Like all logistics companies, Supply Chain Companies (SCCs) (e.g. those specializing in software, solutions or services), saw their valuations suffer significantly during the recession of 2008 and 2009. Since the bottom, the market has rebounded substantially, deal flow is up, and multiples are near 5 year highs. Why has the market rewarded the companies and what’s the outlook going forward? This is part 1 of 3 looking at the market’s valuation of SCCs. In this part, we look at the data, how all Transportation and Logistics Companies have been valued and provide some detail on Supply Chain Company valuations. In Part 2, we examine SCC valuations in more depth, and in Part 3, we examine what will be driving the market in the future and where we think valuations and multiples are most likely to go in the next year or two.

First, the Data

Capital Alliance analyzed publicly traded logistics companies by segment and individual private and public transactions. Individual transactions included all known deals announced or completed in the period. The groupings by segment, provided by Cap IQ, included companies related to the segment (e.g. trucking included truck leasing, public buses). The SCCs tended to be companies providing software or support services used in the management of their supply chain or to coordinate with customers and vendors.

Trends in Logistics Company Valuations

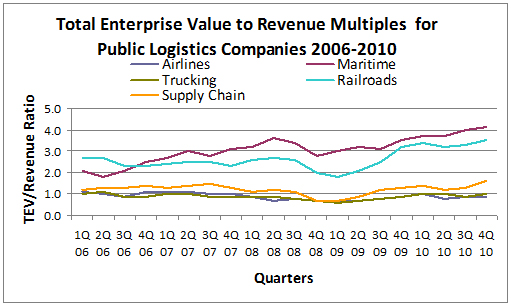

Using the TEV (Total Enterprise Value, i.e. total debt plus equity) to Revenue ratio over the past 5 years provided an important view and perspective on how logistics companies have been valued. Two other valuation ratios were also examined (P/E and TEV/EBITDA ratios) and are discussed in the second part of this series.

As shown in the chart:

Valuations have fluctuated significantly over time with three segments all showing an upward trend in valuation multiples

Values generally began declining before the recession (i.e. in late 2007 or early 2008) and bottomed between the 4th quarter of 2008 and the 1st quarter of 2009

Valuations recovered quickly, preceding the economy’s recovery, and are now at or even above their 5 years highs

The TEV/Revenue ratios differ dramatically by segment, from about .9 to 4.1 times due to differences in their capital structure, their earnings and cash flow characteristics, and their overall competitive position

Railroads have high fixed capital costs and high and relatively stable EBITDA margins; they also have shown significant revenue gains, real price increases and increased market shares leading to higher valuations

In contrast, trucking concerns have smaller and much more volatile EBITDA margins and multiples and have experienced pricing pressure and modal shifts leading to absolute revenue declines resulting in for much lower valuation multiples

Supply chain firms, particularly those with software as a base product, have been better able to balance costs and pricing to manage profitability (very stable EBITDA margins) and growing demand for their services and limited capital needs leading to higher multiples than trucking but still lower than the capital intensive railroads

The Quick Rise in Valuations

Since the market’s bottom, valuations throughout the industry have risen rapidly. SCCs came back the fastest rising 128% from their 4th quarter of 2008 low. Other segments of the industry improved at very different and generally much low rates:

Maritime, since its low point in the 2nd quarter of 2006, improved as much as Supply Chain entities, but it took them longer as they hit their lows a year and a half earlier

Airlines improved the least, rising only 29% from their lows of the 4th quarter 2008 and 2nd quarter 2009

Trucking valuations rose 67% from their 1st quarter 2009 low

Railroad valuations rose 94% from their 1st quarter 2009 low

The SCCs experienced the fastest recovery largely because their cash flows were very stable and predictable, volumes grew rapidly with the expected and realized improvement in the economy, and there was no need for significant capital investment.

Where are valuations now?

Today we see significant differences by segment. Specifically, Railroads and Maritime have broken out of their historic valuation ranges, while Airline and Trucking companies are still within their historic trading ranges. Market dynamics will determine where these valuations go. The key issue in this article is “Where will supply chain valuations go?” The recent increase in valuations put SCC valuations at the top of their five year range, but not yet breaking out. Can they break out? Will they? These are subjects covered in the next two installments of this series.

SC

MR

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More News

Latest Podcast

Explore

Explore

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks