There is substantial debate today regarding whether the trucking sector is heading into a freight recession. Or, could it be a that the decline in dry van and refrigerated spot prices is a function of more attractive contract prices coupled with freight patterns returning to their pre-COVID mix. That’s especially as year-over-year growth in inflation-adjusted retail trade sales slow and manufacturing picks back up. In this article, we look at the available data from government sources and the Logistics Managers Index (LMI) to try and shed some light on this issue.

Dale Rogers, Arizona State University

To paraphrase Mark Twain: rumors of the death of the freight market have been greatly overstated. The data suggest that there has not been a substantial decline in trucking freight volumes in April and May. Rather, the market is returning towards a new equilibrium after having been profoundly discombobulated since the onset of the pandemic.

Our first piece of evidence comes from the Federal Reserve Board’s industrial production index for manufacturing excluding hi-tech products. We exclude hi-tech products because they contribute minimally to freight movements yet their upward movement tends to positively shift industrial production data. These data measure real output, meaning quantity of products produced in the USA (e.g., they are not affected by inflation).

The seasonally adjusted reading for April 2022 was the second highest reading since the end of the Great Recession, trailing only July 2014. As can be seen in the chart below, seasonally adjusted industrial production has been trending strongly upwards, counter to the freight recession narrative. A further point: the declines seen in 2015 – 2016, and especially 2019, corresponded to freight recessions. This makes sense, as the 2017 Commodity Flow Survey indicates manufacturing accounts for more than 50% of all for-hire trucking ton-miles.

Our second piece of evidence is data on single-family housing starts and houses under construction are well above pre-COVID levels (see chart). For example, despite abhorrent weather in much of the U.S. in April, new housing starts were up 24% from 2019. Likewise, permits were up 24% from 2019 levels. This level of housing activity is likely to support manufacturers of lumber, shingles, siding, and large appliances, in addition to wholesalers of construction materials.

Our third piece of evidence is pricing behavior in various sectors of trucking from the Bureau of Labor Statistics. General freight trucking, long-distance, truckload prices increased 5.4% in April from March. Prices are now up 34.4% year-over-year (note, that is an all-in price). Long-distance trucking, specialized prices rose 2.5% in April from March and 6.1% in March from February. Year-over-year, specialized trucking, long-distance prices are up 23.9%.

Furthermore, general freight trucking, long-distance, less-than-truckload prices rose 5.2% in April from March. Year-over-year they are up 23.7%. It doesn’t seem tenable to attribute these increases in April to diesel fuel surcharges, as the price of diesel was down in April from March (although it should be pointed out that the price of diesel was up in May). It seems unlikely carriers could command further linehaul price increases if freight volumes were set to plummet.

Another piece of evidence that freight volumes are not falling dramatically is a mid-quarter update from the Bank of America investors’ conference. As reported by FreightWaves, J.B. Hunt and Schneider both reported strong volumes and stated there was no evidence that volumes were falling. Likewise, Transplace, which manages approximately $15 billion of transportation spend, notes that their volumes were slightly above 2021 levels.

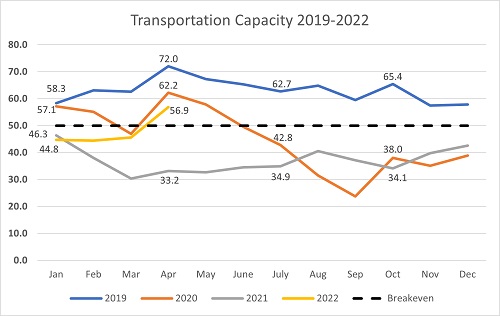

Data from the Logistics Managers’ Index (LMI) corroborates this macro-level data. When observing Transportation Capacity metrics from 2019-2022 it is clear that the loosening of capacity we see in early 2022 is relatively mild.

In April 2022 the LMI’s Transportation Capacity metric shifted from contraction to expansion for the first time since June 2022 – indicating that for the first time in 22 months there was more transportation capacity available than there had been the month before. While this does represent a significant shift, it does not necessarily portend a freight recession, merely a slowdown. The rate of expansion in April 2022 is up 23.7 points from April 2021 but is down 5.3 and 14.1 points from the same time in 2020 and 2019 respectively.

The LMI Transportation Price metrics display a similar phenomenon, as they read in April 2022 lower relative to April 2021, but significantly higher than at the same points in 2020 or 2019. The Transportation Price’s 73.9 is just under the all-time average of 74.9.

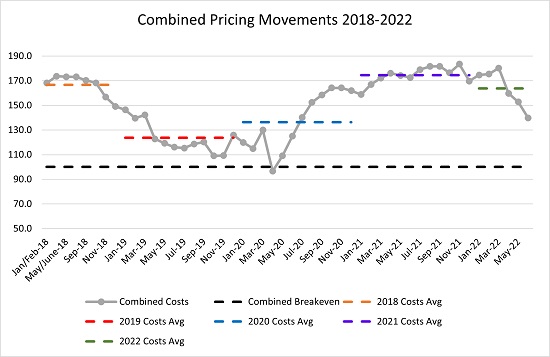

There is a lot of data suggesting that the freight market is regressing back towards the mean. It is possible that this regression will be felt disproportionately by carriers that are newer and have paid high costs to enter the sector and/or only existed in a market that allowed them to pick up high-paying spot loads with ease. Smaller carriers will also have more difficulty with the higher fuel prices as they are more limited in their ability to purchase diesel fuel at wholesale prices.

Interestingly, preliminary results from the May LMI report suggest that the transportation market has rebounded in the back half of May, with price growth coming in significantly stronger from the end of May 2022 versus the beginning of May 2022. As inflation rates slow and consumer spending continues to rise, more evidence contributes to the hypothesis that we’re moving towards a moderation (at a new normal which is somewhat elevated from pre-pandemic levels) and not towards a recession.

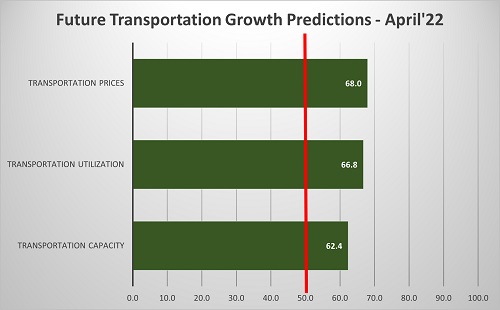

Looking forward, LMI respondents predict moderate rates of growth for the transportation industry. But they do not predict the robust – and unsustainable – expansion of 2021. Instead, we see predictions of mild growth in which capacity will begin the expansion shippers have been calling for, and price and utilization avoid cratering.

Interestingly, respondents are more bullish on the transportation sector for downstream industries such as retail. Transportation utilization downstream is predicted to grow 14 points faster than upstream – a statistically significant difference – perhaps indicating that we may see a repeat of 2019 when we saw the consumer remain hot, and ecommerce continue to grow, while the B2B side slowed down. Whether or not this will be tempered by the high levels of inventory retailers are currently holding remains to be seen.

Right now, the data surrounding U.S. supply chains is encouraging. We may run into slowdowns in the months ahead, but one of the strengths of the U.S. economy seems to be the ability to process sickness quickly.

Even during the Great Recession of 2008 – 2009, the U.S. was able to process serious economic problems much more quickly than the rest of the world. While the recoveries we are seeing in the late spring of 2022 may possibly be temporary, they seem to confirm the ability of the United states to quickly address economic difficulties and get supply chains back online.

The middle of 2022 is confusing both for logisticians and policymakers. But as all supply chain managers know, the greatest strength is agility, resilience and the determination to get healthy quickly.

Jason Miller is an associate professor of supply chain management at Michigan State University. He can be reached at [email protected].

Zac Rogers is an assistant professor of supply chain management at Colorado State University. He can be reached at [email protected].

Dale Rogers is the ON Semiconductor Professor of Supply Chain Management at Arizona State University. He can be reached at [email protected].

SC

MR

Latest Supply Chain News

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- More News

Latest Resources

Explore

Explore

Latest Supply Chain News

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks