Nearly two-thirds of companies with well-established advanced analytics strategies report operating margins and revenues of 15% or more, according to a report developed by Forbes Insights, in collaboration with EY Global.

The report, Data & Advanced Analytics: High Stakes, High Rewards, revealed that among those organizations who have an analytics strategy that is well-established and central to the overall business strategy, rated their competitive ability in data and analytics as market-leading. Of these organizations, 66% achieved revenue growth of 15% or more, while 63% reported that operating margins had increased 15% or more in 2016. In addition, 60% of these companies said they also improved their risk profiles.

With returns of this caliber, a data and analytics strategy is both effective and necessary for global organizations. Over the next 2 years, more than half of the global executive respondents are planning to invest at least $10 million in data and advanced analytics.

In an interview with SCMR, researchers noted that there were a few surprises contained in the research, too:

- The market is moving very fast…75% of ‘top performers' have used advanced analytics to overhaul business strategies and update how they compete in their respective markets…as an example.

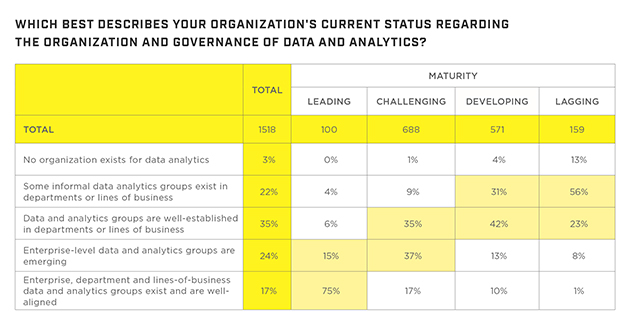

- Yet our maturity assessment suggests that only 7% are ‘Leading'…meaning their analytics strategy is well-established and central to the overall business strategy (among other factors).

- And this maturity REALLY matters…almost 2/3 of the leaders had revenue growth of 15% or more, had improved operating margins 15% or more and had improved their risk profile. This is well above the rest of the population.

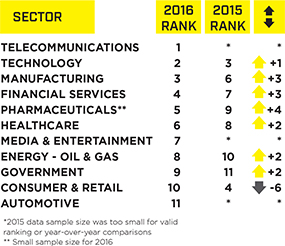

- There were significant changes YOY in sector and country maturity. The drop in CP&R is an example…a bit surprising given that this sector has been using analytics for sales and marketing for years.

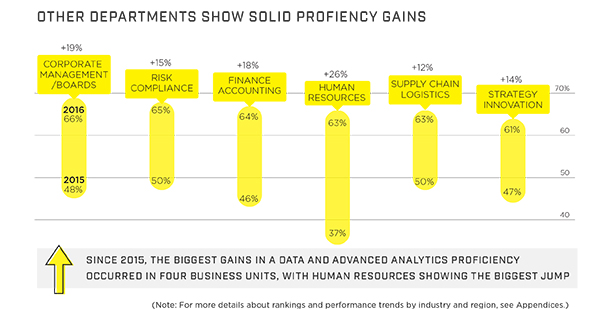

- And significant changes in maturity of different business functions with big improvements across the board – largest in HR. Analytics really starting to get pervasive across the organization.

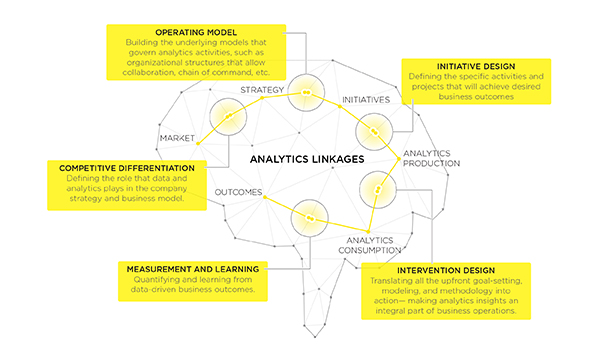

- The findings around the importance and lack of maturity around intervention design (user experience) are really interesting.

“Traditional process-driven organizations are now being disrupted by the new era of businesses that use data as a strategic asset. Companies have moved from pilot projects that originated in business units or countries to using data and advanced analytics at an enterprise level to rethink and reimagine their entire business to identify new opportunities,” says Chris Mazzei, EY Global Chief Analytics Officer and Emerging Technology Leader.

The survey of more than 1,500 global executives from companies with at least $500 million in annual revenues was designed to deliver a maturity assessment of how proficient organizations are in applying analytics throughout their operations. Based on the maturity assessment scores, China maintains the number one spot in the ranking, while the United States comes in second, up from fifth, and the UK holds steady in third place.

In terms of industry rankings, telecommunications came in first place while consumer products and retail dropped to tenth in the ranking from fourth in 2015. Technology takes the number two spot this year, followed by manufacturing in third place. In the area of emerging technologies, market-leading organizations use predictive modeling (67%), artificial intelligence (53%) and robotic process automation (43%).

In a similar EY and Forbes Insights survey a year ago, only 16% of respondents had achieved an analytics strategy that infuses insights across functions such as HR, finance and the supply chain, compared to 23% of this year’s respondents, indicating some progress but there is still more work to be done. This year's survey indicates that there still needs to be a heavy focus on the people who are applying the analytics, making the decisions and changing business processes within organizations. Forty-one percent of organizations still lack the collaboration needed between IT, the data and analytics team and the business team.

With regard to future studies: there are some issues supply chain managers may expect, say researchers:

- Planning to dig deeper in to the use of AI, machine learning and other emerging technologies.

- Planning to explore the ‘convergence' of how these technologies come together to reinvent how value gets created in parts of the business or for the overall enterprise. “The top pain points in successfully imbedding analytics strategically throughout the business continue to be around the human element, not the technology. Collaboration, culture and skills were cited as key hurdles throughout the business life cycle, creating a wider divergence between organizations that are focusing on the people aspects – and separating winners from losers,” says Bruce Rogers, Forbes Chief Insights Officer.

Read the full report from Forbes here.

Read the full report from Forbes here.

SC

MR

Latest Supply Chain News

Latest Podcast

Explore

Explore

Latest Supply Chain News

- A reshoring history lesson

- Strategic cost savings differ from cutting costs

- Planning fatigue may be settling in

- Inflation, economic worries among top supply chain concerns for SMBs

- April Services PMI declines following 15 months of growth, reports ISM

- Attacking stubborn COGS inflation with Digital Design-and-Source-to-Value

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks