Many of the reports on the recently announced U.S. steel and aluminum trade tariffs point to China as the main target of these sanctions. While China may be the target, the action has clearly been misdirected and demonstrates the Wests lack of understanding or appreciation of the geo-political factors in play. By resorting to a mercantilist tactic that helped guide the Marshall plan and end China's dominant Silk Road trade network, it has failed to recognize China's strategy to return Chinese Pride without a seemingly direct challenge but through a sophisticated economic strategy that applies the classic Sun Tzu principle of destroying an enemy without having to resort to fighting.

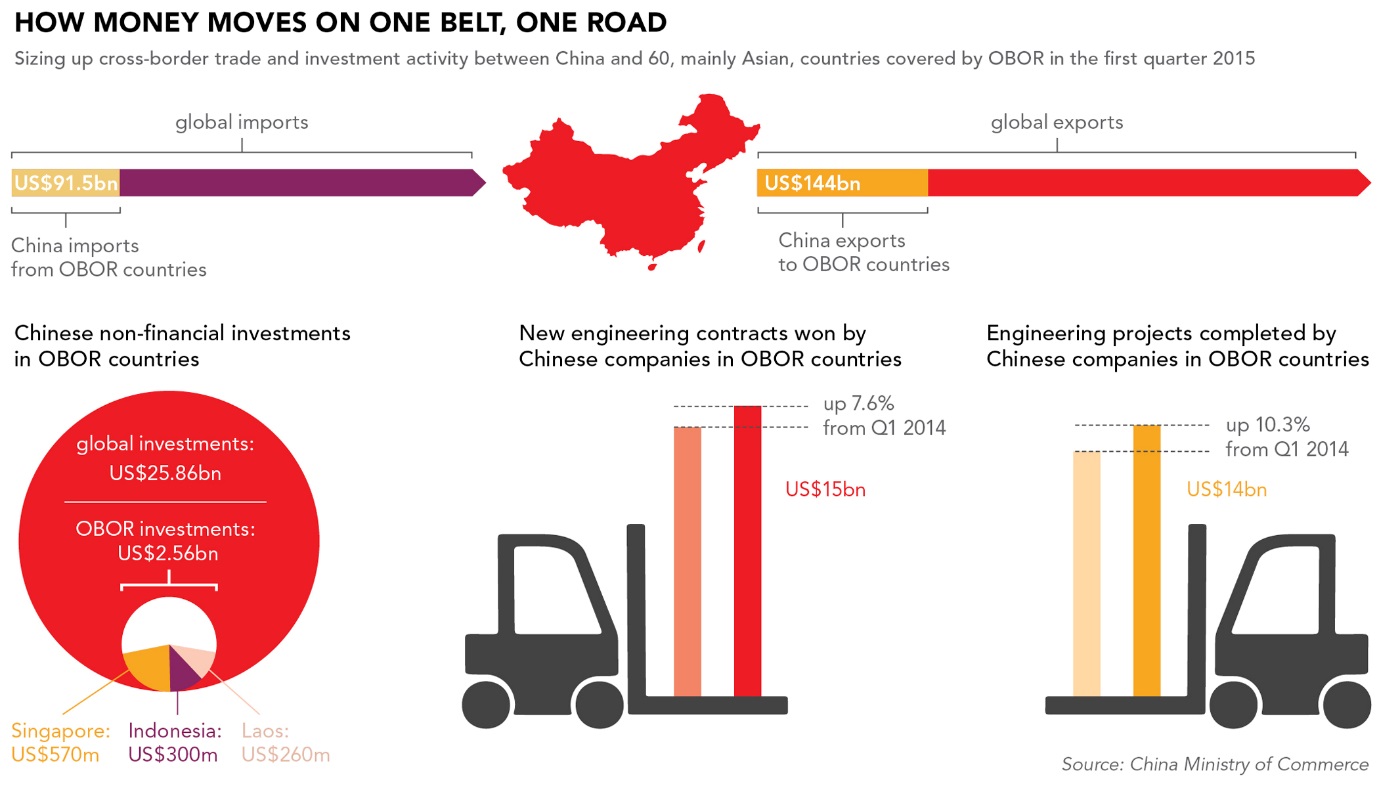

This strategy became more visible in 2013, when Xi Jinping made his first public pronouncement of the One Belt One Road initiative (BRI). Much of the response focused on whether it will happen and the commercial viability of such an audacious plan. In my view, it is already happening and what commentaries miss is that the scope of the BRI extends beyond simply building infrastructure. It is a logistics and transportation network that focuses on those regions promising high economic growth with strategic resources, such as steel, concrete and gas by building infrastructure that connects and links manufacturing with key markets.

Furthermore it not only connects East and West but joins Asia with SE Asia – a market that has 600 million people and is nine times the scale of central Asia. It opens access to a market that covers 65% of the world's population and one third of the world's GDP, summarized by the CPC below.

Following the 2017 summit in Beijing, China's initiative has:

- 46 entities signed up with 100 cooperation agreements in place,

- Covers 86 countries and international organizations,

- Rail and Port agreements worth $140bn signed,

- 41 projects now funded and in process

- 11 Free Trade Zones in place

- Trade volume along the BRI was $983bn.

It should be noted that the initiative incorporates industrial park development, Trade Co-operation Zones, Regional shipping centers by PAIRING ports with rail / road / air networks, all operating on a sound IT platform.

Recent developments include:

- Gwadar Port

- Islamabad International Airport opens end March 2018

- Construction of 180km Hazara motorway in full swing

- Completion of 3.3km Baicheng tunnel on China's Loess Plateau

- Kohat – Rawalpindi rail car service launched

- 2nd unit of 2 x 660MW Port Quasim power project completed 168 hour load operation test Dec 2017

- Malaysian ports of Khlang and Malacca,

- Hambantota Port in Sri Lanka

- Deep water port at Kyauk Phyu in Myanmar.

- Jakarta port Indonesia

China also manages 77 sea terminals in the region, including countries such as Indonesia, Australia, Malaysia and Thailand. These ports / rail connect to special China controlled special economic zones in Sri Lanka, Oman, Myanmar and Malaysia amongst others. They are backed by a 35 rail line network of direct freight trains connecting Eurasia as well as 19 Free Trade Agreements. By way of example, Malaysia was the first ASEAN country to sign a bilateral agreement with China that has a bilateral trade of $96.3bn per year and includes a digital free trade zone allowing for ease of trade between the two countries. Not only does this network give China alternative markets, it also creates options to relocate manufacturing to cheaper centres. All of this will have a profound impact on supply chain and logistics dynamics within the region. Consider the change as China moves from the current 1.5% by volume of trade transported by rail to the 20% model found in Europe.

All the above points to the announced tariffs by the USA having little affect on China's trade. Particularly when you consider that only 3% of Chinese steel by value is exported to the USA. Furthermore, China's total export value of steel to all countries only accounts for 0.05% of GDP, with excess steel production being used in the BRI infrastructure projects, such as rail and bridges.

The tariff penalty would have been effective at the height of U.S. economic dominance, but the geo-political and socio-economic transformation of trade and economics has allowed China to insulate itself. This transformation was ignored by policy makers caught up in the business case / commercial paradigm evaluation of projects and not understanding the strategic returns placed on projects by China. Policy advisors and supply chain professionals need to also take account of the fact that the full roll out of the BRI is expected to reach its high point in 2049. This will have a profound impact on on-shoring manufacturing, giving Eurasia a powerful economic voice as the rising Asian middle class becomes accessible, potentially replacing the USA market. In some ways, Trump's actions have already started the process as Europe threatens counter measures and turns to Asia and China in particular, to secure markets.

Andre Wheeler is CEO of Asia Pacific Connex and has more than 20 years' experience in international business. He is currently working on his Ph.D. on the Impact of the China One Belt One Road initiative on infrastructure and logistics in the ASEAN Region. He can be reached at [email protected].

Andre Wheeler is CEO of Asia Pacific Connex and has more than 20 years' experience in international business. He is currently working on his Ph.D. on the Impact of the China One Belt One Road initiative on infrastructure and logistics in the ASEAN Region. He can be reached at [email protected].

SC

MR

Latest Supply Chain News

- April Services PMI declines following 15 months of growth, reports ISM

- Attacking stubborn COGS inflation with Digital Design-and-Source-to-Value

- Despite American political environment, global geopolitical risks may be easing

- Joseph Esteves named CEO of SGS Maine Pointe

- Employees, employers hold divergent views on upskilling the workforce

- More News

Latest Podcast

Explore

Explore

Topics

Procurement & Sourcing News

- April Services PMI declines following 15 months of growth, reports ISM

- Despite American political environment, global geopolitical risks may be easing

- April manufacturing output slides after growing in March

- World Trade Centers offers a helping hand to create resilient, interconnected supply chains

- Bridging the ESG gap in supply chain management: From ambition to action

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- More Procurement & Sourcing

Latest Procurement & Sourcing Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks