A recent survey of compliance and procurement professionals indicates respondents are less confident about managing third party relationships, with cyber security threats and the increased adoption of artificial intelligence (AI) listed as top concerns.

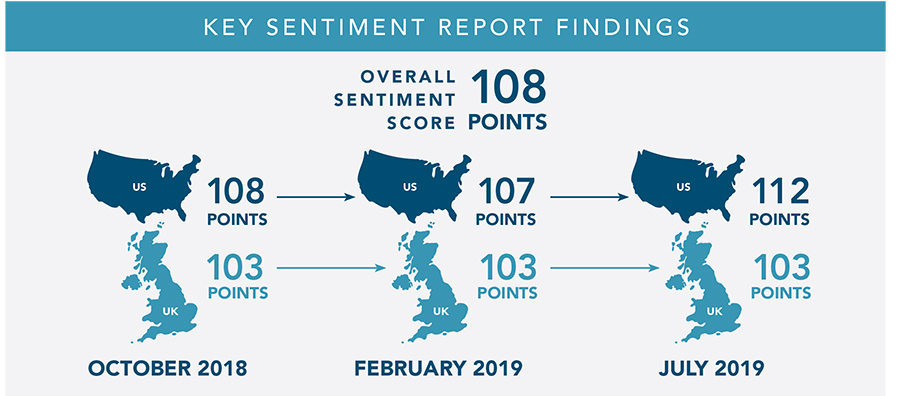

The 2019 Compliance and Procurement Sentiment report from Dun & Bradstreet found that only 85% of respondents were confident about the effectiveness of risk management within their organization; 8% lower than the previous survey. Eighty four percent of respondents also forecast a decline in the future effectiveness of compliance and procurement functions.

Respondents from smaller firms continue to be less confident about managing third party risks than those from larger organizations. Confidence levels in both current and future compliance and procurement effectiveness were lower among businesses with less than 50 employees (79% compared to 92% in larger organizations of 251-1000 employees).

The benchmarking report tracks areas of short and long-term success and concerns for compliance and procurement professionals and the 2019 edition highlighted the following main points:

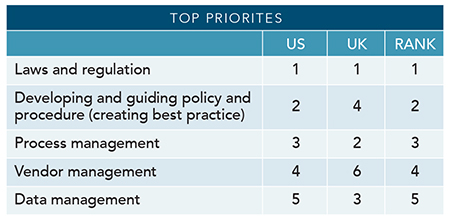

- Compliance with laws and regulations remain top priority.

- An increasing number of regulations and a more complex regulatory framework has most likely contributed to compliance remaining a top concern among respondents for a third consecutive survey.

- Slow response to increased cyber security risk: Although cyber security was the number one concern for respondents, almost half (48%) do not yet incorporate in their third party risk management. Half of this group of respondents had developed an approach to cyber risk but have been slow to implement.

- The right skill set is key to unlocking the value of AI: Over half (53%) of respondents agree that Artificial Intelligence (AI) will improve efficiencies and enhance insight within their compliance and procurement functions. However, 45% are not confident they have the right skills in place to make full use of AI in the coming year, suggesting that additional training and focus on talent development is required.

Commenting on the findings, Brian Alster, General Manager of Third-Party Risk & Compliance at Dun & Bradstreet, said:

“Third-party risk management and compliance programs can’t remain stagnant. As technology changes and the amount of data companies are expected to manage when mitigating risk increases, procurement and compliance professionals need to drive greater efficiencies within their programs. Cyber security and Artificial Intelligence are two key areas of concern and we were keen to explore these in our latest survey.”

Respondents in the Financial Services (60%) and Retail (55%) sectors saw the most potential benefit from AI for improved risk and fraud detection. However, 56% of government agencies and 47% manufacturing believe that data gathering and validation will benefit the most from Artificial Intelligence. The report also highlights the top four areas that respondents believe artificial intelligence will aid compliance and procurement:

Respondents in the Financial Services (60%) and Retail (55%) sectors saw the most potential benefit from AI for improved risk and fraud detection. However, 56% of government agencies and 47% manufacturing believe that data gathering and validation will benefit the most from Artificial Intelligence. The report also highlights the top four areas that respondents believe artificial intelligence will aid compliance and procurement:

Top Four Anticipated Areas to Benefit from Artificial Intelligence

- Risk and Fraud Detection (detection and monitoring of status, changing of circumstance and risks)

- Data Gathering and Validation (new account setup, campaigns and ongoing monitoring)

- Risk Screening (reducing false positives and remediation efforts)

- Account Reconciliation (identifying/merging duplicates and updating records)

In an interview with SCMR, Alster added that regulatory compliance also remains a concern in the current international trade arena.

“While D&B does not have supplier performance data we are able to identify suppliers and suppliers of suppliers,” he said. “This data can help clients both master their supplier list to maximize spend against specific organizations and their family trees but also can help identify the domicile of their suppliers for potential tariff implications.”

According to Alster, D&B has a the largest commercial database containing information including business segmentation (SIC Codes), geo location, corporate hierarchy and ownership details on over 300 million global businesses.

“When our clients are searching for a new supplier we are able to surface details for companies based upon industries that the business are in and also to provide supplier risk scores to help access the potential risk associated with these potential new suppliers,” he concluded.

SC

MR

Latest Supply Chain News

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- More News

Latest Podcast

Explore

Explore

Procurement & Sourcing News

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- How one small part held up shipments of thousands of autos

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks