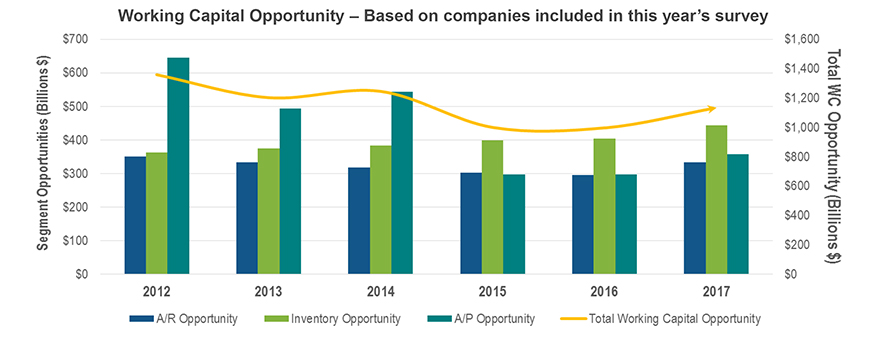

The 1000 largest non-financial companies in the U.S. significantly improved their ability to generate cash in 2017, producing the strongest working capital performance since 2008, noted The Hackett Group in a recent survey. But their ability to collect from customers and manage inventory actually both deteriorated, masked by a significant increase in the time companies take to pay suppliers.

In 2017, companies significantly extended payments to suppliers, taking 3.4 days longer to pay than in 2016 and improving Days Payable Outstanding (DPO) by increasing it to 56.7 days. Increasing DPO keeps cash on the balance sheet longer and improves cash position. The Hackett Group's survey found evidence that for many companies, improving DPO involves companies simply pushing the working capital burden onto their suppliers, including much smaller companies, by forcing them to accept longer payment terms.

Supply chain financing is also growing in popularity as a way to improve DPO performance while limiting the impact on suppliers, says The Hackett Group Associate Principal Craig Bailey.

In an interview with SCMR, Bailey added that performance of the other major elements of working capital performance, receivables and inventory, both deteriorated slightly in 2017. Days Sales Outstanding (DSO) rose by 4.4 percent to 39.5 days and Days Inventory On hand (DIO) rose by just 0.6 percent to 51 days.

“There's been a renewed focus on best cash flow since the financial crisis,” he said. “Supply chain managers are also stretching the boundries beyond standard terms of accounting to optimize inventory.”

The Hackett Group's 2018 US Working Capital Survey and scorecard calculates working capital performance based on the latest publicly available annual financial statements of the 1000 largest non-financial companies in the United States, utilizing data sourced from FactSet.

Overall, the survey found the companies had a Cash Conversion Cycle (CCC) of 33.8 days, an improvement of 1.5 days (4 percent) over last year.

Bailey told SCMR that the survey was also designed to give The Hackett Group a way to extend its supply chain consulting to create more sustainable procedures.

“We hope to transform a culture, by helping companies get out of project environment and move to a more holistic mode.”

SC

MR

More Finance

- Investor expectations influencing supply chain decision-making

- ISM reports manufacturing sees growth in March, snaps 16-month stretch of contraction

- Supply Chains Facing New Pressures as Companies Seek Cost Savings

- February retail sales see annual and sequential gains, reports Commerce and NRF

- A New Model for Retailer-Supplier Collaboration

- How to Create Real Retailer-Brand Loyalty

- More Finance

Latest Podcast

Explore

Explore

Business Management News

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Tips for CIOs to overcome technology talent acquisition troubles

- There is still work to do to achieve supply chain stability

- Blooming success: The vital role of S&OE in nurturing global supply chains

- Supply chain salaries, job satisfaction on the rise

- More Business Management

Latest Business Management Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks