After a disappointing 2016 in automation sales, declining revenues for many equipment suppliers and investment uncertainties in numerous end markets, vendors in industrial automation are hoping for a brighter 2017, contend manufacturing technology analysts.

“With changing market conditions filtering down from the macro level to technology adoption, there's a number of predictions we may assume,” says Mark Watson, senior research manager – manufacturing technology for IHS Markit.

In a new white paper from IHS Markit, manufacturing technology analysts were asked to provide their informed predictions for the global manufacturing technology market in 2017.

“We did not come across any startling surprises,” says Watson, but some additional interesting points to note include:

- Although there are lots of applications being talked about the pace of change is relatively slow

- Automation vendors are using IIoT/smart manufacturing in their own plants to demonstrate capabilities; OEMs are largely yet to catch on

- IT vendors may get frustrated at the slow pace of change; this isn't an industry that changes fast (the opportunity will take longer to realise than they're used to)

“Overall, there's a lot going on with IIoT/smart manufacturing, but things move slowly, especially given the challenging macro environment,” Watson adds.

The Top Seven Manufacturing Technology Predictions for 2017, as identified by IHS Markit analysts and listed in no particular order, are as follows:

Trend #1 – Global Market to Grow, Despite Headwinds

- The industrial automation equipment (IAE) market is expected to grow in 2017, reversing two consecutive years of contraction.

- While growth prospects vary by sector, 2017 growth—projected at 1.5 percent—will take place despite headwinds, mainly in the form of low oil prices as well as a reduction in the sales of heavy machinery.

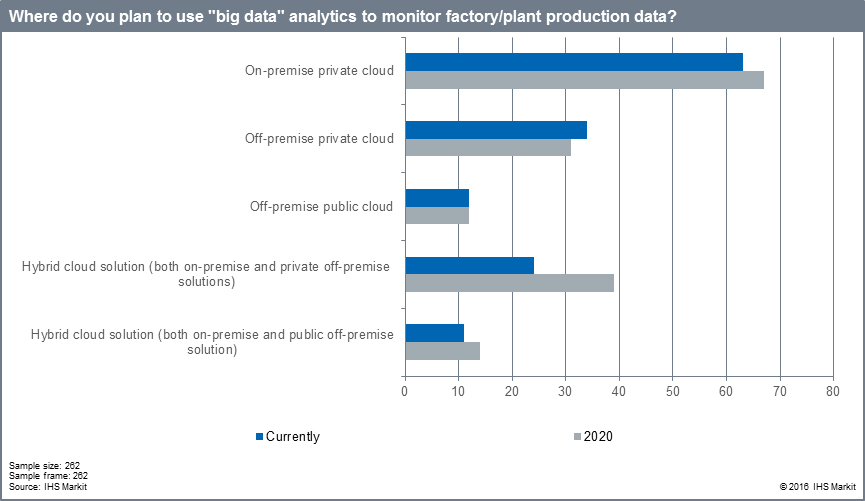

Trend #2 – Remote cloud-based analytics to shift to local and edge computing

- Throughout 2016, many cloud platforms were announced or released to support the Internet of Things (IoT) in manufacturing. While the remote cloud can offer significant advantages in terms of scalability and cost, concerns around cybersecurity caused hesitancy among end users.

- As a result, in-house cloud solutions and “edge” analytics will gain scalability in 2017. However, the continued education of the market will also result in companies gaining increased confidence in the advantages and benefits that the remote cloud can provide.

Trend #3 – Industrial automation to become more influential in outsourced or relocated manufacturing

- Since 2014, changes in currency exchange rates, falling shipping costs, and the questionable longevity of proposed and existing trade agreements, have acted in concert to weaken once-solid justifications for offshoring factories, at least for the time being.

- Expect more vendors in 2017 to choose to invest in automation at US facilities in an effort to leverage tax incentives and a skilled workforce, rather than in offshoring production.

Trend #4 – Software-centric solutions to stay competitive

- While partnerships are one route that companies can undertake in bringing together IT and OT expertise, a handful of automation vendors last year engaged in the active acquisition of software vendors to meet this need.

- Expect to see an acceleration in acquisitions and partnerships in 2017, as automation companies fight over and target software vendors able to expand their smart manufacturing portfolios.

Trend #5 – Capital equipment markets to consolidate

- 2017 will be a year of increased market consolidation across several capital equipment markets, such as those for motors, generators, turbines and generator sets.

- For market leaders, maintaining—or even expanding—market share will remain a high priority, as market growth in 2017 is expected to remain subdued.

Trend #6 – Connectivity standards to prevail

- With ongoing pressure from end users, and opportunities for increased connectivity through industrial-IoT-based solutions, new possibilities for standardized communication have come about.

- The prevalence of OPC-UA—or Open Platform Communications Unified Architecture—together with the release of TSN—or Time-Sensitive Networking—standards at the end of the year will bring further connectivity standardization in 2017.

Trend #7 – Artificial Intelligence (AI) to ramp up on the factory floor

- This year, robots featuring improved connectivity and sensing capabilities will continue to lead in the advancement of smart manufacturing.

- With the further development of AI, industrial robots will become more intelligent—able to perceive, learn and make decisions on their own in the factory.

SC

MR

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More News

Latest Resources

Explore

Explore

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks