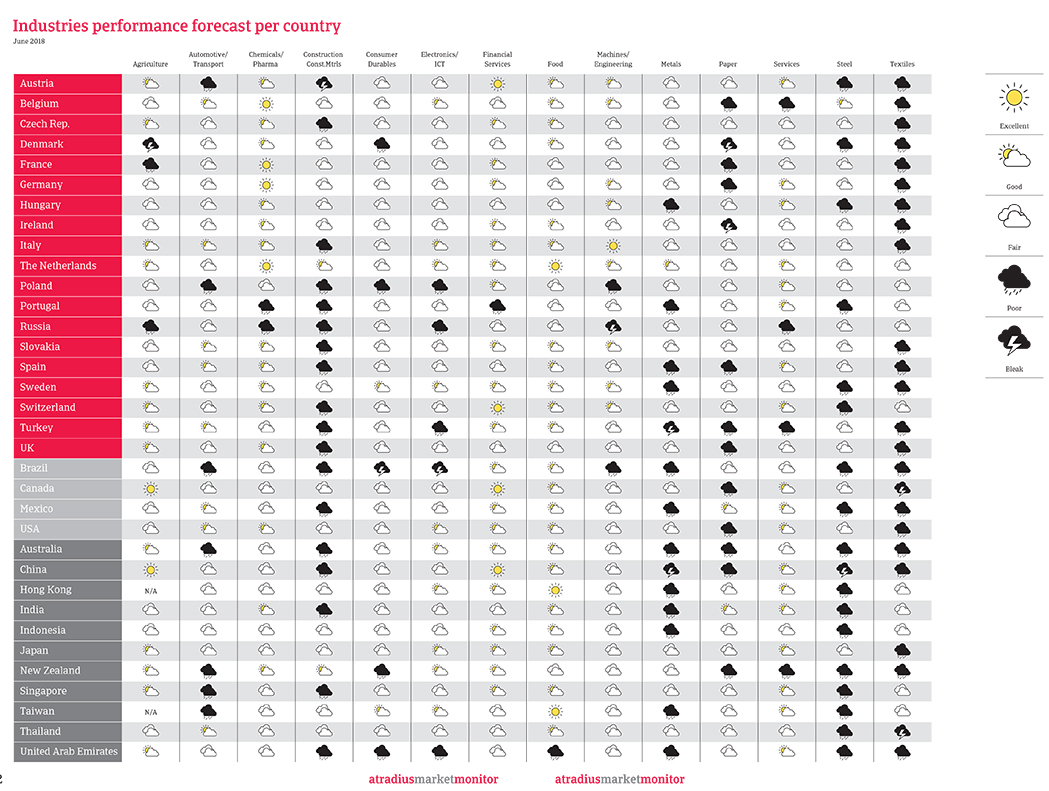

Atradius, a trade credit insurer based in Amsterdam, recently released a report titled “Information and Communication Technologies (ICT) Performance and Outlook” that evaluates the global health of the industry and provides a snapshot of risk in emerging nations.

Dana Bodnar, economist from Atradius, notes in an interview that as advancing technologies and changing market conditions shift in this landscape, the probability of failure increases for businesses that are not able to adapt accordingly.

“A stronger U.S. dollar and higher U.S. interest rates are increasing risks in general for U.S. multinationals operating across emerging markets,” says Bodnar. “This is especially the case for Argentina and South Africa while political uncertainty is increasing challenges for doing business in Latin America, particularly Mexico and Brazil. Multinational firms operating in Turkey face higher political risk alongside an overheating economy also highly vulnerable to Fed tightening.

Among Bodnar's observations in this exclusive interview:

Mexico: Political uncertainty from NAFTA negotiations and presidential election campaigning has increased challenges to doing business in Mexico. The country benefits from a stable macroeconomic environment, but a reversion to World Trade Organization rules in the case of a breakdown of NAFTA could have negative ramifications for operating across the border. The election of the populist candidate Andrés Manuel López Obrador, in July could threaten macroeconomic reform progress and increase costs of local production, but Atradius expects overall policy continuity.

Brazil: Political uncertainty is also higher in Brazil, with the latest truck drivers' strike highlighting popular discontent with the political establishment, lowering the chances that a central candidate will win the October elections. This raises concern about progress on critical reforms and the negative impact on government finances.

Argentina: Consultants consistently flag Argentina as one of the most vulnerable countries in the world to U.S. monetary policy normalization. This is apparent in the negative developments seen there since December 2017. Argentina is facing stubbornly high inflation, currency overvaluation, and rising external imbalances as policy missteps have rattled markets and forced the country to turn to the IMF for stabilization in May.

South Africa: Highly vulnerable to changes in market sentiment due to high dependency on portfolio investments inflows.

Turkey: Turkey's economy is overheating due to high credit growth, severe economic imbalances, and higher geopolitical uncertainty. The shift towards autocracy could lead to social unrest that could further contribute to lower business confidence. Further exchange rate volatility and doubts about central bank independence amid Fed tightening could cause capital inflows to dry up.

“Credit insurance, including political risk coverage, provides protection against many emerging market risks,” says Bodnar. “These include capital controls and problems with currency convertibility.”

She advises global logistics managers to work with a team of specialists who understand the local language and culture and who can respond to changes in local legislation and sudden fluctuations of trade.

SC

MR

Latest Supply Chain News

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- More News

Latest Resources

Explore

Explore

Procurement & Sourcing News

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- How one small part held up shipments of thousands of autos

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks