FleetOps, a North American capacity aggregation and freight matching platform for brokers and third-party logistics companies, released new data showcasing an increase in undriven hours month after month. The company additionally surveyed more than 900 carriers to better understand the catalyst behind this increase.

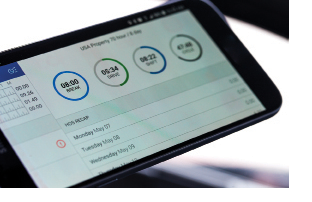

Using real-time data capabilities based on information powered by electronic logging devices (ELD), FleetOps analyzed the number of driving hours by carriers each month in 2022 across the United States, which revealed undriven hours has been increasing year over year. As of June, the percentage of hours left on average increased as much as 12%.

“This past year has certainly proved challenging for freight truck drivers, and many of their pain points and the overall difficulties of a driving job have been brought into the limelight,” said Chris Atkinson, FleetOps co-founder and chief executive officer. “It’s important for these issues to be discussed openly, as carriers are critical to the supply chain–so we get really excited when we receive data intel and survey engagement that can be shared with our partners, and allow us to collaborate on developing solutions that continue to provide operational efficiency.”

Why leave hours on the table?

Responses to FleetOps’ survey included a rise in operating expenses due in large part to the price of gas; a decline in demand; long wait times; and managing ELD mandates.

- Seventy-one percent of survey participants said their decision to leave undriven hours on the table was primarily due to the increased cost of fuel in combination with stagnant wages.

- Thirty-one percent of carriers responded that they have seen a decline in demand, as there simply is not enough for them to haul due in large part to inflation.

- Twenty-nine percent of drivers surveyed said long wait times–both picking up and delivering goods–were affecting their hours of service. Additionally, 20% noted that higher competition for low price hauls meant they were left without freight or choosing to wait until they could capture something.

The data was captured by a survey FleetOps issued to carriers, owner operators, drivers and dispatchers. There were 915 participants.

The visuals are based on a random sample of 2,000 drivers active in the 2021-2022 calendar years. FleetOps is embedded across multiple ELDs capturing hours of service data, location data, carrier preferences and engine data. It is a year-over-year comparison of the unused total cycle hours by drivers in the FleetOps system.

SC

MR

More 3PL

- Orchestration: The Future of Supply Chain

- February and year-to-date U.S. import volume is solid, reports S&P Global Market Intelligence

- 2024 retail sales forecast calls for growth, says National Retail Federation

- ISM reports another month of services sector growth in February

- February manufacturing output declines, notes ISM

- How to Create Real Retailer-Brand Loyalty

- More 3PL

Latest Podcast

Explore

Explore

Topics

Business Management News

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- Supply chain salaries, job satisfaction on the rise

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks