The maritime industry and broader ocean supply chain are suffering from major and costly inefficiencies due to ineffective data sharing and poor cross-industry collaboration, according to a new report and industry survey released today by the Business Performance Innovation (BPI) Network in coordination with Navis and XVELA, both part of Cargotec.

The study, entitled “Competitive Gain in the Ocean Supply Chain: Innovation That's Driving Maritime Operational Transformation,” is based on a global survey of more than 200 executives and professionals from terminal operators, carriers, logistics providers, vessel owner as, port authorities, shippers, consignees and other members of the global ocean supply chain. The study was developed in partnership with maritime industry technology leaders, Navis and XVELA.

This news surfaced just reports of increased ocean carrier cooperation and digitized offerings are taking hold while the industry copes with capacity challenges.

Andy Barrons, Chief Strategy Officer, Navis, shared this observation with SCMR in an interview:

“From what we are seeing, there is a desire among big carriers to accelerate digitization and collaboration efforts in order to achieve greater efficiencies and visibility across the supply chain.”

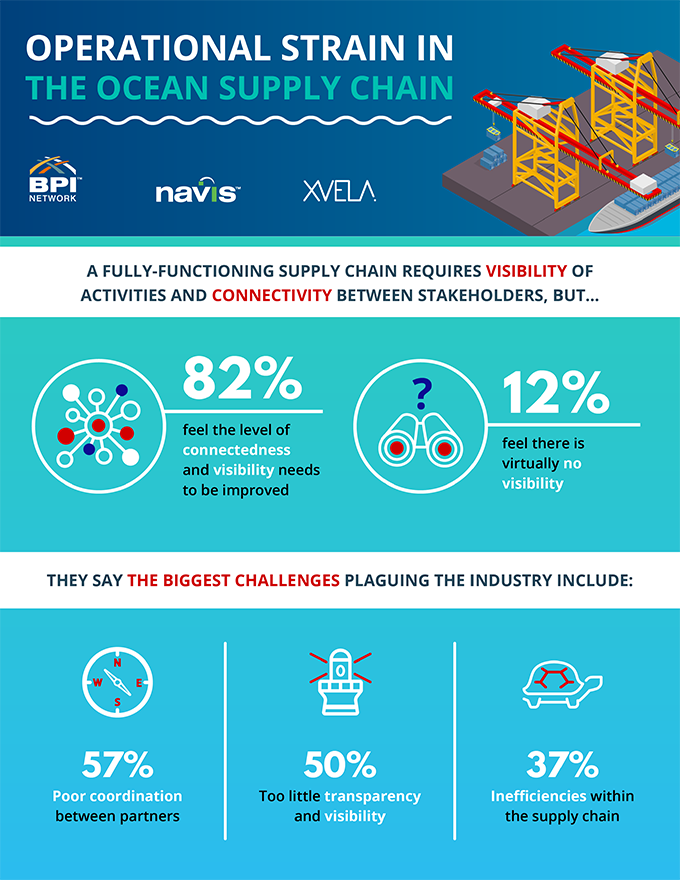

The study indicates that importers, exporters, container carriers, terminal operators, vessel owners and other stakeholders suffer from poor visibility and predictability around shipments and are losing money due to a lack of partner synchronization and insufficient data insight.

However, there is recognition, particularly among industry leaders interviewed, that digitization and mindset shifts are afoot, and will be a boon to all players in the industry. “Everyone benefits from collaboration and data sharing,” says Andreas Mrozek, Global Head Marine & Terminal Operations for the Hamburg Sud Group, one of the world's largest container shipping lines. “It starts with the customers and moves to the carriers, then the terminal operators, vendors, freight systems, truck companies, and keeps going down the line. Closer collaboration is a compelling value proposition for each supply chain partner.”

Ninety percent of survey participants said real-time data access and information sharing was important to increasing the efficiency and performance of the shipping industry. Some 82 percent said the industry needs to improve supply chain visibility.

The push for improvements will likely come from a combination of forces, according to industry executives. Shippers will push for better operational visibility; alliances will demand better ways for their carrier members to share information to improve efficiencies and customer service; and terminals and port authorities under pressure to increase utilization and optimize existing infrastructures.

On average, surveyed executives estimated that each of a wide range of ocean supply chain processes could be improved by as much as 66 percent and no less than 55 percent if the industry updated its IT systems and improved its ability to share data with other members of the supply chain.

“Our study underscores the critical need for the shipping industry to improve collaboration and visibility through the adoption of new technology-driven models and processes,” said Dave Murray, head of thought leadership for the BPI Network. “Perhaps partly because the industry has been preoccupied and constrained by its economic challenges—but also because many of its members are just plain resistant to change—the industry has been far too slow to enter the digital age.”

According to respondents, the areas most in need of improvement are:

- carrier to terminal coordination

- supply chain visibility and information sharing,

- terminal operations

- cargo flow visibility and predictability, and

- coordination across carrier alliances.

“The findings of the study are consistent with what we are hearing in the field from some of the biggest carriers and terminals in the world. As we have already seen in other industries, the visibility, coordination and collaboration across business networks provided by cloud platforms drive higher efficiencies and customer value,” commented Guy Rey-Herme, XVELA President. “It is much easier for everyone in the network to achieve performance and service goals when operations are synchronized.”

You can find the full report from BPI Network here.

SC

MR

Latest Supply Chain News

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- More News

Latest Podcast

Explore

Explore

Business Management News

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks