Companies today are continually seeking innovative ways to further accelerate improvement initiatives and increase value and operating profits across the enterprise. Many companies have invested heavily in extensive operational excellence programs. They have “Leaned” their organizations, trained their workforce and enlisted an army of Six Sigma black belts to drive continuous improvement. While there are numerous success stories, executives can't afford to rely solely on these tried and tested methods; they need to look for new ways to drive competitive advantage which take integration and collaboration to the next level.

Risk factors

As the leaders in an integrated ecosystem, there are inherent risks in not fully understanding the complexity of roles, and the interdependencies of key processes. Innovative companies are realizing they must leverage optionality within their company and with their partners. Failure to effectively manage these partners, resources and risks can have huge financial and operational ramifications.

A dramatic rethink is needed

For years, corporate sourcing initiatives have attempted to drive bottom-line savings, but have consistently failed to deliver on their full promise. A dramatic re-thinking of the traditional sourcing-centric approach commonly used in procurement is key to driving meaningful and lasting value.

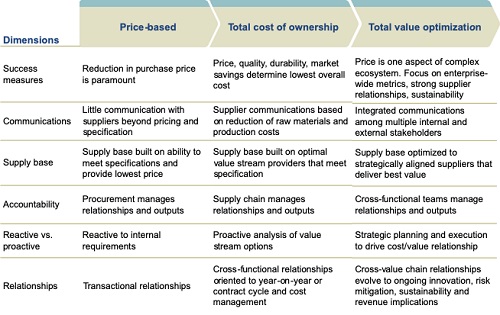

This vision requires many companies to make a radical change in leadership behaviors, both by the owner and supplier – fortunately the sustainable value delivered provides a compelling return on investment. The next wave of strategic procurement acknowledges a transformation marked by three stages of evolution: Price-based, total cost of ownership (TCO), and Total Value Optimization (TVO).

Figure 1

The historic price-based model used purchase price almost exclusively as the determining factor in buy decisions. It was primarily reactive in nature and there was limited communication with suppliers beyond that which is required for pricing negotiations. A simple example of executing using this model. is reverse auction which, while effective in delivering the lowest price, falls well short of delivering optimum value. Most mature organizations have moved to a TCO model where other factors, such as quality and durability, are considered.

That too fails to provide a full picture and, while it attempts to be driven by the bottom line, leaves several opportunities on the table due to focus on costs rather than value creation. The TVO model, on the other hand, goes beyond the price-based and TCO models to focus on overall value for both the company and the supplier ecosystem.

71% of suppliers interviewed feel that a more collaborative relationship would add significant additional value to their customers – the average was 9%.

Time for a new world order

More progressive company leaders are challenging their procurement teams to play a more strategic role – a true orchestrator for next-level value creation which leverages supplier capabilities to drive value at the point of use. Responding to this challenge requires a focus on total value and C-level commitment. Not only must functional boundaries be crossed, they must be redefined and, in some cases, destroyed.

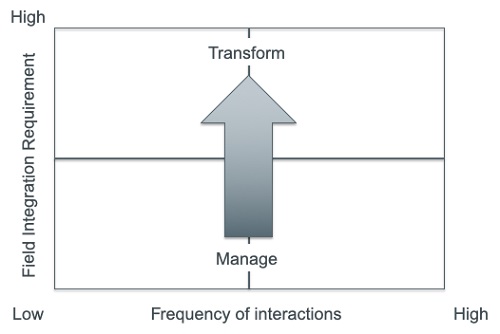

The below illustration shows the need to look at the relationship between field integration requirements and the frequency of interactions with suppliers to define the degree of change involved to capture full value.

Figure 2

This highlights that cross-functional teams (CFTs), which are necessary for any robust procurement effort, are not sufficient for upper quadrant categories. A more comprehensive change program is required to capture full value.

For those categories in the lower quadrant, a traditional CFT-supported strategic procurement event is sufficient to create the optimal relationship. For those categories in the upper quadrant, the relationship created must be in the context of the art of the possible – this will necessarily involve appropriate C-level engagement to ensure a total value path is embraced.

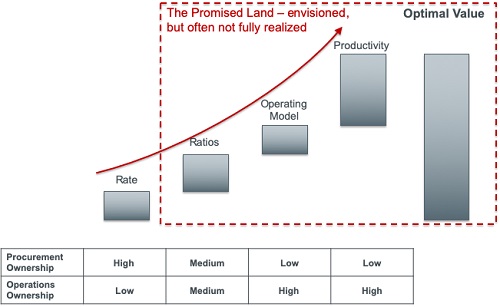

The below chart illustrates the optimal value that can be created and the chasm that exists to capture this total value.

Figure 3

Traditional supplier management falls short

In all cases active management of the supplier is critical to support the relationship established. In the upper quadrant this will require a more comprehensive management system and supporting metrics and dashboards.

Our experience is that, while all companies have upper quadrant categories, very few have the ability to create optimal relationships, and even fewer the ability to manage these relationships to drive committed value and continuous improvement.

Tools and forums, like supplier dashboards and quarterly business reviews, that support effective supplier management on paper, fall far short of delivering the required capabilities in reality. Some of this is due to disparate systems, poor visibility to key data, lack of disciplined methodology and unclear governance/decision making.

The current level of maturity to do this is quite low but that should not preclude a committed company from starting the journey – the payback is rapid and massive.

What's holding procurement back?

Whether they're buying truckloads of raw materials, complex services or boxes of paper clips, most procurement organizations are reasonably adept at getting reasonable pricing. They fail because their involvement often drops off after the deal is made and supplier management devolves to basic data entry, contract maintenance or abdicated to the local supplier and location teams to work out. Projected savings often fail to materialize due to challenges related to the deployment, compliance, and management of both contracts and suppliers. Three of the biggest reasons for failure include:

1. Lack of KPIs and metrics to monitor the effectiveness of the performance to meet the goals of the relationship. If KPIs do exist, they are generally focused on safety and adherence to payment terms with a very limited view, if any, on performance and productivity

2. Unwillingness for end-users / operations groups to modify day to day interactions with suppliers

3. Lack of executive support and commitment to the new operating model developed through the contracting process

Making the right decisions, at the right levels, with the right people holding the right information, supported by the right processes to drive the right results is an often-overlooked discipline. Decision governance, orchestrated and executed across the ecosystem, delivers exceptional and measurable value.

When a new contract is negotiated, the negotiator will - at least temporarily - celebrate the win and tout the significant potential savings over time. Let's say a new deal promises a ten percent saving in one cost category, amounting to $1 million, but those assumptions are typically based on full compliance and potential continuous improvements from the supplier. If only 50 percent compliance is achieved – not at all unusual – the potential savings drop from ten percent to five percent, and the bottom-line impact goes from being a cause to celebrate to little more than a rounding error. In addition, the negotiation is, once again, generally focused on price and misses significant opportunities in areas such as usage/mix of skills, productivity improvement opportunities, etc.

Finally, a legacy issue with relatively low maturity organizations occurs when individual business units feel left out of the decision-making process. Faced with an upstream procurement decision those (often overworked) downstream business units may simply ignore the mandates and sub optimize the total value potential for the company.

Without organization wide buy-in, new procurement agreements, with tremendous value creation potential, invariably fail.

The new era of Total Value Optimization

As a new competitive order evolves beyond price based and TCO-based procurement, Total Value Optimization delivers a differentiated experience, continuous innovation and financially accountable sustainability practices with tangible value. In this model, there is a higher level of integration and collaboration both between internal stakeholders and across the entire buy-make-move-fulfill digital supply chain, from the customer's customer to the supplier's supplier. As a result, companies can better and more consistently drive maximum value; greater efficiency and productivity; increased revenue; and better value.

Total Value Optimization represents a new role for procurement, where it evolves beyond a task-oriented process focused on the bottom line, to one of strategic value creation.

Keeping the procurement promise

Rolling out a new multi-dimensional relationship is complex. After successful negotiations with a supplier, enterprise users must be transitioned from incumbents to the new supplier, all the while minimizing disruption to ongoing operations. Projected savings are based on long-term metrics and, to achieve those projections, agreements must be managed long-term and compliance assured. Long-term management includes not only identifying compliance levels but also implementing strategies to drive continuous improvement.

A formal procurement governance structure is sometimes lacking at even the largest of companies. Such a structure drives procurement initiatives with larger company goals in mind, taking a more holistic approach to procurement. In this holistic approach, the goals include increasing the amount of spend under centralized management and monitoring internal adoption as well as supplier performance. This must include a good understanding of the required behaviors of the owner leadership (down to the foreman level) and supplier leadership.

To achieve this, a thoughtful plan on how to coach the right leadership behaviors is required. Senior leadership (owner/supplier) may also have to make changes within the leadership team if individuals are not willing to adopt the required behaviors. A quarterly business review is often the primary forum for discussing the state of the relationship between the company and the supplier – this is no longer sufficient.

Case study and transformational results

What is often missing is “demand side optimization,” where suppliers are actively managed in a collaborative manner to drive the next level of sustainable value and continuous improvement.

A step-by-step implementation in one case drove $112 million in benefits in what was a very complex post-merger environment. In this case, a major manufacturer had combined two companies into a single global organization and was left with two different cultures and operating models. Phase one involved optimizing logistics operations while phase two aligned the two groups behind a common goal, delivering substantial savings across procurement and logistics by creating long-term supply relationships and consolidating multiple vendors and processes. In the final phase, sound practices were aligned across procurement, logistics and operations, and a culture of innovation and Total Value Optimization was established, delivering over $35 million in further cost savings. In this case, a clear vision was foundational to sustainable success.

Beyond the initial win

Procurement departments revel in the win of a new deal and the creativity of strategic sourcing, but the minutiae of day-to-day management of those deals requires a different skill set. It is more methodical and task-oriented, requiring project and change-management skills, and close attention to metrics, KPIs and other performance indicators. In the 21st Century, procurement cannot function in isolation, it must be fully integrated with logistics, operations and data analytics as part of a collaborative culture focused on delivering the greatest value to stakeholders and customers at the lowest cost to business.

The fact of the matter is, projected savings for new deals are meaningless without follow-through. Company leadership must actively pursue supporting ongoing day-to-day execution for continuous improvement: whether through the focused oversight and education of internal specialists or through the introduction of external resources with proven knowledge and capability.

About the author: Mark Montanari is vice president, chemicals and oil & gas at Maine Pointe, a global supply chain and operations consultancy.

SC

MR

Latest Supply Chain News

- Few executives believe their supply chains can respond quickly to disruptions

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- More News

Latest Podcast

Explore

Explore

Latest Supply Chain News

- Few executives believe their supply chains can respond quickly to disruptions

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks