After a pullback in freight transportation demand in the second half of 2022 that accelerated downward in the fourth quarter, there are some initial signs that freight markets may be approaching (or have hit) a bottom in terms of freight demand. However, despite some carriers expressing positive sentiment for volumes in the second half of 2023, we believe there are several signals indicating that additional freight demand will not reach the heights of 2021 – particularly for upstream industrial demand – leaving some excess capacity idle in the 2nd half of 2023.

Clearly, the consumer portion of the economy is hotter than the upstream B to B economy. It is much like 2018 and 2019 – except with inflation.

In February the Logistics Managers’ Index’s (LMI) Transportation Price metric read in at the fastest rate of contraction in the 6.5-year history of the index. This marks eight consecutive months of contraction in transportation price, coming after nearly two years of expansion. Consistent with this, the producer price index for long distance general freight trucking registered the steepest monthly decline going back to 1992 in January, with February’s prices down 11% year-over-year. While some carriers have expressed optimism that volumes will pick back up later in 2023’s second quarter, this has clearly not materialized through the first two months of 2023 (see chart).

These gloomy transportation numbers may seem to be at odds with recent positive job growth and ongoing tightness in the labor market. There is no one-size-fits-all prognosis that can properly describe the entire economy. Instead, we observe economic conditions varying by tier in the supply chain, creating a nuanced environment that is not unlike what existed during 2019. To better understand this nuance, we dig into the data at every level of the supply chain, exploring the manufacturing, wholesale and retail industries.

The story in manufacturing

The sluggishness in industrial demand can be seen in the durable goods manufacturing sector: which makes primary metals like steel and aluminum; transportation equipment like SUVs and airplanes; building materials like lumber and bricks; and machinery of all sorts. This sector has seen a sharp cooling since October based on data from the Federal Reserve Board.

While there was encouragingly a rebound in January’s preliminary data, January’s seasonally adjusted output was down 1.9% from October. Importantly, prior history suggests downturns in durable goods production can take many months to reach a bottom.

For example, following a post Great Recession peak in late 2014, durable goods production slid roughly 5% over the next 18 months before reaching a nadir in mid-2016. Likewise, after peaking in Q3 2018, durable goods production slid roughly 5% in 2019. As such, it would be unusual for durable goods production to reach a bottom in only a few months (though we can only hope). Within durable goods manufacturing there are concerns about the sharp declines in raw steel, equipment steel and aluminum production as these inputs are utilized across a great many other durable products. Likewise, the fact fabricated metal product production has stalled since early 2022 is not encouraging, as expansion in this sector tends to correspond to strong freight demand conditions. Manufacturing activity in the USA accounts for roughly 58% of ton-miles hauled by trucking companies, suggesting strong headwinds on freight volumes unless there is a broad-based turnaround in the coming months.

The story in wholesale

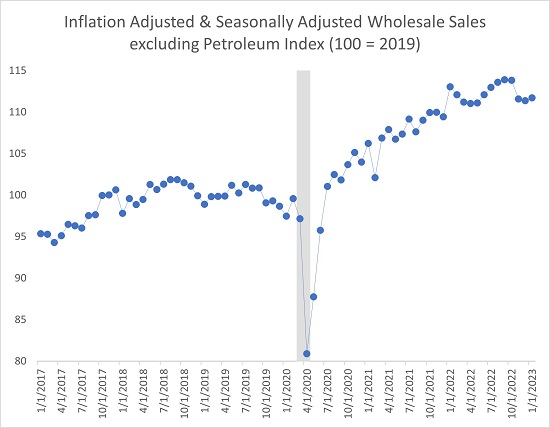

In addition to slowing manufacturing sales, the wholesale trade sector—which accounts for about 30% of ton miles hauled by trucking companies—saw a substantial slowdown in the second half of 2022. Data from the Census Bureau’s new program providing inflation adjusted wholesale trade sales shows that physical quantities sold by wholesalers excluding petroleum products (removed due to the volatility of price deflators impacting sales in this subsector) indicate seasonally adjusted wholesale activity fell in the fourth quarter of 2022. While inflation adjusted wholesale sales are still 11% above their 2019 levels, this slowdown suggests further headwinds for freight volumes (see chart).

The story in retail

Retail is more of a mixed bag. While general merchandisers such as Walmart and Target have reported evidence that they are getting bloated inventories under control, the same cannot be said for other sectors of retail trade. This includes building material retailers, where seasonally adjusted inventories relative to sales are hovering at levels not seen since the height of the housing crisis during the Great Recession and its immediate aftermath. Moving further upstream to wholesalers, inventories to sales ratios are elevated in sectors such furniture wholesaling; household appliance, electrical, and electronic goods wholesaling; hardware, plumbing, and heating equipment wholesaling; and apparel wholesaling.

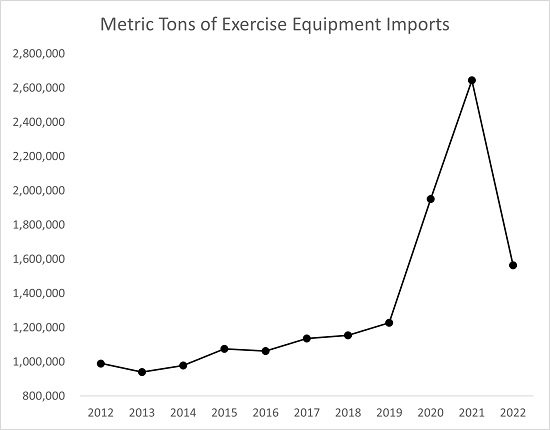

These categories generally seem to be areas which thrive during the pandemic, but are no longer as important to consumers. Furthermore, we are seeing evidence of sharply rising inventories to sales in sectors such as miscellaneous durable goods wholesaling. This includes wholesalers of toys and workout equipment, categories in intense demand in 2020 and 2021 that have seen waning demand. There is a strong likelihood that wholesalers imported too many of these products in 2022. Census Bureau data on the imports of toys indicate that 2022 saw imports that were 29% above 2019 levels. Meanwhile, imports of workout equipment—while down from their incredibly elevated levels in 2021—were still 27% above their 2019 levels (see chart).

Essentially, retailers still have too much in inventory when it comes to goods that are tied to things like housing, which has been deeply impacted by rising interest rates, or with items that were over-ordered during the pandemic.

Despite this, people are still making purchases, however they have shifted away from goods and back towards services. Consumer expenditure in the United States is now 33% for goods, which is like pre-pandemic levels of 30%. When it comes to purchasing physical products, American consumers continue to prioritize spending on essentials like groceries and energy and avoid making discretionary purchases like clothing and technology.

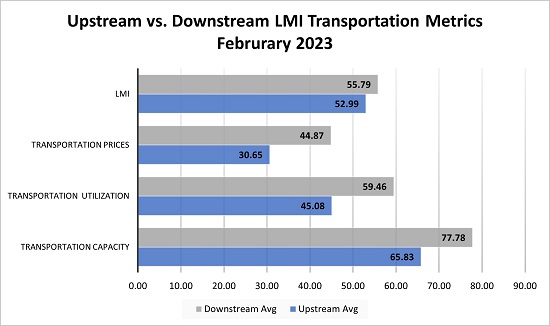

While the freight market is down overall, it is important to note that it remains strong in some portions of the economy. Evidence of this can be seen in the Upstream/Downstream data split from the February 2023 LMI.

Downstream retailers reported significantly slower transportation price contraction than their upstream counterparts, despite having more available capacity. The biggest difference between the two groups is in utilization of available transportation. Downstream firms reported a significant expansion (59.5) of Transportation Utilization whereas Upstream firms reported contraction (45.1).

The significant variation between transportation markets at different levels of the supply chain adds nuance to our understanding of current and future trends and helps to disentangle the mixed signals coming out of the industry. This bifurcation of transportation markets is similar to what we saw in 2019 when the upstream B2B freight markets slowed down significantly, but the consumer market stayed hot (see chart). This had the effect of leading to a freight recession, but not a recession of the overall economy.

Future of the freight, general economy

Recent macro-economic reports shed further light on the future situation. The consumer price index excluding shelter is showing substantial signs of slowing down, with the three-month unweighted moving average of the compound annual rate of change averaging just 1.4%, which is line with the Fed’s 2% inflation target.

Given the shelter cost component of the CPI lags changes in market conditions, the negative monthly readings for February’s producer price indexes, and the uncertainty created by the failure of Silicon Valley Bank and Signature Bank, the FOMC may slow or even curtail interest rate hikes. However, even if the Fed takes its foot off the interest rate pedal, given housing prices remain elevated about 39 percent from where they were before the pandemic, the most likely scenario for housing 2023 is muted activity that is around 2018 or 2019 levels.

This suggests that manufacturing tied to products including lumber, bricks, shingles, carpets, furniture and appliances will remain low, limiting industrial cargo for trucking firms to haul. This will also impact wholesale and retail traffic related to these goods. However, consumer spending seems to be remaining strong, and certain sectors of downstream retail industry – particularly those with a service or consumable component, should continue to remain steady if not grow slightly through the next year.

Similar to 2019, the overall freight market will likely struggle, but consumer-oriented freight and the overall economy should continue to push along. The bifurcated nature of the current economic is borne out in the recently released employment numbers. While overall employment grew at a higher-than-expected 311,000 jobs, the transportation and warehousing sector was actually down 22,000 in February – adding to the 42,000 positions lost since October.

There are reasons to hope that freight markets have hit their nadir, and consumer demand remains strong. The LMI’s future predictions project a level of steadiness returning to the market over the next 12 months, and strong demand at the retail level could eventually trickle upstream to wholesale and industrial traffic. However, with interest rates as high as they are and likely to move higher in the coming months, we are not yet ready to call it a comeback for the freight market.

SC

MR

Latest Supply Chain News

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- More News

Latest Podcast

Explore

Explore

Latest Supply Chain News

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- Humanoid robots’ place in an intralogistics smart robot strategy

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks