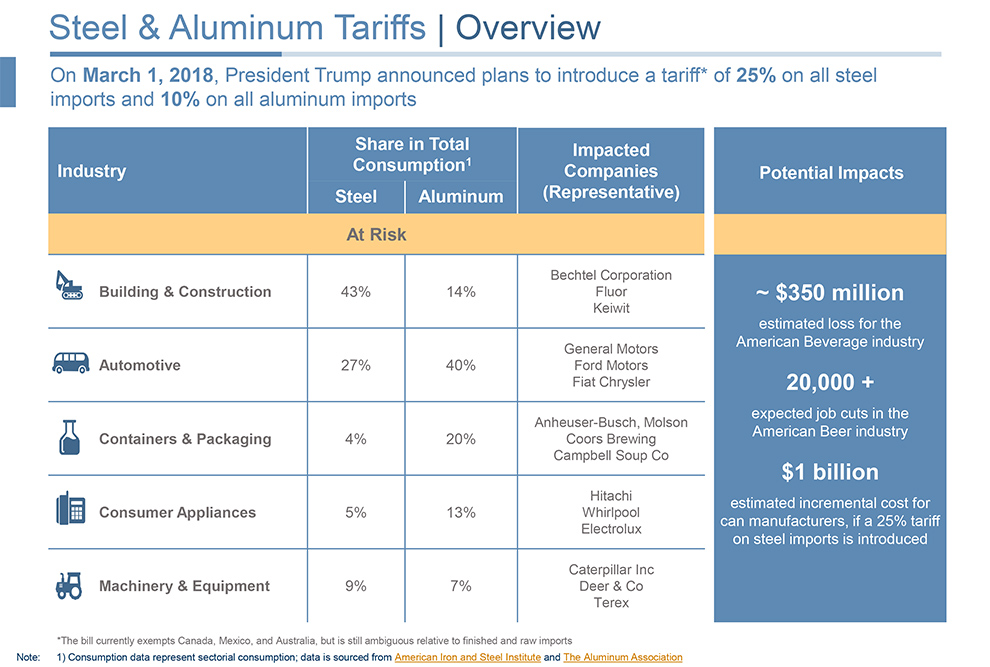

Bechtel Corporation, Fluor, and Keiwit are among those giants in the building and construction industries most vulnerable, says A&M. In the automotive sector, it's General Motors, Ford, and Fiat Chrysler.

“Consumer appliances made by Hitachi, Whirlpool and Electrolux have also warned shareholders about this issue,” says Stanfield.

As a consequence, A&M is advising managers to reassess their sourcing, procurement and manufacturing strategies to identify and mitigate exposure. This involves reviewing current contracts and “supplier engagement” beyond the 12-month deal.

“We also advise the development of ‘what if' models to anticipate yet more trade compliance barriers” says Stanfield. “Manufacturers in all these sectors should be asking themselves ‘what are my alternatives?'”

SC

MR

Latest Supply Chain News

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- More News

Latest Resources

Explore

Explore

Procurement & Sourcing News

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- How one small part held up shipments of thousands of autos

- Shining light on procurement’s dark purchases problem

- 40% of procurement leaders ignoring sustainability, study reveals

- ISM reports that services sector sees continued growth in March

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks