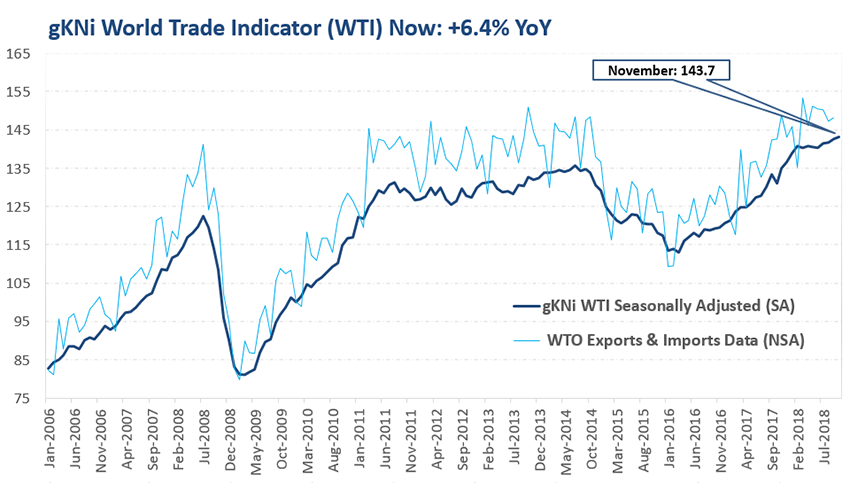

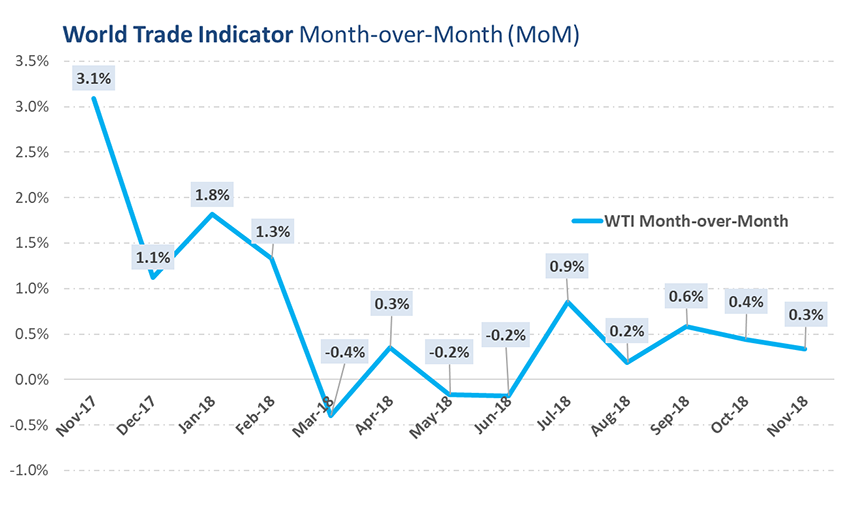

Despite recent episodes political turmoil, analysts for Global Kuehne + Nagel Indicators (gKNi) say World trade experienced a slight upswing in recent months and reached a new high in November.

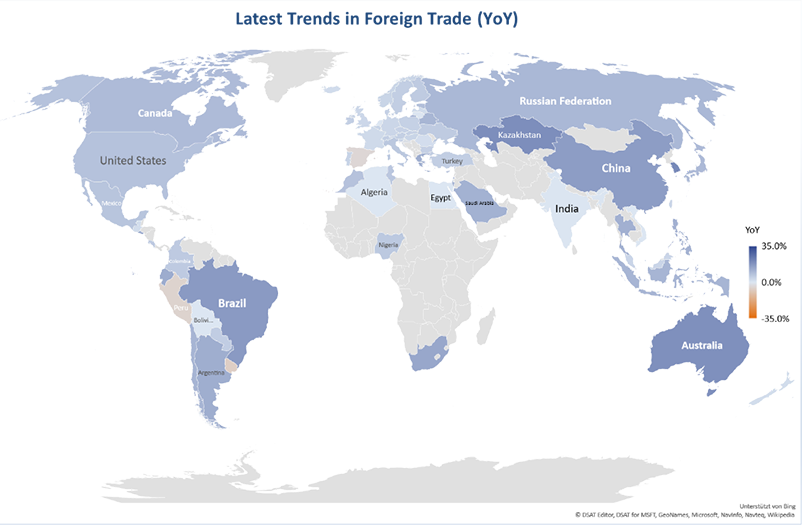

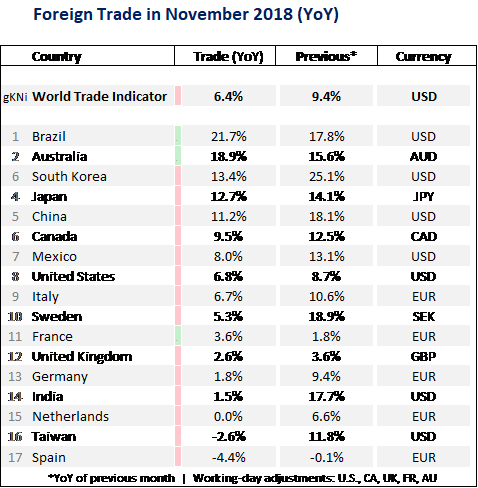

So far this year, international merchandise trade has risen by 10.6%. Emerging markets and North America are the main growth drivers. Despite new tariffs on exported products, China is benefiting from the strong U.S. economy.

“The nowcasts show we should expect this to continue also throughout December,” says Hans-Peter Arnold a spokesman for LogIndex AG.

“Nowcasting” is the prediction of the present, the very near future and the very recent past in economics. The term is a contraction of “now” and “forecasting”

The gKNi World Trade Indicator powered by LogIndex AG, the data company of Kuehne + Nagel, stood at 143.7 at the end of November, up 0.3% on the previous month and 6.4% from last year. The World Trade Indicator not only reached a new record high, but this was also the fifth sequential increase since June.

The main driver is strong domestic demand in the United States but also in China. For China, analysts expect import growth of 21.2% YoY in the second half of the year (first half: +20.2% YoY in USD). Export estimates are at 10.6% (first half: +14.3%). Imports also overtake exports in the United States at an annual rate of 9.1% and 7.1% respectively (first half: 8.1% versus 8.6%).

The analyses show a particularly robust demand for consumer goods: In November, imports of furniture were over 10% higher than in the previous year. Even vehicles imports tend to be higher as do electronic products and capital goods. So far, the figures point to an extraordinarily dynamic fourth quarter.

In ocean freight, measured by the live throughput of ports, the unit volume declined slightly in November (-0.3% MoM), after a jump in October (+1.0%). Sea freight has still risen by +2.9% since the beginning of the year. The cargo and container throughput in U.S. ports increased by +4.5% year-to-date and in Chinese ports by +2.6% year-to-date (compared with the same period in 2017).

Australia and Brazil recorded the highest annual rates in exports. India, the Netherlands, Taiwan and Spain are at the bottom. Exports of Taiwan and India are also expected to be negative in December.

Not all the news was positive, however.

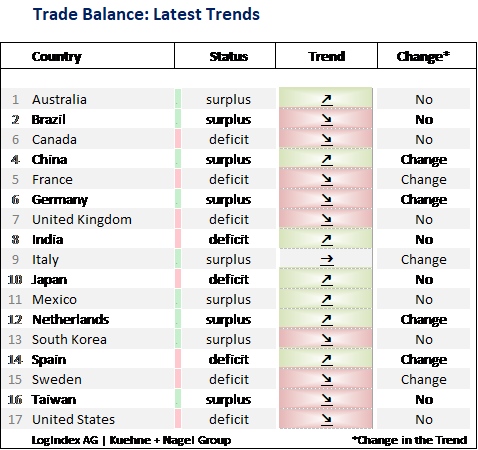

The trends in trade balances (exports minus imports) based on the latest forecasts signal a worsening of existing deficits in Canada, France, United Kingdom, Sweden and the United States.

SC

MR

Latest Supply Chain News

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- More News

Latest Podcast

Explore

Explore

Business Management News

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks