Supply chain managers trying to make sense of the recent disruptions in the ocean cargo marketplace may expect more change to come, say industry analysts.

According to a new report issued by The Boston Consulting Group, container lines must also adopt future strategies for enhancing their performance in a commercial environment characterized by declining demand.

The BSG report – Sailing in Strong Winds: The New Normal in Global Trade and Container Shipping – comes in the wake of Hanjin's bankruptcy and the newly announced formation of a Japanese carrier conference comprising that nation's three largest players.

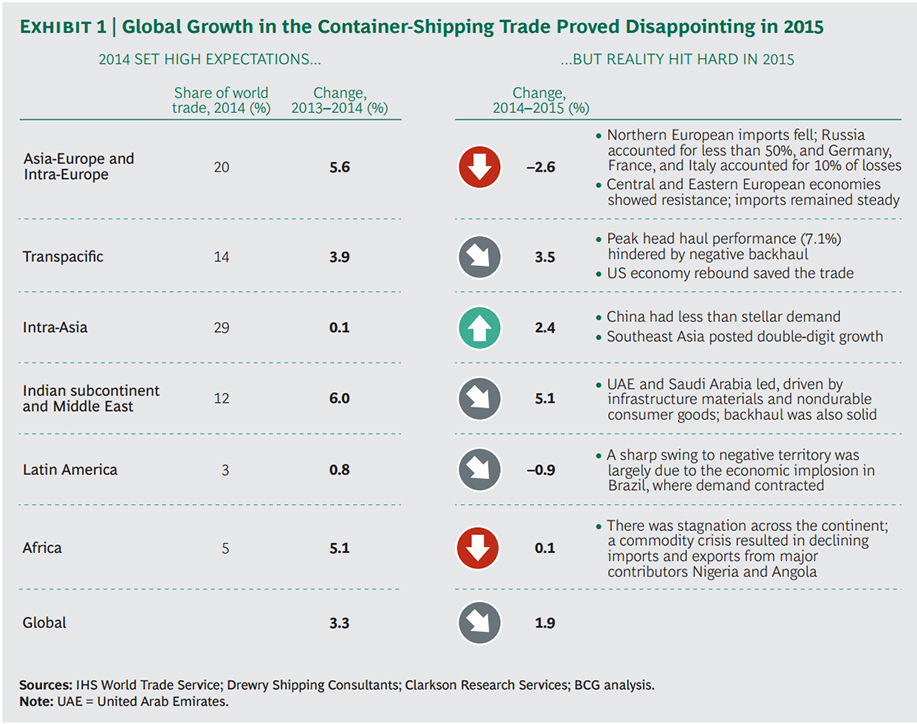

The report in some cases, overstates the obvious: Demand for containers picked up during 2014, but by the end of 2015, average global growth in the container-shipping trade was a disappointing 1.9%.

Still, in a bid to boost scale and reduce slot costs, liners continued to invest in new and large vessels. This worsened the overcapacity that was already afflicting the market and pulled freight rates down to a new low.

“In 2015, for the first time in history, growth in container demand lagged behind global gross domestic product,” says Ulrik Sanders, a BCG senior partner and a coauthor of the report.

To identify potential “culprits” behind the disappointing news for 2015, the authors analyzed the performance (including import and export volumes) of six major trade routes, or trades, that collectively represent more than 80% of the total world container trade.

The trades are: Asia-Europe, Transpacific, Intra-Asia (including Intra-China), Indian subcontinent and Middle East, Latin America, and Africa. Several individual trade regions—particularly Asia-Europe (including Intra-Europe), Transpacific, and Indian subcontinent and Middle East—achieved impressive growth rates that year, even as Intra-Asia, historically a powerful growth engine, saw disappointing rates.

Performance varied depending on key drivers of demand in the different trades, such as industrial and consumer demand, as well as structural changes in economies such as China.

Anticipating Global Container Shipping in 2020

In addition to analyzing container demand volumes in 2015 for key trades, the authors assessed the main drivers of demand to develop several scenarios—base, bear, and bull—for what global container shipping might look like over the next several years.

“Our goal was to answer the question, ‘Was 2015 a cyclical low point or an indication of a new normal for global trade?'” says Camille Egloff, a BCG partner and a coauthor of the report.

The authors took a particularly close look at possible scenarios for container demand and container supply-and-demand balance over a six-year period. For container demand, they expect global container traffic to grow from 2.2% to 3.8% annually from 2015 through 2020, depending on the growth performance in each of the six major trades. For container supply-and-demand balance, they anticipate a supply-demand gap ranging from 8.2% to 13.8% in 2020. (The gap was 7% in 2015.)

The authors estimate that by the end of 2020, oversupply in vessel capacity will stand at 2.0 million to 3.3 million 20-foot-equivalent units (TEUs)—90 to 150 Triple E class “Mega” vessels.

Carriers' Next Moves

BCG's analysis of shipping companies globally suggests that many container carriers are stuck in the middle between being a scale leader and being a niche player focused on certain trades.

“They lack sufficient scale to drive down costs and enough differentiation to offer unique commercial value or to command premium rates,” Egloff says. “This is a dangerous position in an increasingly commoditized industry.”

To improve their performance in the industry's new normal, container liners should consider making several moves. These include boosting scale on their own through a blend of global mergers and smaller M&A deals that can help them lower costs, harvesting synergies from savvier deployment of their fleet, rationalizing their combined network of lines, and streamlining their network of agencies.

“Our client work suggests that maximizing synergies through such means could deliver a 5% to 10% decrease in the cost base of a combined company,” Egloff adds.

Pushing alliances to the next level to unlock even more synergies (for instance, by forging joint procurement and operations arrangements), another move worth considering, could deliver a 3% lift in EBIT, according to the authors. Still, capturing these gains will require sophisticated alliance models characterized by better integration of operations and assets. Moreover, the additional complexity that comes with collaboration with many alliance partners may offset potential benefits.

Meanwhile, optimizing the core business (for example, by rethinking the company's product offering and services network while also controlling costs) could deliver EBIT improvements of 5% to 7%. Enhancing commercial excellence, even in a commoditized industry, can create competitive advantage in areas such as yield, sales force effectiveness, and channel strategy, delivering EBIT improvements of 3% to 5%.

Extracting value from adjacent markets (by, for example, accelerating development of additional forwarding services in rapidly developing economies) could also improve carriers' returns on assets. Finally, carriers can leverage digital technologies to improve commercial platforms and booking systems, as well as boost internal-process efficiency, improve fleet management, and foster more fluid collaboration with value chain players.

SC

MR

Latest Supply Chain News

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- More News

Latest Resources

Explore

Explore

Latest Supply Chain News

- Tech investments bring revenue increases, survey finds

- Survey reveals strategies for addressing supply chain, logistics labor shortages

- Israel, Ukraine aid package to increase pressure on aerospace and defense supply chains

- How CPG brands can deliver on supplier diversity promises

- How S&OP provides the answer to in-demand products

- AI, virtual reality is bringing experiential learning into the modern age

- More latest news

Latest Resources

Subscribe

Supply Chain Management Review delivers the best industry content.

Editors’ Picks