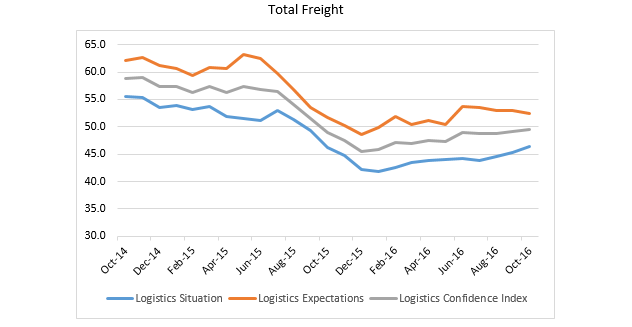

The Stifel Logistics Confidence Index remained below the neutral mark at 49.4, but once again noted a slight improvement against the previous month.

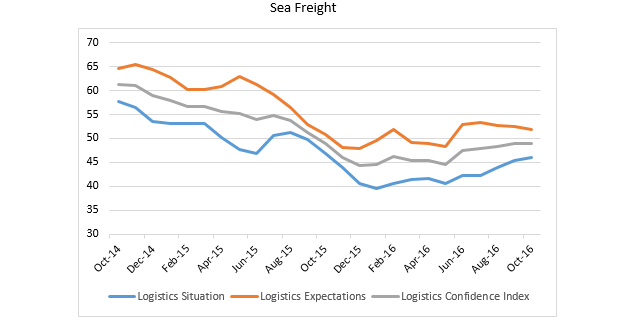

In a sign that the bankruptcy of Hanjin Shipping has had little overall effect upon the container shipping industry, the October Sea Freight Confidence Index remained unchanged from September, at 49.0 points.

This tallies with industry expectations.

“Power abhors a vacuum,” observes Nick Bailey, Managing Consultant for the London-based think tank, Transport Intelligence (Ti).

He notes that Alphliner analysts in Paris have reported that rival carriers have been quick to fill the gap in services Hanjin Shipping left behind; nine extra sailings were added in September, according to the consultancy, with another six scheduled for October.

“Nonetheless, even the biggest carriers are feeling the heat,” says Bailey.

He points to an interview with Bloomberg at the end of September, where the Chairman of A.P. Møller – Mærsk stated that the company “is done with ordering new steel,” in the face of the systemic overcapacity issue.

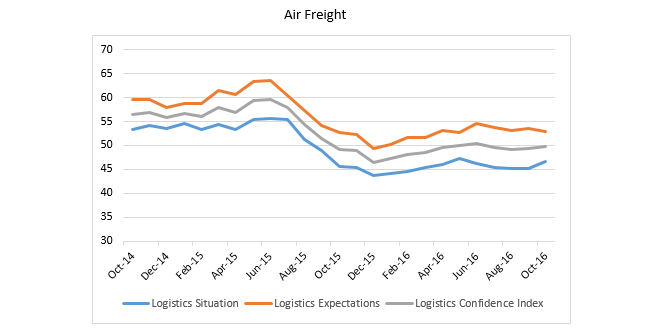

With regards to air freight, the most recent cargo statistics from International Air Transport Association ( IATA) show that volumes, as measured in freight tons, increased by 3.9% for the month of August.

It seems as though at least some are seeing positives in the current market, as continuing into October, the Air Freight Logistics Confidence Index saw a month on month gain of 0.6 points to 49.9, driven by a 1.6 point rise in the Present Index. It is nonetheless prudent to view such growth with caution, as advanced by the head of IATA, who stated: “the underlying market conditions make it difficult to have long-term optimism.”

Air freight

Reaching a total of 49.9 points, the October Air Freight Confidence Index gained 0.6 points on the results for September, and also marked a year on year improvement of 0.7 points, when compared to October 2015. Nonetheless, the Index was 6.6 points below the total recorded for October 2014.

The Present Index results for Air Freight were the chief driver behind the monthly uptick, rising by 1.6 points against the previous month to total 46.7. This result was also 1.0 points greater than the Index result for October 2015. Only a single lane, Europe to Asia, saw a month on month decline, falling by 3.5 points to 39.3. Meanwhile, Europe to US rose by 1.3 points to 48.0, with Asia to Europe up by 2.2 points to 47.2.

Ti analysts say the most significant month on month improvement was recorded by U.S. to Europe, which gained 6.2 points to total 52.3.

Though remaining above the neutral 50 point mark, air freight logistics expectations were down slightly, falling by 0.5 points against those for September to total 53.0. Two lanes recorded declines, with Asia to Europe the most influential, falling by 2.0 points to 54.5. Meanwhile, Europe to Asia also declined, by 1.1 points to 45.3, offsetting Europe to US, which gained 0.1 points to 56.3, and US to Europe, which gained 0.8 points to 56.0.

Sea Freight

Standing at 49.0 points, the Sea Freight Confidence Index was unchanged between September and October, as the results of the present situation cancelled out those of the expected situation. The total measured was 0.1 points greater than in October 2015.

The Present Index for Sea Freight recorded a month on month increase of 0.7 points to 46.1. Though there was a mixed set of results amongst the four lanes surveyed, the gains outweighed the losses. Asia to Europe rose by 2.2 points to 52.3, whilst US to Europe rose by 1.4 points to 46.7. This offset a 0.7 point decline in Europe to Asia, which fell to 39.6, and a 0.3 point fall in Europe to U.S., which tot 45.3.

The Expected Sea Freight Index fell by 0.7 points to 51.9, as three of the four lanes recorded month on month declines. The exception to this was Asia to Europe, which increased by 0.9 points to 54.9. Nonetheless, Europe to US fell by 2.0 points to 52.8, whilst Europe to Asia declined by 1.9 points to 47.9. Furthermore, U.S. to Europe saw a 0.2 point fall to 51.6.

SC

MR

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- More News

Latest Podcast

Explore

Explore

Latest Supply Chain News

- Technology’s role in mending supply chain fragility after recent disruptions

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks