Maersk Line's latest “North America Trade Report” reveals that U.S.-Canadian trade is set to deliver another year of robust growth.

Both nations will benefit from an expected increase of more than 3% in global trade volumes this year as U.S. consumers underpin imports and Canadians gain from the signing of a free trade agreement covering a $12.6 trillion market, according to the world's largest shipping company Maersk Line.

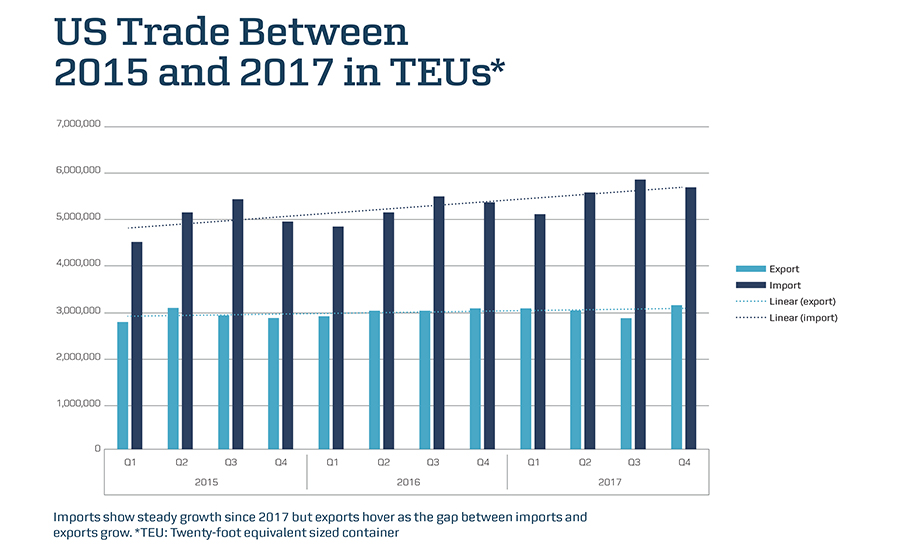

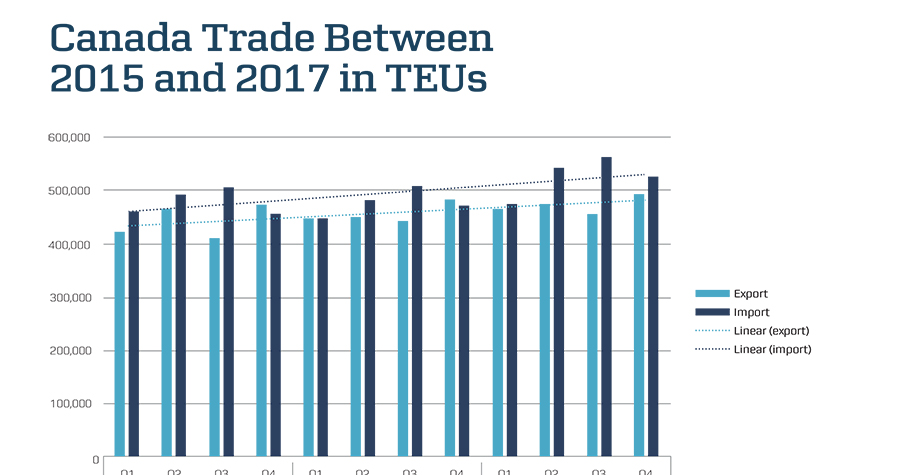

However, the U.S. and Canada, which have grown at similar accumulative rates of 8.7% and 8.3% from 2015 to 2017, have two very different tales to tell this year.

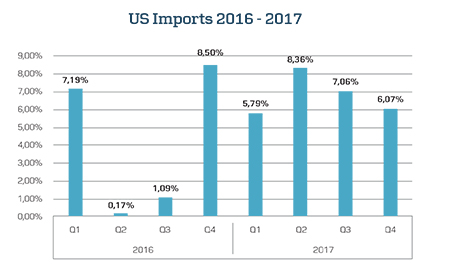

For the U.S., gains will come from retail, chemicals, consumer electronics and grains sectors but the nation faces a number of homegrown issues as the import-to-export gap continues to widen.

The U.S. is facing a trucking crisis, rail infrastructure needs to be updated, terminal competitiveness lags behind other countries, while digital transformation is putting pressure on the way the U.S. does trade – not to mention the bunker fuel hikes and terminal congestions persist.

Meanwhile, the outlook is more positive for Canada, which promises to be one of the fastest growing markets in terms of container trade across the Americas this year.

In 2017, U.S. total maritime container imports and exports grew 4.7%, up from 3.9% in 2016, while Canadian total imports and exports expanded 6.9%,

up from 1.4% in 2016. The U.S. accounts for 24% of all global container trade, which moves more than $4 trillion worth of goods a year. Maersk Line moves approximately one in five containers around the world.

In 2017, U.S. total maritime container imports and exports grew 4.7%, up from 3.9% in 2016, while Canadian total imports and exports expanded 6.9%,

up from 1.4% in 2016. The U.S. accounts for 24% of all global container trade, which moves more than $4 trillion worth of goods a year. Maersk Line moves approximately one in five containers around the world.

“The US and Canada are growing and yet they are in two very distinct moments. The US is in digital disruption and transformation, putting pressure on the way the nation trades, so much so that the end-goal must change so that booking a container and moving it across continents becomes as easy as posting a parcel, helping US business flourish locally and globally,” says Omar Shamsie, President for Maersk Line North America. “It sounds far-fetched when you consider how the industry does business now, but the future of the whole supply chain needs to be discussed at the highest levels, U.S. competitiveness needs to come under a magnifying glass so the whole industry and authorities can address new ways of narrowing the ever- increasing gap with imports and update itself in the face of digital disruption and increasing competition from Asia, Latin America and Europe,” he adds.

As reported in SCMR, parent company A.P. Moller- Maersk is already taking steps to help overhaul global trade after unveiling in January a joint venture with IBM to create an industry-wide paperless platform that is aimed at speeding up trade transactions, boosting transparency for supply chain managers and potentially saving them billions of dollars.

Christian Pedersen, Vice-President of Trade and Marketing, Maersk Line, North America told SCMR in an interview that he was especially impressed by the export growth in the U.S. gulf region where there's been much new investment in transport infrastructure.

“This is the brightest spot for outbound cargo,” he says, “although we slower growth elsewhere due to structural problems.”

The inbound cargo picture is more positive for U.S. ports as consumer demand continues to drive demand “for the right product at the right time.”

“Consistent across all geographies, is the need to satisfy customer experience,” he said.

Jack Mahoney, President for Maersk Line Canada, told SCMR in a separate interview that the ports of Prince Rupert and Vancouver are well positioned to take market share away from U.S. West Coast ocean cargo gateways.

“Our terminal operations with DP World at Prince Rupert are world class,” he said. “We also have excellent rail service to inland destinations deep into the U.S. The labor situation remains positive, and the perhaps the most important advantage is the port's proximity to Asia markets.”

SC

MR

Latest Supply Chain News

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- Tips for CIOs to overcome technology talent acquisition troubles

- More News

Latest Podcast

Explore

Explore

Business Management News

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks