Atradius, a trade credit insurer based in Amsterdam, recently published its “Economic Outlook,” noting that the global economy is in a fragile state, and the time for governments to act is now.

The report provides insights into the past six months of the global economy and forecasts what's to come in the second half of 2019. It also takes a deep dive into the prospects and risks for advanced and emerging economies, as well as implications for the insolvency environment.

Key points from the report include:

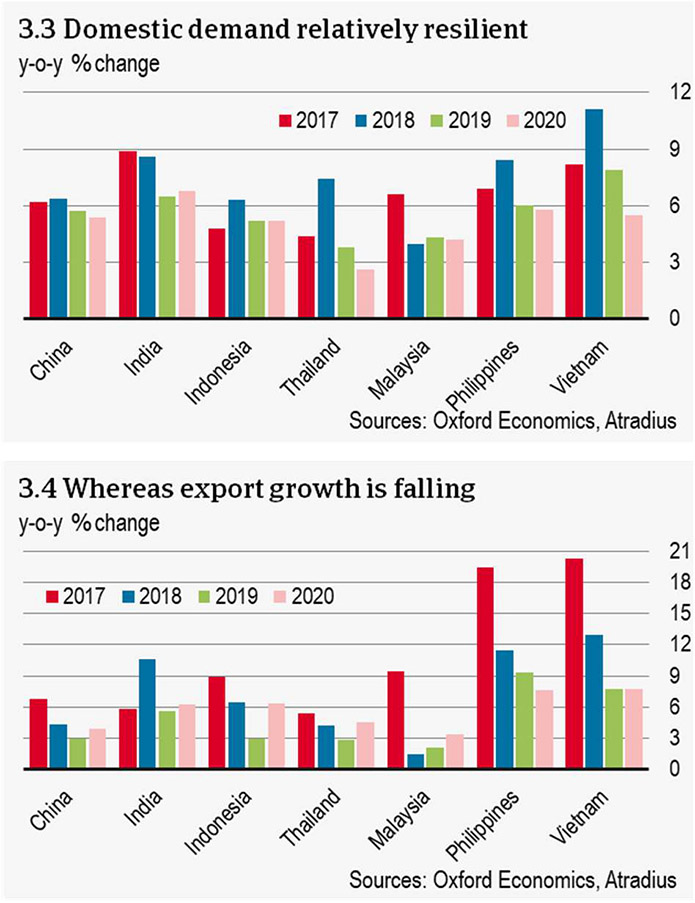

- Global economic growth is slowing modestly in 2019 as the U.S. fiscal stimulus fades. Trade growth is also decelerating, strained by trade policy uncertainty and higher global headwinds.

- The most prominent risks to the global economy include trade war proliferation and the risk of escalation with Europe, a slowdown in Chinese GDP growth, fallout from misguided Fed policy, and oil price volatility.

According to Dana Bodnar, an economist at Atradius the market reaction to the latest flare-up in U.S.-China trade tensions is evidence that emerging markets may also be at risk.

“Since May 5, the day of President Trump's infamous tweets pouring cold water on prospects for an anticipated deal with China, the MSCI emerging markets index is down more than 7%,” he says. “Emerging market currencies had their worst week since the lira crisis of last summer. Elevated domestic policy risks, such as in Argentina and Turkey, also increase the vulnerability of individual emerging markets to global uncertainty.”

According to Bodnar, policy uncertainty in the form of trade war proliferation or a no-deal Brexit are significant risks for supply chains.

“Disruptions are causing some supply chains to shift – either substituting like moving a factory from China to Indonesia or localising to avoid cross-border uncertainty (though raising costs in the process),” he said. “Increasing oil price volatility, especially amid increasing geopolitical tensions, is also a concern for transport costs.”

SC

MR

Latest Supply Chain News

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- More News

Latest Resources

Explore

Explore

Business Management News

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks